Economists Predict Rate Cuts Amid Weak Retail Sales

Table of Contents

Weak Retail Sales Signal Economic Slowdown

Weak retail sales are a major indicator of a slowing economy. Declining consumer spending reflects a decrease in consumer confidence and purchasing power, signaling potential trouble ahead.

Declining Consumer Spending

The recent retail sales figures paint a concerning picture. Sales across various sectors are experiencing significant declines, raising serious concerns about the overall health of the economy.

- Apparel Sales Down 5%: Major apparel retailers are reporting significant drops in sales, reflecting a shift in consumer priorities and decreased discretionary spending.

- Electronics Sales Drop 8%: The slump in electronics sales indicates a reduction in large purchases, suggesting consumers are tightening their belts.

- Furniture Sales Fall 7%: The decline in furniture sales points to a decrease in home improvement and renovation projects, further highlighting the overall economic slowdown.

Several factors contribute to this reduced consumer spending:

- Inflation: Persistently high inflation erodes purchasing power, forcing consumers to cut back on spending.

- High Interest Rates: Elevated interest rates increase borrowing costs, making it more expensive for consumers to finance purchases.

- Decreased Consumer Confidence: Negative economic news and uncertainty contribute to decreased consumer confidence, leading to less spending.

Impact on Businesses and Employment

Weak retail sales have far-reaching consequences for businesses and the job market. Businesses are facing reduced revenues, forcing them to cut costs and potentially lay off employees.

- Retail Store Closures: Several retail chains are announcing store closures and restructuring plans due to falling sales.

- Reduced Investment: Businesses are less likely to invest in expansion or new projects when consumer demand is weak.

- Layoffs and Hiring Freezes: Many companies are resorting to layoffs and hiring freezes to reduce expenses in the face of declining revenue.

Economists' Rationale for Predicting Rate Cuts

The prediction of rate cuts stems from a combination of factors, primarily the assessment of inflation and the anticipated response of the Federal Reserve.

Inflation Expectations

Economists are carefully analyzing inflation metrics to determine the trajectory of price increases. While inflation may be cooling, the question remains whether it's cooling sufficiently to justify maintaining high interest rates.

- CPI (Consumer Price Index): The CPI, while showing a decrease from its peak, is still above the Federal Reserve's target rate.

- PPI (Producer Price Index): The PPI also shows signs of easing but remains elevated, potentially indicating persistent inflationary pressures.

- Debate on Transitory vs. Persistent Inflation: Economists are debating whether the current inflationary pressures are transitory or represent a more persistent trend.

Federal Reserve's Response

The Federal Reserve is likely to respond to the weak retail sales and the overall economic slowdown by cutting interest rates. Rate cuts are a tool used to stimulate economic activity by making borrowing cheaper.

- Magnitude of Rate Cuts: The extent of rate cuts will depend on the severity of the economic slowdown and the inflation outlook. Some economists predict multiple rate cuts over the coming months.

- Timing of Rate Cuts: The timing of rate cuts is uncertain and will be data-dependent. The Federal Reserve will closely monitor economic indicators before making any decisions.

Alternative Economic Scenarios

It's essential to consider alternative scenarios beyond the dominant narrative of rate cuts. The economic future is far from certain.

- Recessionary Possibilities: The severity of a potential recession depends on various factors, including consumer spending, business investment, and global economic conditions.

- Sustained, Slower Growth: Another possible scenario is sustained economic growth, although at a slower pace than previously anticipated. This would likely necessitate a more measured approach to interest rate adjustments.

Implications of Rate Cuts for Consumers and Investors

Rate cuts have significant implications for both consumers and investors, affecting borrowing costs and investment strategies.

Impact on Borrowing Costs

Rate cuts directly affect interest rates on various loans, mortgages, and credit cards. Lower interest rates can stimulate borrowing and spending.

- Stimulated Borrowing and Spending: Lower interest rates make borrowing more attractive, potentially leading to increased consumer spending and economic growth.

- Potential Risks of Increased Borrowing: While lower interest rates can be beneficial, they also carry the risk of increasing overall debt levels.

Effects on Investment Strategies

Investors are likely to adjust their portfolios in response to anticipated rate cuts. This can impact different asset classes differently.

- Potential Shifts in Investment Strategies: Investors may shift their portfolios towards assets that perform well in a lower interest rate environment, such as stocks.

- Potential Risks and Opportunities: Each asset class presents different risks and opportunities in the context of rate cuts. Careful consideration and diversification are crucial.

Conclusion

Weak retail sales are a clear signal of an economic slowdown, leading economists to predict rate cuts to stimulate economic activity. The implications for consumers and investors are significant, potentially impacting borrowing costs and investment strategies. While rate cuts can provide a boost to the economy, uncertainty remains about the overall economic outlook. A recession remains a possibility, depending on the severity and duration of the slowdown. Staying informed about economic developments and monitoring the Federal Reserve's announcements regarding future interest rate decisions is crucial. Consult reputable financial news sources for further analysis and updates on the impact of potential interest rate cuts. Understanding the potential implications of future rate cuts will be key to navigating the coming economic landscape.

