Economists Forecast Bank Of Canada Rate Cuts Due To Tariff-Related Job Losses

Table of Contents

The Impact of Tariffs on Canadian Employment

The imposition of tariffs has dealt a blow to several key sectors of the Canadian economy, resulting in substantial job losses and dampening economic growth.

Sector-Specific Job Losses

The manufacturing and agricultural sectors have been particularly hard-hit by tariffs. These increased costs have made Canadian goods less competitive in international markets, leading to reduced production and subsequent layoffs.

- Manufacturing: Statistics Canada reports a significant decline in manufacturing jobs since the implementation of new tariffs, with particular impacts on the automotive and steel industries. Specific examples include plant closures and workforce reductions in Ontario and Quebec.

- Agriculture: The agricultural sector has also felt the pinch, with reduced exports of key products like canola and lumber due to retaliatory tariffs. Industry reports indicate a sharp rise in farm bankruptcies and job losses in rural communities across the country.

The unemployment rate has shown a clear correlation with the increase in tariffs, further solidifying the negative impact on employment. Data from Statistics Canada reveals a steady increase in unemployment figures in regions heavily reliant on the affected sectors.

The Ripple Effect

Job losses in manufacturing and agriculture aren't isolated incidents; they have a ripple effect throughout the Canadian economy. Reduced employment leads to decreased consumer spending, further slowing economic growth.

- Multiplier Effect: The loss of a single manufacturing job, for instance, can lead to further job losses in related sectors like transportation and retail, creating a downward spiral.

- GDP Impact: This decreased economic activity translates directly into lower GDP growth, impacting government revenues and potentially leading to further economic instability.

- Consumer Confidence: The uncertainty surrounding job security and economic prospects has negatively impacted consumer confidence, resulting in reduced spending and investment. Recent surveys reveal a decline in consumer sentiment, reflecting the widespread apprehension about the future.

Economists' Predictions for Bank of Canada Rate Cuts

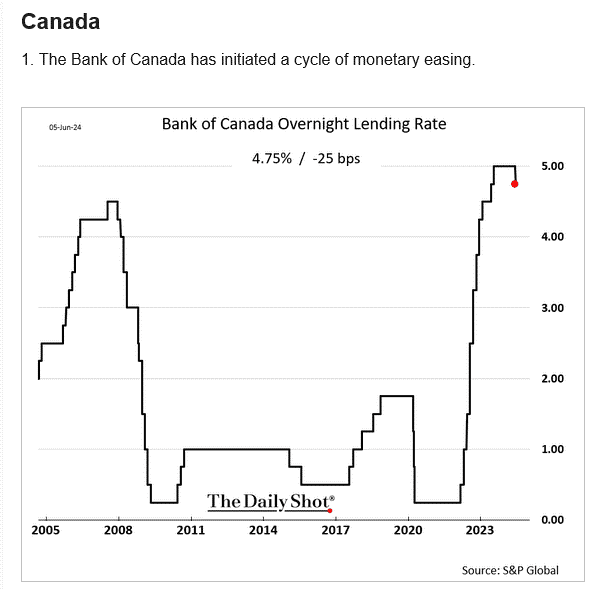

Given the significant negative impact of tariffs on employment and the overall economy, many economists predict that the Bank of Canada will respond by cutting interest rates.

Reasons for Predicted Rate Cuts

The Bank of Canada's mandate is to maintain price stability and full employment. The current economic climate, characterized by tariff-related job losses, clearly threatens these objectives. Rate cuts are a common monetary policy tool used to stimulate the economy.

- Monetary Policy Response: By lowering interest rates, the Bank of Canada aims to encourage borrowing and investment, stimulating economic activity and potentially creating new jobs.

- Expert Opinion: Many prominent economists and financial analysts, such as [insert name and affiliation of economist 1] and [insert name and affiliation of economist 2], have publicly voiced their belief that a rate cut is imminent, citing the weakening economy and rising unemployment as key factors.

Potential Timing and Magnitude of Rate Cuts

The timing and magnitude of potential Bank of Canada rate cuts remain subject to ongoing economic data and future developments.

