Elon Musk's Net Worth: A Look At The Factors Behind The Recent Drop Below $300 Billion

Table of Contents

The Impact of Tesla Stock Performance on Elon Musk's Net Worth

Tesla's success is inextricably linked to Elon Musk's personal wealth. A substantial portion of his net worth is directly tied to his ownership stake in the electric vehicle (EV) giant. Therefore, fluctuations in Tesla's stock price have a profound effect on his overall billionaire net worth. Recent negative impacts on Tesla's stock price can be attributed to several converging factors:

-

Increased competition from other EV manufacturers: The EV market is becoming increasingly crowded, with established automakers and new startups vying for market share. This heightened competition puts pressure on Tesla's pricing and market dominance, impacting investor confidence and, consequently, the Tesla stock price.

-

Concerns regarding Tesla's production capacity and delivery timelines: Meeting the growing demand for Tesla vehicles has presented challenges. Concerns about production bottlenecks and delays in deliveries have occasionally dampened investor enthusiasm and contributed to stock price volatility.

-

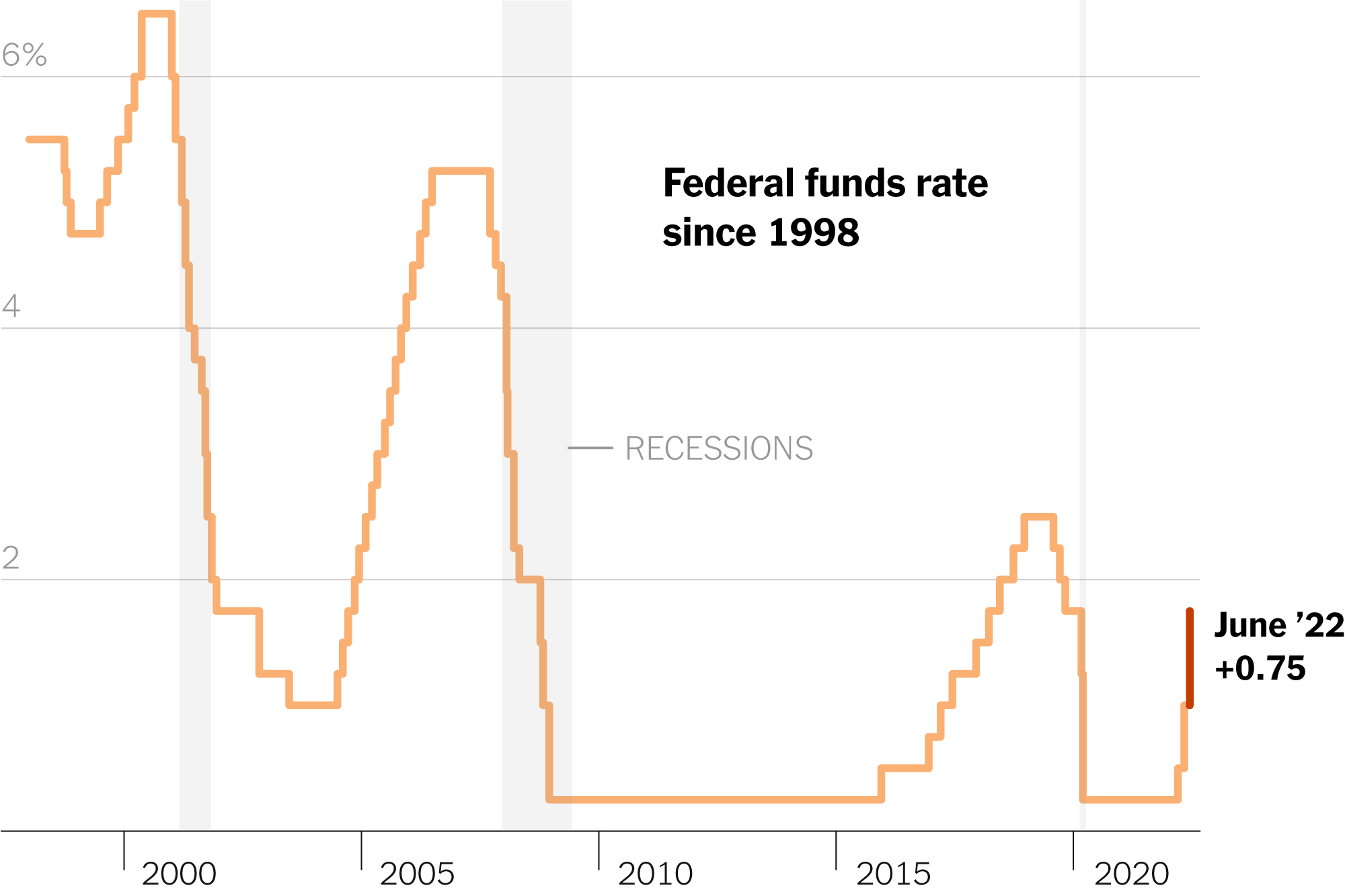

Negative investor sentiment due to macroeconomic factors: Broader economic headwinds, such as inflation, rising interest rates, and recessionary fears, have negatively impacted investor sentiment across various sectors, including the EV market. This general market downturn has contributed to the decline in Tesla's market capitalization and, by extension, Elon Musk's net worth. The Tesla market cap is a key indicator of the company’s overall value and directly reflects on Musk’s wealth.

The interplay of these factors has led to significant swings in the Tesla stock price, directly affecting Elon Musk's billionaire net worth and highlighting the volatility inherent in such heavily stock-based fortunes.

The Twitter Acquisition and its Financial Implications

The controversial acquisition of Twitter by Elon Musk represents another significant factor in the recent decline of his net worth. The hefty price tag of the acquisition, coupled with subsequent decisions, has placed a considerable financial burden on Musk.

-

Debt financing and interest payments: Musk financed a substantial portion of the Twitter acquisition through debt, incurring significant interest payments. These ongoing costs eat into his personal wealth and contribute to the overall reduction in his net worth.

-

Loss of advertising revenue: Controversial changes implemented at Twitter, including mass layoffs and policy shifts, led to a decline in advertising revenue, impacting the platform's profitability and further impacting Musk's investment.

-

Costs associated with restructuring and layoffs: The restructuring efforts at Twitter, including significant layoffs, incurred substantial costs, adding to the financial strain and impacting the overall valuation of the social media platform. This negatively impacted his net worth tied to his Twitter investment.

