Nvidia Reports Strong Forecast, But China Concerns Remain

Table of Contents

Stellar Q2 2024 Earnings and Positive Forecast

Nvidia's Q2 2024 earnings exceeded expectations, showcasing robust revenue growth and strong earnings per share (EPS). The company reported a revenue of [Insert Actual Revenue Figure] representing a [Insert Percentage]% increase year-over-year. EPS reached [Insert Actual EPS Figure], significantly surpassing analyst predictions. This stellar performance was driven by several key factors:

- Data Center Dominance: The data center business, fueled by surging demand for Nvidia's AI chips like the H100 and A100, was the primary growth engine. This segment experienced a [Insert Percentage]% revenue increase, highlighting the immense potential of the AI market. The increasing adoption of AI in cloud computing and high-performance computing further bolstered this growth.

- Gaming Segment Resilience: Despite some market headwinds, Nvidia's gaming segment continued to perform well, contributing [Insert Percentage]% of total revenue. The release of new GPUs and continued strong demand for gaming hardware contributed to this segment's stability.

- Automotive Growth Trajectory: Nvidia's automotive segment also showcased promising growth, indicating the increasing adoption of its technology in autonomous vehicles and advanced driver-assistance systems (ADAS). This sector represents a significant long-term growth opportunity for the company.

The positive financial results led to a significant surge in Nvidia stock price, reflecting investor confidence in the company's future prospects. The strong performance and positive outlook solidified Nvidia's position as a dominant force in the semiconductor industry.

The Dominant Role of AI in Nvidia's Success

Artificial intelligence is undeniably the cornerstone of Nvidia's recent success. The company's GPUs, specifically designed for parallel processing, are exceptionally well-suited for powering the complex computations required by machine learning and deep learning algorithms. This has led to Nvidia achieving a dominant market share in:

- Data Centers: Nvidia's GPUs are the preferred choice for many of the world's largest data centers, powering AI workloads for various applications including natural language processing, image recognition, and recommendation systems. The shift towards cloud computing and the increasing demand for high-performance computing further solidify Nvidia's position in this crucial market segment.

- High-Performance Computing (HPC): Nvidia's technology is essential for scientific research, weather forecasting, and other computationally intensive tasks. The company’s continued innovation in GPU technology ensures its continued dominance in HPC.

Nvidia's technological leadership in GPU architecture, coupled with its strategic partnerships and investments in AI research, has solidified its position as a key player in the rapidly expanding AI landscape. The competitive landscape, while growing, still positions Nvidia as the market leader in terms of performance and adoption.

China's Impact on Nvidia's Future Growth

While Nvidia's current performance is impressive, the company's significant exposure to the Chinese market presents both opportunities and substantial risks. China represents a substantial portion of Nvidia's revenue, particularly in the data center and gaming segments. However, escalating geopolitical tensions and evolving trade policies present challenges:

- Trade Restrictions and Export Controls: The ongoing US-China trade war and potential export controls on advanced semiconductor technology could significantly impact Nvidia's ability to supply its products to the Chinese market, potentially leading to revenue losses and supply chain disruptions.

- Regulatory Uncertainty: The unpredictable regulatory environment in China introduces further uncertainty, potentially impacting market access and business operations. Navigating this complex regulatory landscape is crucial for Nvidia’s continued success in the region.

- Supply Chain Diversification: While Nvidia has started efforts in diversifying its supply chain and exploring alternative markets to reduce its reliance on China, this process will take time and involve considerable investment.

These factors introduce considerable geopolitical risk, which demands careful consideration and proactive risk mitigation strategies.

Navigating Geopolitical Challenges

The complex geopolitical landscape necessitates a multifaceted approach from Nvidia. The company must carefully balance its desire for growth in the lucrative Chinese market with the potential risks associated with escalating trade tensions and sanctions. This requires:

- Strategic Diversification: Reducing dependence on any single market, including China, is paramount. This involves expanding into other high-growth markets and diversifying its customer base.

- Robust Risk Management: Implementing robust risk management strategies to mitigate the impact of potential trade restrictions and regulatory uncertainties is crucial. This includes contingency planning for supply chain disruptions and alternative market development.

- Engagement with Regulators: Maintaining open communication with regulatory bodies in both the US and China to address concerns and ensure compliance is essential.

Conclusion

Nvidia's Q2 2024 earnings showcased impressive growth fueled by the burgeoning AI market and strong demand for its high-performance GPUs. While the company's forecast looks optimistic, the ongoing concerns regarding China's influence on its future performance cannot be ignored. The balance between capitalizing on the AI revolution and mitigating geopolitical risks will be crucial to Nvidia's sustained success.

Call to Action: Stay informed about the latest developments concerning Nvidia's performance and its strategic response to the evolving geopolitical landscape. Regularly check for updates on the Nvidia stock forecast and analysis to make informed investment decisions. Understanding the interplay of factors influencing Nvidia's forecast is key to navigating the complex semiconductor market.

