Ethereum Price To Hit $4,000? CrossX Indicators And Institutional Buying Suggest So

Table of Contents

The Rise of Institutional Ethereum Investment

The growing interest from institutional investors is a significant catalyst for potential Ethereum price growth. This increased participation is injecting substantial capital into the market and bolstering demand for ETH.

Increased Institutional Adoption

A growing number of institutional investors are allocating significant portions of their portfolios to Ethereum. While specific investment amounts are often kept private, the trend is undeniable. The reasons behind this institutional interest are multifaceted:

- Examples of institutions investing in ETH: While many institutions remain discreet about their holdings, the increased activity on major exchanges and the comments from some financial analysts suggest a significant shift towards ETH adoption amongst institutional players. Publicly announced investments, while limited, signal a broader trend.

- Reasons for institutional interest: The inherent utility of Ethereum as a foundation for decentralized finance (DeFi), smart contracts, and non-fungible tokens (NFTs) is driving institutional interest. Furthermore, ongoing improvements in scalability and transaction speed make it a more attractive investment.

- Impact on ETH price: Increased demand from large institutional buyers directly impacts the price, pushing it upwards as they compete for limited ETH supply. This effect is further amplified by the perceived stability and potential for long-term growth associated with Ethereum.

Ethereum's Role in Institutional Portfolios

Ethereum is rapidly transitioning from a niche asset to a core holding in diversified institutional portfolios. This strategic shift reflects a growing recognition of its importance within the broader crypto landscape.

- Comparison to Bitcoin: While Bitcoin remains the dominant cryptocurrency, Ethereum's unique functionalities and potential for growth make it a compelling addition to a balanced institutional portfolio, offering diversification beyond Bitcoin's price movements.

- Diversification strategies: Many institutional investors view Ethereum as a hedge against market volatility and a pathway to participate in the burgeoning DeFi and NFT sectors. This makes it a crucial element in their diversification strategies.

- Role of Ethereum in institutional investment strategies: Ethereum is increasingly becoming a strategic investment, rather than a speculative one, for institutions, reflecting a long-term outlook on its potential.

Positive Signals from CrossX Indicators

Technical analysis plays a vital role in predicting price movements. CrossX indicators, a specific type of technical indicator, are providing positive signals suggesting a potential rise to $4,000.

Understanding CrossX Indicators

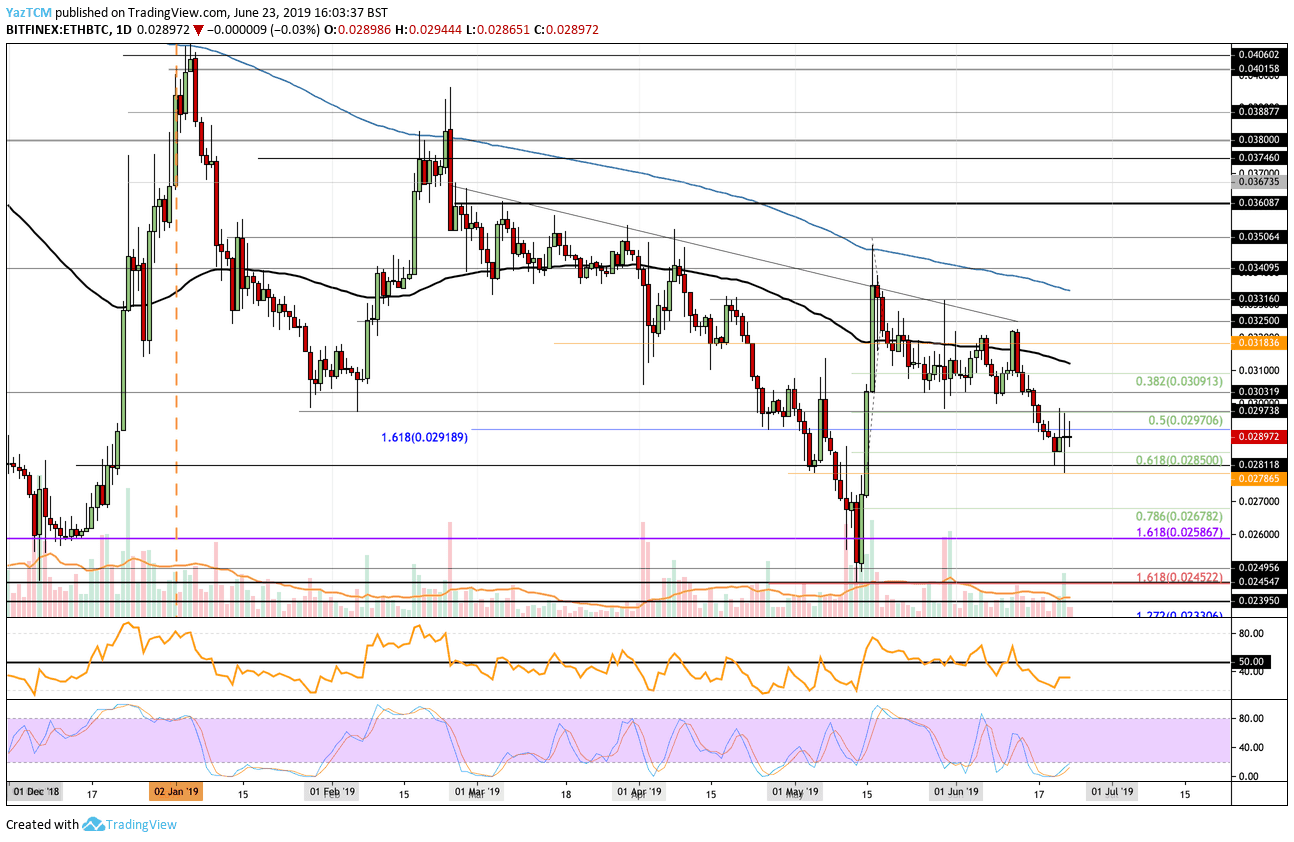

CrossX indicators are a complex set of technical indicators that combine various metrics to assess market momentum and potential price reversals. They analyze multiple factors such as volume, price action, and market sentiment. While the precise calculations are complex, the core concept is to identify potential trend changes.