- Inflation Data: The Bank of Canada will closely monitor inflation data to ensure that rate cuts don't inadvertently lead to higher inflation. Low inflation allows for more flexibility in lowering interest rates.

- Economic Growth Projections: The Bank’s projections for future economic growth will also significantly influence their decision. A more pessimistic outlook might justify a more aggressive rate cut.

- Various Scenarios: Analysts predict scenarios ranging from a single, modest rate cut to several more substantial reductions, depending on the evolving economic conditions. The probability of each scenario will be continually reassessed based on new data.

Implications for Canadian Businesses and Consumers

Potential Bank of Canada rate cuts will have distinct implications for both Canadian businesses and consumers.

Impact on Businesses

Lower interest rates could significantly influence business investment and borrowing costs.

- Reduced Borrowing Costs: Cheaper borrowing could encourage businesses to invest in expansion, new equipment, and hiring, potentially offsetting some of the job losses caused by tariffs.

- Return on Savings: Conversely, lower rates could reduce the returns on savings, potentially discouraging some business investments. Businesses may need to weigh the advantages of cheaper borrowing against the lower returns on their cash reserves.

- Business Response: The overall effect on businesses will depend on their individual circumstances and risk appetite. Some businesses may be encouraged to expand, while others might remain cautious.

Impact on Consumers

For consumers, lower interest rates could translate to more affordable mortgages and personal loans.

- Housing Affordability: Lower mortgage rates could make housing more affordable, potentially boosting the housing market.

- Consumer Debt: However, lower rates could also stimulate borrowing, leading to an increase in consumer debt if not managed responsibly.

- Purchasing Power: Increased affordability of credit could enhance consumer purchasing power, stimulating spending and overall economic activity. The effect on purchasing power will depend on individual consumer behaviors and financial situations.

Conclusion

The economic fallout from tariff-related job losses is pushing economists to predict Bank of Canada rate cuts. This anticipated monetary policy response aims to stimulate the economy and counteract the negative effects of decreased employment and consumer spending. The implications for Canadian businesses and consumers are multifaceted, with both potential benefits and drawbacks associated with lower interest rates. The impact will depend on the magnitude and timing of any rate cuts, as well as the overall response of businesses and consumers.

To stay informed about the potential impacts of Bank of Canada rate cuts and to monitor future announcements, follow reputable financial news sources and regularly visit the Bank of Canada's official website. Stay updated on Bank of Canada rate cuts to make informed decisions for your business or personal finances.

