Impact Of Trump Tariffs: ECB's Holzmann's Perspective On Disinflation

Table of Contents

Holzmann's Stance on the Impact of Trump Tariffs

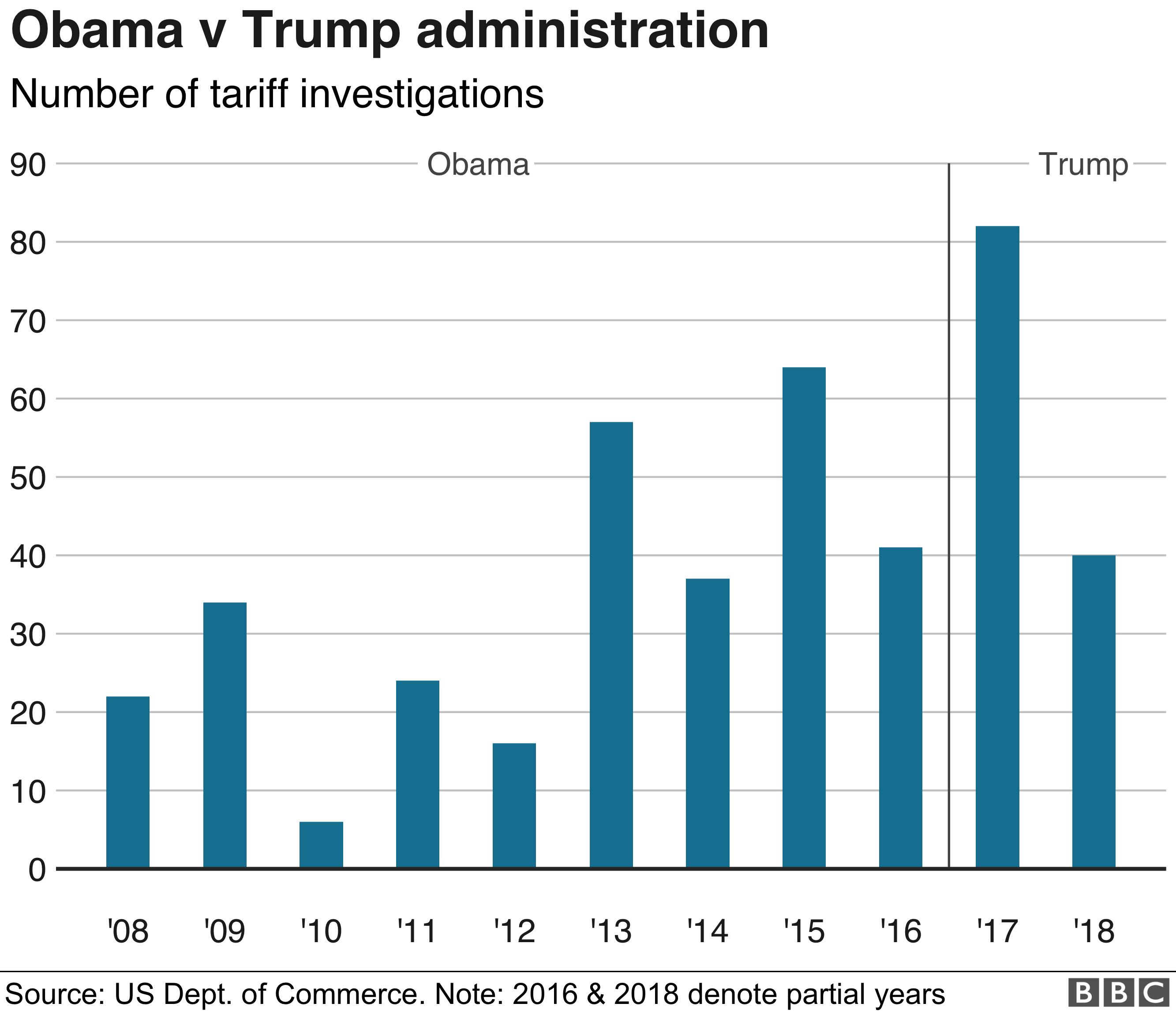

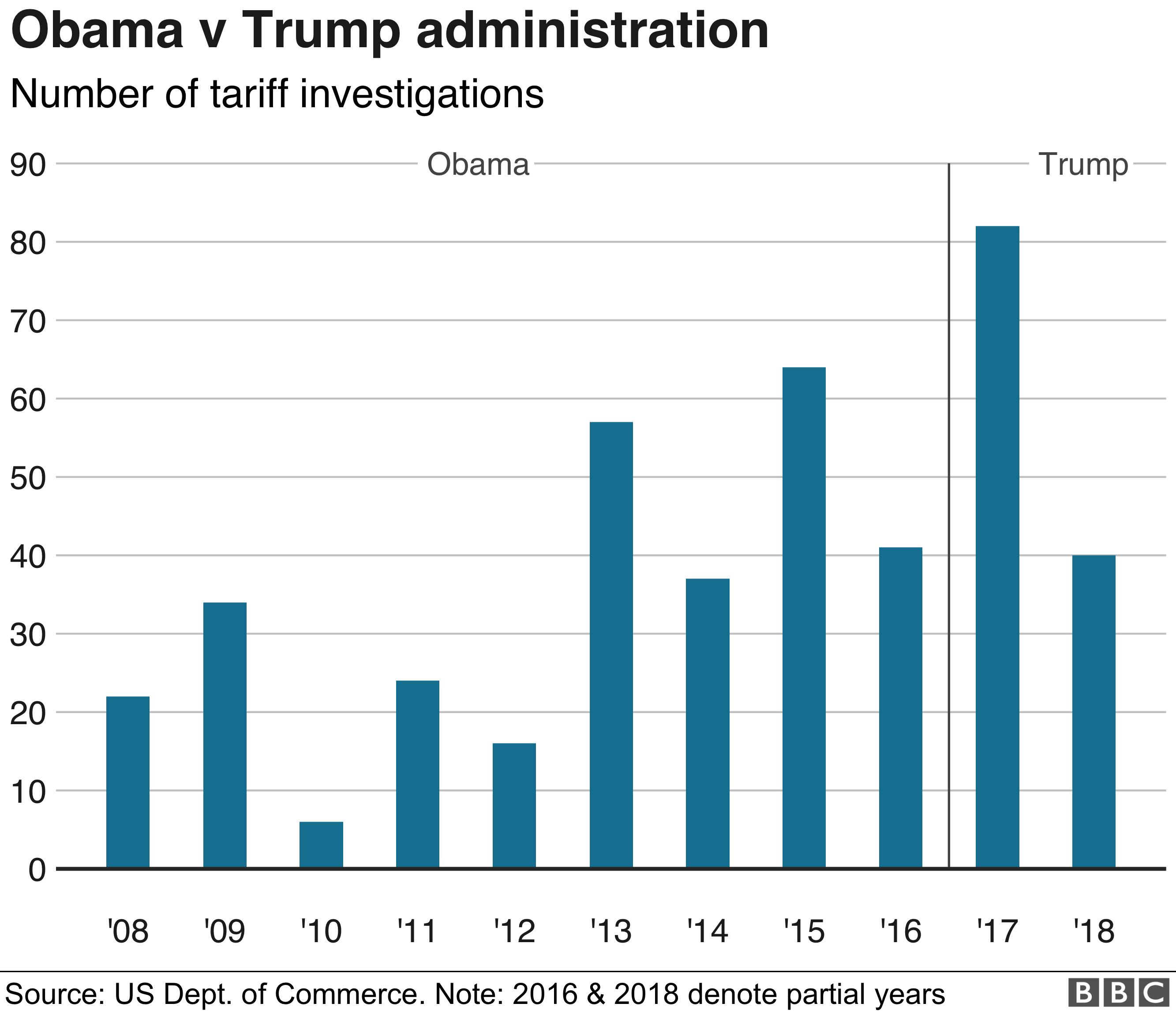

Robert Holzmann, a prominent voice within the ECB, has consistently highlighted the significant role of global trade disruptions, particularly those stemming from the Trump administration's tariffs, in contributing to disinflationary trends. While he may not have solely attributed disinflation to these tariffs, his analysis clearly positions them as a substantial contributing factor. Holzmann's perspective emphasizes the multifaceted nature of the problem, acknowledging other contributing elements to the overall economic slowdown, but consistently highlighting the impact of trade wars.

- Summary of Holzmann's public statements: Holzmann's public comments and appearances frequently mentioned the dampening effect of increased trade uncertainty and protectionist policies on investment and overall economic activity. He often linked this to reduced inflationary pressures.

- Specific examples of tariff impacts: Holzmann's analysis likely encompassed the impact on specific sectors heavily reliant on global supply chains, such as manufacturing and automotive industries. Tariffs on imported materials raised production costs, potentially leading to reduced output and dampening price increases.

- Alternative explanations considered: While focusing on tariffs, Holzmann likely acknowledged other factors influencing disinflation, such as slowing global growth, technological advancements leading to lower production costs, and changing consumer behavior. However, his emphasis consistently points to trade wars as a significant exacerbating factor.

The Mechanism: How Tariffs Contribute to Disinflation (or Deflationary Pressures)

Trump's tariffs triggered a cascade of economic consequences that contributed to disinflation. The mechanism is complex but can be broken down into several key elements:

- Supply chain disruptions: Tariffs created significant bottlenecks in global supply chains. Increased costs and uncertainty led to reduced imports, impacting the availability of goods and potentially lowering overall price levels in some sectors.

