Elon Musk's Net Worth Falls Below $300 Billion: Tesla Troubles And Tariff Impacts

Table of Contents

H2: Tesla's Stock Market Dip

Tesla's recent stock market performance has been a major driver in the decrease of Elon Musk's net worth. Several intertwined factors have contributed to this dip.

H3: Production and Delivery Challenges

Tesla has faced significant hurdles in meeting its ambitious production and delivery targets. This has directly impacted investor confidence and subsequently, the company's stock price.

- Tesla production: Factory shutdowns due to COVID-19 outbreaks, supply chain bottlenecks, and logistical issues have led to production delays across several Tesla models.

- Tesla delivery delays: These delays have resulted in frustrated customers and a backlog of orders, further negatively impacting the company's image and sales figures.

- Supply chain disruptions: The global chip shortage and disruptions in the supply of crucial raw materials, like lithium for batteries, have significantly hampered Tesla's production capacity.

H3: Competition in the EV Market

The electric vehicle (EV) market is rapidly evolving, with increasingly strong competition emerging from established automakers and new EV startups. This intensified competition is putting significant pressure on Tesla.

- Electric vehicle market: The market is becoming saturated with a diverse range of EVs, offering competitive pricing and features.

- EV competition: Companies like Volkswagen, Ford, and Rivian are aggressively expanding their EV portfolios, challenging Tesla's market dominance.

- Tesla competitors: The increased competition forces Tesla to contend with pricing pressures and the need for continuous innovation to maintain its competitive edge.

H3: Negative News and Investor Sentiment

Negative news cycles, including safety recalls, controversies surrounding Elon Musk's public statements, and concerns about Tesla's autopilot system, have all contributed to a decline in investor sentiment.

- Tesla stock price: Negative news directly impacts the Tesla stock price, leading to significant volatility and downward trends.

- Investor sentiment: Negative publicity erodes investor confidence, leading to selling pressure and a further decline in the stock price.

- Tesla controversies: Controversies surrounding the company and its CEO can significantly impact investor perception and consequently, the company's valuation.

H2: The Impact of Tariffs and Global Economic Uncertainty

Beyond Tesla's internal challenges, external factors such as tariffs and global economic uncertainty have significantly impacted the company's performance and, consequently, Elon Musk's net worth.

H3: Rising Raw Material Costs

Tariffs and global inflation have led to a substantial increase in the cost of raw materials essential for Tesla's vehicle production.

- Tesla costs: The rising costs of raw materials, including steel, aluminum, and lithium, directly impact Tesla's profit margins.

- Raw material prices: Fluctuations in global commodity prices, exacerbated by geopolitical events and trade disputes, add to the uncertainty.

- Inflation impact: The current inflationary environment adds further pressure on Tesla's costs and profitability.

H3: Geopolitical Factors and Market Volatility

Geopolitical instability and global economic uncertainty contribute to market volatility, impacting the valuation of all publicly traded companies, including Tesla.

- Global market volatility: Global events, such as the war in Ukraine and rising interest rates, create uncertainty and negatively affect investor sentiment.

- Geopolitical risk: Geopolitical risks, such as trade wars and sanctions, introduce further uncertainty and volatility into the market.

- Tesla market cap: These factors contribute to fluctuations in Tesla's market capitalization, directly impacting Elon Musk's net worth.

H3: Trade Wars and Export Challenges

Trade disputes and tariffs imposed on Tesla vehicles in certain markets have hindered the company's global sales and profitability.

- Tesla tariffs: Tariffs imposed by different countries on imported Tesla vehicles increase their prices, impacting competitiveness and sales.

- Trade wars: Trade wars and protectionist policies create trade barriers, limiting Tesla's ability to expand its global reach.

- International trade: Navigating the complexities of international trade and overcoming trade barriers is crucial for Tesla's continued global success.

3. Conclusion

The recent decline in Elon Musk's net worth below $300 billion is a result of several interconnected factors. Tesla's struggles with production, increased competition in the EV market, negative news cycles, and the impact of tariffs and global economic uncertainty have all played significant roles. The future trajectory of Tesla's stock and Elon Musk's net worth remains uncertain, depending on the company's ability to address these challenges and navigate the evolving global landscape. To stay updated on the latest developments concerning Elon Musk's net worth and the future of Tesla, follow our social media channels and subscribe to our newsletter for exclusive insights and analysis on Tesla stock forecast and electric vehicle industry trends. Keep informed about the dynamic world of Elon Musk's Net Worth and the future of Tesla.

