Economic Slowdown: Examining President Biden's Role

Table of Contents

Inflation and its Impact under the Biden Administration

The Inflationary Environment

The United States is currently experiencing its highest inflation rate in decades. The Consumer Price Index (CPI) consistently shows significant increases across various sectors, squeezing household budgets and impacting consumer spending. This high inflation rate directly translates to a decreased purchasing power for Americans, impacting their ability to afford essential goods and services.

- Rising Costs of Essentials: The cost of gasoline, groceries, and housing has skyrocketed, significantly impacting low- and middle-income families. This increased cost of living forces many consumers to cut back on discretionary spending, further slowing economic growth.

- Impact on Consumer Spending: Reduced consumer spending directly translates to decreased demand, which can lead to business slowdowns and potential job losses. The ripple effect of reduced consumer confidence significantly impacts the overall economic health.

- Government Policies and Inflationary Pressures: Some economists argue that expansive government spending, such as the American Rescue Plan, contributed to inflationary pressures by injecting significant funds into the economy during a period of already constrained supply chains. This increased demand without a corresponding increase in supply fueled price increases.

- Statistical Support: Data from the Bureau of Labor Statistics (BLS) clearly demonstrates the sharp rise in inflation, providing concrete evidence to support these claims. Analyzing this data in relation to government spending allows for a more informed understanding of the correlation between policy and inflationary pressures.

Biden Administration's Economic Policies and Their Effects

American Rescue Plan and its Long-Term Effects

The American Rescue Plan (ARP), a $1.9 trillion economic stimulus package, aimed to provide relief to individuals and businesses impacted by the COVID-19 pandemic. While it undeniably provided short-term relief and boosted employment in some sectors, its long-term effects on inflation and economic growth remain a subject of ongoing debate.

- Intended Goals of the ARP: The ARP aimed to provide direct payments to individuals, support state and local governments, and fund vaccine distribution. These goals were intended to jumpstart the economy and aid recovery from the pandemic.

- Impact on Employment and Economic Recovery: The ARP did contribute to a significant reduction in unemployment. However, the extent to which this was due solely to the ARP, versus other factors contributing to the recovery, remains debatable among economists.

- Contribution to Inflationary Pressures: Critics argue that the substantial injection of funds into the economy exacerbated existing inflationary pressures. The increased demand, coupled with ongoing supply chain disruptions, fueled price increases across various sectors.

- Economic Reports and Analyses: Various economic reports and analyses from organizations like the Congressional Budget Office (CBO) and the Federal Reserve provide data-driven insights into the ARP’s impact.

Infrastructure Investment and Job Creation

President Biden's infrastructure investment plan aims to modernize the nation's infrastructure through significant government spending. While projected to create jobs and stimulate economic growth in the long term, its impact on the current economic slowdown is less immediate.

- Projected Job Creation and Economic Stimulus: The plan is expected to generate millions of jobs and inject trillions of dollars into the economy over several years. This long-term investment aims to enhance productivity and bolster economic growth.

- Potential for Increased Long-Term Productivity: Improvements to infrastructure are intended to boost efficiency, reduce transportation costs, and facilitate economic activity. The long-term benefits of this investment are significant.

- Criticisms and Current Economic Slowdown: Critics argue that the current economic slowdown necessitates a more immediate focus on addressing inflationary pressures, rather than long-term investments. The timing of such a large-scale investment is a point of contention.

- Government Data and Economic Analyses: Independent economic analyses and government data on infrastructure spending and its projected impact are crucial for evaluating the plan's effectiveness.

Global Factors Contributing to the Economic Slowdown

The Role of Global Supply Chain Disruptions

Global factors significantly influence the US economy. The ongoing disruptions to global supply chains, exacerbated by the war in Ukraine and other geopolitical events, have contributed to increased inflation and constrained economic growth.

- Impact of Geopolitical Events: The war in Ukraine, along with other geopolitical uncertainties, has created significant disruptions to global trade and energy markets. This has led to shortages and increased prices for various goods.

- Supply Chain Bottlenecks and Inflation: Supply chain bottlenecks have hampered the ability of businesses to meet demand, leading to shortages and higher prices. This is a major factor contributing to the current inflationary environment.

- Global Factors and Domestic Performance: The interconnectedness of the global economy means that domestic economic performance is significantly impacted by global events and trends.

The Impact of Rising Interest Rates

In response to rising inflation, the Federal Reserve has implemented a series of interest rate hikes. While aimed at curbing inflation, these measures can also slow economic growth and potentially trigger a recession.

