Dow Futures And The Global Market: Assessing China's Economic Response To Trade Tensions

Table of Contents

Understanding the Impact of Trade Tensions on Dow Futures

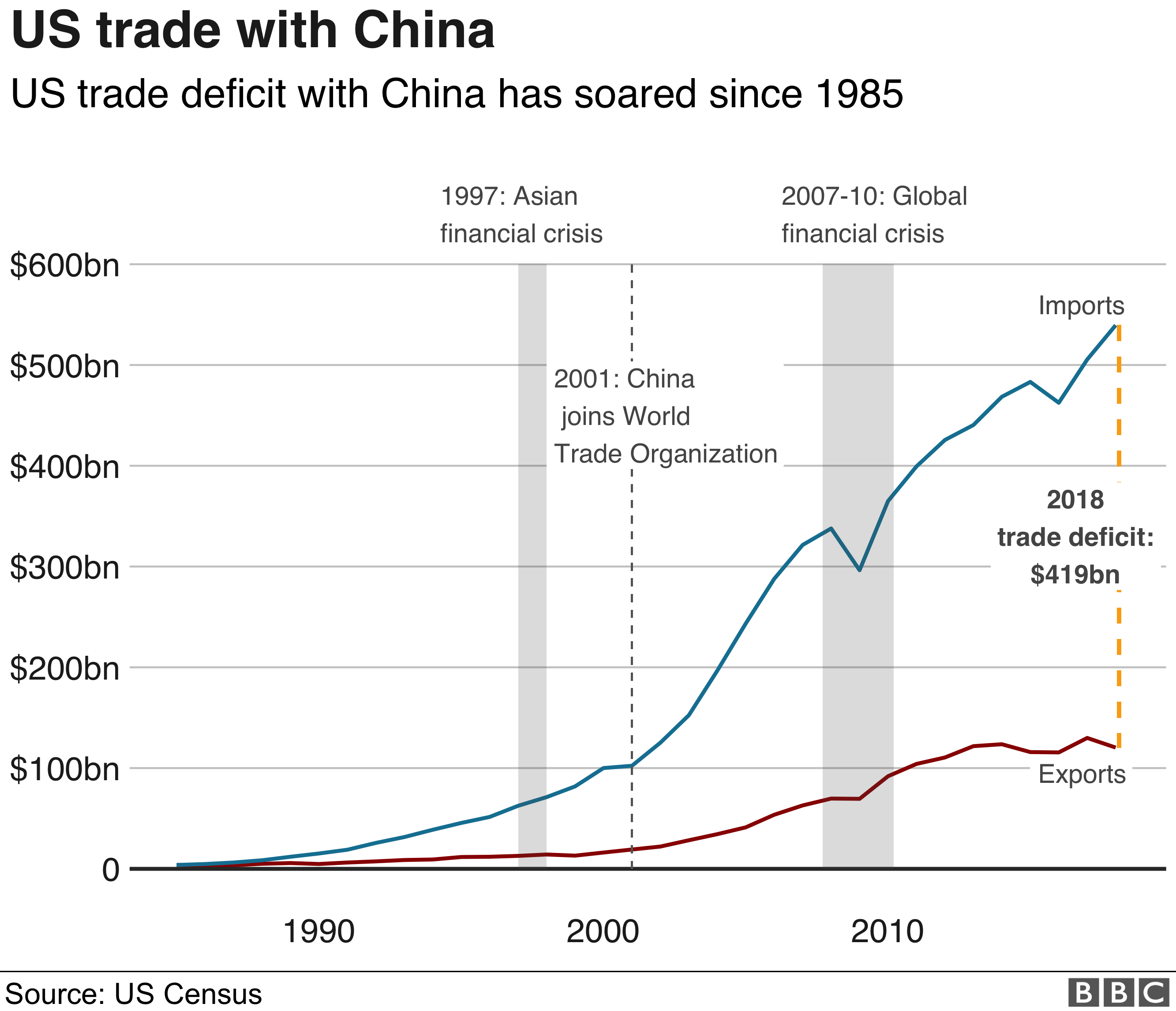

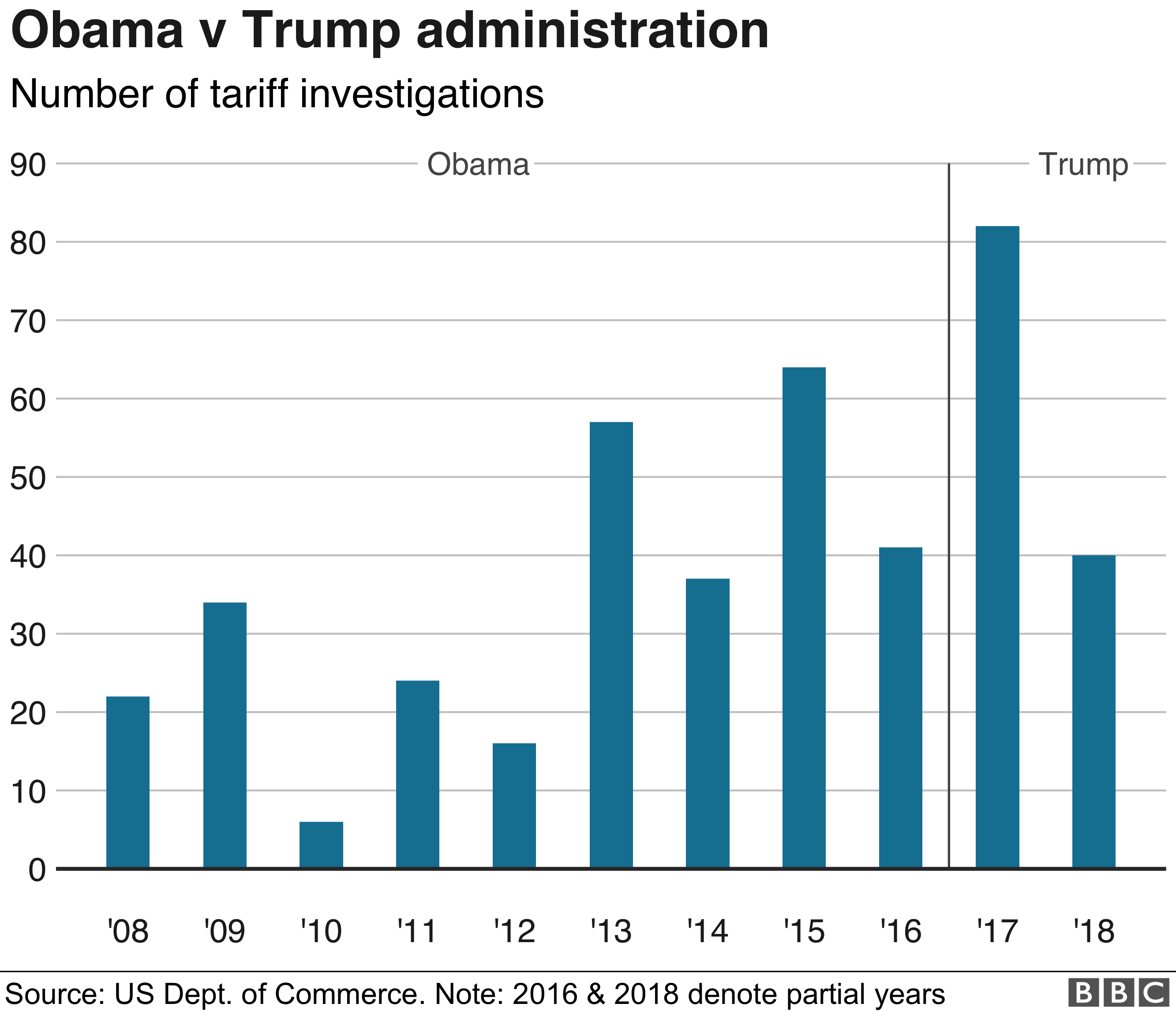

Trade disputes significantly influence Dow Futures performance. Uncertainty surrounding tariffs, trade restrictions, and retaliatory measures creates volatility in the market. Investors, hesitant about the future economic landscape, often adopt a wait-and-see approach, leading to market fluctuations.

- Increased uncertainty leads to market corrections: Periods of heightened trade tension often see a downturn in Dow Futures as investors react to the perceived risk.

