Elon Musk's Net Worth Falls Below $300 Billion: Tesla, Tariffs, And Market Downturn

Table of Contents

Tesla Stock's Significant Role in Elon Musk's Net Worth Decline

Elon Musk's net worth is intrinsically linked to the performance of Tesla, Inc. (TSLA). As the largest shareholder, fluctuations in Tesla's stock price directly translate to changes in his personal wealth. The recent decline in Elon Musk's net worth mirrors a substantial drop in Tesla's market capitalization.

- Recent Tesla Stock Price Fluctuations:

- Significant drops in TSLA stock price over the past quarter.

- Increased volatility compared to previous periods.

- Negative investor sentiment impacting stock valuation.

- Factors Influencing Tesla Stock:

- Production challenges and supply chain disruptions affecting vehicle deliveries.

- Increased competition in the electric vehicle (EV) market from established and new players.

- Concerns about Tesla's overall financial performance and future growth projections. This directly impacts Tesla's market cap and consequently, Musk's net worth.

The correlation between Tesla stock price (TSLA stock) and Elon Musk's billionaire status is undeniable. Understanding the dynamics of Tesla's market cap is crucial to understanding the fluctuations in Musk's overall wealth. The volatility of Tesla stock makes his net worth significantly susceptible to market shifts.

Impact of Tariffs and Global Economic Uncertainty

International trade tensions and global economic uncertainty have created significant headwinds for Tesla, impacting its sales and profitability. Tariffs imposed on imported goods, including certain components used in Tesla vehicles, have increased production costs and reduced profit margins. This, in turn, affects Tesla's overall financial health and consequently Elon Musk's net worth.

- Specific Tariffs Impacting Tesla:

- Tariffs on imported batteries and other components.

- Trade disputes affecting Tesla's operations in key markets such as China and Europe.

- Increased logistical complexities and costs due to trade restrictions.

- Ripple Effect on Elon Musk's Net Worth: Reduced profitability directly translates to a lower valuation of Tesla, leading to a decrease in Elon Musk's overall wealth. Global trade wars and economic uncertainty create significant risks for Tesla's future growth, further contributing to the decline.

The impact of global trade wars and supply chain disruptions on Tesla’s performance underscores the interconnectedness of global economics and the fortunes of high-net-worth individuals like Elon Musk.

The Broader Market Downturn and its Effect on High-Net-Worth Individuals

The recent global market downturn has significantly impacted the wealth of high-net-worth individuals, including Elon Musk. A general decline in asset values across various sectors, fueled by recession fears and inflation concerns, has contributed to a decrease in the overall value of Musk's investment portfolio.

- Broader Market Trends:

- Decreased investor confidence leading to sell-offs across major stock indices.

- Rising interest rates impacting the valuation of growth stocks like Tesla.

- Increased volatility and uncertainty in the global financial markets.

- Impact on Musk's Portfolio: The downturn has affected not only Tesla stock but also potentially other investments in Musk's diversified portfolio, leading to a compounding effect on his net worth.

The effect of market downturns on billionaire wealth demonstrates the vulnerability of even the most substantial fortunes to macroeconomic forces. Recession fears and asset devaluation pose considerable risks to investment portfolios.

Analyzing Elon Musk's Diversified Holdings and Their Current Performance

While Tesla significantly contributes to Elon Musk's wealth, he also holds stakes in other ventures, including SpaceX. The performance of these diversified holdings plays a role in his overall net worth, although Tesla's influence remains dominant.

- SpaceX Valuation: While SpaceX remains a privately held company, its valuation is substantial, contributing to Musk's overall wealth. However, the impact of current market conditions on future funding rounds and private valuations requires consideration.

- Other Investments: Understanding the current status and performance of Musk's other investments offers a more comprehensive view of the factors influencing his total net worth.

The diversification of Elon Musk's portfolio provides some cushion against the volatility of Tesla's stock price. However, the interconnected nature of global financial markets means that even diversified holdings are subject to broader economic trends.

Conclusion: Understanding the Fluctuations in Elon Musk's Net Worth

The decline in Elon Musk's net worth below $300 billion is a result of intertwined factors: a significant drop in Tesla stock price (TSLA stock), the negative impact of international tariffs and global economic uncertainty on Tesla's profitability, the broader market downturn affecting asset values, and the performance of his other investments. The interconnectedness of these factors highlights the vulnerability of even the most substantial fortunes to market volatility and broader economic trends. While future changes in his net worth are difficult to predict, continued monitoring of Tesla's performance and global economic conditions will be crucial in assessing his financial future. Stay informed about the latest developments regarding Elon Musk's net worth and the factors influencing his wealth by following [your website/publication].