Featured Posts

-

Watch Rory Mc Ilroys Daughters Putt At Augusta

May 12, 2025

Watch Rory Mc Ilroys Daughters Putt At Augusta

May 12, 2025 -

Chaplin And Victory Key Moments For Ipswich Town

May 12, 2025

Chaplin And Victory Key Moments For Ipswich Town

May 12, 2025 -

Lily Collins Sexy New Calvin Klein Campaign Photo 5133597

May 12, 2025

Lily Collins Sexy New Calvin Klein Campaign Photo 5133597

May 12, 2025 -

Holstein Kiels Defeat Werder Bremen Secures Important Victory

May 12, 2025

Holstein Kiels Defeat Werder Bremen Secures Important Victory

May 12, 2025 -

Asylunterkuenfte Potenzial Zur Kostenreduktion Um 1 Milliarde Euro

May 12, 2025

Asylunterkuenfte Potenzial Zur Kostenreduktion Um 1 Milliarde Euro

May 12, 2025

Latest Posts

-

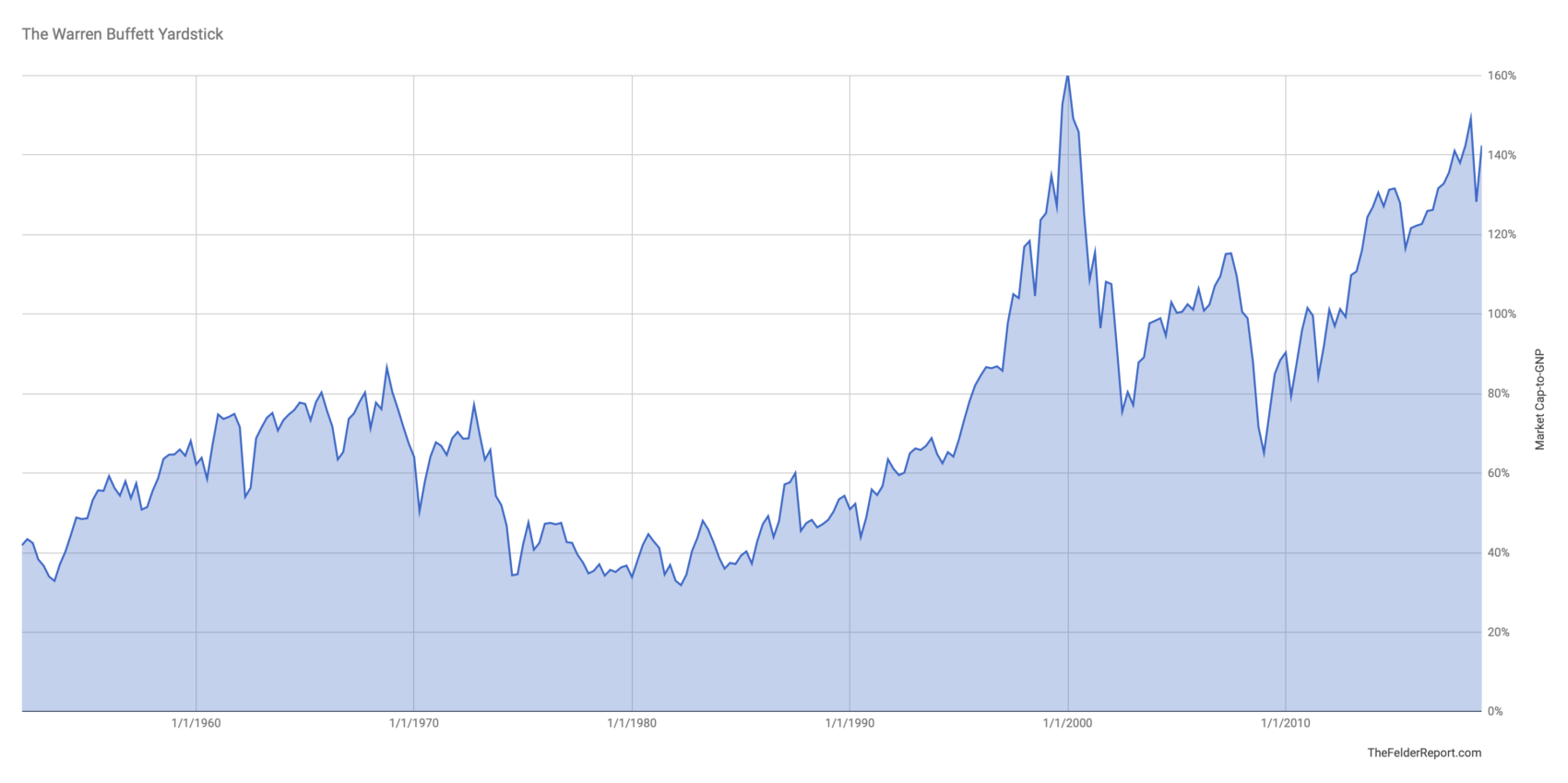

Bof As View On High Stock Market Valuations Reasons For Investor Calm

May 12, 2025

Bof As View On High Stock Market Valuations Reasons For Investor Calm

May 12, 2025 -

Snl Cold Open Features Surprise Appearances By Cecily Strong And Colin Jost

May 12, 2025

Snl Cold Open Features Surprise Appearances By Cecily Strong And Colin Jost

May 12, 2025 -

Understanding High Stock Market Valuations Bof As Analysis For Investors

May 12, 2025

Understanding High Stock Market Valuations Bof As Analysis For Investors

May 12, 2025 -

Trumps Cheap Oil Agenda Conflicts And Compromises With The Energy Industry

May 12, 2025

Trumps Cheap Oil Agenda Conflicts And Compromises With The Energy Industry

May 12, 2025 -

The Trump Presidency And Cheap Oil An Examination Of Policy And Impact

May 12, 2025

The Trump Presidency And Cheap Oil An Examination Of Policy And Impact

May 12, 2025