- Types of CrossX indicators used in ETH price analysis: Several CrossX indicators, including moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence), are commonly used to analyze Ethereum price trends.

- How these indicators predict price movements: By analyzing trends and patterns within these metrics, analysts can predict potential upward or downward price movements. Positive CrossX signals typically suggest strong upward momentum.

- Limitations of these indicators: It's crucial to remember that CrossX indicators, like all technical indicators, are not foolproof. They should be used in conjunction with fundamental analysis and other market factors for a complete picture.

CrossX Signals Pointing Towards $4,000

Current readings from several CrossX indicators suggest a strong bullish trend for Ethereum, pointing towards a potential price target of $4,000.

- Specific indicator values: [Insert specific examples of indicator values and charts here, with proper attribution to the source. For example: "The 50-day moving average has crossed above the 200-day moving average, a classic bullish signal. Furthermore, the RSI is currently above 70, indicating overbought conditions but also strong momentum." Remember to cite sources].

- Interpretation of the indicators: A confluence of positive signals from multiple CrossX indicators strengthens the prediction of a potential price rise.

- Supporting data and charts: [Include relevant charts and graphs here to visually support the analysis. Clearly label all charts and cite data sources].

Ethereum's Technological Advancements and Network Growth

Ethereum's continued technological advancements and the growth of its ecosystem are fundamental drivers of its price appreciation.

Ethereum 2.0 and its Impact

The development of Ethereum 2.0 is a game-changer. This upgrade promises significant improvements in scalability, security, and energy efficiency.

- Key features of Ethereum 2.0: Sharding, proof-of-stake consensus mechanism, and enhanced transaction throughput are key features of Ethereum 2.0.

- Positive market impact: These improvements will address current limitations, leading to increased transaction speeds, reduced fees, and higher overall network capacity.

- Timeline for completion: While the full rollout of Ethereum 2.0 is ongoing, its progress is constantly monitored and contributes to positive sentiment around the ETH price.

Growing DeFi Ecosystem

The thriving decentralized finance (DeFi) ecosystem built on Ethereum is a key factor driving demand.

- Total Value Locked (TVL) in DeFi protocols: The steadily increasing TVL signifies growing confidence and participation in DeFi applications built on Ethereum.

- New DeFi applications: The continuous innovation and development of new DeFi applications create a self-reinforcing cycle of growth and increased ETH demand.

- Growth potential: The DeFi sector is expected to continue expanding, further strengthening the demand for Ethereum.

Conclusion

The convergence of institutional buying, positive CrossX indicators, and Ethereum's ongoing technological advancements paints a picture of significant potential for Ethereum price growth. While reaching $4,000 is not guaranteed, the factors discussed strongly suggest a pathway towards this target.

While no one can predict the future with certainty, the convergence of these factors strongly suggests a potential for significant growth in the Ethereum price. Stay informed on Ethereum price predictions, analyze CrossX indicators, and consider adding Ethereum to your investment portfolio – but always remember to conduct your own thorough research before making any investment decisions. Continue to monitor the Ethereum price and related news to make informed decisions about your investment in this exciting cryptocurrency. The potential for Ethereum to reach $4,000 and beyond remains a compelling possibility.

Featured Posts

-

March 2024 Ps Plus Premium And Extra Games What To Expect

May 08, 2025

March 2024 Ps Plus Premium And Extra Games What To Expect

May 08, 2025 -

Wall Street Kurumlari Kripto Paraya Nasil Yaklasiyor

May 08, 2025

Wall Street Kurumlari Kripto Paraya Nasil Yaklasiyor

May 08, 2025 -

Thailand Theater Teases 5 Minute Minecraft Superman Preview

May 08, 2025

Thailand Theater Teases 5 Minute Minecraft Superman Preview

May 08, 2025 -

Oklahoma Citys Tough Road Ahead Grizzlies Game Preview

May 08, 2025

Oklahoma Citys Tough Road Ahead Grizzlies Game Preview

May 08, 2025 -

Saving Private Ryan Nathan Fillions Impact In A Short Appearance

May 08, 2025

Saving Private Ryan Nathan Fillions Impact In A Short Appearance

May 08, 2025

Latest Posts

-

Understanding The 400 Xrp Price Increase Is It A Short Term Or Long Term Trend

May 08, 2025

Understanding The 400 Xrp Price Increase Is It A Short Term Or Long Term Trend

May 08, 2025 -

Xrps 400 Growth A Prudent Investors Guide To Buying Or Selling

May 08, 2025

Xrps 400 Growth A Prudent Investors Guide To Buying Or Selling

May 08, 2025 -

Analyzing The Factors Affecting Xrps Price Potential To 5 In 2025

May 08, 2025

Analyzing The Factors Affecting Xrps Price Potential To 5 In 2025

May 08, 2025 -

Is Xrps 400 Rise Sustainable A Comprehensive Market Overview

May 08, 2025

Is Xrps 400 Rise Sustainable A Comprehensive Market Overview

May 08, 2025 -

The Likelihood Of Xrp Reaching 5 By 2025

May 08, 2025

The Likelihood Of Xrp Reaching 5 By 2025

May 08, 2025