Featured Posts

-

Fealyat Fn Abwzby Tbda 19 Nwfmbr

Apr 29, 2025

Fealyat Fn Abwzby Tbda 19 Nwfmbr

Apr 29, 2025 -

Trumps Transgender Athlete Ban Us Attorney General Issues Warning To Minnesota

Apr 29, 2025

Trumps Transgender Athlete Ban Us Attorney General Issues Warning To Minnesota

Apr 29, 2025 -

Tragedy Strikes Vancouver Festival Car Drives Into Crowd Causing Multiple Injuries

Apr 29, 2025

Tragedy Strikes Vancouver Festival Car Drives Into Crowd Causing Multiple Injuries

Apr 29, 2025 -

American Manufacturing A Look At The Difficulties

Apr 29, 2025

American Manufacturing A Look At The Difficulties

Apr 29, 2025 -

Gas Leak Prompts Evacuation Of Downtown Louisville Buildings

Apr 29, 2025

Gas Leak Prompts Evacuation Of Downtown Louisville Buildings

Apr 29, 2025

Latest Posts

-

Why Older Adults Are Choosing You Tube For Entertainment

Apr 29, 2025

Why Older Adults Are Choosing You Tube For Entertainment

Apr 29, 2025 -

You Tubes Growing Popularity Among Older Viewers

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers

Apr 29, 2025 -

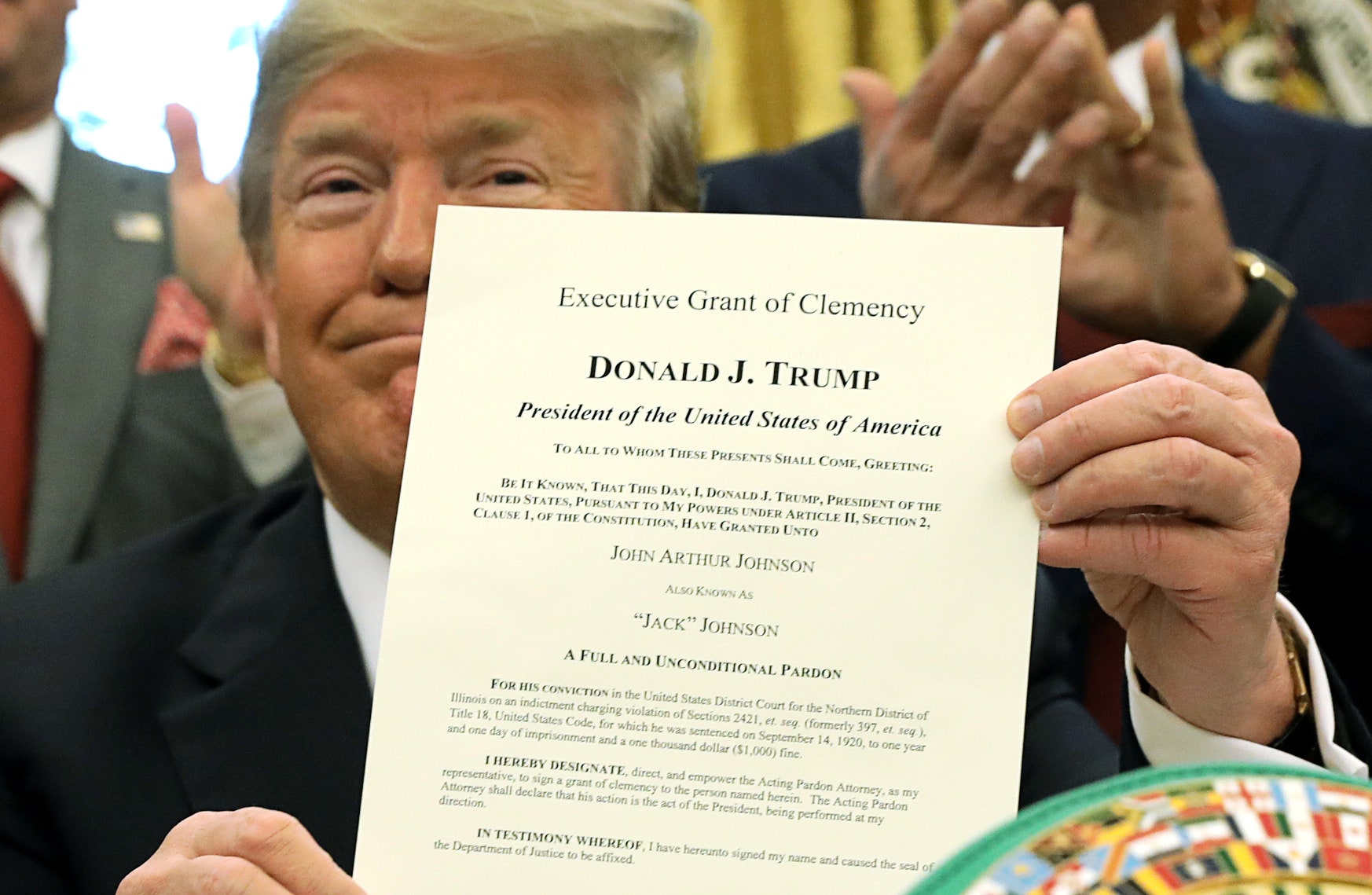

Full Pardon For Rose Trumps Decision And Its Fallout

Apr 29, 2025

Full Pardon For Rose Trumps Decision And Its Fallout

Apr 29, 2025 -

Rose Pardon Will Trump Grant Executive Clemency

Apr 29, 2025

Rose Pardon Will Trump Grant Executive Clemency

Apr 29, 2025 -

Will Trump Pardon Rose A Complete Analysis

Apr 29, 2025

Will Trump Pardon Rose A Complete Analysis

Apr 29, 2025