- Effects of Interest Rate Hikes: Higher interest rates increase borrowing costs for businesses and consumers, potentially reducing investment and consumer spending.

- Potential for a Recession: Aggressive interest rate hikes carry the risk of triggering a recession by significantly slowing economic activity.

- Monetary Policy and Economic Slowdown: The Federal Reserve's monetary policy plays a crucial role in managing inflation and influencing the overall economic trajectory. The balance between controlling inflation and avoiding a recession is a delicate one.

Conclusion

The current economic slowdown is a complex phenomenon resulting from a confluence of factors. While President Biden's policies, including the American Rescue Plan and the infrastructure investment plan, have played a role, it's crucial to acknowledge the significant impact of global factors like supply chain disruptions and geopolitical instability. The Federal Reserve's response to inflation, through interest rate hikes, further complicates the economic landscape. Understanding the interplay of these factors is essential for forming an informed opinion on the current economic situation. To gain a deeper understanding of the economic slowdown, analyze the impact of Biden’s policies, and evaluate the current economic situation, consult resources like reports from the Bureau of Labor Statistics, the Congressional Budget Office, and the Federal Reserve. Only through thorough research can we fully grasp the complexities of this challenging economic climate.

Featured Posts

-

Justice Department Concludes Longstanding Louisiana School Desegregation Case

May 03, 2025

Justice Department Concludes Longstanding Louisiana School Desegregation Case

May 03, 2025 -

Lotto Draw Results Wednesday April 16 2025

May 03, 2025

Lotto Draw Results Wednesday April 16 2025

May 03, 2025 -

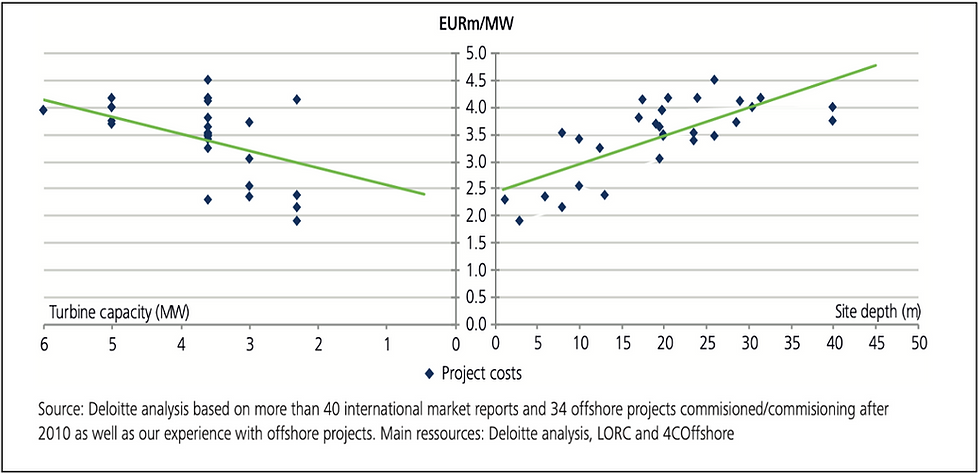

Cost Concerns Hamper Growth Of Offshore Wind Energy Projects

May 03, 2025

Cost Concerns Hamper Growth Of Offshore Wind Energy Projects

May 03, 2025 -

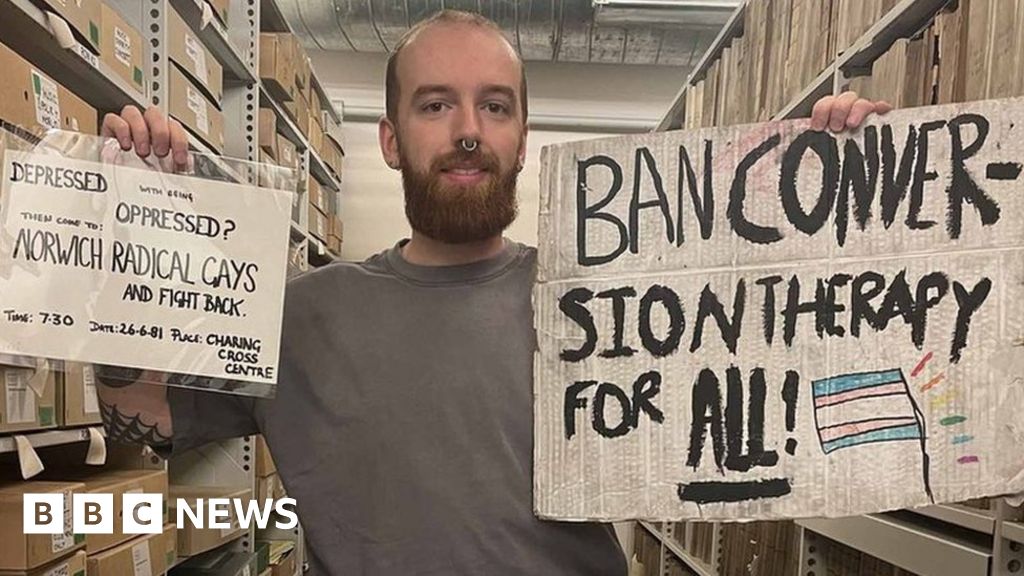

Norfolk Mp Battles Nhs In Landmark Gender Identity Supreme Court Case

May 03, 2025

