Did Trump Tariffs Influence The Bank Of Canada's April Rate Decision?

Table of Contents

The Economic Context of April 2019

Global Trade Tensions and the Trump Tariffs

The Trump administration's imposition of tariffs on various goods significantly impacted global trade, creating uncertainty and disrupting established supply chains. Canada, a major trading partner of the United States, was directly affected by these protectionist measures. The resulting trade war sparked concerns about potential economic slowdown and inflationary pressures worldwide.

- Specific examples of tariffs imposed: Tariffs on steel and aluminum, lumber, and agricultural products were particularly impactful for Canada.

- Industries affected in Canada: The Canadian lumber industry faced significant challenges due to US tariffs, as did the agricultural sector, particularly with regards to dairy and other products.

- Initial economic responses: Canadian businesses faced increased costs, reduced export opportunities, and a general climate of uncertainty. This led to some job losses and hampered investment. The Canadian dollar also experienced volatility. The keyword "Trump tariffs" directly impacted Canadian businesses, causing a significant ripple effect throughout the economy and affecting future economic growth.

Canadian Economic Indicators in April 2019

Before the Bank of Canada's April 2019 rate decision, several key economic indicators painted a mixed picture.

- Inflation rate: Inflation remained relatively stable, hovering near the Bank of Canada's target of 2%.

- GDP growth: GDP growth was showing signs of moderation, reflecting both global uncertainty and domestic factors.

- Unemployment rate: The unemployment rate was relatively low, signaling a strong labor market, yet vulnerable to external shocks.

These indicators presented a complex challenge for the Bank of Canada. While the labor market was robust, the global uncertainty introduced by the Trump tariffs presented a serious downside risk to future economic growth and the stability of inflation. The Bank had to carefully weigh the potential impact of these conflicting signals in formulating its policy decision.

The Bank of Canada's April Rate Decision: A Detailed Analysis

The Official Statement and Justification

The Bank of Canada's official press release for its April 2019 decision maintained its key interest rate. The Bank cited a cautious outlook due to global uncertainty, particularly regarding trade tensions, as a key factor in maintaining the status quo. The statement emphasized the need to monitor the evolving situation closely.

- Key quotes from the statement: The statement highlighted the "uncertain global economic outlook" and the need to "assess the implications of recent developments."

- Interpretation of the Bank's reasoning: The Bank appeared to be adopting a wait-and-see approach, acknowledging the risks posed by global trade uncertainty without taking drastic action.

Analyzing the Influence of External Factors

The Bank of Canada's April 2019 decision clearly acknowledged the influence of external factors, though not explicitly mentioning "Trump tariffs" by name. Global trade uncertainty, coupled with the performance of the US economy (a significant trading partner), heavily influenced their decision.

- Evidence from the statement and subsequent analyses: Analysts widely interpreted the Bank's caution as a direct response to the heightened uncertainty caused by the escalating trade war. The potential for negative spillover effects on the Canadian economy from trade disputes was palpable.

- Weight given to external factors: The external factors were given considerable weight in the Bank's assessment, suggesting a significant impact on their decision-making process.

Alternative Perspectives and Counterarguments

Other Contributing Factors to the Rate Decision

While global trade uncertainty was a significant consideration, other factors likely played a role in the Bank of Canada's April 2019 decision.

- Domestic inflation: Moderate inflation levels gave the Bank some leeway in its policy response.

- Housing market trends: The housing market was showing signs of cooling, reducing concerns about overheating. This reduced the pressure to raise rates.

Arguments Against a Significant Tariff Influence

Some argue that the impact of the Trump tariffs on the Bank of Canada's decision was minimal. They point to other factors, such as domestic economic conditions, as more significant determinants of the rate decision.

- Evidence supporting this perspective: The relatively stable inflation and the cooling housing market are often cited as evidence that domestic factors held more sway than global trade tensions. Furthermore, some argue the impact of the tariffs on the Canadian economy was less severe than initially feared.

Conclusion

The influence of the Trump-era tariffs on the Bank of Canada's April 2019 rate decision remains a complex issue. While the Bank's official statement acknowledged global uncertainty, it did not explicitly cite the tariffs as a primary factor. However, the prevailing economic climate, heavily influenced by the trade war and the subsequent uncertainty, significantly shaped the Bank's cautious approach. The evidence suggests a clear correlation between the trade war and the Bank's decision to maintain rates. Other domestic factors, such as inflation and housing trends, also contributed to the decision.

