Could Bitcoin Reach New Heights? A 1,500% Growth Forecast

Table of Contents

Factors Contributing to Potential Bitcoin Growth

Several factors could contribute to significant Bitcoin growth, potentially leading to the ambitious 1500% Bitcoin growth forecast some analysts predict. Let's explore the key drivers:

Increased Institutional Adoption

The growing acceptance of Bitcoin by institutional investors is a significant catalyst for potential growth.

- Growing number of institutional investors: Hedge funds, corporations, and even sovereign wealth funds are increasingly allocating a portion of their portfolios to Bitcoin, demonstrating a growing confidence in its long-term value as a cryptocurrency investment.

- Grayscale Bitcoin Trust inflows: The consistent inflow of funds into Grayscale's Bitcoin Trust, a publicly traded investment vehicle, reflects the significant institutional interest in gaining Bitcoin exposure.

- Increased regulatory clarity: While regulatory uncertainty remains a concern, increasing clarity in certain jurisdictions is making institutional investment more palatable. This reduced uncertainty encourages further investment.

- Bitcoin as a hedge against inflation: Many see Bitcoin as a potential hedge against inflation, particularly in times of economic uncertainty. This perception is driving institutional demand as traditional assets lose value.

The impact of institutional investment is substantial. Their large-scale purchases can significantly influence Bitcoin's price stability and fuel further growth. The entry of these players brings a level of maturity and stability often lacking in purely retail-driven markets, potentially making a 1500% Bitcoin growth a possibility, though a highly speculative one.

Global Economic Uncertainty & Inflation

Global economic uncertainty and persistent inflation are powerful tailwinds for Bitcoin's price.

- Bitcoin as a safe haven asset: During economic downturns, investors often seek safe haven assets, and Bitcoin's decentralized nature and limited supply make it an attractive option.

- Inflationary pressures: As traditional currencies lose purchasing power due to inflation, investors are increasingly turning to alternative assets like Bitcoin, potentially driving significant price increases.

- Outperforming traditional markets: In inflationary environments, Bitcoin has historically shown the potential to outperform traditional markets, making it a compelling investment choice for those seeking to protect their wealth.

The correlation between macroeconomic factors and Bitcoin's price is undeniable. As global economic uncertainty persists and inflation continues to rise, Bitcoin's appeal as a store of value and hedge against inflation could fuel its price appreciation, even to the extent of the 1500% Bitcoin growth forecast.

Technological Advancements & Network Upgrades

Ongoing technological advancements are bolstering Bitcoin's scalability and functionality, further enhancing its potential.

- Layer-2 scaling solutions (Lightning Network): The Lightning Network significantly improves Bitcoin's transaction speed and reduces fees, making it more practical for everyday use.

- Improved transaction speed and efficiency: Technological upgrades continually enhance Bitcoin's efficiency, making it a more attractive option for both individuals and businesses.

- Development of new applications: The Bitcoin blockchain is increasingly being used as a foundation for new applications and decentralized finance (DeFi) projects, expanding its utility and potentially driving demand.

- Environmental concerns and solutions: The environmental impact of Bitcoin mining is being addressed through the increasing adoption of renewable energy sources, mitigating a significant criticism and potentially broadening its appeal.

These technological improvements contribute directly to increased adoption and utility, creating a positive feedback loop that could significantly impact Bitcoin's price, adding to the possibility, albeit remote, of the 1500% Bitcoin growth prediction.

Challenges and Risks to Consider

Despite the potential for significant growth, investing in Bitcoin carries substantial risks.

Regulatory Uncertainty and Government Intervention

The regulatory landscape surrounding Bitcoin varies significantly across countries.

- Varying regulatory landscapes: Different governments have adopted diverse approaches to regulating cryptocurrencies, creating uncertainty and potential risks for investors.

- Potential for government crackdowns: There's always the risk of governments imposing stricter regulations or even outright bans on cryptocurrencies, which could negatively impact Bitcoin's price.

- Impact on adoption and price: Unfavorable regulations can stifle adoption and suppress Bitcoin's price, negating the potential for a 1500% Bitcoin growth.

The regulatory environment is a critical factor impacting Bitcoin's future. Uncertain or restrictive regulations could significantly dampen its growth potential.