- Impact on specific sectors: Sectors heavily reliant on international trade, such as technology and manufacturing, are disproportionately affected. Companies facing increased import costs may see reduced profitability, impacting their stock prices and consequently, the Dow Futures.

- Analysis of historical Dow Futures trends: Examining past trade conflicts reveals a clear correlation between escalating tensions and Dow Futures volatility. Data analysis shows a significant drop in futures prices during periods of high trade uncertainty, followed by a gradual recovery once resolutions are reached or uncertainty diminishes. (Insert relevant chart here showing historical correlation).

The relationship between trade wars and Dow Futures isn't simply reactive; it's a complex interplay of investor sentiment, economic forecasts, and corporate earnings. Analyzing this relationship requires a nuanced understanding of the specific trade policies in place and their impact on various sectors.

China's Economic Response Strategies

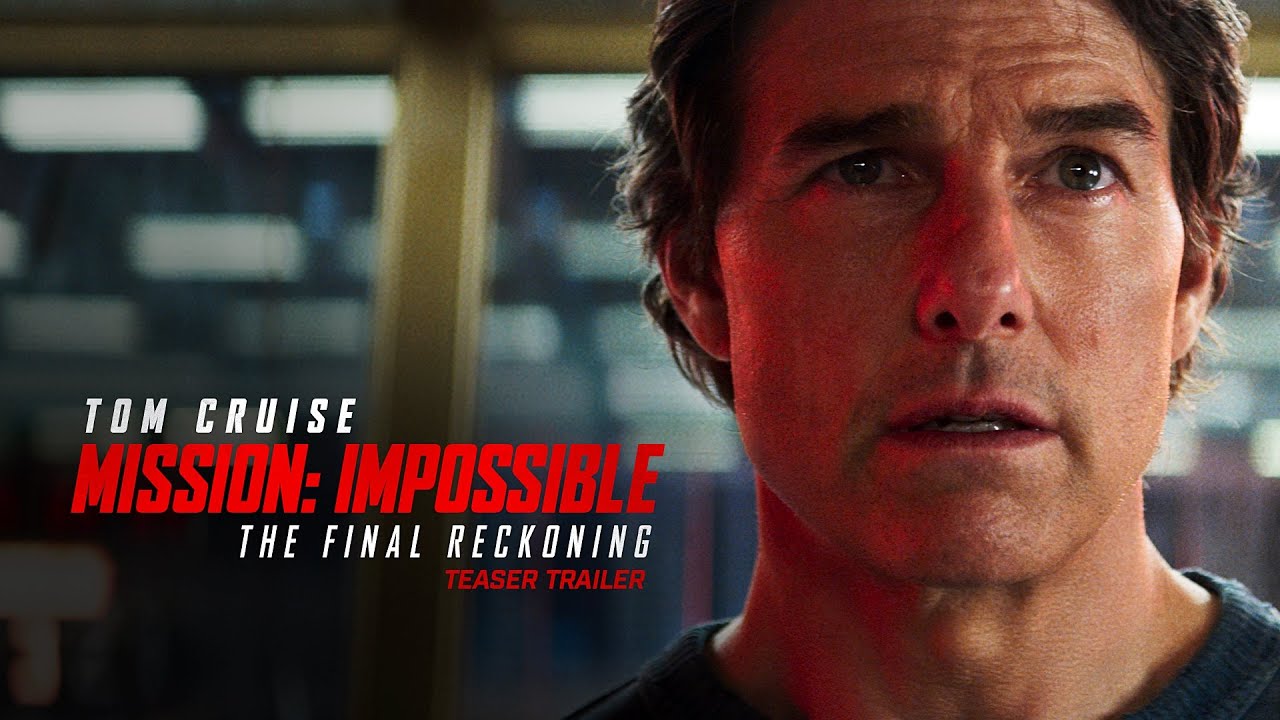

China has implemented several key economic strategies in response to trade tensions, aiming to mitigate negative impacts and foster long-term economic resilience. These strategies are multifaceted and center on reducing dependence on exports and building a stronger domestic economy.

- Stimulus packages and infrastructure investments: Significant government spending on infrastructure projects aims to boost domestic demand and create jobs, counteracting any slowdown caused by trade friction.

