Could Bitcoin's 10x Multiplier Reshape The Financial Landscape?

Table of Contents

Factors Contributing to a Potential Bitcoin 10x Multiplier

Several converging factors could contribute to a significant Bitcoin price increase, potentially leading to a 10x multiplier.

Increased Institutional Adoption

Large financial institutions are increasingly recognizing Bitcoin's potential. This growing acceptance is a key driver of potential price appreciation.

- Growing acceptance by large financial institutions (e.g., BlackRock, Fidelity): Major players like BlackRock and Fidelity are actively exploring and offering Bitcoin-related services, signaling a shift in institutional sentiment. This influx of institutional capital could significantly boost Bitcoin's price.

- Increased regulatory clarity and acceptance in key markets: As regulatory frameworks evolve and become more favorable in major economies, institutional investors will feel more confident allocating capital to Bitcoin. The development of clear regulatory guidelines reduces uncertainty and risk.

- Development of Bitcoin-related financial products (ETFs, futures): The launch of Bitcoin ETFs and futures contracts provides more accessible and regulated avenues for institutional investors to gain exposure to Bitcoin, further driving demand. This increased liquidity can fuel price appreciation.

Global Macroeconomic Instability

Global economic uncertainty is another factor that could propel Bitcoin's price.

- Inflationary pressures and devaluation of fiat currencies: High inflation erodes the purchasing power of fiat currencies, driving investors towards alternative assets like Bitcoin, which is designed to be deflationary. This makes Bitcoin an attractive inflation hedge.

- Geopolitical uncertainties driving safe-haven investment: During times of geopolitical instability, investors often seek safe-haven assets. Bitcoin's decentralized nature and limited supply make it a compelling option for preserving wealth during turbulent times. Bitcoin's position as a safe haven asset is increasingly recognized.

- Increased demand for decentralized, inflation-resistant assets: As trust in traditional financial systems diminishes, the demand for decentralized and inflation-resistant assets like Bitcoin is likely to increase, pushing its price higher.

Technological Advancements

Continuous technological improvements within the Bitcoin ecosystem are enhancing its usability and appeal.

- Layer-2 scaling solutions improving transaction speed and cost: Solutions like the Lightning Network significantly increase Bitcoin's transaction capacity and reduce fees, making it more practical for everyday use. This improved scalability addresses a major criticism of Bitcoin's early limitations.

- Development of privacy-enhancing technologies for Bitcoin: Advancements like Taproot enhance Bitcoin's privacy features, addressing concerns about transaction transparency and making it more attractive to a wider range of users.

- Growing adoption of Bitcoin as a medium of exchange: As more merchants and businesses accept Bitcoin as payment, its utility as a medium of exchange increases, further boosting demand and price.

Potential Consequences of a Bitcoin 10x Multiplier

A 10x Bitcoin multiplier would have far-reaching consequences across various sectors.

Impact on Traditional Financial Markets

A dramatic rise in Bitcoin's price could significantly disrupt traditional financial markets.

- Increased competition for investment capital: Bitcoin's growth could draw significant investment capital away from traditional assets, potentially impacting stock markets and other investment vehicles.

- Potential disruption to existing financial institutions: The increasing adoption of Bitcoin could challenge the dominance of traditional financial institutions, forcing them to adapt and integrate cryptocurrency into their offerings.

- Shift in global power dynamics: The widespread adoption of Bitcoin could shift global financial power dynamics, potentially reducing the influence of central banks and governments over monetary policy.

Societal Implications

The societal impact of a 10x Bitcoin multiplier would be profound and multifaceted.

- Increased accessibility to financial services in underserved communities: Bitcoin's decentralized nature could provide increased access to financial services for people in underserved communities who lack access to traditional banking systems. This could lead to greater financial inclusion.

- Potential for increased wealth inequality: The benefits of a 10x Bitcoin multiplier might not be evenly distributed, potentially exacerbating existing wealth inequality. Early adopters and large holders could disproportionately benefit.

- Ethical considerations surrounding Bitcoin's environmental impact: The energy consumption associated with Bitcoin mining remains a significant concern, raising ethical questions about its environmental sustainability.

Regulatory Challenges

A 10x Bitcoin multiplier would undoubtedly present significant regulatory challenges.

- Balancing innovation with consumer protection: Regulators will face the challenge of balancing the need to foster innovation in the cryptocurrency space with the imperative to protect consumers from fraud and market manipulation.

- International cooperation on Bitcoin regulation: Given Bitcoin's global nature, international cooperation will be crucial in developing a consistent and effective regulatory framework.

- Challenges in taxing Bitcoin transactions: Tax authorities worldwide face the challenge of effectively taxing Bitcoin transactions, given its decentralized nature and the complexity of tracking cross-border transfers.