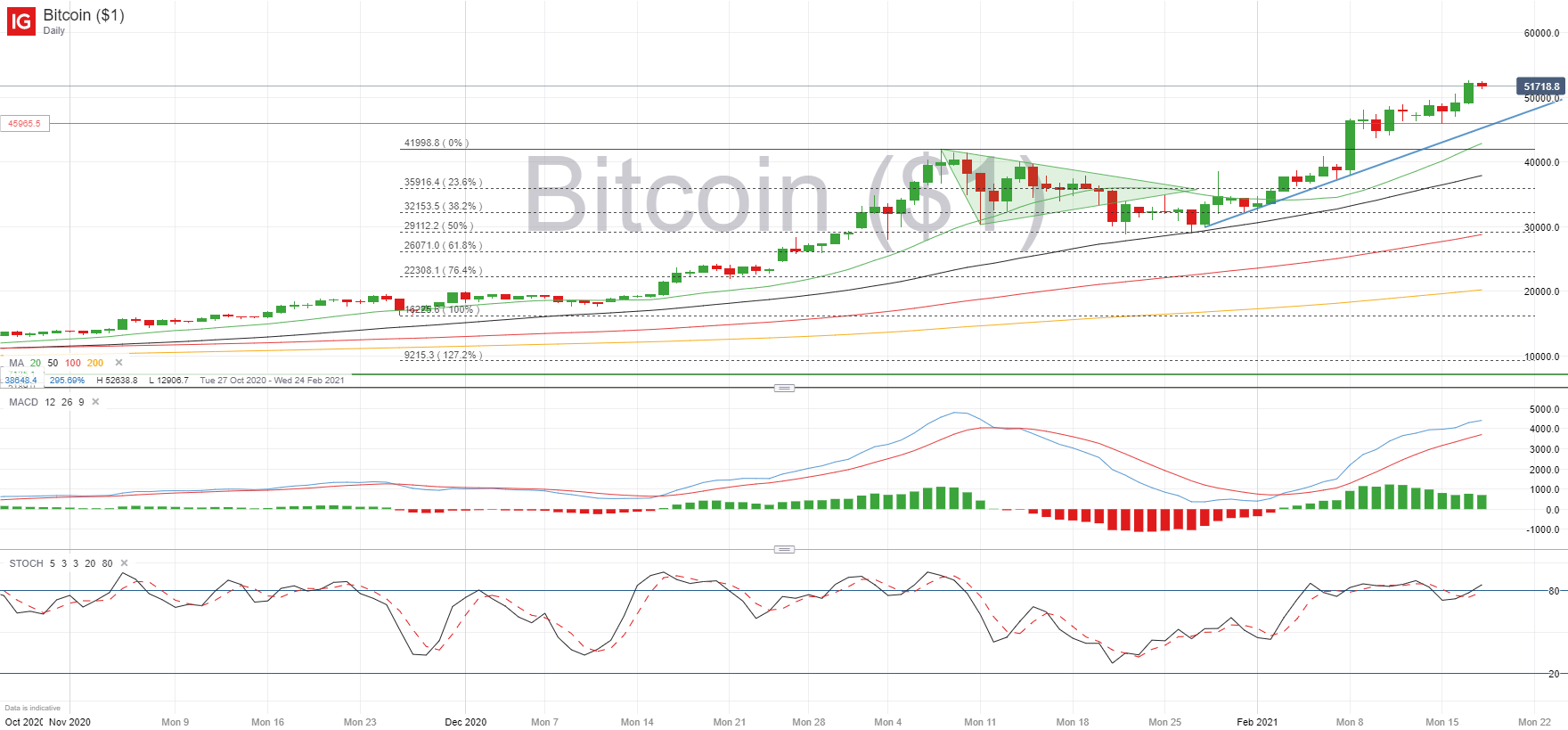

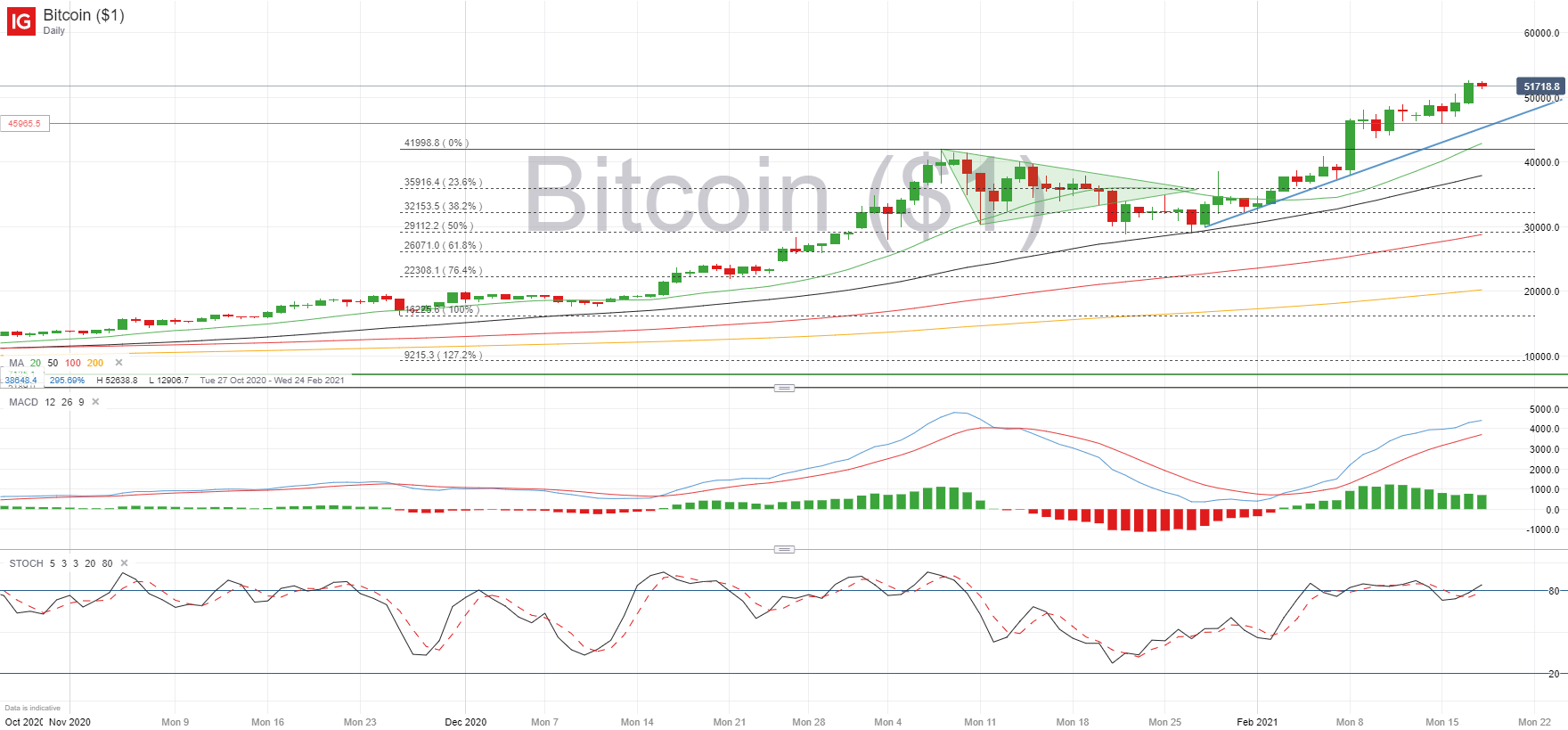

Market Volatility and Price Fluctuations

Bitcoin is known for its extreme price volatility.

- Historical volatility: Bitcoin's history is marked by significant price swings, both upward and downward.

- Impact of news events and market sentiment: News events and overall market sentiment can cause dramatic shifts in Bitcoin's price.

- Risks of significant price corrections: Investors should be prepared for potential large price corrections, which can lead to significant losses.

The inherent volatility of Bitcoin presents a significant risk for investors, even negating the possibility of a 1500% Bitcoin growth.

