DBS Bank: Giving Polluters Time To Reform Their Environmental Impact

Table of Contents

DBS Bank's Stance on Financing Polluting Industries

DBS Bank's approach to financing companies with substantial environmental impact centers around a strategy of engagement rather than immediate divestment. This approach forms a core component of their DBS Bank environmental policy.

The "Engagement" Approach

DBS Bank emphasizes a collaborative approach, focusing on:

- Focus on collaborative solutions: Instead of outright rejection, DBS engages in dialogue with companies, aiming to collaboratively develop and implement sustainability strategies.

- Setting emissions reduction targets: The bank works with its clients to establish clear and measurable targets for reducing greenhouse gas emissions.

- Providing financial support for green transitions: DBS offers financial incentives and resources to facilitate the transition towards more sustainable practices, including investments in renewable energy and green technologies.

- Risk assessment and due diligence processes: Rigorous due diligence processes are implemented to assess environmental risks associated with its investments, helping to identify and mitigate potential negative impacts.

Criticisms of the Engagement Strategy

Environmental activists and advocacy groups raise several concerns about DBS Bank's engagement strategy, arguing it:

- Promotes greenwashing: Critics claim the engagement approach allows companies to appear environmentally responsible without enacting significant change, leading to accusations of greenwashing.

- Lacks transparency in reporting progress: The lack of readily available and independently verified data on the effectiveness of the engagement efforts raises concerns about the actual progress being made.

- Insufficient pressure on companies to make rapid changes: The gradual approach is seen as insufficient to address the urgency of the climate crisis, allowing continued environmental damage.

- Potential for continued financing of unsustainable practices: The continued financing, even with engagement efforts, allows polluting companies to remain operational and potentially continue harmful practices.

The Economic Realities and Challenges

DBS Bank’s approach must be understood within the context of broader economic considerations.

The Difficulty of Immediate Divestment

A sudden withdrawal of funding from polluting industries presents several challenges:

- Impact on employment in affected sectors: Divestment could lead to significant job losses in industries heavily reliant on DBS's financing, raising social and economic concerns.

- Potential for increased financial instability: A rapid withdrawal of capital could destabilize entire sectors, potentially causing wider financial instability.

- The need for a balanced approach to economic and environmental concerns: Finding a balance between the urgency of environmental protection and the need for economic stability is crucial.

The Role of Transitional Finance

DBS Bank likely defends its strategy by arguing that continued financing, coupled with engagement, enables a managed transition to sustainable practices. This involves:

- Investing in renewable energy infrastructure: Supporting the development of renewable energy sources is vital for a transition away from fossil fuels.

- Supporting the development of green technologies: Providing capital for innovative green technologies is critical for accelerating sustainable practices.

- Providing financial incentives for environmental improvements: Financial support incentivizes companies to implement environmental improvements and adopt sustainable practices.

Alternative Approaches and Best Practices

Assessing DBS Bank's policy requires comparing it to global standards and best practices.

Comparing DBS Bank's Policy to Global Standards

A comparative analysis of DBS Bank's environmental policies with those of other major international banks (such as HSBC and Citibank) reveals critical insights:

- Reviewing the policies of competitors like HSBC and Citibank: Benchmarking against competitors identifies areas where DBS Bank's policy falls short or excels.

- Analyzing the effectiveness of different approaches to ESG investing: Studying the effectiveness of different ESG investment strategies provides valuable lessons and best practices.

- Highlighting best practices in responsible financing: Identifying and promoting best practices in responsible financing helps establish a higher standard across the financial industry.

The Importance of Transparency and Accountability

For DBS Bank's approach to be credible, greater transparency and accountability are crucial:

- Regular reporting on environmental impact: Regular, detailed, and independently verified reports on the environmental impact of their investments are essential.

- Independent audits and verification of progress: Independent audits provide credibility and ensure the accuracy of reported progress.

- Strengthening stakeholder engagement and feedback mechanisms: Open communication and feedback mechanisms with stakeholders (environmental groups, investors, and the public) are vital.

Conclusion

DBS Bank's approach to financing polluters, emphasizing engagement over immediate divestment, presents a complex dilemma. While the "engagement" strategy holds the potential for gradual change, concerns remain about greenwashing and the speed of emissions reduction. The key to justifying its DBS Bank environmental policy lies in improved transparency, robust accountability, and a demonstrably effective pathway towards a greener future. To truly meet the challenges of climate change, DBS Bank must strengthen its commitment to a sustainable future and actively demonstrate its progress. A strengthened DBS Bank environmental policy, underpinned by verifiable action, is essential for maintaining trust and achieving genuine environmental sustainability.

