The Economic Fallout Of Trump's China Tariffs: Inflation, Supply Chain Disruptions And More

Table of Contents

Soaring Inflation: A Direct Consequence of Trump's China Tariffs

Trump's China tariffs directly increased the price of imported goods, contributing significantly to soaring inflation rates in the US. The tariffs acted as a tax, adding to the cost of manufacturing and shipping, which businesses then passed on to consumers. This "pass-through" effect of tariffs on consumer prices is a key factor in understanding the inflationary pressures experienced during this period.

- Examples of affected goods: Consumer electronics, furniture, clothing, and numerous other everyday items saw price increases due to the tariffs.

- Inflation data: The Consumer Price Index (CPI) showed a clear correlation between the implementation of tariffs and an increase in inflation rates. Specific data points comparing inflation before, during, and after the tariff period would further illustrate this point.

- Pass-through effect: Many businesses, unable to absorb the increased costs, were forced to raise prices, ultimately impacting consumers' purchasing power and reducing overall economic activity. The trade war initiated by these tariffs exacerbated existing inflationary pressures.

Related keywords: trade war, import prices, consumer price index (CPI), inflation rate.

Supply Chain Disruptions: A Tangled Web of Global Trade

The globalized nature of modern supply chains made them particularly vulnerable to the disruptions caused by Trump's China tariffs. These tariffs didn't just increase prices; they also created significant logistical challenges. Businesses were forced to scramble to find alternative sources of goods, leading to delays, increased costs, and a general sense of uncertainty.

- Shipping and manufacturing delays: Tariffs led to increased port congestion and delays in shipping, further compounding the problem of rising prices. This resulted in shortages of goods and contributed to inflationary pressures.

- Increased business costs: The logistical challenges associated with navigating the new trade environment led to substantial increases in business costs, hurting profitability and potentially leading to job losses.

- Industries significantly impacted: The manufacturing and automotive sectors were particularly hard-hit, facing significant disruptions to their supply chains.

Related keywords: global supply chains, logistics, manufacturing costs, trade disruptions, business uncertainty.

Impact on Specific Industries: Winners and Losers in the Trade War

While some domestic producers potentially benefited from increased demand due to import substitution spurred by Trump's China tariffs, many other sectors suffered significantly. The overall net effect was far from positive for the US economy.

- Industries that benefited: Some domestic manufacturers of goods previously heavily imported from China may have experienced short-term gains, at least until retaliatory tariffs from China impacted their exports.

- Industries that suffered: The retail sector, which heavily relies on imported goods, felt the pinch of higher prices and reduced consumer spending. The agricultural sector, a key export market, also suffered due to retaliatory tariffs imposed by China.

- Specific examples and data: Detailed analysis of specific industries' financial performance during and after the tariff period would provide concrete evidence of the winners and losers.