- Increased import prices: Tariffs directly increased the price of imported goods. While this might seem inflationary, it simultaneously reduced consumer purchasing power, dampening demand and thus overall price increases across the economy.

- Reduced consumer spending: Higher prices on imported goods and increased uncertainty about future prices led to decreased consumer confidence and reduced spending, further contributing to weak inflationary pressures. This reduced demand consequently put downward pressure on prices.

- Overall economic slowdown: The combined effects of supply chain disruptions, higher prices, and reduced consumer spending resulted in a broader economic slowdown, reducing the overall pressure on prices. This further contributed to the disinflationary environment.

ECB's Response to Disinflationary Pressures Exacerbated by Tariffs

Faced with disinflationary pressures potentially worsened by the impact of Trump tariffs, the ECB implemented a range of monetary policy tools aimed at stimulating economic activity and achieving its inflation target.

- ECB's inflation target: The ECB aims for inflation rates of below, but close to, 2% over the medium term. The tariffs threatened to push inflation even lower, necessitating intervention.

- Monetary policy tools: The ECB responded with measures such as maintaining low interest rates, and, in previous years, engaging in quantitative easing (QE) – purchasing government bonds and other assets to inject liquidity into the financial system.

- Effectiveness of ECB actions: The effectiveness of these measures in countering the impact of tariffs on inflation is a subject of ongoing debate among economists. While the ECB undoubtedly sought to mitigate the disinflationary effects, the full extent of its success is difficult to isolate from other economic factors.

Comparing Holzmann's Views with Other ECB Members

While a complete consensus within the ECB on the precise impact of Trump tariffs on disinflation is unlikely, understanding the degree of agreement or disagreement within the governing council is crucial. It is important to note that analyzing the specific nuances of the internal debates within the ECB requires in-depth research into the minutes of their meetings and public statements from various members. This could reveal whether Holzmann's comparatively strong emphasis on the role of tariffs was a common perspective or a more individual viewpoint.

Conclusion

Robert Holzmann's perspective highlights the significant role of Trump's tariffs in contributing to disinflationary pressures. By examining the mechanisms through which tariffs disrupted supply chains, increased import prices, and reduced consumer spending, we can better understand the interplay between trade policy and monetary policy. The ECB's response, involving a combination of monetary policy tools, attempted to counteract these disinflationary forces. To further understand the complexities of the impact of tariffs on inflation, delve into the ECB's publications and related economic research on their website. Further exploration into the impact of tariffs on inflation, Holzmann's analysis of trade wars, and the ECB's response to disinflation will provide a deeper understanding of this critical economic issue.

Featured Posts

-

The Future Of Martin Luther King Jr Day Celebration Or Cancellation

Apr 26, 2025

The Future Of Martin Luther King Jr Day Celebration Or Cancellation

Apr 26, 2025 -

Is It Ethical To Bet On Natural Disasters Like The La Wildfires

Apr 26, 2025

Is It Ethical To Bet On Natural Disasters Like The La Wildfires

Apr 26, 2025 -

Le Chef Etoile Guillaume Scheer S Installe A Strasbourg Ouverture Du Zuem Ysehuet Le 13 Juin

Apr 26, 2025

Le Chef Etoile Guillaume Scheer S Installe A Strasbourg Ouverture Du Zuem Ysehuet Le 13 Juin

Apr 26, 2025 -

Waarom Is Dit Zoete Nederlandse Broodje Zo Bizar

Apr 26, 2025

Waarom Is Dit Zoete Nederlandse Broodje Zo Bizar

Apr 26, 2025 -

Uk Wind Energy Future Uncertain Vestas Highlights Auction Reform Risks

Apr 26, 2025

Uk Wind Energy Future Uncertain Vestas Highlights Auction Reform Risks

Apr 26, 2025

Latest Posts

-

Ariana Grandes Style Overhaul The Professionals Who Helped Create Her New Look

Apr 27, 2025

Ariana Grandes Style Overhaul The Professionals Who Helped Create Her New Look

Apr 27, 2025 -

Understanding The Professional Help Behind Ariana Grandes Drastic Style Change

Apr 27, 2025

Understanding The Professional Help Behind Ariana Grandes Drastic Style Change

Apr 27, 2025 -

New Hair New Ink The Professionals Behind Ariana Grandes Style Evolution

Apr 27, 2025

New Hair New Ink The Professionals Behind Ariana Grandes Style Evolution

Apr 27, 2025 -

Ariana Grandes Hair And Tattoo Transformation The Professionals Who Made It Happen

Apr 27, 2025

Ariana Grandes Hair And Tattoo Transformation The Professionals Who Made It Happen

Apr 27, 2025 -

The Team Behind Ariana Grandes Latest Transformation Hair Tattoos And Professional Help

Apr 27, 2025

The Team Behind Ariana Grandes Latest Transformation Hair Tattoos And Professional Help

Apr 27, 2025