- Focus on technological innovation and reducing reliance on foreign technology: This strategy involves substantial investments in research and development, promoting technological self-reliance and reducing vulnerability to trade restrictions. This includes initiatives to develop domestic semiconductor industries and advanced manufacturing capabilities.

- Emphasis on domestic consumption and reduced reliance on exports: China is actively promoting domestic consumption through various policies to stimulate internal economic activity.

- Potential retaliatory measures and their impact on global markets: While aiming for economic self-sufficiency, China's retaliatory measures against specific countries can create further global market instability and affect Dow Futures through various supply chain disruptions.

The effectiveness of these strategies is a subject of ongoing debate. While some measures have shown short-term success in boosting domestic growth, their long-term consequences require further observation.

Assessing the Effectiveness of China's Response on Dow Futures and Global Markets

China's economic response has had a mixed impact on Dow Futures and global markets.

- Short-term vs. long-term effects on Dow Futures: While some stimulus measures might temporarily buoy markets, the long-term impact hinges on the success of China's strategy to foster a robust domestic economy independent of export-led growth.

- Impact on global supply chains and commodity prices: Trade disruptions have caused significant ripple effects in global supply chains, leading to fluctuations in commodity prices and influencing the performance of companies reliant on these goods.

- Analysis of potential risks and opportunities for investors: Navigating this environment requires careful assessment of risks and opportunities. Some sectors may benefit from China's focus on domestic consumption, while others might face increased challenges due to supply chain disruptions.

The interconnected nature of global markets means that China's actions have significant repercussions for other economies, including the US and consequently, Dow Futures. Understanding these intricate relationships is crucial for effective investment strategies.

Predicting Future Trends: Dow Futures and China's Economic Trajectory

Predicting future trends requires analyzing several factors.

- Potential for escalation or de-escalation of trade tensions: The future trajectory of trade relations between major economies remains uncertain, significantly impacting Dow Futures.

- Impact of global economic growth on Dow Futures and China's economy: Global economic conditions play a crucial role; strong global growth can mitigate some negative impacts of trade tensions.

- Long-term implications for global supply chains and geopolitical dynamics: China's economic policies will continue to reshape global supply chains, and their geopolitical implications require careful monitoring.

While the future remains uncertain, a cautious assessment suggests that China's economic strategy will continue to influence global markets and Dow Futures for the foreseeable future. A balanced approach acknowledging both risks and opportunities is vital for navigating this dynamic landscape.

Conclusion: Dow Futures and the Global Market: Key Takeaways and Future Outlook

China's economic response to trade tensions is a multifaceted strategy with both short-term and long-term implications for Dow Futures and global markets. The interconnectedness of these markets is undeniable, making understanding China's economic policies essential for investors. To effectively manage investments in Dow Futures and navigate this complex environment, stay informed about developments in trade relations and China's economic trajectory. We encourage further reading on "Dow Futures trading strategies," "China's economic policy," or "Global trade implications" to enhance your understanding of this critical interplay between China's economy and global financial markets.

Featured Posts

-

Tom Cruises Mission Impossible Dead Reckoning Teaser Review And Analysis

Apr 26, 2025

Tom Cruises Mission Impossible Dead Reckoning Teaser Review And Analysis

Apr 26, 2025 -

Chelsea Handlers No Holds Barred Take On Dating Elon Musk For A Better America

Apr 26, 2025

Chelsea Handlers No Holds Barred Take On Dating Elon Musk For A Better America

Apr 26, 2025 -

Potential Dam Hazards A Safety Review For Ajaxs 125th Anniversary Event

Apr 26, 2025

Potential Dam Hazards A Safety Review For Ajaxs 125th Anniversary Event

Apr 26, 2025 -

Impact Of Trump Tariffs Ecbs Holzmanns Perspective On Disinflation

Apr 26, 2025

Impact Of Trump Tariffs Ecbs Holzmanns Perspective On Disinflation

Apr 26, 2025 -

Stock Market Valuations Bof As Rationale For Investor Calm

Apr 26, 2025

Stock Market Valuations Bof As Rationale For Investor Calm

Apr 26, 2025

Latest Posts

-

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025 -

Bsw Leader Crumbachs Resignation Impact On The Spd Coalition

Apr 27, 2025

Bsw Leader Crumbachs Resignation Impact On The Spd Coalition

Apr 27, 2025 -

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025 -

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025