Norfolk Mp Battles Nhs In Landmark Gender Identity Supreme Court Case

May 03, 2025 -

Hudsons Bays Future A Toronto Firms Bid And The Road Ahead

May 03, 2025

Hudsons Bays Future A Toronto Firms Bid And The Road Ahead

May 03, 2025

Latest Posts

-

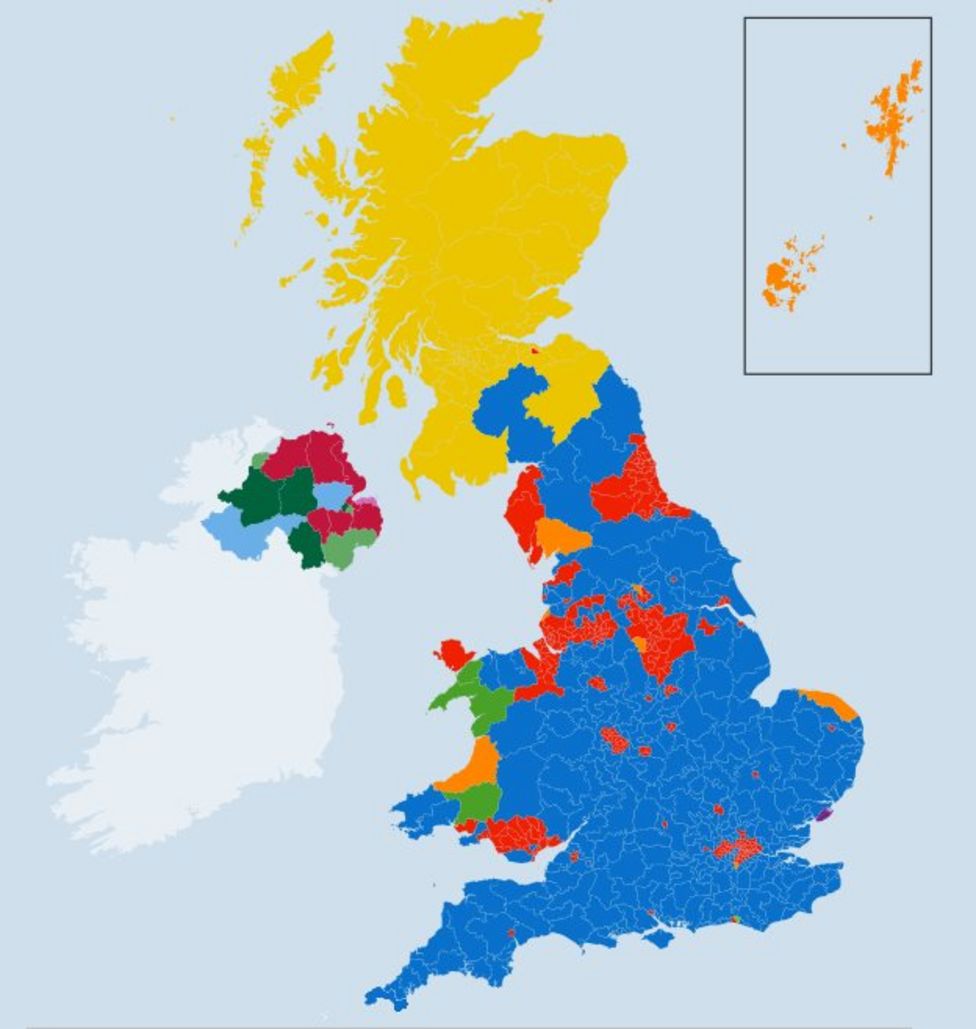

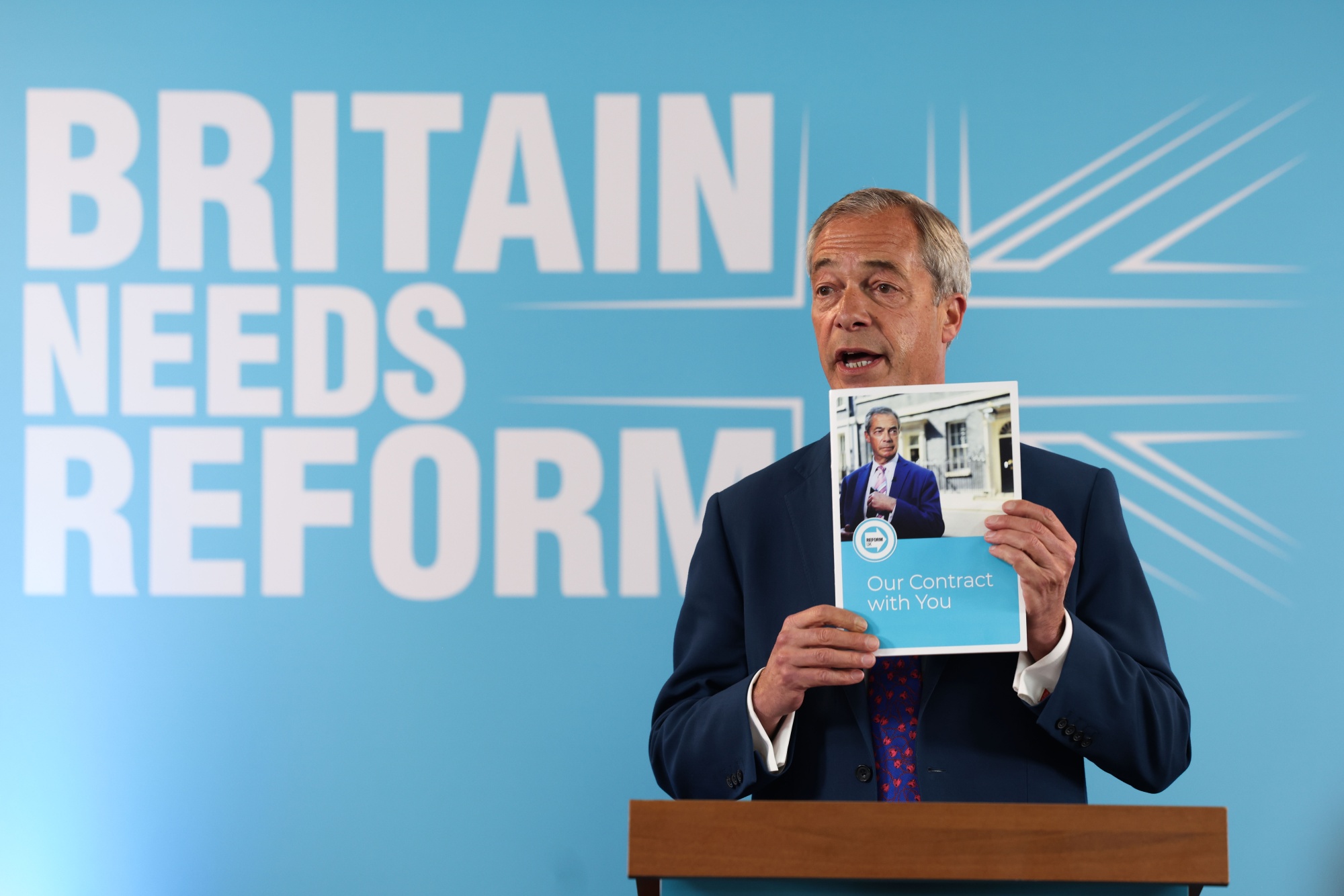

Uk Local Elections Can The Reform Party Under Farage Make Gains

May 03, 2025

Uk Local Elections Can The Reform Party Under Farage Make Gains

May 03, 2025 -

Reform Partys Local Election Performance A Key Test For Farage

May 03, 2025

Reform Partys Local Election Performance A Key Test For Farage

May 03, 2025 -

Councillors Defection A Major Blow To Labour Boost To Reform

May 03, 2025

Councillors Defection A Major Blow To Labour Boost To Reform

May 03, 2025 -

Reform Party Gains Ground As Labour Councillor Defects

May 03, 2025

Reform Party Gains Ground As Labour Councillor Defects

May 03, 2025 -

Lee Anderson Welcomes Councillors Switch To Reform Party

May 03, 2025

Lee Anderson Welcomes Councillors Switch To Reform Party

May 03, 2025