Featured Posts

-

Municipales Dijon 2026 L Ambition Ecologique

May 09, 2025

Municipales Dijon 2026 L Ambition Ecologique

May 09, 2025 -

The Snl Impression That Upset Harry Styles

May 09, 2025

The Snl Impression That Upset Harry Styles

May 09, 2025 -

Dijon Ou Donner Ses Cheveux Pour Aider Les Autres

May 09, 2025

Dijon Ou Donner Ses Cheveux Pour Aider Les Autres

May 09, 2025 -

Bitcoin Madenciliginin Azalan Karliligi Yeni Bir Doenem Mi Basliyor

May 09, 2025

Bitcoin Madenciliginin Azalan Karliligi Yeni Bir Doenem Mi Basliyor

May 09, 2025 -

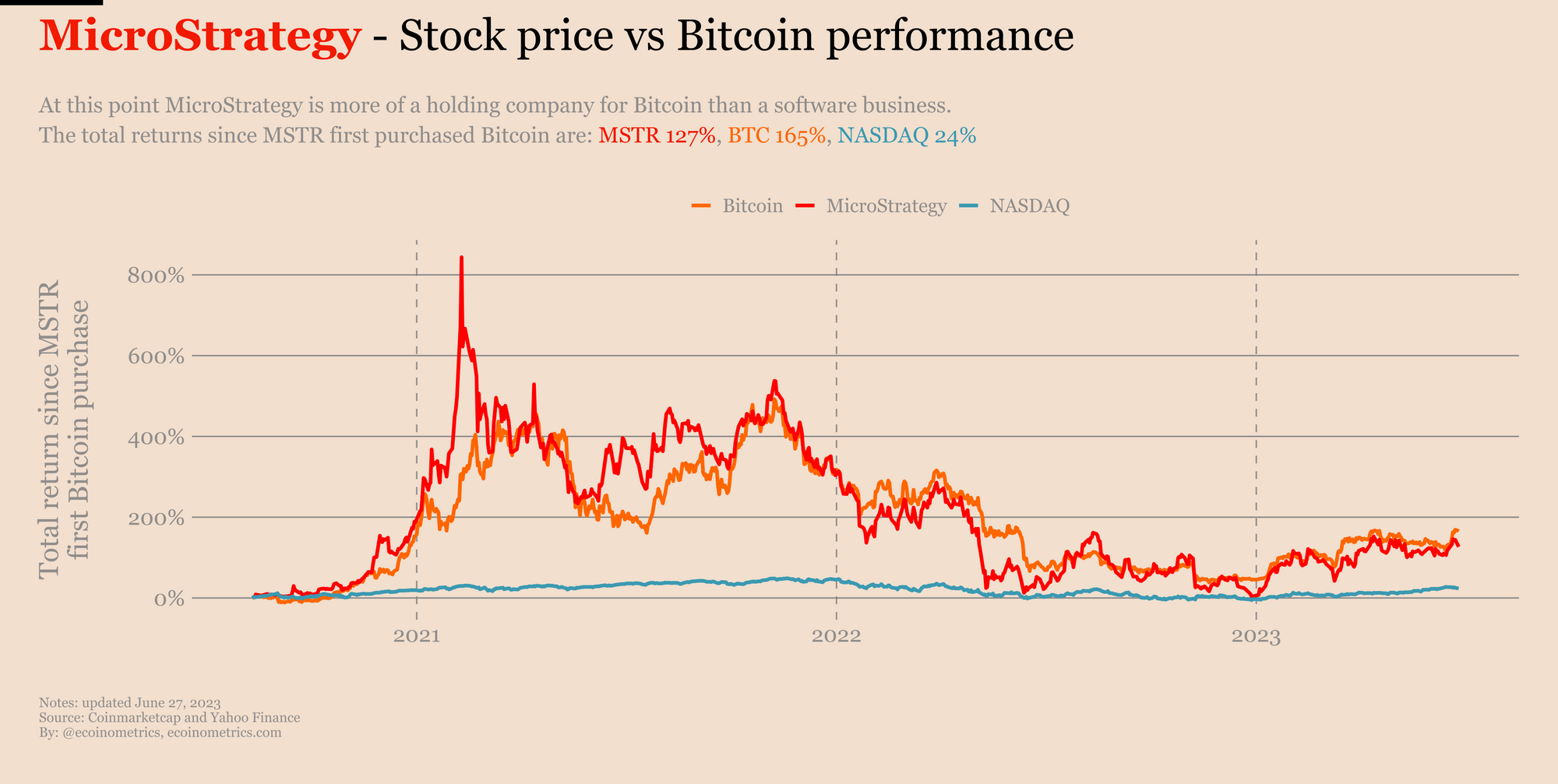

Micro Strategy Vs Bitcoin Predicting Investment Returns For 2025

May 09, 2025

Micro Strategy Vs Bitcoin Predicting Investment Returns For 2025

May 09, 2025