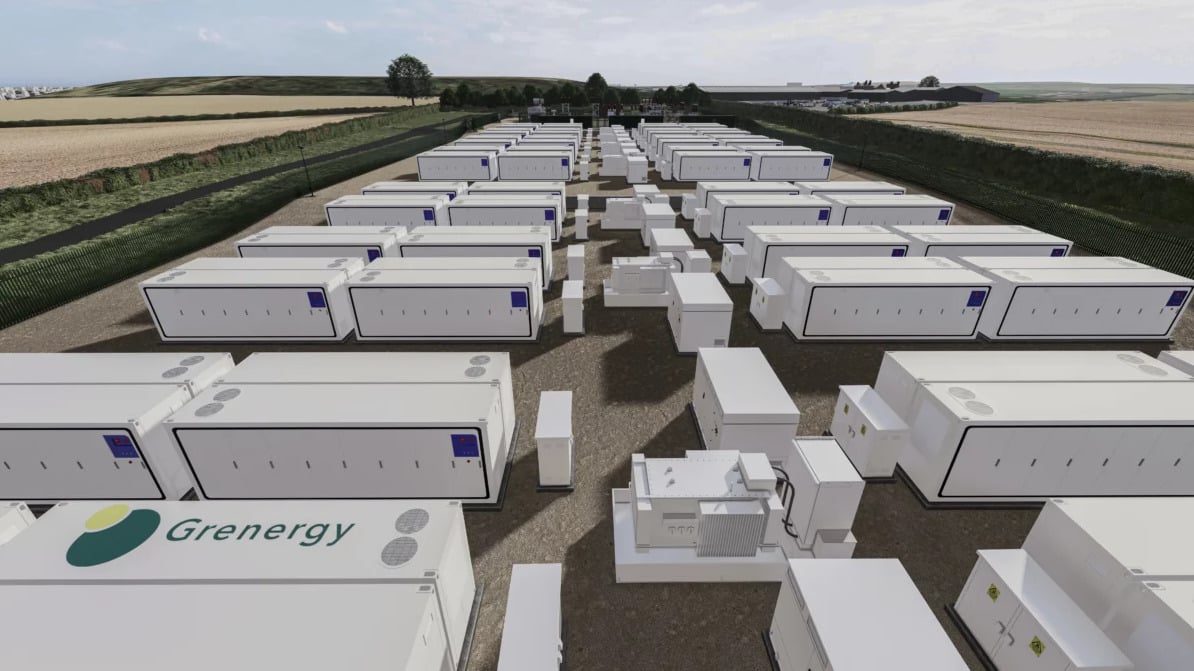

Financing A 270MWh BESS In Belgium's Complex Merchant Market

Table of Contents

Understanding the Belgian Energy Market and its Impact on BESS Financing

The Belgian energy market, with its increasing reliance on renewable energy sources and commitment to decarbonization, presents both challenges and opportunities for BESS deployment. Successfully financing a 270MWh BESS project hinges on navigating these complexities.

Regulatory Framework and Incentives

Belgium's ambitious renewable energy targets are driving the demand for energy storage solutions like BESS. However, navigating the regulatory framework is crucial for securing financing.

- Belgian renewable energy targets: The Belgian government has set ambitious targets for renewable energy integration, creating a strong incentive for BESS deployment to manage intermittency.

- Impact on BESS deployment: These targets directly influence the attractiveness of BESS investments, creating a favorable environment for project financing.

- Available subsidies and tax benefits for energy storage: Several government programs offer subsidies and tax benefits for energy storage projects, significantly reducing the initial investment cost and improving project returns. Understanding and accessing these incentives is critical.

- Grid connection regulations: Grid connection procedures and capacity limitations can influence project timelines and costs. Early engagement with grid operators is essential for securing timely and cost-effective grid access.

- Permitting processes: Navigating the permitting process efficiently is critical for project success. Understanding the regulatory requirements and timelines is crucial for accurate financial projections.

Specific legislation such as [insert relevant Belgian legislation here] directly impacts BESS project feasibility and financing. Challenges may arise from navigating complex bureaucratic procedures and ensuring compliance with evolving regulations.

The Merchant Market Model and Revenue Streams

Belgium's merchant market model introduces price volatility, impacting the profitability of BESS projects. However, this volatility also creates opportunities for arbitrage and other revenue streams.

- Intricacies of the Belgian merchant market: Understanding the price dynamics, including seasonal variations and peak demand periods, is critical for accurate revenue forecasting.

- Price volatility and its effect on BESS profitability: Price volatility creates both risks and opportunities. Sophisticated revenue models are necessary to account for these fluctuations.

- Potential revenue streams:

- Frequency Regulation: Providing frequency regulation services to the grid operator can generate stable, recurring income.

- Capacity Market participation: Participating in capacity markets can offer additional revenue streams based on the system's need for reserve power.

- Arbitrage opportunities: Profiting from price differences between peak and off-peak hours requires sophisticated trading strategies and forecasting capabilities.

