Decoding VusionGroup's AMF CP Document: 2025E1029754

Table of Contents

Key Financial Highlights of VusionGroup's 2025E1029754 AMF CP Document

This section delves into the core financial data presented within VusionGroup's 2025E1029754 AMF CP document, providing a clear picture of the company's financial performance.

Revenue Analysis

Analyzing VusionGroup's revenue trends offers crucial insights into its market position and growth trajectory. The 2025E1029754 filing reveals the following key data points:

- Total Revenue: [Insert Total Revenue from Document - e.g., €500 million] representing a [Insert Percentage - e.g., 15%] increase year-over-year.

- Revenue Growth (YoY): [Insert Percentage from Document - e.g., 15%], indicating strong growth momentum.

- Revenue Breakdown by Segment: [Insert Breakdown from Document - e.g., 50% from Software Sales, 30% from Services, 20% from Licensing]. This breakdown highlights the relative contributions of different business segments to overall revenue.

- Impact of Specific Events: [Analyze and describe any specific events mentioned impacting revenue - e.g., successful product launch or a major contract win].

Profitability Metrics

Understanding profitability is key to assessing VusionGroup's financial strength. The AMF CP document provides the following profitability indicators:

- Gross Profit Margin: [Insert Percentage from Document - e.g., 60%], showing a [Insert Trend - e.g., slight increase] compared to the previous year.

- Operating Income: [Insert Value from Document - e.g., €100 million], indicating strong operational efficiency.

- Net Income: [Insert Value from Document - e.g., €75 million], reflecting profitability after all expenses.

- Earnings Per Share (EPS): [Insert Value from Document - e.g., €2.50], an important metric for investors. [Compare to previous periods or industry benchmarks where applicable].

Balance Sheet Analysis

A robust balance sheet demonstrates a company's financial health. Key highlights from VusionGroup's 2025E1029754 filing include:

- Current Ratio: [Insert Ratio from Document - e.g., 1.8], suggesting a strong ability to meet short-term obligations.

- Debt-to-Equity Ratio: [Insert Ratio from Document - e.g., 0.5], indicating a manageable level of debt.

- Total Assets: [Insert Value from Document - e.g., €800 million], showcasing the company's overall resources.

- Financial Health Assessment: [Based on the data, provide a concise assessment of VusionGroup's financial health—e.g., “The balance sheet reveals a healthy financial position with a manageable debt level and sufficient assets to support ongoing operations.”]

Operational Performance and Strategic Initiatives within VusionGroup's 2025E1029754 Filing

This section analyzes VusionGroup’s operational efficiency, strategic moves, and the risks it faces.

Operational Efficiency

VusionGroup's operational efficiency is crucial for sustained growth. Key indicators from the 2025E1029754 filing include:

- Operating Expenses: [Insert Value from Document - e.g., €300 million], illustrating cost management strategies.

- Productivity Ratios: [Insert Relevant Ratios from Document - e.g., Revenue per employee], reflecting the efficiency of resource utilization.

- Future Performance Implications: [Discuss the implications of the observed operational efficiency for the company's future performance—e.g., “The controlled operating expenses suggest a focus on efficiency, which can contribute to improved profitability in the future.”]

Strategic Investments and Acquisitions

The 2025E1029754 document highlights VusionGroup's strategic approach to growth:

- Acquisition of [Company Name]: [Describe the acquisition, its purpose as stated in the document, and its potential impact on VusionGroup’s future.]

- Investment in [Area/Technology]: [Detail the investment and the rationale behind it as explained in the filing.]

- Impact on Future Growth: [Analyze the combined effects of these strategic initiatives on VusionGroup’s projected future growth.]

Risk Factors and Future Outlook

Understanding potential risks is crucial for evaluating VusionGroup's prospects.

- Key Risk Factors: [List key risk factors identified in the document - e.g., competition, market volatility, regulatory changes].

- Mitigating Strategies: [Discuss any mitigation strategies VusionGroup plans to employ to address these risks].

- Future Outlook: [Summarize VusionGroup's future outlook as presented in the AMF CP document - e.g., projected growth rates, market expansion plans].

Regulatory Compliance and Disclosure in VusionGroup's AMF CP Document 2025E1029754

This section assesses VusionGroup's compliance with regulatory requirements and the clarity of its disclosures.

Compliance with AMF Regulations

The 2025E1029754 filing must adhere to specific AMF (Autorité des marchés financiers) regulations.

- Relevant AMF Regulations: [Mention specific relevant regulations, providing a brief explanation of each.]

- Compliance Assessment: [Based on the review, state whether the document appears compliant or not. If any potential compliance concerns exist, mention them here.]

Transparency and Disclosure Practices

Evaluating the clarity and comprehensiveness of VusionGroup's disclosures is essential.

- Disclosure Detail: [Assess the level of detail provided in the document's disclosures.]

- Suggestions for Improvement: [Identify any areas where enhanced transparency could benefit stakeholders.]

Conclusion: Key Takeaways and Next Steps for Understanding VusionGroup's AMF CP Document 2025E1029754

Analyzing VusionGroup's AMF CP document 2025E1029754 provides valuable insights into the company’s financial performance, operational strategies, and regulatory compliance. Understanding such documents is vital for informed investment decisions and stakeholder engagement. Key takeaways include a strong revenue growth, healthy profitability, and a manageable debt level. However, potential risks and challenges highlighted in the document should be carefully considered. To further your understanding, we recommend thoroughly reviewing the complete VusionGroup 2025E1029754 AMF CP document and seeking professional financial advice if needed for informed decision-making regarding VusionGroup's AMF CP documents or similar financial reports. [Insert link to VusionGroup’s investor relations page, if available]. Remember, navigating the intricacies of VusionGroup’s AMF CP documents requires careful scrutiny and potentially professional assistance.

