Deutsche Bank Head Of Distressed Sales Resigns, Joins Morgan Stanley

Table of Contents

The Resignation of Jane Doe: A Detailed Look

Jane Doe, a highly respected figure in the distressed debt market, had a distinguished career at Deutsche Bank spanning over 15 years. She consistently exceeded expectations, leading numerous successful transactions and building strong relationships with key clients. Her expertise in complex debt restructuring and her sharp analytical skills made her a valuable asset to the bank.

The resignation, announced last week, was reportedly voluntary. While no official statement detailing the reasons has been released by either Deutsche Bank or Jane Doe herself, industry insiders suggest that the move represents a compelling career advancement opportunity.

- Key Career Highlights at Deutsche Bank:

- Successfully led the restructuring of several high-profile distressed assets.

- Developed and implemented innovative strategies to enhance Deutsche Bank's market share in distressed debt sales.

- Mentored and developed a high-performing team of distressed debt specialists.

- Consistently ranked among the top performers in the distressed sales division.

The potential underlying reasons for her departure remain speculative, but a more lucrative compensation package and the chance to lead a larger team at Morgan Stanley are likely contributing factors.

Impact on Deutsche Bank's Distressed Sales Team and Strategy

Deutsche Bank's distressed sales team is a significant player in the global market, known for its expertise and extensive network. However, Doe's departure creates a considerable void in leadership and experience. The loss of such a key figure could temporarily impact Deutsche Bank's market share and its ability to compete effectively in the short term.

- Key Challenges for Deutsche Bank:

- Finding a suitable replacement with comparable experience and expertise.

- Maintaining client relationships and preventing potential defections to competitors.

- Ensuring a smooth transition and preventing disruption to ongoing transactions.

- Reaffirming its competitive position in the distressed debt market.

The process of finding a successor will be crucial. Deutsche Bank will need to identify a candidate who can not only maintain the team's performance but also bring fresh perspectives and strategies to navigate the ever-evolving landscape of distressed debt.

Morgan Stanley's Acquisition: Strategic Implications and Benefits

Morgan Stanley's hiring of Jane Doe represents a significant strategic move. Her extensive experience and network will undoubtedly strengthen Morgan Stanley's position in the competitive distressed debt market. The acquisition of such a talent demonstrates Morgan Stanley's commitment to expanding its presence and market share in this sector.

- Strategic Advantages for Morgan Stanley:

- Immediate access to a wealth of expertise and client relationships.

- Enhanced ability to compete for lucrative distressed debt transactions.

- Improved market positioning and brand reputation.

- Potential for attracting additional talent within the distressed debt market.

The synergies between Doe's expertise and Morgan Stanley's existing resources are expected to generate significant benefits, boosting the bank’s overall performance in the distressed debt sector.

Wider Implications for the Distressed Debt Market

The current distressed debt market is characterized by heightened volatility and increased opportunities due to macroeconomic factors. Doe's move from Deutsche Bank to Morgan Stanley adds a new layer of complexity and competition to this already dynamic market.

- Broader Implications:

- Potential reshuffling of market share among investment banks.

- Increased competition for distressed assets and talent.

- Potential impact on pricing and deal structures in the distressed debt market.

- Enhanced scrutiny of talent acquisition strategies within the financial sector.

This move serves as a strong signal to other investment banks, highlighting the importance of retaining top talent and strategically investing in their distressed debt capabilities to maintain a competitive edge.

Conclusion

This article examined the significant resignation of Jane Doe, the Deutsche Bank Head of Distressed Sales, and her subsequent move to Morgan Stanley. We analyzed the impact on both banks, the competitive landscape, and the distressed debt market as a whole. This high-profile move signals potential shifts in strategies and market power within the financial sector. The implications are far-reaching, impacting not only the two banks directly involved but also the wider landscape of the distressed debt market.

Call to Action: Stay informed on the latest developments in the financial world by following our coverage of key players like Deutsche Bank and Morgan Stanley, particularly regarding their activities in the Deutsche Bank Head of Distressed Sales and broader distressed debt market. Subscribe to our newsletter for more in-depth analysis and insights.

