Do Film Tax Credits Work? A Minnesota Case Study

Table of Contents

The film industry boasts a significant economic impact, contributing billions to the US economy annually. Minnesota, aiming to tap into this potential, has implemented its own film tax credit program. But do these film tax credits actually work to stimulate economic growth? This article examines the effectiveness of Minnesota's film tax credit program, analyzing both its purported benefits and potential drawbacks to determine its true return on investment. We'll delve into the specifics of the program, assess its impact on job creation and economic activity, and compare it to similar initiatives in other states. Our analysis will utilize keywords such as "film tax credits," "Minnesota film industry," "economic impact," "job creation," and "return on investment" to thoroughly explore this complex issue.

2. Main Points:

2.1. Minnesota's Film Tax Credit Program: An Overview

Minnesota's film tax credit program offers a 20% credit on qualified production spending within the state. Eligibility criteria include various factors such as the production's budget, the amount of spending within Minnesota, and the type of production (feature films, television series, commercials, etc.). The program has been in place since 2004, with several minor adjustments to eligibility criteria over the years. The annual budget allocation varies, but generally, millions are allocated each year to incentivize film production in Minnesota. This program falls under the umbrella of "film production incentives" and aims to bolster "Minnesota film industry funding," attracting productions that might otherwise choose other locations.

2.2. Claimed Benefits of the Minnesota Film Tax Credit

Proponents of the Minnesota film tax credit cite several key benefits:

- Job Creation: The program claims to create numerous jobs, both directly (e.g., actors, crew members, directors) and indirectly (e.g., local businesses providing services to productions). While precise figures are debated, studies commissioned by the state often highlight a significant number of jobs created through these "job creation film tax credits."

- Increased Film Production: Data suggests a rise in film and television productions in Minnesota since the program's inception. This increased "Minnesota film production" has brought in productions that may not have considered Minnesota otherwise.

- Economic Ripple Effect: Beyond direct employment, the influx of productions stimulates the local economy. Increased spending on hotels, restaurants, equipment rentals, and other local businesses creates a significant "economic impact of film" within the state, further boosting the "tourism boost" through location-based film tourism.

2.3. Potential Drawbacks and Criticisms of the Program

Despite the claimed benefits, several drawbacks and criticisms exist:

- Cost-Effectiveness: A critical question revolves around the "film tax credit ROI." Is the state's investment in tax credits generating sufficient economic return to justify the expenditure? Studies on this issue often yield differing results, with some suggesting a positive ROI, while others raise concerns about the program's "economic efficiency." This is a key area where further research, specifically concerning "government spending," is needed.

- Administrative Burden: Administering the program involves significant costs in terms of staff time, auditing processes, and ensuring compliance. This represents a significant "administrative burden" that should be factored into the program’s overall evaluation.

- Lack of Transparency: Some argue for increased transparency and accountability regarding how tax credits are allocated and used, raising concerns about potential "taxpayer money" mismanagement. Improved data collection and public reporting could alleviate some of these concerns.

- Potential for Abuse: There's always a risk of fraudulent claims or misuse of funds, necessitating robust auditing and oversight mechanisms to minimize the potential for "abuse" of the system.

2.4. Comparative Analysis: Minnesota vs. Other States

Comparing Minnesota's program to similar "state film incentives" across other states reveals various approaches to film tax credits. Some states offer higher percentages, while others have more restrictive eligibility criteria. Analyzing programs with demonstrably higher "film tax credit comparison" success rates could help identify best practices and suggest areas for improvement within the Minnesota program. This comparative analysis should highlight successful approaches and potential areas where the Minnesota program could learn from "best practices film tax credits" employed in other states.

3. Conclusion: Do Minnesota Film Tax Credits Deliver? A Final Verdict

Determining the overall effectiveness of Minnesota's film tax credit program requires careful consideration of both its benefits and drawbacks. While the program has undoubtedly stimulated some economic activity and job creation, questions remain about its cost-effectiveness and long-term sustainability. The "Minnesota film tax credit effectiveness" is an ongoing debate, and further analysis is needed to definitively assess whether the program achieves its intended goals. Based on the current evidence, a comprehensive cost-benefit analysis is crucial to ensure responsible use of "taxpayer money" and to inform future "film industry policy." "Economic development strategies" often benefit from comprehensive evaluation and refinement. To engage in this crucial evaluation, we encourage readers to learn more about the impact of Minnesota film tax credits and contact their representatives to advocate for improvements or a comprehensive evaluation of the current program. Let's continue the conversation about the future of film tax credits in Minnesota.