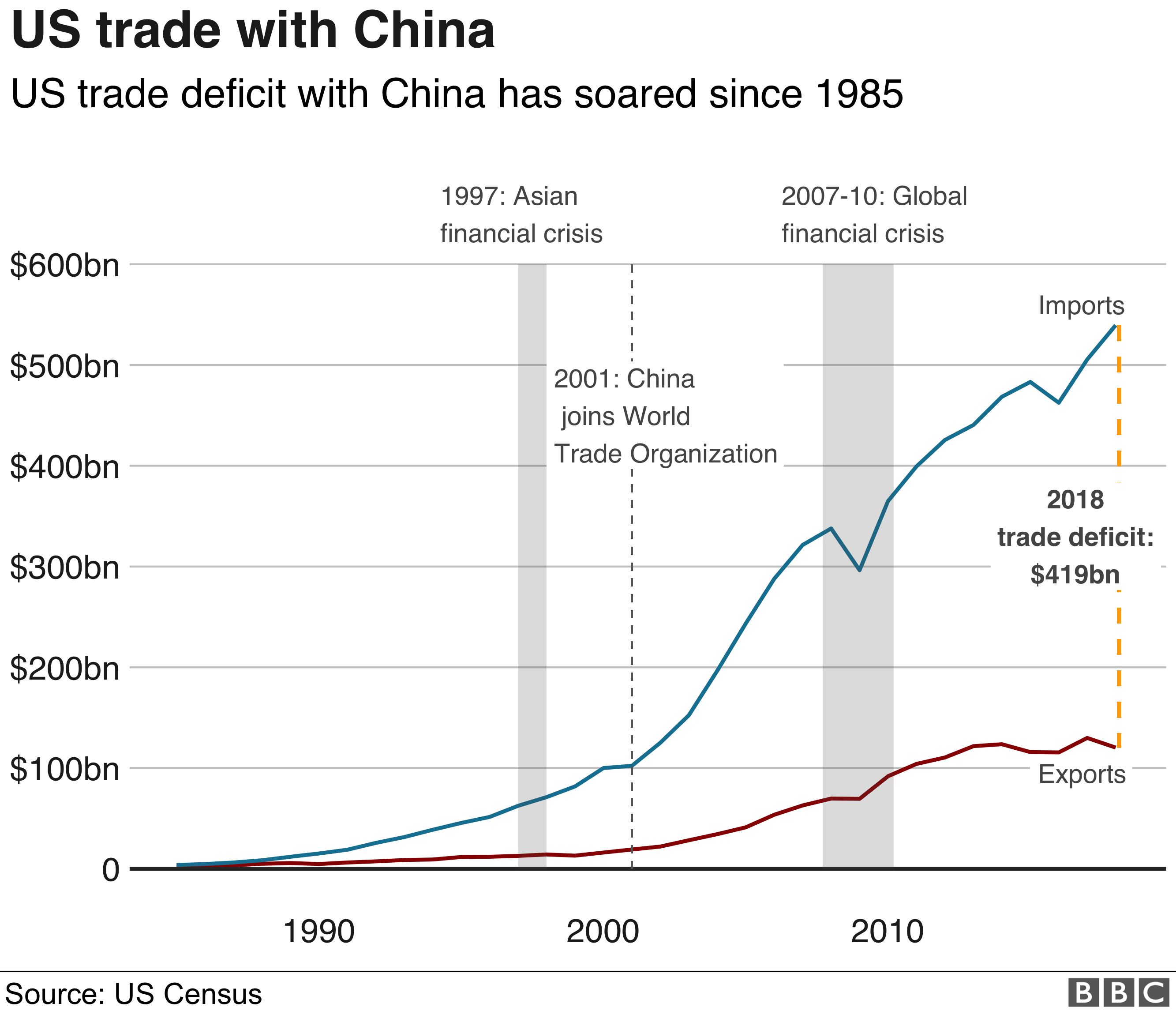

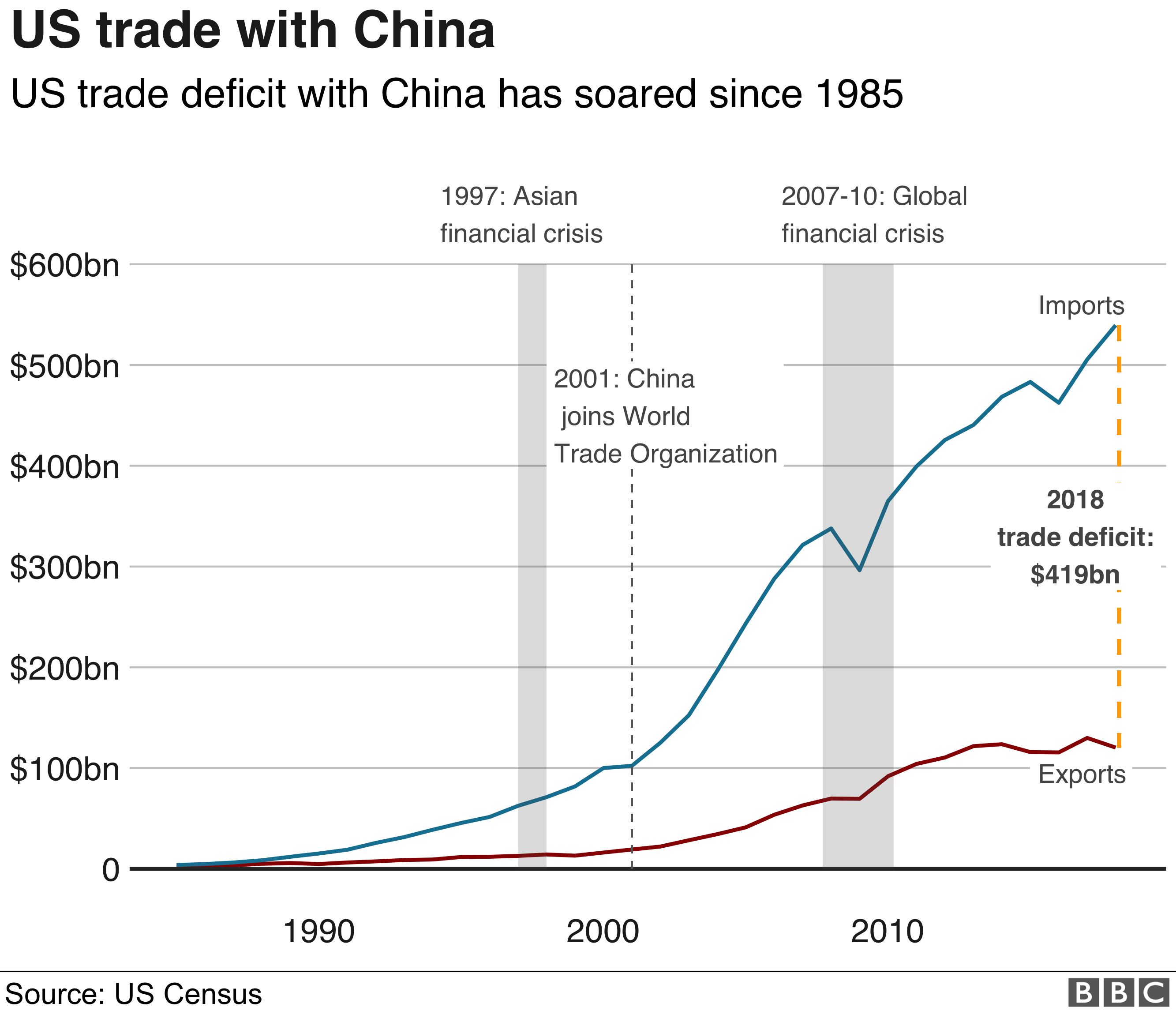

Related keywords: domestic manufacturing, import substitution, agricultural exports, trade deficit.

The Long-Term Economic Effects of Trump's China Tariffs: A Lingering Impact

The long-term economic effects of Trump's China tariffs extend far beyond the immediate disruptions. Increased trade tensions between the US and China, reduced global trade, and diminished business confidence all contributed to a less favorable economic climate.

- Increased trade tensions: The tariffs exacerbated pre-existing tensions between the US and China, creating uncertainty and hindering future cooperation on global economic issues.

- Impact on long-term economic growth: The tariffs likely contributed to slower overall economic growth, both in the US and globally, by reducing trade and investment.

- Influence on investment decisions and business confidence: The uncertainty surrounding trade policy led to reduced investment and hampered business confidence, hindering economic expansion.

Related keywords: economic growth, trade relations, geopolitical risks, long-term economic impact.

Conclusion: Assessing the Lasting Legacy of Trump's China Tariffs

In conclusion, the economic fallout of Trump's China tariffs was multifaceted and far-reaching. The increased inflation, substantial supply chain disruptions, and significant negative impacts on various US industries paint a picture of a policy with largely negative consequences for the American economy. The long-term effects of Trump's China tariffs, including increased trade tensions and reduced economic growth, continue to pose challenges. Understanding the lasting impact of Trump's China tariffs is crucial for informed economic policy. Learn more about the long-term implications by exploring [link to related article/resource].