A 270MWh BESS project offers significant arbitrage potential due to its scale. However, accurate forecasting and risk management are paramount to achieving projected returns in the volatile merchant market.

Assessing Project Risk and Bankability

Financing a 270MWh BESS project requires a thorough risk assessment to enhance its bankability.

- Technological risk: The reliability and performance of the BESS technology must be rigorously assessed.

- Operational risk: Potential downtime, maintenance requirements, and unforeseen operational challenges must be considered.

- Regulatory risk: Changes in regulations, permitting delays, or grid connection issues can impact project viability.

- Market risk: Price volatility and changes in market demand can affect revenue streams.

- Offtake risk: Securing long-term contracts or demonstrating reliable revenue streams is crucial for reducing offtake risk.

Mitigating these risks through robust technology selection, detailed operational planning, and comprehensive risk management strategies is essential for securing favorable financing terms. Insurance policies and guarantees can significantly improve project bankability.

Exploring Financing Options for a 270MWh BESS Project

Securing funding for a large-scale BESS project like this requires a diversified approach.

Debt Financing

Traditional debt financing options are suitable, but their suitability depends on the project's risk profile and the lender's appetite for renewable energy projects.

- Traditional bank loans: Banks are increasingly providing financing for renewable energy projects, but obtaining favorable terms requires a strong business plan and a low-risk profile.

- Green bonds: Issuing green bonds can attract environmentally conscious investors, offering potentially lower interest rates.

- Project finance: Project finance structures allow lenders to secure repayment based on the project's cash flows, reducing the reliance on the developer's balance sheet.

The choice of lender and the structuring of the loan agreement are critical for optimizing financing costs and terms.

Equity Financing

Equity financing can provide significant upfront capital but involves diluting ownership.

- Private equity: Private equity firms often invest in large-scale infrastructure projects, providing significant capital injections.

- Venture capital: Venture capital may be suitable for early-stage projects with high growth potential but carries higher risk.

The terms of equity financing, including valuation, equity stake, and investor control, need careful consideration.

Hybrid Financing Structures

Combining debt and equity financing can optimize the capital structure and mitigate risks.

- Combinations of debt and equity: A blended approach can reduce the reliance on a single funding source, improving resilience.

- Potential benefits of a blended approach: This approach can lower the overall cost of capital, improve the risk profile, and provide access to diverse investor pools.

Developing a hybrid financing structure tailored to the specific risk profile and funding requirements of the project is crucial.

Case Studies and Best Practices

Successful BESS financing in Belgium and similar markets, such as the Netherlands and Germany, demonstrates the importance of robust financial modeling and thorough due diligence. Analysis of these case studies reveals key success factors including: securing offtake agreements, strong regulatory compliance, and efficient project management. [Insert examples of successful BESS financing in comparable markets here]. These examples highlight the importance of meticulous financial modeling and due diligence in demonstrating the project's viability and achieving favorable financing terms.

Conclusion

Financing a 270MWh BESS project in Belgium's merchant market demands a strategic approach. By thoroughly understanding the regulatory environment, market dynamics, and available funding options, developers can enhance their project's bankability. Careful risk assessment, robust financial modeling, and a well-structured financing strategy incorporating debt, equity, or hybrid structures are crucial for securing the necessary capital to finance a 270MWh BESS in Belgium. Contact us today to discuss your project and explore potential funding solutions.