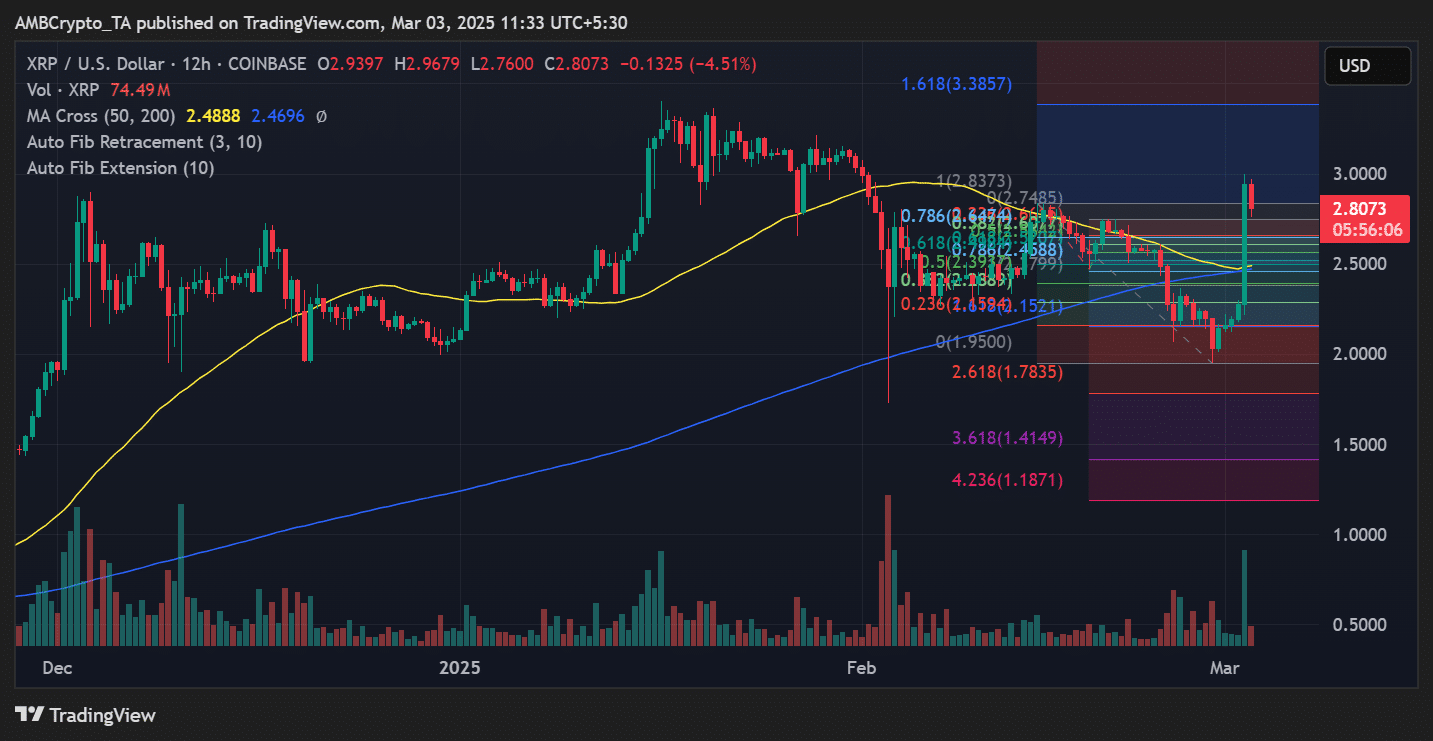

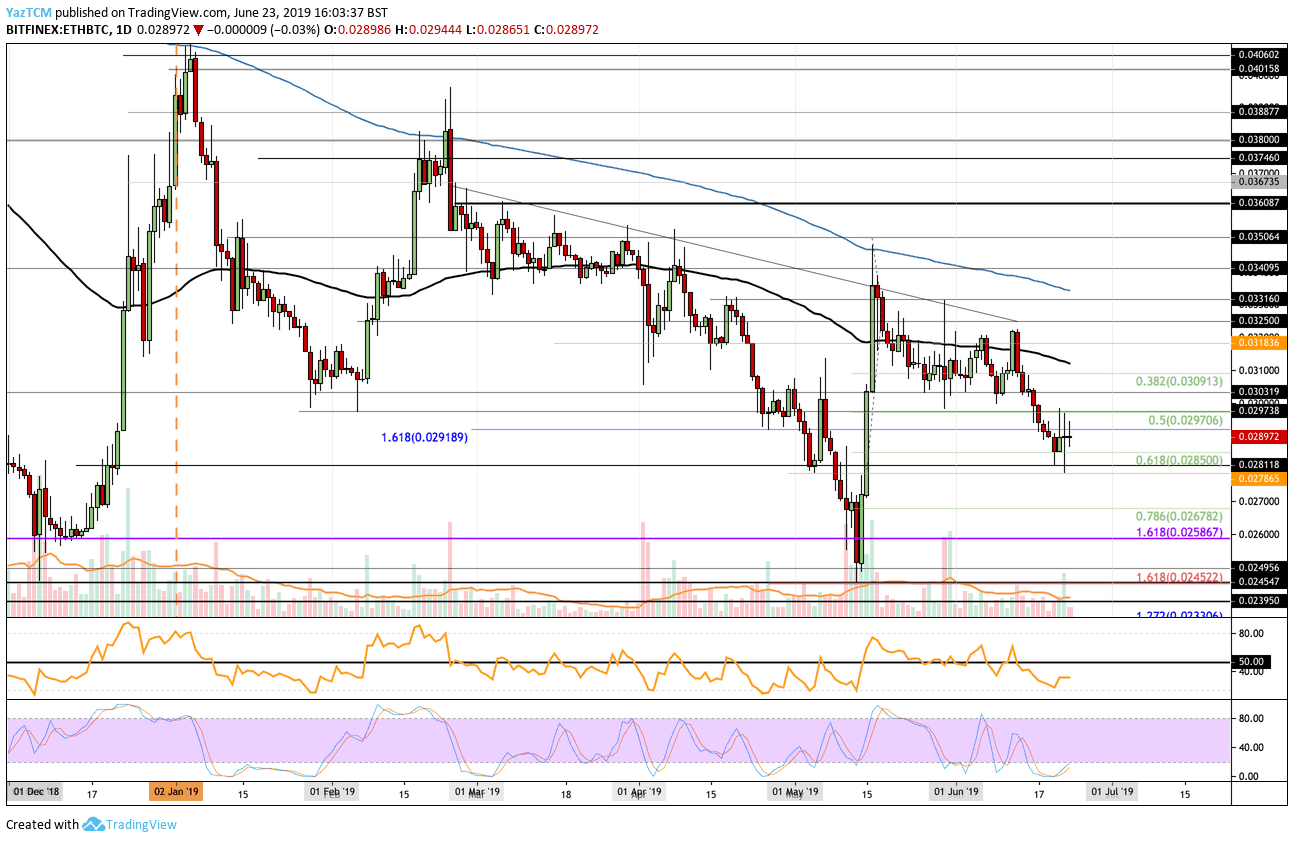

Competition from Other Cryptocurrencies

Bitcoin faces competition from a rapidly growing number of alternative cryptocurrencies.

- Emergence of new cryptocurrencies: New cryptocurrencies with innovative technologies are constantly emerging, challenging Bitcoin's dominance.

- Competition for market share and investor interest: Bitcoin is competing for investor attention and market share with other cryptocurrencies offering potentially superior features.

- Potential for altcoins to outperform Bitcoin: There's a possibility that other cryptocurrencies could outperform Bitcoin in the future.

The competitive landscape is dynamic, and Bitcoin's continued dominance is not guaranteed.

Conclusion

This article explored the potential for Bitcoin to reach new heights, focusing on factors like institutional adoption, economic uncertainty, and technological advancements. However, it also highlighted significant challenges and risks, including regulatory uncertainty, market volatility, and competition from other cryptocurrencies. A 1,500% growth forecast, while exciting, is ambitious and highly speculative. While the potential for a 1500% Bitcoin growth exists, it's crucial to remember the inherent risks involved in this cryptocurrency investment.

Call to Action: While predicting the future of Bitcoin with certainty is impossible, understanding the contributing factors and potential risks is crucial for any investor. Conduct thorough research and consider your risk tolerance before investing in Bitcoin. Learn more about the potential of Bitcoin and its future price by exploring further resources and staying informed about market trends. Could Bitcoin reach new heights? Only time will tell, but understanding the factors at play is the first step.

