Dow Futures And Dollar Decline After Moody's Rating Action

Table of Contents

Moody's Rating Action: A Detailed Look

Moody's downgrade of the United States' credit rating is a significant event with far-reaching consequences. The keywords associated with this section are Moody's Credit Rating, US Debt Ceiling, Fiscal Policy, and Government Debt. The agency cited concerns about the US debt ceiling, persistent political gridlock, and the country's escalating government debt as primary factors in their decision.

-

The Downgrade: Moody's lowered the US government's credit rating, impacting investor confidence and market sentiment. The specific rating change and its historical context should be referenced here (e.g., a one-notch downgrade from AAA to Aa1, the first time the US rating has been lowered in decades). This information can be easily sourced from the official Moody's press release. [Insert Link to Official Moody's Press Release Here]

-

Implications: This downgrade increases the US government's borrowing costs, making it more expensive to finance its debt. It also raises questions about the country's long-term fiscal sustainability and its international standing. The potential impact on global financial markets is substantial, potentially influencing global currency exchange rates and investment decisions.

Impact on Dow Futures

The immediate reaction to Moody's announcement was a significant drop in Dow Futures. Keywords for this section are Dow Futures, Stock Market Volatility, Market Sentiment, and Investor Confidence. The percentage change and the overall market sentiment following the news should be clearly stated.

-

Market Reaction: Investor confidence took a hit, leading to a sell-off in the stock market. The uncertainty surrounding the economic implications of the downgrade fuelled risk aversion among investors.

-

Reasons for Decline: The decline in Dow Futures reflects investor concerns about potential economic slowdown, reduced corporate profits, and the increased uncertainty surrounding future economic growth. Specific sectors particularly sensitive to interest rate changes are likely to experience a more pronounced impact.

-

Long-Term Effects: The long-term impact on the US stock market remains to be seen, but sustained economic uncertainty could lead to prolonged volatility. Close monitoring of Dow Futures movements will be crucial in assessing the market's overall reaction and potential trajectory.

Dollar Decline and Currency Markets

The decline in the US dollar's value is directly linked to Moody's rating action. Keywords for this section are Dollar Decline, US Dollar, Currency Exchange Rates, Global Markets, and Safe Haven Assets.

-

Correlation: The downgrade diminishes investor confidence in the US economy, reducing demand for the US dollar as a reserve currency. This decrease in demand directly translates to a weakening dollar compared to other major currencies.

-

Impact on Global Markets: The weaker dollar makes US exports more competitive but increases the cost of imports. This will affect businesses involved in international trade and potentially trigger inflation. Foreign investment in US assets could also decrease, impacting long-term economic growth.

-

Safe Haven Assets: Investors often seek safe-haven assets during times of uncertainty. This event may lead to increased demand for assets like gold, Swiss francs, or other government bonds perceived as less risky than US treasuries. Analyzing the movement of these assets in relation to the dollar's decline provides a broader perspective of market sentiment.

Strategic Implications for Investors

Navigating this market volatility requires a carefully considered investment strategy. Keywords for this section are Investment Strategy, Risk Management, Portfolio Diversification, and Market Outlook.

-

Risk Assessment: Investors should reassess their risk tolerance and adjust their portfolios accordingly. This may involve reducing exposure to riskier assets or increasing holdings in more conservative investments.

-

Diversification: Diversifying your portfolio across different asset classes is crucial to mitigate risk and reduce potential losses. This could involve allocating funds to international stocks, bonds, real estate, or alternative investments.

-

Hedging Strategies: Hedging strategies, such as using options or futures contracts, can help protect against potential losses. This requires a deeper understanding of financial markets and appropriate risk management techniques.

Conclusion

Moody's rating action has undeniably created a period of uncertainty in the financial markets, triggering a decline in both Dow Futures and the US dollar. Understanding the implications of this downgrade and its ripple effects across various asset classes is crucial for informed investment decision-making. The interplay between these factors – Dow Futures, dollar decline, and the broader macroeconomic environment – requires constant monitoring and strategic adaptation.

Call to Action: Stay informed about the evolving situation with Dow Futures and the dollar's movement by regularly checking financial news and conducting your own thorough research. By understanding the complexities of Dow Futures and related market shifts, you can refine your investment strategy and navigate the current volatility effectively. Continue to monitor Dow Futures and the broader market for further updates and adjust your portfolio accordingly.

Featured Posts

-

Asbh A Biarritz En Pro D2 Le Mental Facteur Cle De La Victoire

May 20, 2025

Asbh A Biarritz En Pro D2 Le Mental Facteur Cle De La Victoire

May 20, 2025 -

Former Navy Number Two Convicted A Landmark Corruption Case

May 20, 2025

Former Navy Number Two Convicted A Landmark Corruption Case

May 20, 2025 -

Le Transfert De Melvyn Jaminet Kylian Jaminet Apporte Des Precisions Sur Les Sommes En Jeu

May 20, 2025

Le Transfert De Melvyn Jaminet Kylian Jaminet Apporte Des Precisions Sur Les Sommes En Jeu

May 20, 2025 -

8 Mars A Biarritz Echanges Et Reflexions Avec Parcours De Femmes

May 20, 2025

8 Mars A Biarritz Echanges Et Reflexions Avec Parcours De Femmes

May 20, 2025 -

Chinas Automotive Landscape The Challenges Faced By Premium Brands Like Bmw And Porsche

May 20, 2025

Chinas Automotive Landscape The Challenges Faced By Premium Brands Like Bmw And Porsche

May 20, 2025

Latest Posts

-

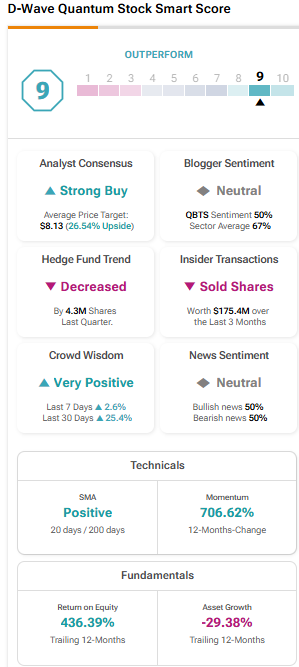

The Reasons Behind D Wave Quantum Qbts Stocks Monday Drop

May 20, 2025

The Reasons Behind D Wave Quantum Qbts Stocks Monday Drop

May 20, 2025 -

Analyzing The D Wave Quantum Qbts Stock Fall On Monday

May 20, 2025

Analyzing The D Wave Quantum Qbts Stock Fall On Monday

May 20, 2025 -

Investing In Big Bear Ai Bbai A Penny Stock Analysis For Potential Investors

May 20, 2025

Investing In Big Bear Ai Bbai A Penny Stock Analysis For Potential Investors

May 20, 2025 -

Big Bear Ai Holdings Inc Sued Allegations Of Securities Law Violations

May 20, 2025

Big Bear Ai Holdings Inc Sued Allegations Of Securities Law Violations

May 20, 2025 -

Mondays D Wave Quantum Qbts Stock Dip A Comprehensive Look

May 20, 2025

Mondays D Wave Quantum Qbts Stock Dip A Comprehensive Look

May 20, 2025