Economic Uncertainty Grows Amidst Rising Inflation And Unemployment

Table of Contents

The Inflationary Spiral and its Impact on Economic Uncertainty

The current inflationary spiral is a significant driver of economic uncertainty. Rising prices are eroding purchasing power, leading to decreased consumer spending and ultimately, slower economic growth. This creates a dangerous feedback loop, exacerbating existing economic instability.

Rising Prices and Reduced Consumer Spending

High inflation significantly impacts household budgets. The cost of living is increasing across the board.

- Food prices: Grocery bills are soaring, forcing families to make difficult choices about what to buy.

- Energy costs: Rising energy prices are impacting transportation, heating, and electricity bills, placing a significant strain on household finances.

- Housing costs: Rent and mortgage payments are increasing, leaving less disposable income for other necessities.

This increase in the cost of living directly affects consumer sentiment. Decreased consumer confidence leads to reduced spending, further hindering economic growth and creating a cycle of economic uncertainty. The inflation rate needs to be carefully monitored and managed to alleviate this.

The Impact of Inflation on Businesses

Businesses are also feeling the pinch of inflation. Increased input costs, from raw materials to labor, are squeezing profit margins.

- Increased production costs: Companies are facing higher costs for everything from raw materials to transportation, making it difficult to maintain profitability.

- Challenges in pricing strategies: Businesses face a difficult balancing act: raise prices and risk losing customers, or absorb the increased costs and reduce profitability.

- Potential business closures: Many businesses, particularly small and medium-sized enterprises, are struggling to cope with rising costs and may be forced to close.

These challenges highlight how inflation contributes significantly to overall economic uncertainty by impacting business sustainability and the stability of the job market. Understanding the impact of price increases on businesses is crucial for navigating this period of financial instability.

Unemployment: A Key Driver of Economic Uncertainty

Rising unemployment is another major contributor to economic uncertainty. Job losses lead to reduced consumer spending, further weakening the economy and creating a vicious cycle.

Rising Job Losses and Economic Slowdown

The relationship between unemployment and economic slowdown is undeniable. A rising unemployment rate signals a weakening economy.

- Statistics on unemployment rates: Official unemployment figures often lag behind the reality, but even the reported rates reflect a significant rise in job losses.

- Types of job losses: Layoffs are prevalent across various sectors, reflecting broader economic weakness.

- Impact on social welfare systems: Increased unemployment puts significant strain on social welfare systems, requiring greater government spending and potentially leading to increased national debt. This adds another layer to the already complex issue of economic uncertainty.

The job market is a crucial indicator of economic health, and its instability contributes directly to overall economic uncertainty.

The Psychological Impact of Unemployment

Job loss has a devastating impact on individuals and families, creating significant economic hardship and mental health challenges.

- Impact on mental health: Unemployment is associated with increased rates of depression, anxiety, and other mental health issues.

- Financial hardship: Loss of income leads to financial stress and difficulty meeting basic needs.

- Reduced spending: Unemployed individuals significantly reduce their spending, further impacting economic growth and creating a ripple effect.

Understanding the psychological impact of unemployment is critical for addressing the broader issue of economic uncertainty. The resulting financial stress needs to be addressed through adequate social safety nets and support programs.

Government Responses and Their Effectiveness in Addressing Economic Uncertainty

Governments worldwide are implementing various measures to address the growing economic uncertainty. However, the effectiveness of these responses varies widely.

Monetary and Fiscal Policies

Central banks are using monetary policy tools, primarily interest rate adjustments, to combat inflation. Governments employ fiscal policy, adjusting government spending and taxation, to stimulate the economy and support vulnerable populations.

- Examples of government interventions: These can range from interest rate hikes to direct financial aid programs.

- Their effectiveness: The effectiveness of these policies is often debated, with some arguing that they are not sufficient to address the scale of the current economic crisis.

- Potential unintended consequences: For example, rapid interest rate increases can stifle economic growth and exacerbate unemployment.

The interplay between monetary policy and fiscal policy is critical in managing economic uncertainty, but finding the right balance is challenging and requires careful consideration.

The Effectiveness of Government Initiatives

The success of government initiatives in mitigating economic uncertainty is a complex issue.

- Assessment of policy impact: Evaluating the effectiveness of government interventions requires careful analysis and consideration of various factors.

- Potential limitations: Government policies can have limitations, such as slow implementation or unintended consequences.

- Suggestions for improvement: Continuous evaluation and adaptation of policies are necessary to address evolving economic challenges.

Understanding the limitations and potential improvements of government programs is essential for navigating periods of economic instability. Effective government response is crucial to building a more resilient economy and reducing economic uncertainty.