Featured Posts

-

Stiven King I Ego Yarostnaya Ataka Na Trampa I Maska

May 10, 2025

Stiven King I Ego Yarostnaya Ataka Na Trampa I Maska

May 10, 2025 -

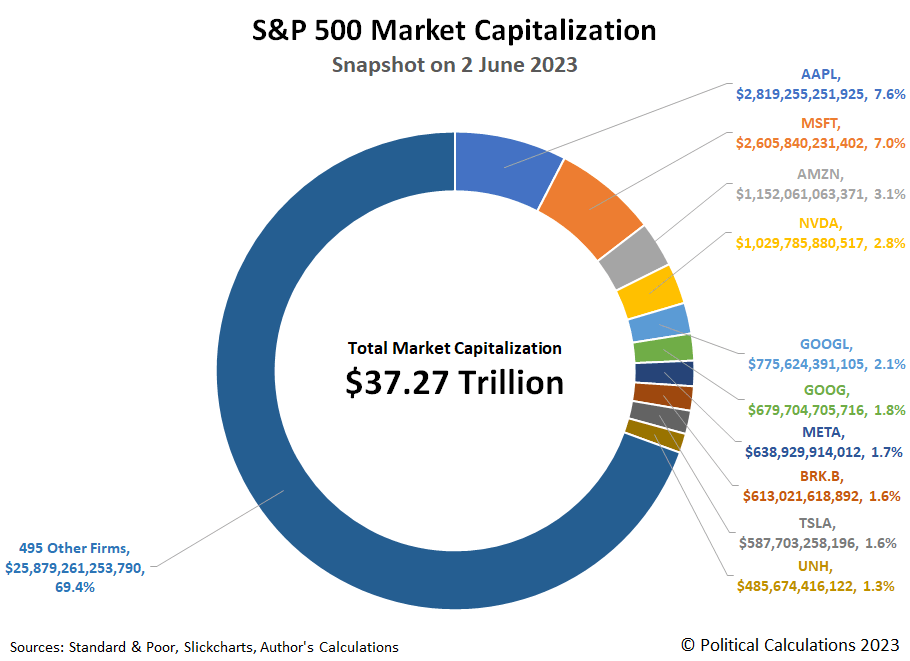

Palantirs Potential Can It Achieve A Trillion Dollar Market Cap By The End Of The Decade

May 10, 2025

Palantirs Potential Can It Achieve A Trillion Dollar Market Cap By The End Of The Decade

May 10, 2025 -

Kucherov Leads Lightning To 4 1 Win Over Draisaitl And Oilers

May 10, 2025

Kucherov Leads Lightning To 4 1 Win Over Draisaitl And Oilers

May 10, 2025 -

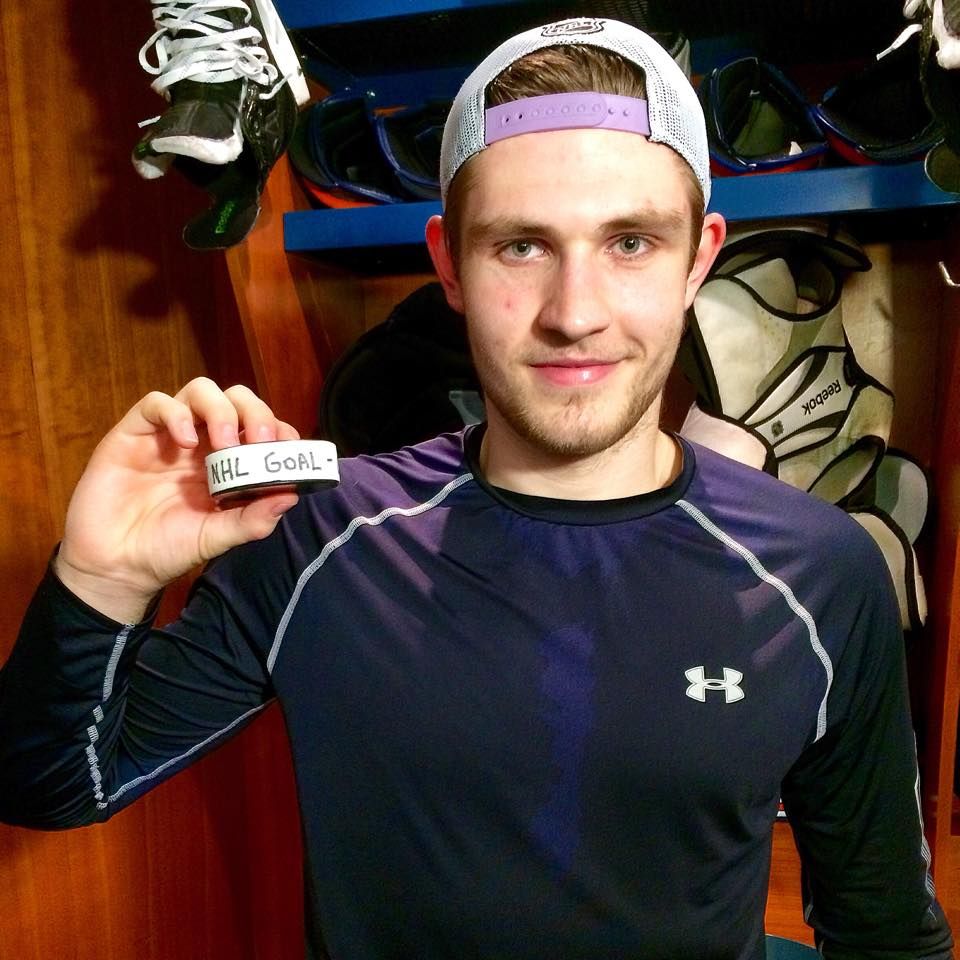

Nhls Leading Goal Scorer Leon Draisaitl Injured

May 10, 2025

Nhls Leading Goal Scorer Leon Draisaitl Injured

May 10, 2025 -

The Fentanyl Crisis And Its Impact On U S China Trade Relations

May 10, 2025

The Fentanyl Crisis And Its Impact On U S China Trade Relations

May 10, 2025