Featured Posts

-

U S Businesses Implement Cost Cutting Strategies In Response To Tariffs

Apr 29, 2025

U S Businesses Implement Cost Cutting Strategies In Response To Tariffs

Apr 29, 2025 -

Indias Dsp Fund Shifts Strategy Stock Caution And Cash Increase

Apr 29, 2025

Indias Dsp Fund Shifts Strategy Stock Caution And Cash Increase

Apr 29, 2025 -

Cassidy Hutchinson Plans Memoir Detailing Her Jan 6 Testimony

Apr 29, 2025

Cassidy Hutchinson Plans Memoir Detailing Her Jan 6 Testimony

Apr 29, 2025 -

Chat Gpt Maker Open Ai Faces Ftc Investigation Key Questions Answered

Apr 29, 2025

Chat Gpt Maker Open Ai Faces Ftc Investigation Key Questions Answered

Apr 29, 2025 -

Blue Origins Launch Scrubbed Investigation Into Subsystem Issue Underway

Apr 29, 2025

Blue Origins Launch Scrubbed Investigation Into Subsystem Issue Underway

Apr 29, 2025

Latest Posts

-

Is This The New Quinoa A Rising Star In Healthy Eating

Apr 29, 2025

Is This The New Quinoa A Rising Star In Healthy Eating

Apr 29, 2025 -

Beyond Quinoa Introducing The Latest Superfood Sensation

Apr 29, 2025

Beyond Quinoa Introducing The Latest Superfood Sensation

Apr 29, 2025 -

Quinoas Reign Is Over Discover The New It Crop

Apr 29, 2025

Quinoas Reign Is Over Discover The New It Crop

Apr 29, 2025 -

The Impact Of Tariff Uncertainty U S Companies Cost Cutting Response

Apr 29, 2025

The Impact Of Tariff Uncertainty U S Companies Cost Cutting Response

Apr 29, 2025 -

Move Over Quinoa The Next Big Superfood Is Here

Apr 29, 2025

Move Over Quinoa The Next Big Superfood Is Here

Apr 29, 2025