Conclusion

The current economic landscape is characterized by significant economic uncertainty, driven primarily by the interconnected challenges of rising inflation and unemployment. These factors are impacting consumers, businesses, and the overall economy. The effectiveness of government responses in mitigating this economic uncertainty remains a topic of ongoing debate and requires continuous evaluation and adaptation. It's crucial to understand the interconnectedness of these issues and to take proactive steps to manage your personal finances during this period of financial uncertainty. Stay informed about economic developments and consider seeking guidance on managing your personal finances during times of economic instability. Understanding these challenges and taking proactive measures is essential to navigate this period of heightened economic uncertainty.

Featured Posts

-

Portugals President To Consult Parties Before Appointing Prime Minister

May 30, 2025

Portugals President To Consult Parties Before Appointing Prime Minister

May 30, 2025 -

Stock Market News Dow And S And P 500 Performance May 29

May 30, 2025

Stock Market News Dow And S And P 500 Performance May 29

May 30, 2025 -

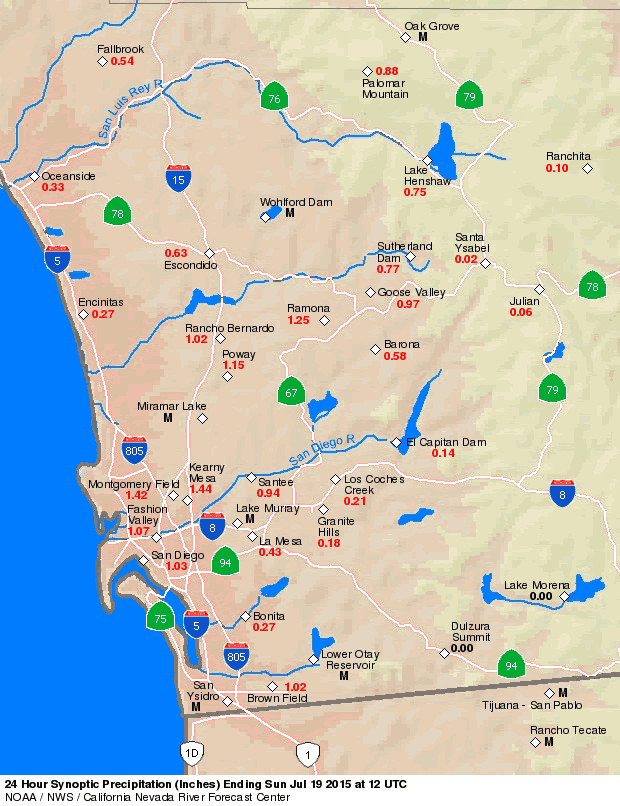

San Diego Rain Comprehensive Totals Via Cbs 8 Com

May 30, 2025

San Diego Rain Comprehensive Totals Via Cbs 8 Com

May 30, 2025 -

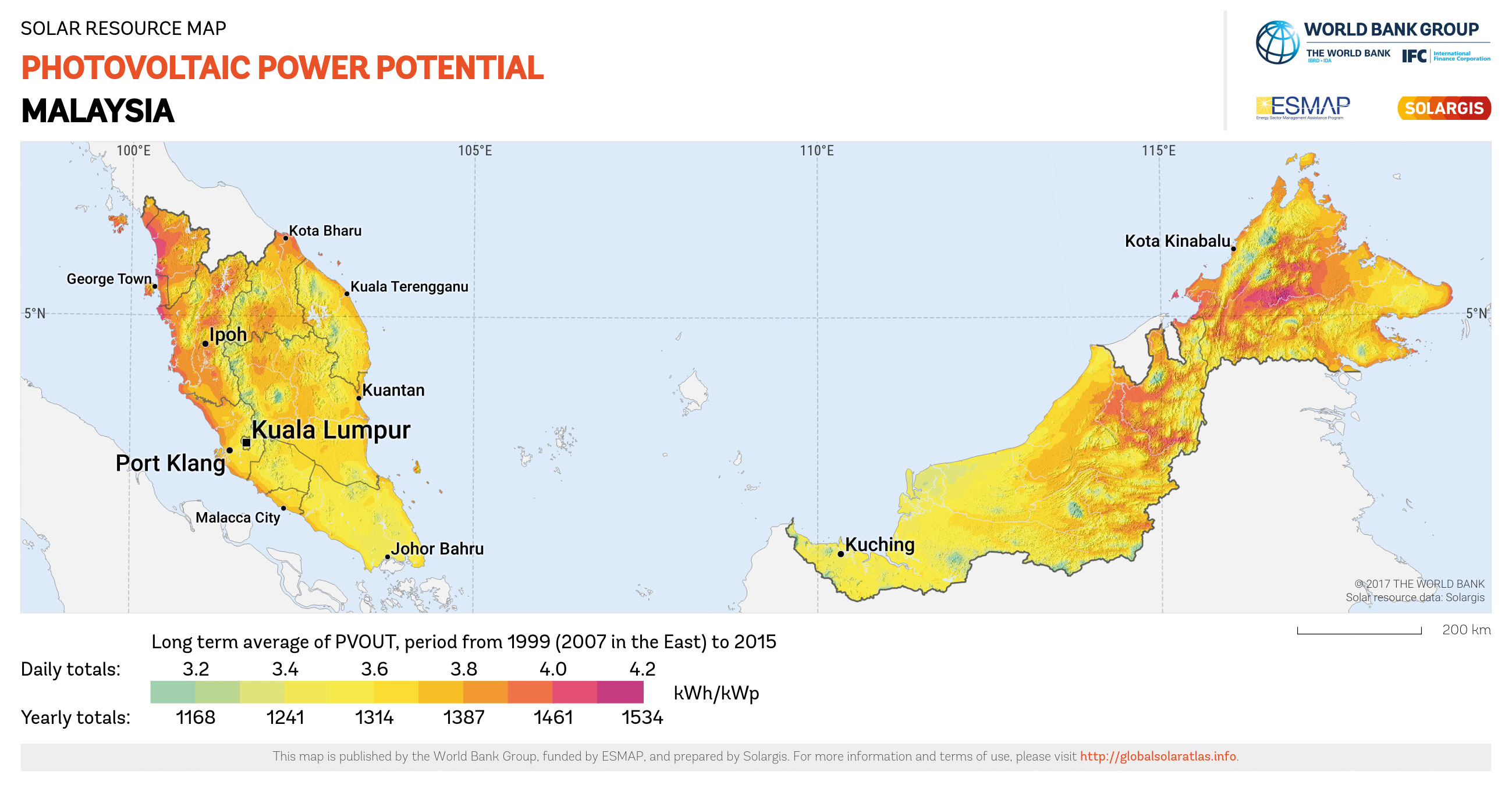

Malaysia Among Four Nations Facing New Us Solar Tariffs

May 30, 2025

Malaysia Among Four Nations Facing New Us Solar Tariffs

May 30, 2025 -

Ditte Okman Udstiller Kare Quist En Analyse Af Han Taler Udenom

May 30, 2025

Ditte Okman Udstiller Kare Quist En Analyse Af Han Taler Udenom

