Delinquent Student Loans: The Government's Aggressive Pursuit And Your Rights

Table of Contents

Understanding Delinquency and its Consequences

Defining Delinquent Student Loans

What constitutes a delinquent student loan? Simply put, it means you've missed one or more payments on your student loan(s). This can lead to a "past due student loan" status, and eventually, student loan default. The definition of delinquency varies, typically categorized by the number of missed payments:

- 30 days past due: Your loan is considered delinquent. Late payment fees may be applied, and negative marks may appear on your credit report.

- 60 days past due: Delinquency escalates, increasing the negative impact on your credit score. Collection efforts may intensify.

- 90+ days past due: This often triggers the most serious consequences, including potential wage garnishment, tax refund offset, and even legal action. Your loan may be referred to a collection agency. A "student loan default" may be reported.

The impact on your credit score can be significant, making it harder to obtain loans, rent an apartment, or even get a job. Wage garnishment involves a portion of your paycheck being directly seized to repay the loan, and tax refund offset means the government intercepts your tax refund to cover the debt.

The Government's Collection Agencies

Several agencies are involved in collecting delinquent student loans. The primary entity is the Department of Education, but they often partner with private collection agencies to handle the process.

- Department of Education: They oversee the entire student loan system and have the authority to pursue various collection actions.

- Private Collection Agencies: These agencies are contracted by the Department of Education to collect on defaulted loans. They use various methods to contact borrowers.

These agencies have legal authority to pursue repayment. It's crucial to respond to all communication from them. Ignoring their attempts to contact you will not make the problem disappear; it will likely worsen the situation. Common collection tactics include:

- Repeated phone calls

- Demand letters

- Legal action, potentially leading to a lawsuit and court judgment

Remember, even though these agencies are aggressive in their pursuit of repayment, their actions must adhere to the law.

Protecting Your Rights as a Borrower

Your Rights Under the Law

Federal law protects borrowers facing delinquent student loans. Understanding these rights is crucial:

- Fair Debt Collection Practices Act (FDCPA): This act regulates how collection agencies can contact you and prohibits harassing or abusive behavior.

- Right to Dispute a Debt: If you believe the debt is incorrect or you’ve already repaid it, you have the right to dispute it with your loan servicer.

- Right to Negotiate Repayment Plans: You can negotiate with your loan servicer to create a manageable repayment plan.

Knowing your rights is the first step in protecting yourself. Resources like the Federal Student Aid website (studentaid.gov) offer detailed information on your legal protections.

Exploring Repayment Options

Several options can help manage delinquent student loans:

- Income-Driven Repayment (IDR) Plans: Your monthly payment is based on your income and family size. Several IDR plans exist, each with specific eligibility requirements.

- Deferment: Temporarily postpones your payments, often for a limited time due to specific circumstances (like unemployment or enrollment in school).

- Forbearance: Similar to deferment, but usually doesn't require demonstrating financial hardship. Interest may still accrue during forbearance.

- Student Loan Consolidation: Combining multiple federal student loans into a single loan with a potentially lower monthly payment.

Each option has eligibility criteria and advantages/disadvantages. Carefully research each program and choose what best suits your situation.

Taking Action to Resolve Delinquent Student Loans

Contacting Your Loan Servicer

Proactive communication is key. Contact your loan servicer immediately:

- Gather your information: Prepare your loan details, income information, and any relevant documentation.

- Contact methods: Call, email, or write a letter to your servicer. Keep records of all communication.

Early intervention can help negotiate a repayment plan before the situation escalates.

Seeking Professional Help

If you're struggling to manage your delinquent student loans on your own, consider professional assistance:

- Credit Counselors: Can provide guidance on budgeting and debt management.

- Attorneys specializing in student loan debt: Can represent you in legal matters and negotiate with lenders.

These professionals can provide valuable support and guidance. However, be sure to choose reputable organizations and understand any associated fees.

Conclusion

Facing delinquent student loans can feel overwhelming, but understanding your rights and available options is crucial. The government's pursuit of repayment is aggressive, but the law provides protections. By proactively addressing your delinquent student loans, exploring repayment options like income-driven repayment plans, and seeking professional help when necessary, you can regain control and work towards a resolution. Don't delay; take action today to manage your delinquent student loan debt effectively. Learn more about your rights and explore available options for managing your delinquent student loans. Take control of your financial future.

Featured Posts

-

Tuerkiye Birlesik Arap Emirlikleri Iliskilerinde Yeni Bir Doenem Erdogan Al Nahyan Goeruesmesi

May 17, 2025

Tuerkiye Birlesik Arap Emirlikleri Iliskilerinde Yeni Bir Doenem Erdogan Al Nahyan Goeruesmesi