Featured Posts

-

Post Trump Funding Cuts A Global Battle For Scientific Talent

Apr 29, 2025

Post Trump Funding Cuts A Global Battle For Scientific Talent

Apr 29, 2025 -

Wrong Way Crash On Minnesota North Dakota Border Claims Texas Womans Life

Apr 29, 2025

Wrong Way Crash On Minnesota North Dakota Border Claims Texas Womans Life

Apr 29, 2025 -

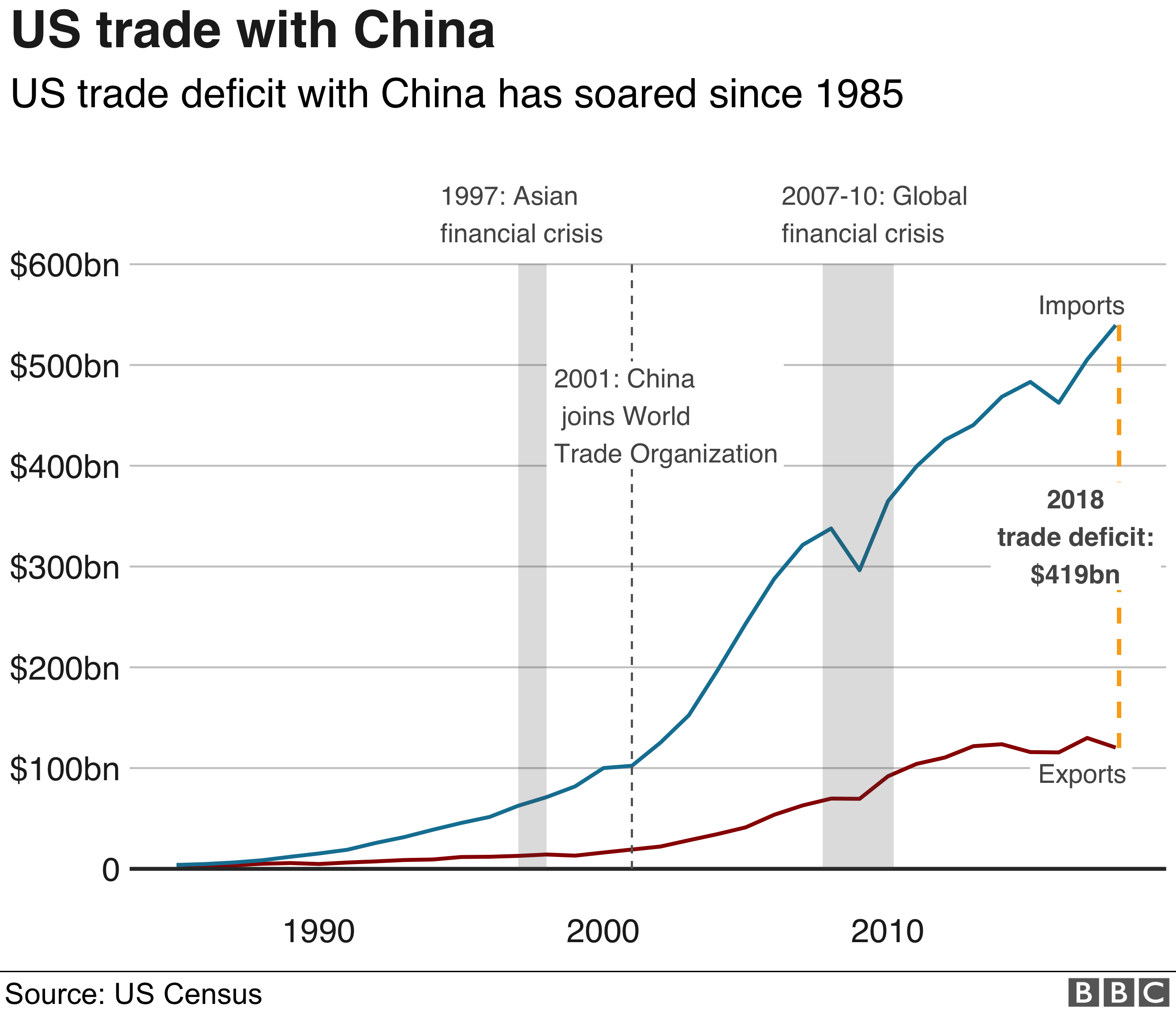

Trumps China Tariffs Higher Prices And Empty Shelves The Economic Impact

Apr 29, 2025

Trumps China Tariffs Higher Prices And Empty Shelves The Economic Impact

Apr 29, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 29, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 29, 2025 -

The Economic Fallout Of Trumps China Tariffs Inflation Supply Chain Disruptions And More

Apr 29, 2025

The Economic Fallout Of Trumps China Tariffs Inflation Supply Chain Disruptions And More

Apr 29, 2025

Latest Posts

-

Is This The New Quinoa A Rising Star In Healthy Eating

Apr 29, 2025

Is This The New Quinoa A Rising Star In Healthy Eating

Apr 29, 2025 -

Beyond Quinoa Introducing The Latest Superfood Sensation

Apr 29, 2025

Beyond Quinoa Introducing The Latest Superfood Sensation

Apr 29, 2025 -

Quinoas Reign Is Over Discover The New It Crop

Apr 29, 2025

Quinoas Reign Is Over Discover The New It Crop

Apr 29, 2025 -

The Impact Of Tariff Uncertainty U S Companies Cost Cutting Response

Apr 29, 2025

The Impact Of Tariff Uncertainty U S Companies Cost Cutting Response

Apr 29, 2025 -

Move Over Quinoa The Next Big Superfood Is Here

Apr 29, 2025

Move Over Quinoa The Next Big Superfood Is Here

Apr 29, 2025