Featured Posts

-

Understanding Ethereums Price A Deep Dive Into Market Dynamics

May 08, 2025

Understanding Ethereums Price A Deep Dive Into Market Dynamics

May 08, 2025 -

Wall Street Kurumlari Kripto Paraya Nasil Yaklasiyor

May 08, 2025

Wall Street Kurumlari Kripto Paraya Nasil Yaklasiyor

May 08, 2025 -

Us Steps Up Spying Efforts In Greenland Exclusive Report

May 08, 2025

Us Steps Up Spying Efforts In Greenland Exclusive Report

May 08, 2025 -

Trump Calls Cusma A Good Deal But Threatens Termination

May 08, 2025

Trump Calls Cusma A Good Deal But Threatens Termination

May 08, 2025 -

Ps Zh Aston Villa Povna Istoriya Yevrokubkovikh Zustrichey

May 08, 2025

Ps Zh Aston Villa Povna Istoriya Yevrokubkovikh Zustrichey

May 08, 2025

Latest Posts

-

New Crypto Etf From Trump Media And Crypto Com Cro Price Analysis

May 08, 2025

New Crypto Etf From Trump Media And Crypto Com Cro Price Analysis

May 08, 2025 -

Cro Skyrockets Trump Medias Crypto Etf Partnership With Crypto Com

May 08, 2025

Cro Skyrockets Trump Medias Crypto Etf Partnership With Crypto Com

May 08, 2025 -

Crypto Com And Trump Media Team Up For New Etf Boosting Cro

May 08, 2025

Crypto Com And Trump Media Team Up For New Etf Boosting Cro

May 08, 2025 -

Anlik Bitcoin Fiyati Son Dakika Degerleri Ve Piyasa Hareketleri

May 08, 2025

Anlik Bitcoin Fiyati Son Dakika Degerleri Ve Piyasa Hareketleri

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Buying Suggest So

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Buying Suggest So

May 08, 2025