Featured Posts

-

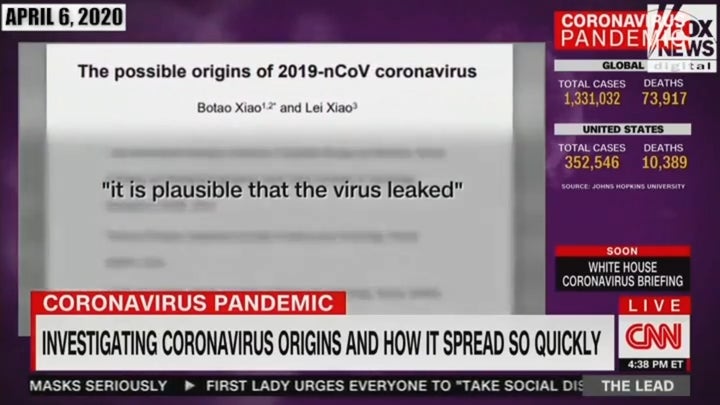

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

May 03, 2025

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

May 03, 2025 -

Soupcons A Rome Macron Et L Influence Sur Le Conclave

May 03, 2025

Soupcons A Rome Macron Et L Influence Sur Le Conclave

May 03, 2025 -

Tulsa Forecast Record Cold And Delayed Snowmelt

May 03, 2025

Tulsa Forecast Record Cold And Delayed Snowmelt

May 03, 2025 -

Belgium Financial Strategies For A 270 M Wh Battery Energy Storage System

May 03, 2025

Belgium Financial Strategies For A 270 M Wh Battery Energy Storage System

May 03, 2025 -

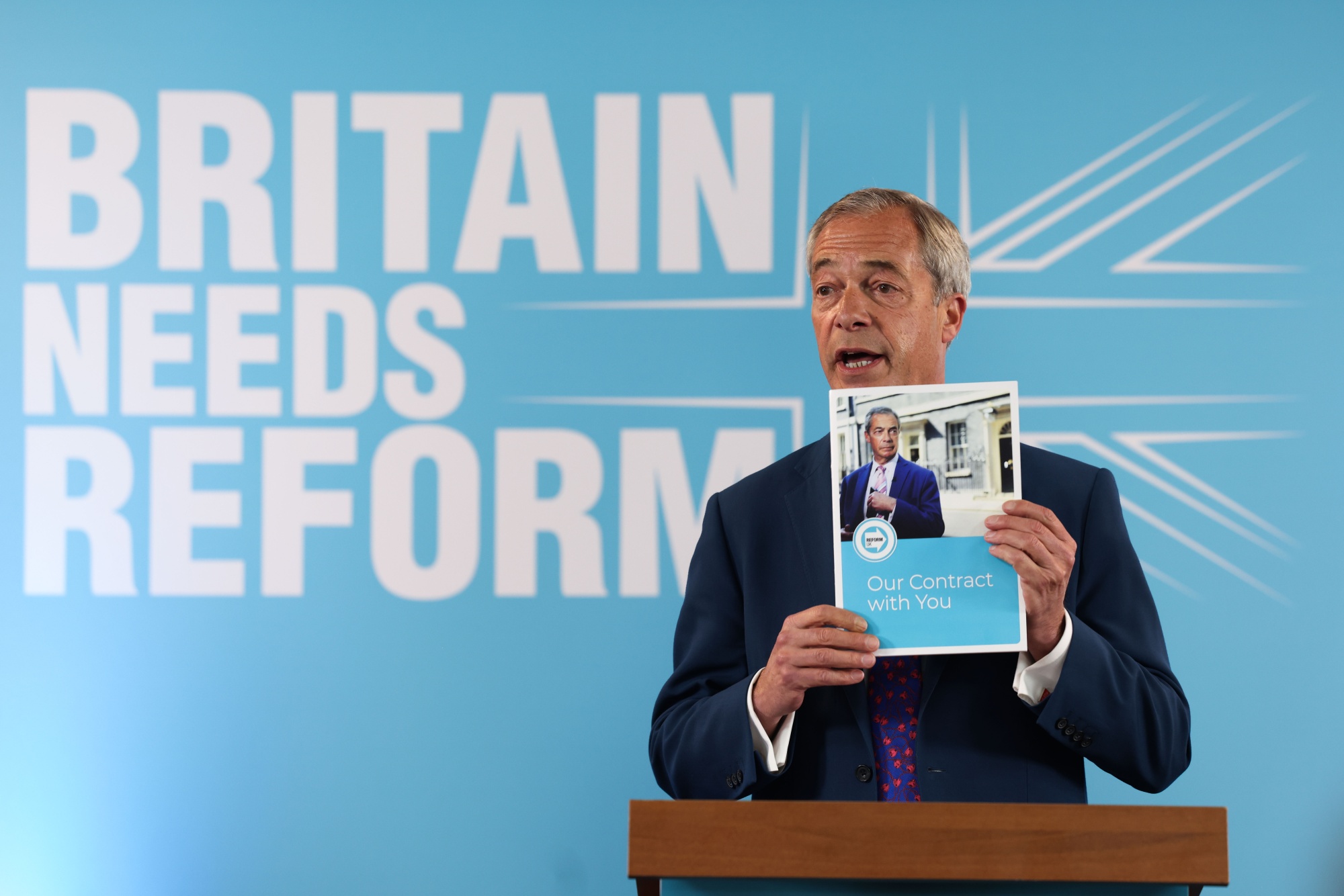

Reform Uks Holyrood Election Gambit Farage Sides With Snp

May 03, 2025

Reform Uks Holyrood Election Gambit Farage Sides With Snp

May 03, 2025

Latest Posts

-

Watch Belgium Vs England Live Tv Channel Kick Off Time And Online Streaming

May 03, 2025

Watch Belgium Vs England Live Tv Channel Kick Off Time And Online Streaming

May 03, 2025 -

Experience The New Harry Potter Shop In Chicago

May 03, 2025

Experience The New Harry Potter Shop In Chicago

May 03, 2025 -

Poppy Atkinson Funeral Held For Manchester United Fan After Tragic Accident

May 03, 2025

Poppy Atkinson Funeral Held For Manchester United Fan After Tragic Accident

May 03, 2025 -

Find Belgium Vs England On Tv Kick Off Time And Streaming Details

May 03, 2025

Find Belgium Vs England On Tv Kick Off Time And Streaming Details

May 03, 2025 -

Lionesses Vs Belgium Tv Channel Kick Off Time And How To Watch The Match

May 03, 2025

Lionesses Vs Belgium Tv Channel Kick Off Time And How To Watch The Match

May 03, 2025