Opportunities and Risks Associated with a Bitcoin 10x Multiplier

A 10x Bitcoin multiplier presents both significant opportunities and substantial risks:

Opportunities:

- Early investment returns for Bitcoin holders.

- New financial innovations built upon Bitcoin's blockchain technology.

- Increased financial inclusion and access to financial services globally.

Risks:

- Extreme market volatility and potential for significant price crashes.

- Increased potential for scams, fraud, and illicit activities.

- Regulatory uncertainty and potential for government crackdowns.

Conclusion

A 10x Bitcoin multiplier presents both immense opportunities and significant challenges. While the potential for reshaping the financial landscape is undeniable, careful consideration of the associated risks and regulatory hurdles is crucial. Factors such as institutional adoption, macroeconomic instability, and technological advancements will all play a pivotal role in determining whether this scenario unfolds. Understanding the potential of Bitcoin's 10x multiplier is crucial for navigating the evolving financial world. Stay informed about Bitcoin developments and explore the potential – and pitfalls – of this revolutionary asset. Learn more about Bitcoin and its potential for growth.

Featured Posts

-

Rogue From Fear To Leadership In The X Men

May 08, 2025

Rogue From Fear To Leadership In The X Men

May 08, 2025 -

Los Angeles Angels Games Best Streaming Options Without Cable 2025

May 08, 2025

Los Angeles Angels Games Best Streaming Options Without Cable 2025

May 08, 2025 -

Nba Playoffs Triple Doubles Quiz How Many Can You Name

May 08, 2025

Nba Playoffs Triple Doubles Quiz How Many Can You Name

May 08, 2025 -

Mlb Insiders Brutally Rank Angels Farm System

May 08, 2025

Mlb Insiders Brutally Rank Angels Farm System

May 08, 2025 -

Complete 2025 Game Release Calendar Ps 5 Ps 4 Xbox Pc And Switch

May 08, 2025

Complete 2025 Game Release Calendar Ps 5 Ps 4 Xbox Pc And Switch

May 08, 2025

Latest Posts

-

Before The Rookie Nathan Fillions Unforgettable Wwii Moment

May 08, 2025

Before The Rookie Nathan Fillions Unforgettable Wwii Moment

May 08, 2025 -

Nathan Fillion From Iconic Wwii Movie To The Rookie

May 08, 2025

Nathan Fillion From Iconic Wwii Movie To The Rookie

May 08, 2025 -

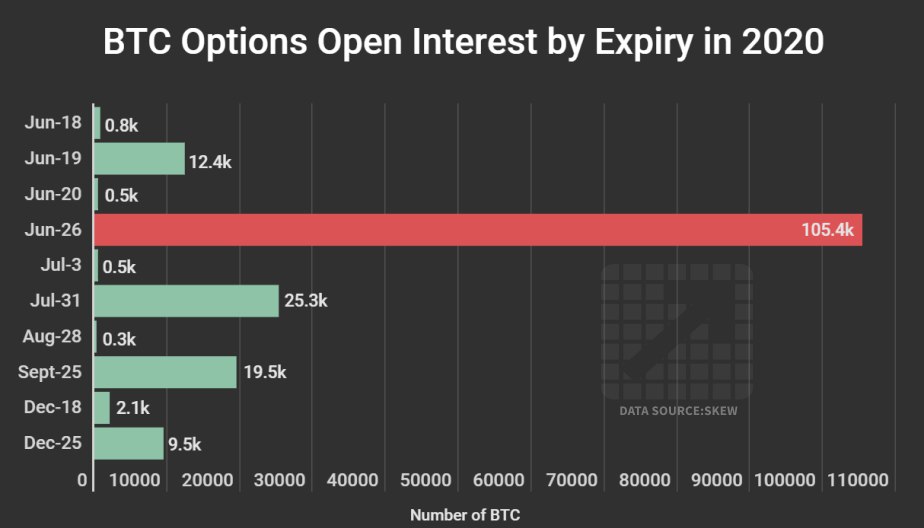

Billions In Crypto Options Expire Bitcoin And Ethereum Face Volatility

May 08, 2025

Billions In Crypto Options Expire Bitcoin And Ethereum Face Volatility

May 08, 2025 -

Three Minutes Of Brilliance Nathan Fillions Memorable Saving Private Ryan Scene

May 08, 2025

Three Minutes Of Brilliance Nathan Fillions Memorable Saving Private Ryan Scene

May 08, 2025 -

The Lasting Impression Nathan Fillions 3 Minute Masterclass In Saving Private Ryan

May 08, 2025

The Lasting Impression Nathan Fillions 3 Minute Masterclass In Saving Private Ryan

May 08, 2025