Further research is needed to definitively assess the long-term impact of trade disputes, like the one initiated by the Trump tariffs, on the Bank of Canada's monetary policy decisions. Continue to monitor the Bank of Canada's announcements and economic data to understand the ongoing effects of global trade on the Canadian economy and future interest rate decisions. Stay informed about the impact of Trump tariffs on the Bank of Canada's future interest rate decisions.

Featured Posts

-

Le Vatican Theatre D Une Altercation Entre Trump Et Macron

May 03, 2025

Le Vatican Theatre D Une Altercation Entre Trump Et Macron

May 03, 2025 -

Official Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 03, 2025

Official Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 03, 2025 -

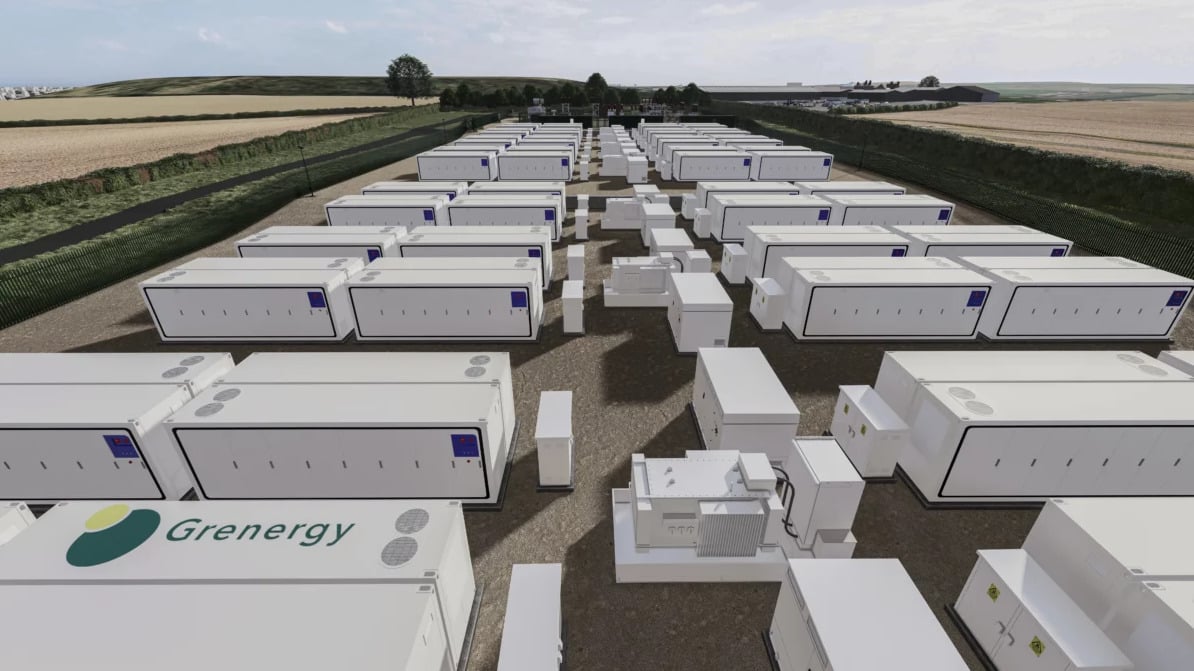

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025 -

Harnessing The Wind How Wind Powered Trains Can Reduce Pollution And Save Energy

May 03, 2025

Harnessing The Wind How Wind Powered Trains Can Reduce Pollution And Save Energy

May 03, 2025 -

Manchester United Pays Tribute To 10 Year Old Poppy Atkinson

May 03, 2025

Manchester United Pays Tribute To 10 Year Old Poppy Atkinson

May 03, 2025

Latest Posts

-

Expert Prediction Souness Names Arsenals Top Champions League Rival

May 03, 2025

Expert Prediction Souness Names Arsenals Top Champions League Rival

May 03, 2025 -

Arsenal Faces Stiff Champions League Competition Sounesss Expert Analysis

May 03, 2025

Arsenal Faces Stiff Champions League Competition Sounesss Expert Analysis

May 03, 2025 -

Souness Issues Stark Arsenal Warning Unbeatable Champions League Rival Emerges

May 03, 2025

Souness Issues Stark Arsenal Warning Unbeatable Champions League Rival Emerges

May 03, 2025 -

Graeme Souness Arsenal Warning Another Champions League Contender Soars

May 03, 2025

Graeme Souness Arsenal Warning Another Champions League Contender Soars

May 03, 2025 -

Drone Attack On Gaza Freedom Flotilla Ship Sos Signal Issued Near Malta

May 03, 2025

Drone Attack On Gaza Freedom Flotilla Ship Sos Signal Issued Near Malta

May 03, 2025