Featured Posts

-

Nvidia Reports Strong Forecast But China Concerns Remain

May 30, 2025

Nvidia Reports Strong Forecast But China Concerns Remain

May 30, 2025 -

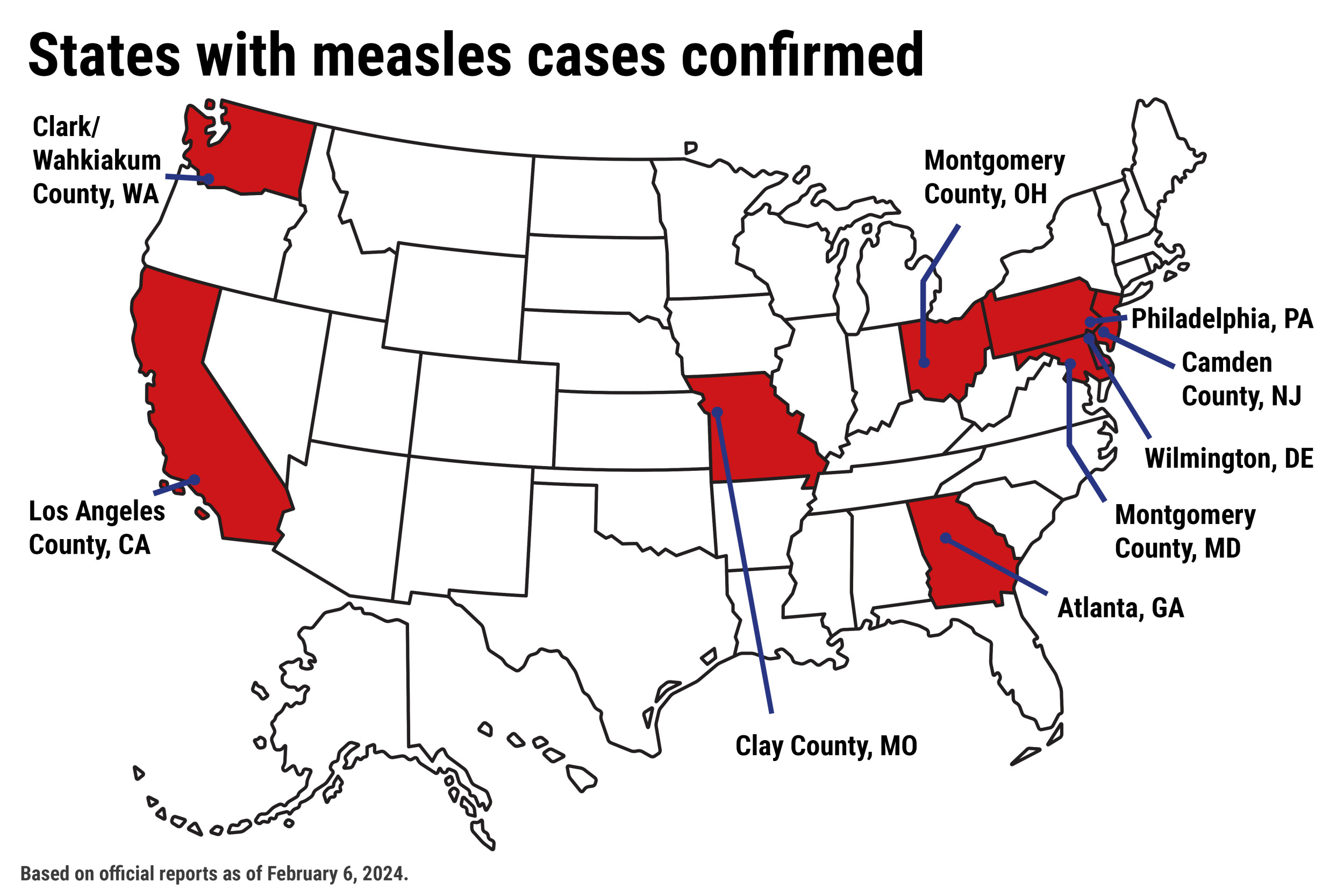

Updated Us Measles Case Count 1 046 Cases Indiana Outbreak Resolved

May 30, 2025

Updated Us Measles Case Count 1 046 Cases Indiana Outbreak Resolved

May 30, 2025 -

Ouverture Du Tunnel De Tende En Juin Confirmation Du Ministre Tabarot

May 30, 2025

Ouverture Du Tunnel De Tende En Juin Confirmation Du Ministre Tabarot

May 30, 2025 -

Como Reclamar Tu Reembolso Cancelacion Festival Axe Ceremonia 2025 Ticketmaster

May 30, 2025

Como Reclamar Tu Reembolso Cancelacion Festival Axe Ceremonia 2025 Ticketmaster

May 30, 2025 -

Del Toros Pick The Most Immersive World In Gaming

May 30, 2025

Del Toros Pick The Most Immersive World In Gaming

May 30, 2025