DAX Surge: Will Wall Street's Comeback Dampen German Market Gains?

Table of Contents

The Recent DAX Surge: Factors Contributing to Growth

The recent DAX increase is a result of several converging factors contributing to positive market sentiment and robust economic indicators. The German economy, despite global uncertainties, has demonstrated resilience. Several key sectors have fueled this growth.

-

Automotive Industry's Revival: The German automotive sector, a significant component of the DAX, is experiencing a period of renewed growth, driven by increased demand and technological advancements in electric vehicles. This sector's performance significantly impacts the overall DAX index.

-

Technological Innovation: The German technology sector is also contributing significantly. Innovation in areas like renewable energy and software development is attracting investments and boosting the DAX's overall value.

-

Industrial Strength: Germany's robust industrial base continues to be a pillar of its economic strength, with exports driving a significant portion of the recent growth.

Let's summarize the key factors contributing to the DAX surge:

- Strong export performance: German goods remain highly competitive in the global market.

- Positive corporate earnings: Many DAX-listed companies have reported strong and exceeding earnings, boosting investor confidence.

- Government stimulus measures: Government initiatives to support the economy have played a role in bolstering growth.

- Increased investor confidence: Positive economic indicators and corporate performance have led to increased investor confidence in the German market.

Wall Street's Comeback: A Detailed Analysis

Wall Street's recent recovery is fueled by a combination of factors indicating a positive shift in the US economy. The Federal Reserve's monetary policy adjustments, coupled with improving economic data, have played a significant role.

-

Easing Inflation Concerns: Decreasing inflation rates have lessened concerns about aggressive interest rate hikes, improving investor sentiment.

-

Strong Corporate Earnings Reports: Many US companies have reported better-than-expected earnings, boosting market confidence.

-

Positive Economic Forecasts: Positive economic forecasts suggest continued growth, further fueling investor optimism.

-

Technological Advancements: Breakthroughs in various sectors continue to drive innovation and investment in the US stock market.

The potential spillover effects of Wall Street's performance on European markets, including the DAX, are significant. A strong US market often attracts global investment, potentially diverting capital away from other regions.

Correlation Between DAX and Wall Street: Historical Perspective

The DAX and major US indices like the S&P 500 and Dow Jones exhibit a degree of correlation, although the strength of this relationship fluctuates over time. Historical data reveals periods of strong correlation, where the indices move in tandem, reflecting global economic trends and investor sentiment. However, there are also periods of divergence, often influenced by region-specific factors or geopolitical events.

-

High Correlation Periods: These typically occur during periods of global economic stability or significant global events impacting both markets.

-

Low Correlation Periods: These often arise due to region-specific factors, such as differing economic policies or industry-specific news affecting one market more than the other.

Analyzing historical charts clearly illustrates this fluctuating correlation, highlighting the complex interplay between these markets.

Potential Dampening Effects on DAX Gains

While the DAX has shown impressive strength, Wall Street's recovery presents potential risks. The influx of capital back into US markets could lead to a reduction in investments in the German market, impacting the DAX's performance.

-

Capital Flight to US Markets: Higher returns in the US market could entice investors to shift their capital, potentially causing a decline in DAX valuations.

-

Stronger US Dollar Impacting Exports: A stronger US dollar can make German exports more expensive, potentially hindering economic growth and negatively impacting the DAX.

-

Increased Competition from US Companies: Increased competitiveness from US companies in various sectors could put pressure on German businesses.

-

Shift in Investor Sentiment: Positive news from the US could shift investor attention and capital allocation away from the European market.

Conclusion: The Future of the DAX and Wall Street's Influence

The recent DAX surge reflects positive economic indicators and strong performance in key sectors of the German economy. However, the recovery of Wall Street introduces uncertainty. While the correlation between the DAX and Wall Street is undeniable, it is not absolute. The strength of this correlation fluctuates based on a complex interplay of economic and geopolitical factors. Therefore, the future trajectory of the DAX will depend on the balancing act between sustained German economic strength, the influence of a resurgent US market, and evolving global conditions. A stronger US dollar and potential capital flight to US markets could exert downward pressure on the DAX, but strong German fundamentals could mitigate these risks.

Stay tuned for further updates on the DAX and its correlation with Wall Street's performance. Understanding the interplay between these two major markets is crucial for navigating the complexities of the global stock market. Making informed investment decisions requires close monitoring of both the DAX index and the overall performance of Wall Street.

Featured Posts

-

Uniklinikum Essen Nachbarschaftliches Ereignis Loest Traenen Aus

May 24, 2025

Uniklinikum Essen Nachbarschaftliches Ereignis Loest Traenen Aus

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist What Investors Need To Know

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist What Investors Need To Know

May 24, 2025 -

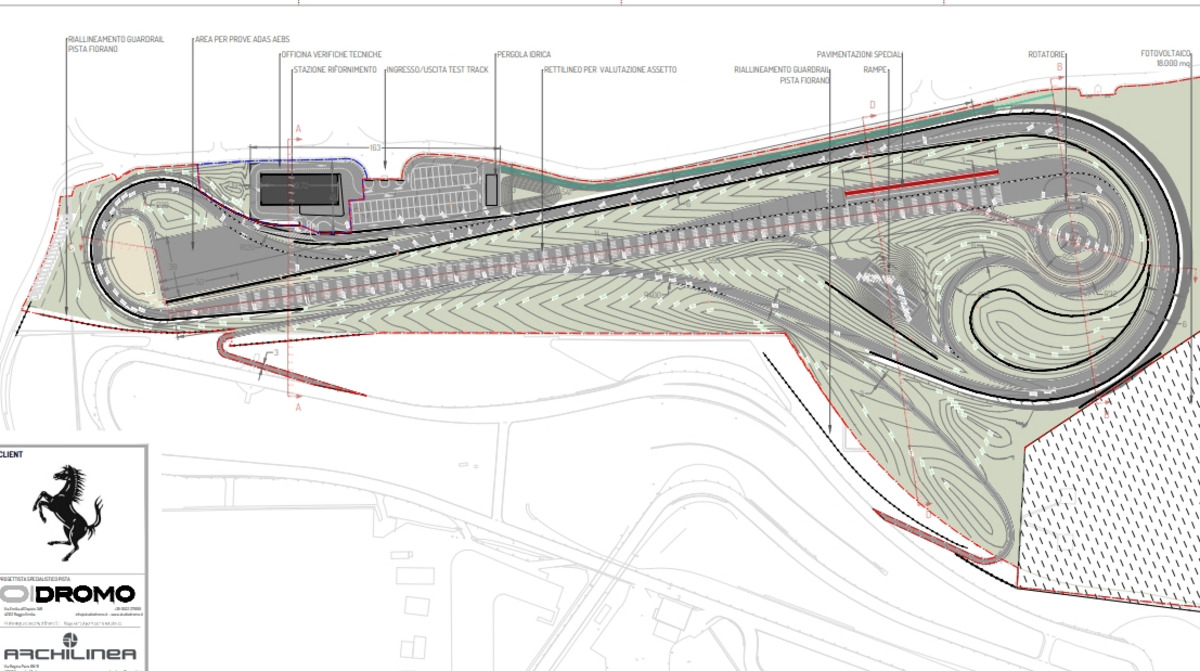

Fiorano Track Times Fastest 10 Standard Production Ferraris

May 24, 2025

Fiorano Track Times Fastest 10 Standard Production Ferraris

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025 -

Ai I Phone

May 24, 2025

Ai I Phone

May 24, 2025

Latest Posts

-

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025 -

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025