The Twitter acquisition, while a bold move, has undeniably contributed significantly to the downward pressure on Elon Musk's net worth, underscoring the considerable financial risks associated with such large-scale acquisitions.

Other Factors Contributing to the Net Worth Decline

Beyond Tesla and Twitter, several other factors have potentially contributed to the decline in Elon Musk's net worth.

-

Legal challenges and settlements: Elon Musk has faced various legal challenges throughout his career, and any settlements or legal costs associated with these cases can impact his personal finances.

-

Performance of other Musk-owned companies: While Tesla and SpaceX are his most prominent ventures, Musk has investments in other companies. The performance of these ventures can also influence his overall net worth.

-

Broader economic downturn and its impact on high-net-worth individuals: The prevailing economic climate plays a significant role. A broader economic downturn typically impacts the valuations of all assets, including those owned by high-net-worth individuals like Elon Musk. Market volatility directly affects his investments.

These additional factors, while perhaps less prominent than Tesla's stock performance and the Twitter acquisition, collectively contribute to the overall picture of the recent decline in Elon Musk's net worth.

Conclusion: Understanding the Fluctuations in Elon Musk's Net Worth

The recent drop in Elon Musk's net worth below $300 billion is a complex issue stemming from a confluence of factors. Tesla's stock performance, the significant financial burden of the Twitter acquisition, and other contributing elements have all played a role. Understanding these interconnected factors is crucial to comprehending the volatility inherent in Elon Musk's billionaire net worth and the broader dynamics of the markets he operates within. Stay informed about the future fluctuations in Elon Musk's net worth by following our updates on the ever-evolving world of billionaire wealth and market trends. Analyzing the market analysis and financial news surrounding Tesla stock price and the social media valuation will be key to tracking his financial future.

Featured Posts

-

The Federal Reserve And Interest Rates Navigating Economic Uncertainty

May 09, 2025

The Federal Reserve And Interest Rates Navigating Economic Uncertainty

May 09, 2025 -

Recrutement A Dijon Postes Disponibles En Restauration Rooftop Dauphine Inclus

May 09, 2025

Recrutement A Dijon Postes Disponibles En Restauration Rooftop Dauphine Inclus

May 09, 2025 -

Harry Styles Devastated Reaction To Snls Poor Impression

May 09, 2025

Harry Styles Devastated Reaction To Snls Poor Impression

May 09, 2025 -

Kimbal Musk Exploring The Life And Career Of Elon Musks Brother

May 09, 2025

Kimbal Musk Exploring The Life And Career Of Elon Musks Brother

May 09, 2025 -

Stalking Charge Polish Womans Madeleine Mc Cann Claim Under Scrutiny

May 09, 2025

Stalking Charge Polish Womans Madeleine Mc Cann Claim Under Scrutiny

May 09, 2025