May 30, 2025

Latest Posts

-

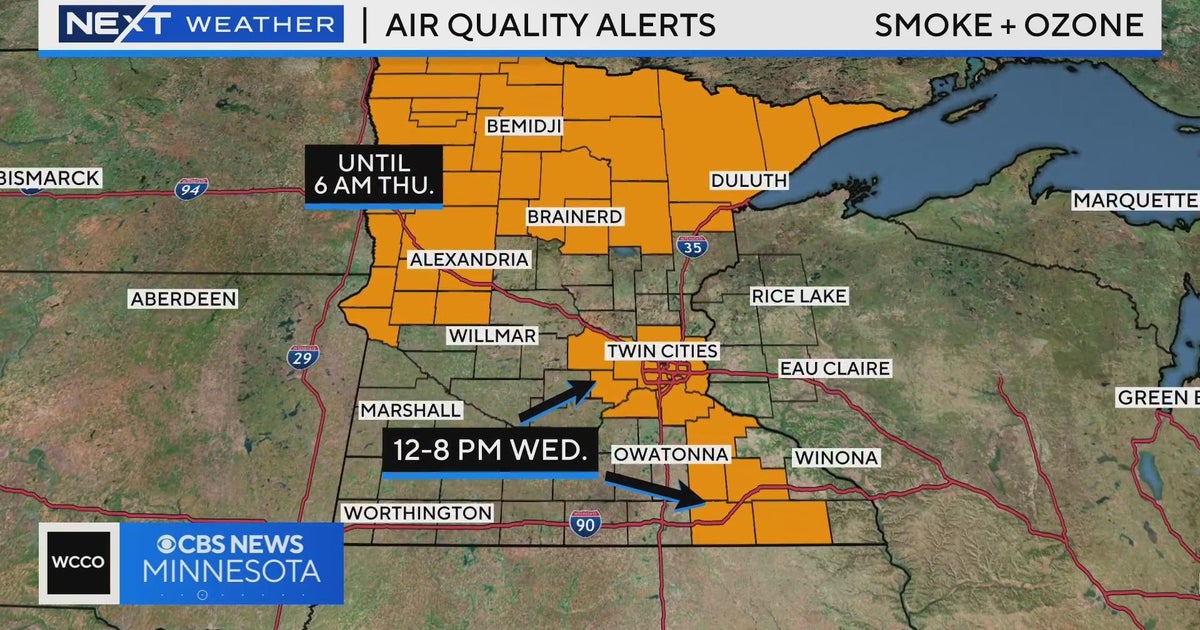

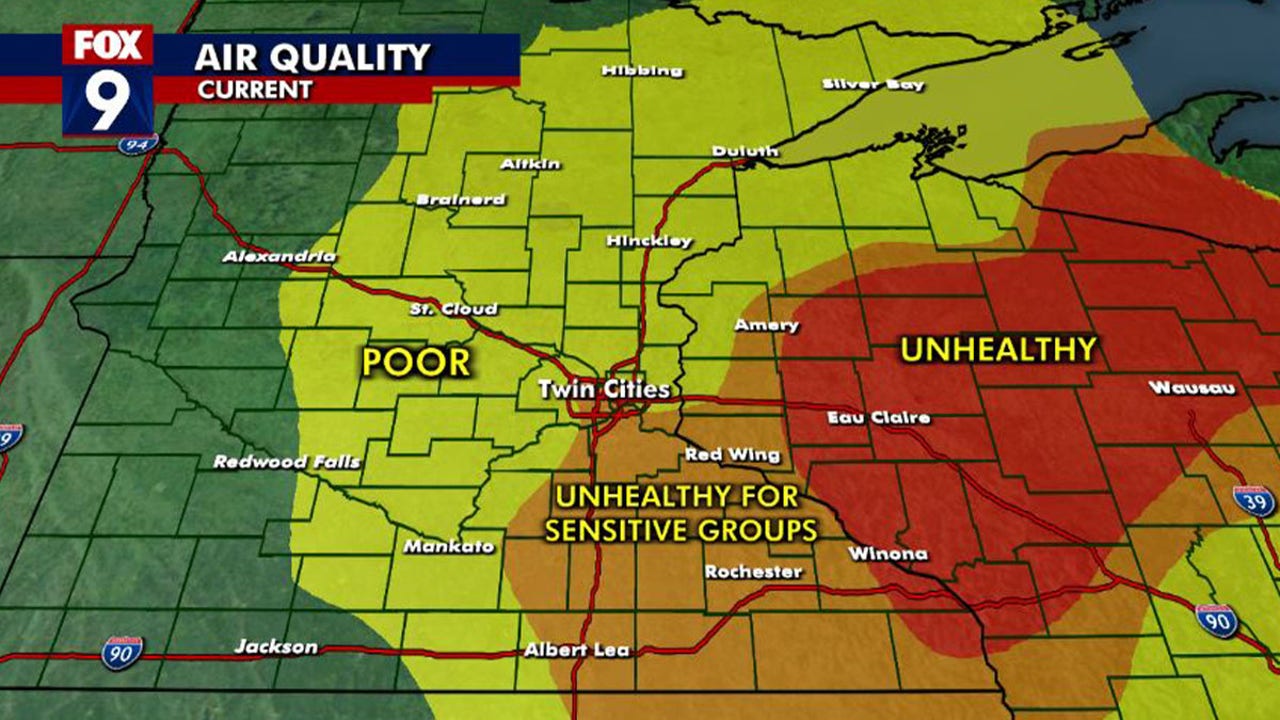

Wildfires In Canada Severe Air Quality Degradation In Minnesota

May 31, 2025

Wildfires In Canada Severe Air Quality Degradation In Minnesota

May 31, 2025 -

Canadian Wildfire Smoke Impacts Minnesotas Air Quality

May 31, 2025

Canadian Wildfire Smoke Impacts Minnesotas Air Quality

May 31, 2025 -

Minnesota Air Quality Crisis Impact Of Canadian Wildfires

May 31, 2025

Minnesota Air Quality Crisis Impact Of Canadian Wildfires

May 31, 2025 -

Canadian Wildfires Minnesota Air Quality Plummets

May 31, 2025

Canadian Wildfires Minnesota Air Quality Plummets

May 31, 2025 -

The Texas Panhandle Wildfire A Year Of Recovery And Rebirth

May 31, 2025

The Texas Panhandle Wildfire A Year Of Recovery And Rebirth

May 31, 2025