Featured Posts

-

Epcots Flower And Garden Festival Top Things To See And Do

May 30, 2025

Epcots Flower And Garden Festival Top Things To See And Do

May 30, 2025 -

Charleston Tennis Pegula Claims Victory Against Collins

May 30, 2025

Charleston Tennis Pegula Claims Victory Against Collins

May 30, 2025 -

Monte Carlo Masters Final Alcaraz Begins Musetti Withdraws Injured

May 30, 2025

Monte Carlo Masters Final Alcaraz Begins Musetti Withdraws Injured

May 30, 2025 -

Master The Bargain Hunt Strategies For Smart Spending

May 30, 2025

Master The Bargain Hunt Strategies For Smart Spending

May 30, 2025 -

Sangre Del Toro A Guillermo Del Toro Documentary Debuts In Cannes

May 30, 2025

Sangre Del Toro A Guillermo Del Toro Documentary Debuts In Cannes

May 30, 2025

Latest Posts

-

Nfl Draft Mel Kiper Jr S Pick For The Cleveland Browns At No 2

May 31, 2025

Nfl Draft Mel Kiper Jr S Pick For The Cleveland Browns At No 2

May 31, 2025 -

Cleveland Guardians Opening Day Weather Is It Typically Cold

May 31, 2025

Cleveland Guardians Opening Day Weather Is It Typically Cold

May 31, 2025 -

Mel Kiper Jr On The Browns No 2 Overall Draft Choice

May 31, 2025

Mel Kiper Jr On The Browns No 2 Overall Draft Choice

May 31, 2025 -

Mel Kiper Jr S Prediction Browns No 2 Overall Draft Pick

May 31, 2025

Mel Kiper Jr S Prediction Browns No 2 Overall Draft Pick

May 31, 2025 -

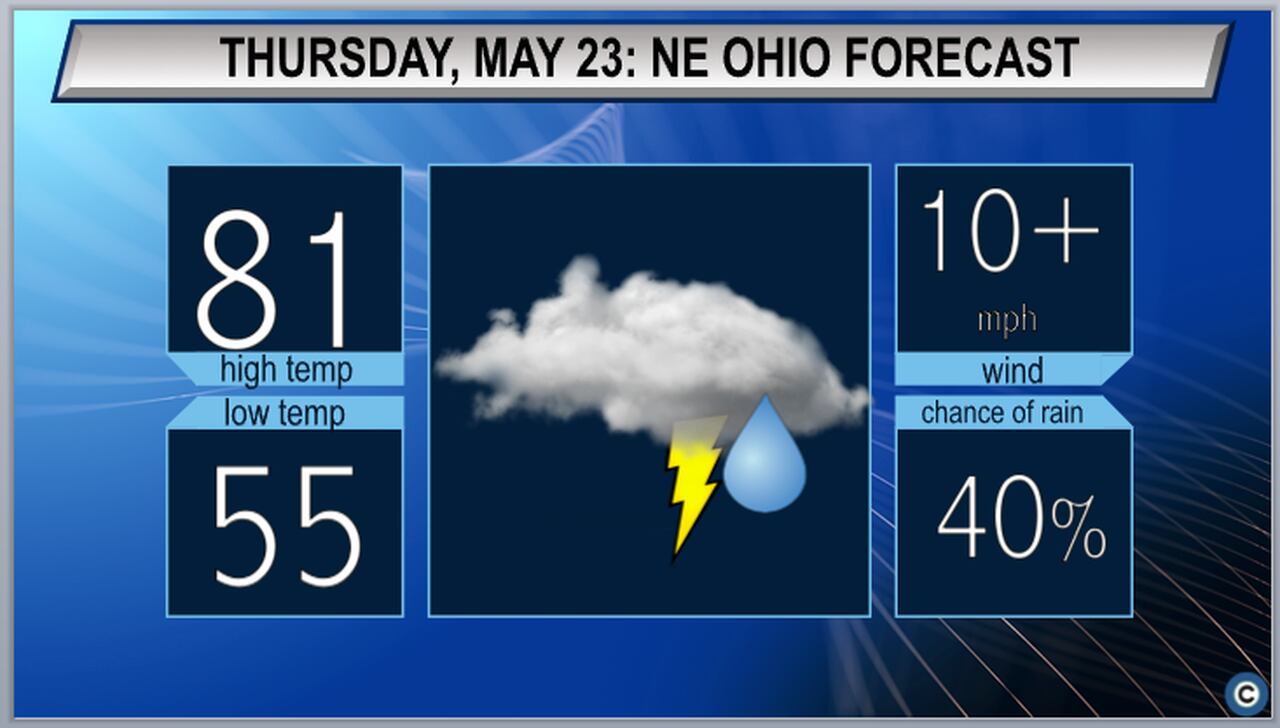

Northeast Ohio Braces For Strong Thunderstorms Latest Forecast

May 31, 2025

Northeast Ohio Braces For Strong Thunderstorms Latest Forecast

May 31, 2025