May 17, 2025 -

7 Bit Casino A Top Rated No Kyc Casino With Instant Withdrawals In 2025

May 17, 2025

7 Bit Casino A Top Rated No Kyc Casino With Instant Withdrawals In 2025

May 17, 2025 -

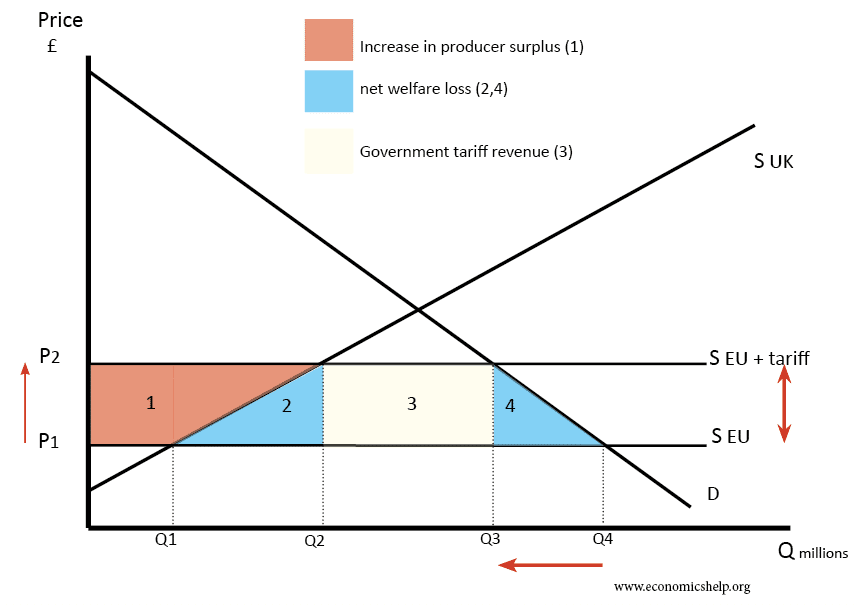

Ontarios 14 6 Billion Deficit Tariff Impacts And Economic Outlook

May 17, 2025

Ontarios 14 6 Billion Deficit Tariff Impacts And Economic Outlook

May 17, 2025 -

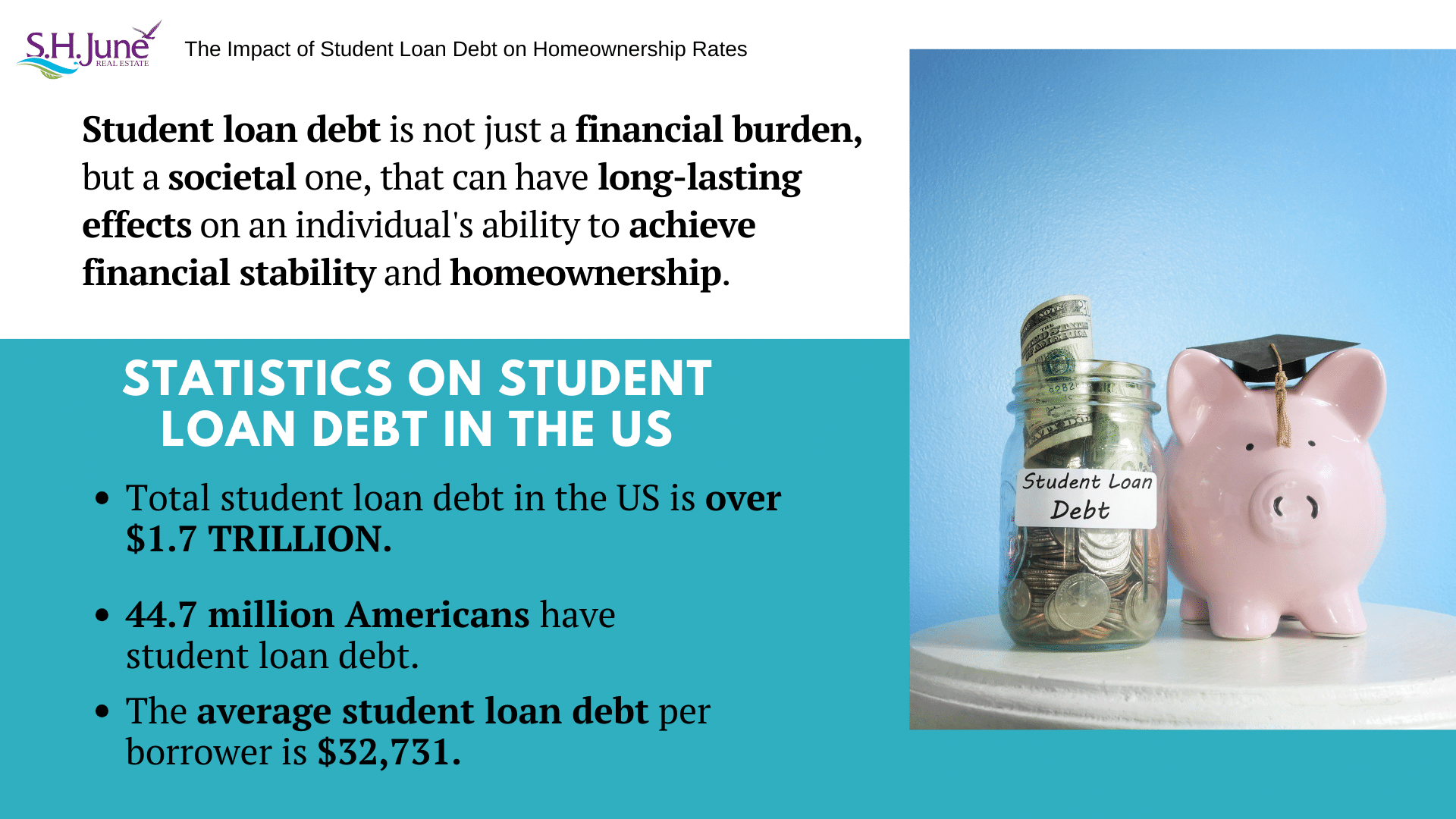

Homeownership With Student Loan Debt Tips And Strategies

May 17, 2025

Homeownership With Student Loan Debt Tips And Strategies

May 17, 2025 -

Alianza Lima Vs Talleres Goles Resumen Y Resultado Final 0 2

May 17, 2025

Alianza Lima Vs Talleres Goles Resumen Y Resultado Final 0 2

May 17, 2025