Featured Posts

-

Understanding Vusion Groups Amf Cp Document 2025 E1029754

Apr 30, 2025

Understanding Vusion Groups Amf Cp Document 2025 E1029754

Apr 30, 2025 -

New Cnil Guidelines On Ai A Practical Guide For Compliance

Apr 30, 2025

New Cnil Guidelines On Ai A Practical Guide For Compliance

Apr 30, 2025 -

The Us And Canada Trumps Perspective Days Before The Canadian Election

Apr 30, 2025

The Us And Canada Trumps Perspective Days Before The Canadian Election

Apr 30, 2025 -

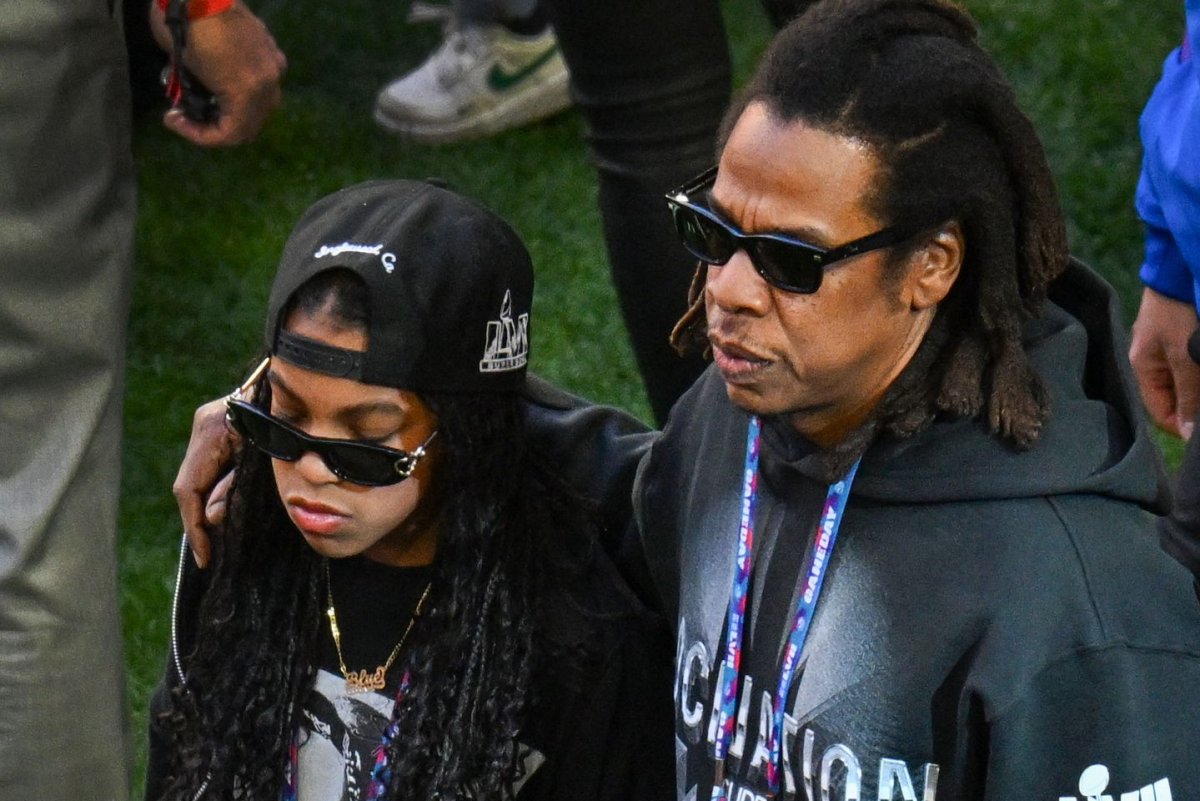

Super Bowl Lvii Blue Ivy Carters Fashionable Appearance Garners Attention

Apr 30, 2025

Super Bowl Lvii Blue Ivy Carters Fashionable Appearance Garners Attention

Apr 30, 2025 -

The Case Of The Missing Mexican Activist A Tragic Conclusion

Apr 30, 2025

The Case Of The Missing Mexican Activist A Tragic Conclusion

Apr 30, 2025

Latest Posts

-

Mstqbl Alelaqat Alamrykyt Alkndyt Ray Tramb Waldwr Alamryky Alhasm

Apr 30, 2025

Mstqbl Alelaqat Alamrykyt Alkndyt Ray Tramb Waldwr Alamryky Alhasm

Apr 30, 2025 -

Us Canada Relations In The Spotlight Trumps Influence On The Canadian Vote

Apr 30, 2025

Us Canada Relations In The Spotlight Trumps Influence On The Canadian Vote

Apr 30, 2025 -

Trump And Canada Understanding The 51st State Controversy

Apr 30, 2025

Trump And Canada Understanding The 51st State Controversy

Apr 30, 2025 -

The Canadian Election And Us Relations Trumps Perspective

Apr 30, 2025

The Canadian Election And Us Relations Trumps Perspective

Apr 30, 2025 -

Decoding Trumps 51st State Remarks On Canada Fact Or Fiction

Apr 30, 2025

Decoding Trumps 51st State Remarks On Canada Fact Or Fiction

Apr 30, 2025