Featured Posts

-

Addressing Ps 5 Stuttering Performance Issues And Solutions

May 08, 2025

Addressing Ps 5 Stuttering Performance Issues And Solutions

May 08, 2025 -

Price Gouging Allegations Surface In La After Devastating Fires

May 08, 2025

Price Gouging Allegations Surface In La After Devastating Fires

May 08, 2025 -

Ethereum Price 1 11 Million Eth Accumulated Bullish Market Outlook

May 08, 2025

Ethereum Price 1 11 Million Eth Accumulated Bullish Market Outlook

May 08, 2025 -

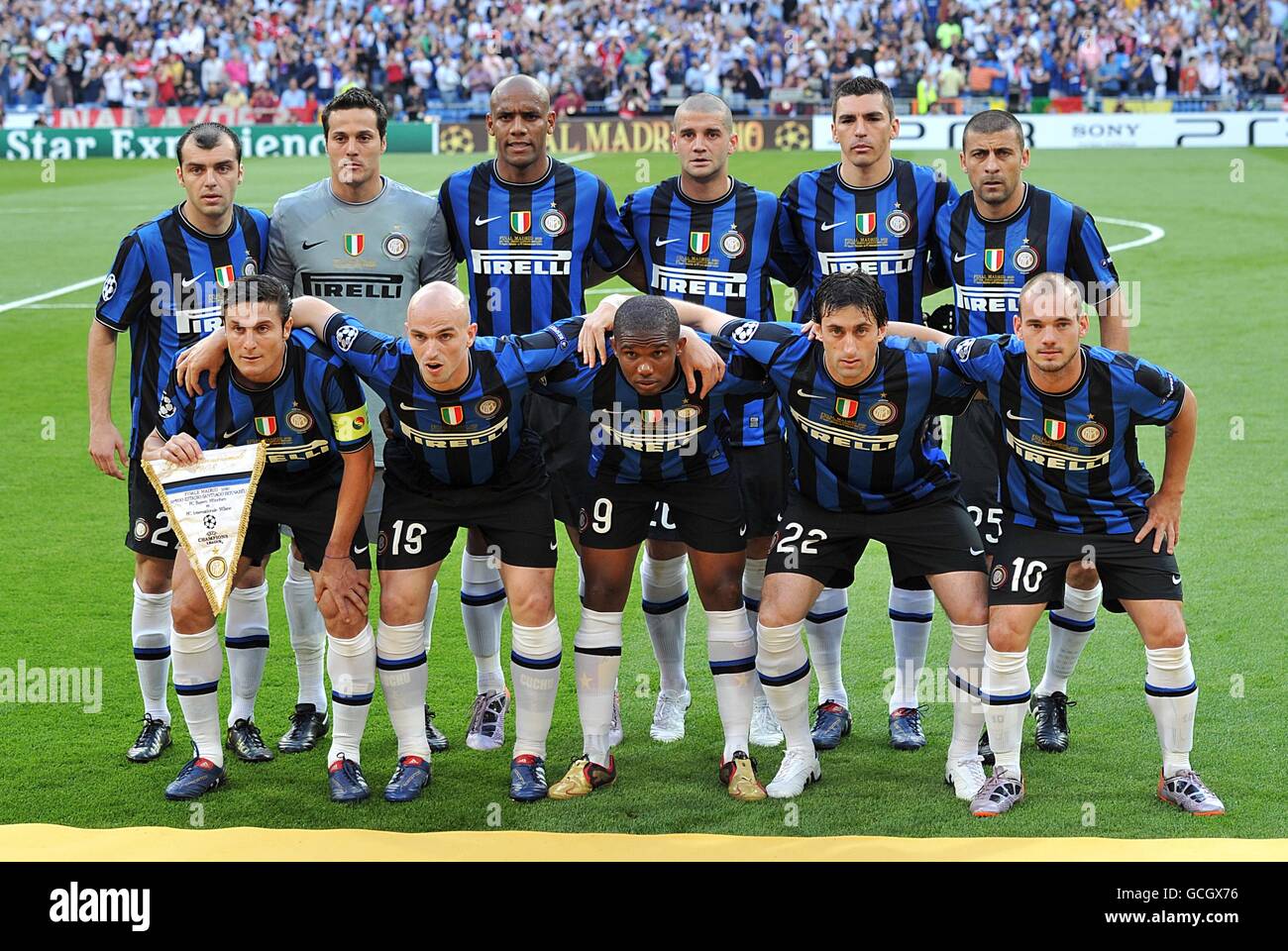

Inter Milan Stuns Bayern Munich In Champions League Quarterfinal

May 08, 2025

Inter Milan Stuns Bayern Munich In Champions League Quarterfinal

May 08, 2025 -

Largimi I Pese Yjeve Te Psg Reagimi I Luis Enriques

May 08, 2025

Largimi I Pese Yjeve Te Psg Reagimi I Luis Enriques

May 08, 2025

Latest Posts

-

Ethereum Price Prediction Could 2 700 Be Next As Wyckoff Accumulation Ends

May 08, 2025

Ethereum Price Prediction Could 2 700 Be Next As Wyckoff Accumulation Ends

May 08, 2025 -

Trump Medias Crypto Etf Venture A Partnership With Crypto Com

May 08, 2025

Trump Medias Crypto Etf Venture A Partnership With Crypto Com

May 08, 2025 -

Impact Of Trump Media And Crypto Coms Etf Partnership On The Crypto Market

May 08, 2025

Impact Of Trump Media And Crypto Coms Etf Partnership On The Crypto Market

May 08, 2025 -

Analysis Trump Media Crypto Com Etf Partnership And Cros Future

May 08, 2025

Analysis Trump Media Crypto Com Etf Partnership And Cros Future

May 08, 2025 -

New Crypto Etf From Trump Media And Crypto Com Cro Price Analysis

May 08, 2025

New Crypto Etf From Trump Media And Crypto Com Cro Price Analysis

May 08, 2025