Direct Lender Tribal Loans: Guaranteed Approval Even With Bad Credit

Table of Contents

Are you struggling to secure a loan because of your bad credit history? Securing financing when you have less-than-perfect credit can feel impossible. Traditional lenders often turn down applications with low credit scores, leaving many feeling trapped in a cycle of debt. But what if there was an alternative? Direct lender tribal loans offer a potential solution, promising the possibility of guaranteed approval even with bad credit. While this sounds appealing, it's crucial to understand the benefits, eligibility requirements, and potential risks before considering this option. This article explores the world of direct lender tribal loans, helping you make informed decisions about your financial future.

Understanding Direct Lender Tribal Loans

Direct lender tribal loans are offered by lending institutions owned and operated by Native American tribes. These loans differ significantly from traditional loans offered by banks or credit unions, and importantly, they differ from loans brokered by third-party lenders who merely connect you with a lender. Tribal lenders operate under the sovereignty of their respective tribes, meaning they are governed by tribal law and regulations, separate from state and federal laws in many instances. This unique regulatory environment significantly impacts the lending process and the terms of the loans.

- Advantages of Direct Lenders: Dealing directly with the lender eliminates intermediaries, often leading to faster processing times and potentially simpler application procedures.

- Potential Disadvantages: It's crucial to acknowledge that interest rates on tribal loans are often higher than conventional loans. Furthermore, there's a risk of encountering predatory lending practices if not careful in choosing a lender. Always thoroughly investigate any lender before committing.

- Sovereign Immunity: Tribal lenders often operate under the principle of sovereign immunity, which means they may be less subject to certain state and federal regulations that govern traditional lenders. Understanding this legal framework is vital when evaluating the potential risks and benefits.

Eligibility Requirements for Tribal Loans

While tribal lenders often have less stringent credit score requirements than traditional banks, certain eligibility criteria still apply. Generally, you'll need to meet several requirements to be considered for a loan.

- Required Documentation: Be prepared to provide proof of income (pay stubs, tax returns), a valid government-issued ID, and bank statements to demonstrate your financial stability.

- Credit Score Requirements: Although a lower credit score might not automatically disqualify you, a higher score will usually improve your chances of approval and potentially secure a more favorable interest rate. The specific minimum credit score requirements vary significantly among lenders.

- Income Verification: Tribal lenders will verify your income to ensure you have the ability to repay the loan. This may involve providing pay stubs, tax returns, or bank statements.

- Accurate Information: Providing false or misleading information can lead to loan application rejection and potentially damage your credit further. Honesty is paramount throughout the application process.

Bad Credit and Tribal Loans: A Closer Look

The question many with bad credit ask is: Can I get approved for a tribal loan with bad credit? The answer is potentially yes. While "guaranteed approval" is often used as a marketing tactic, it's crucial to understand that this doesn't mean automatic approval regardless of your financial circumstances. "Guaranteed approval" usually means the lender will review your application even with bad credit, not that approval is certain.

Tribal lenders often assess risk beyond credit scores. They consider factors like your income, employment history, and debt-to-income ratio. Responsible borrowing is key, even with potentially easier approval.

- Factors Considered Besides Credit Score: A consistent income, stable employment history, and a manageable debt-to-income ratio all contribute to a stronger application.

- Responsible Borrowing: Even if approved, borrowing responsibly is crucial to avoid further financial hardship. Carefully budget to ensure timely repayment.

- High-Interest Rates: Remember that high-interest rates are common with tribal loans. Carefully weigh the cost of borrowing before committing.

Finding Reputable Direct Lenders

Navigating the world of tribal lending requires caution. Thorough research is essential to avoid predatory lenders who may take advantage of your financial situation.

- Importance of Reading Reviews: Check online reviews and testimonials from previous borrowers to gauge a lender's reputation and customer service.

- Avoiding Loan Scams: Be wary of lenders who promise unrealistic terms or require upfront fees before loan disbursement. Legitimate lenders won't ask for money before approval.

- Where to Find Legitimate Lenders: Search for reputable tribal lenders online using verified directories or financial comparison websites.

The Cost of Tribal Loans and Repayment Options

Tribal loans, like many alternative financing options, often come with higher interest rates and fees than traditional loans.

- APR (Annual Percentage Rate): Pay close attention to the APR, which reflects the total cost of borrowing over a year, including interest and fees.

- Late Payment Fees and Penalties: Understand the penalties for late or missed payments to avoid accumulating additional debt.

- Repayment Schedule: Review the repayment schedule carefully before accepting a loan, ensuring you can comfortably meet the monthly payments. Installment loans are the most common repayment option, offering a fixed monthly payment spread over a set period.

Conclusion

Direct lender tribal loans can offer a pathway to financing for individuals with bad credit. While the possibility of approval is higher than with some traditional lenders, it's vital to remember that these loans often come with higher interest rates and fees. "Guaranteed approval" should be interpreted cautiously. Prioritize responsible borrowing and a thorough understanding of the terms and costs before applying. Finding a reputable direct lender is paramount. Research thoroughly, compare options, and carefully consider all aspects before making a decision. If you meet the eligibility criteria and understand the associated risks, direct lender tribal loans could be a viable solution. Use online comparison tools to find the best options for your circumstances. Remember to always borrow responsibly.

Featured Posts

-

Arsenal On Verge Of Signing Key Transfer Target Ahead Of Rivals

May 28, 2025

Arsenal On Verge Of Signing Key Transfer Target Ahead Of Rivals

May 28, 2025 -

100 000 Job Losses Predicted As Recession Looms Tds Posthaste Warning

May 28, 2025

100 000 Job Losses Predicted As Recession Looms Tds Posthaste Warning

May 28, 2025 -

Sinner Announces Hamburg Tournament Following Doping Ban

May 28, 2025

Sinner Announces Hamburg Tournament Following Doping Ban

May 28, 2025 -

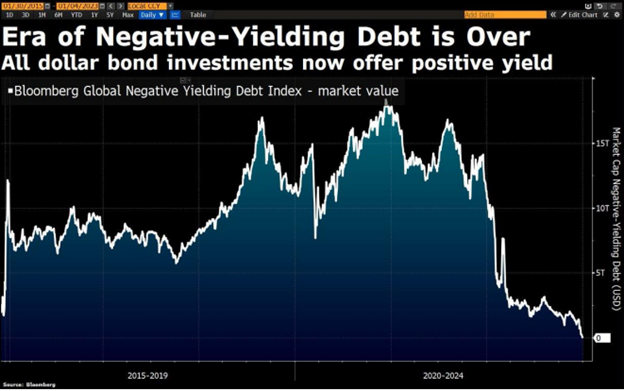

The Impact Of The Bond Crisis On Global Markets

May 28, 2025

The Impact Of The Bond Crisis On Global Markets

May 28, 2025 -

Was Hailee Steinfelds Spit Scene In The Sinner Filmed Practically

May 28, 2025

Was Hailee Steinfelds Spit Scene In The Sinner Filmed Practically

May 28, 2025