Elon Musk's Private Companies: Investment Opportunities For A Side Hustle

Table of Contents

Understanding the Risks and Rewards of Investing in Elon Musk's Private Companies

Investing in private companies, especially those associated with a high-profile figure like Elon Musk, presents a high-risk, high-reward scenario. It's crucial to understand both sides of the coin before taking the plunge.

High-Risk, High-Reward Potential

The inherent volatility of private company investments is undeniable. Unlike publicly traded stocks, there's no readily available market for quick exits. Your investment could skyrocket, bringing exceptional returns, or it could plummet, resulting in a complete loss. The success or failure is often heavily tied to the performance of the company and its leadership.

- Successful Examples: SpaceX's increasing valuation and successful launches demonstrate the potential for massive returns.

- Unsuccessful Examples: While many of Musk's ventures have been highly successful, it's important to acknowledge that not all are guaranteed wins. Thorough due diligence is essential.

- Liquidity Concerns: Unlike public markets, selling your stake in a private company can be extremely difficult and time-consuming. You may be locked into your investment for an extended period.

Due Diligence is Crucial

Before even considering an investment, thorough due diligence is paramount. Accessing reliable financial information for private companies is challenging compared to publicly traded corporations.

- Research Strategies: Scrutinize news articles, industry reports, and financial analyses focusing on the specific company.

- Expert Advice: Seek advice from experienced financial professionals specializing in private equity investments. They can provide valuable insights and help you assess the risks involved.

- Understanding Financial Statements: If available, carefully analyze any financial statements provided to gauge the company's financial health and growth trajectory.

Exploring Key Investment Opportunities: SpaceX, The Boring Company, and Neuralink

Elon Musk's portfolio offers several intriguing investment possibilities, each with its unique risk profile and potential for return.

SpaceX: The Space Exploration Frontier

SpaceX, with its ambitious goals in space exploration and satellite internet services (Starlink), represents a significant investment opportunity. Its revenue streams are diverse, including commercial satellite launches and the rapidly expanding Starlink constellation. Investment avenues may include participating in funding rounds (if available) or engaging in secondary market transactions.

- Potential Rewards: The potential for exponential growth in the space industry is immense. SpaceX's leading position gives it a strong competitive edge.

- Potential Risks: The space industry is highly competitive, with both established players and new entrants vying for market share. Technological setbacks or regulatory hurdles could significantly impact the company's performance.

The Boring Company: Revolutionizing Infrastructure

The Boring Company aims to revolutionize urban transportation through underground tunnel networks. This disruptive technology holds significant potential, but it’s still in its early stages of development. Investment opportunities might emerge through private funding rounds or other specialized channels.

- Potential Rewards: Successful implementation could transform urban transportation and create a massive market for The Boring Company's services.

- Potential Challenges: The company faces considerable regulatory hurdles and significant engineering challenges. The technology's long-term viability remains uncertain.

Neuralink: The Future of Brain-Computer Interfaces

Neuralink is perhaps the most speculative yet potentially revolutionary venture in Elon Musk's portfolio. Its development of brain-computer interfaces could have far-reaching implications across healthcare, technology, and beyond. However, this technology faces immense ethical and regulatory challenges.

- Potential Rewards: The long-term potential for this technology is almost unimaginable.

- Potential Risks: The highly experimental nature of Neuralink's technology carries substantial risks. Ethical concerns and potential regulatory roadblocks could significantly delay or even halt its progress.

Practical Strategies for Accessing Private Company Investments

Accessing investments in these private companies requires careful planning and strategic effort.

Networking and Relationship Building

Building relationships within the investment community is crucial. Attending industry events, leveraging professional networks, and engaging with investors online are essential strategies.

- Networking Events: Industry conferences and investor meetups offer opportunities to connect with individuals involved in private company investments.

- Online Platforms: LinkedIn and other professional networking sites can facilitate connections with individuals in the venture capital and private equity sectors.

Accredited Investor Status

Becoming an accredited investor significantly broadens access to private investment opportunities. This typically requires a substantial net worth or income.

- Net Worth Requirement: Generally, a net worth exceeding $1 million (excluding primary residence) is required.

- Income Requirement: Alternatively, an annual income exceeding $200,000 ($300,000 for joint filers) for the past two years, with a reasonable expectation of similar income in the current year, is often sufficient.

Utilizing Investment Platforms

Several specialized platforms facilitate investments in private companies. However, exercising caution and due diligence to avoid scams is vital.

- Reputable Platforms: Thorough research is required to identify legitimate platforms with a track record of success and transparency. Always verify credentials and check for independent reviews.

Conclusion

Investing in Elon Musk's private companies presents a high-risk, high-reward proposition. While the potential returns are considerable, the inherent volatility and challenges in accessing these opportunities necessitate careful consideration and thorough due diligence. Remember, successful investing requires a deep understanding of the companies, the market, and your own risk tolerance.

Start your journey into the world of Elon Musk's private company investment opportunities today! But remember, always conduct thorough research and seek professional advice before making any investment decisions.

Featured Posts

-

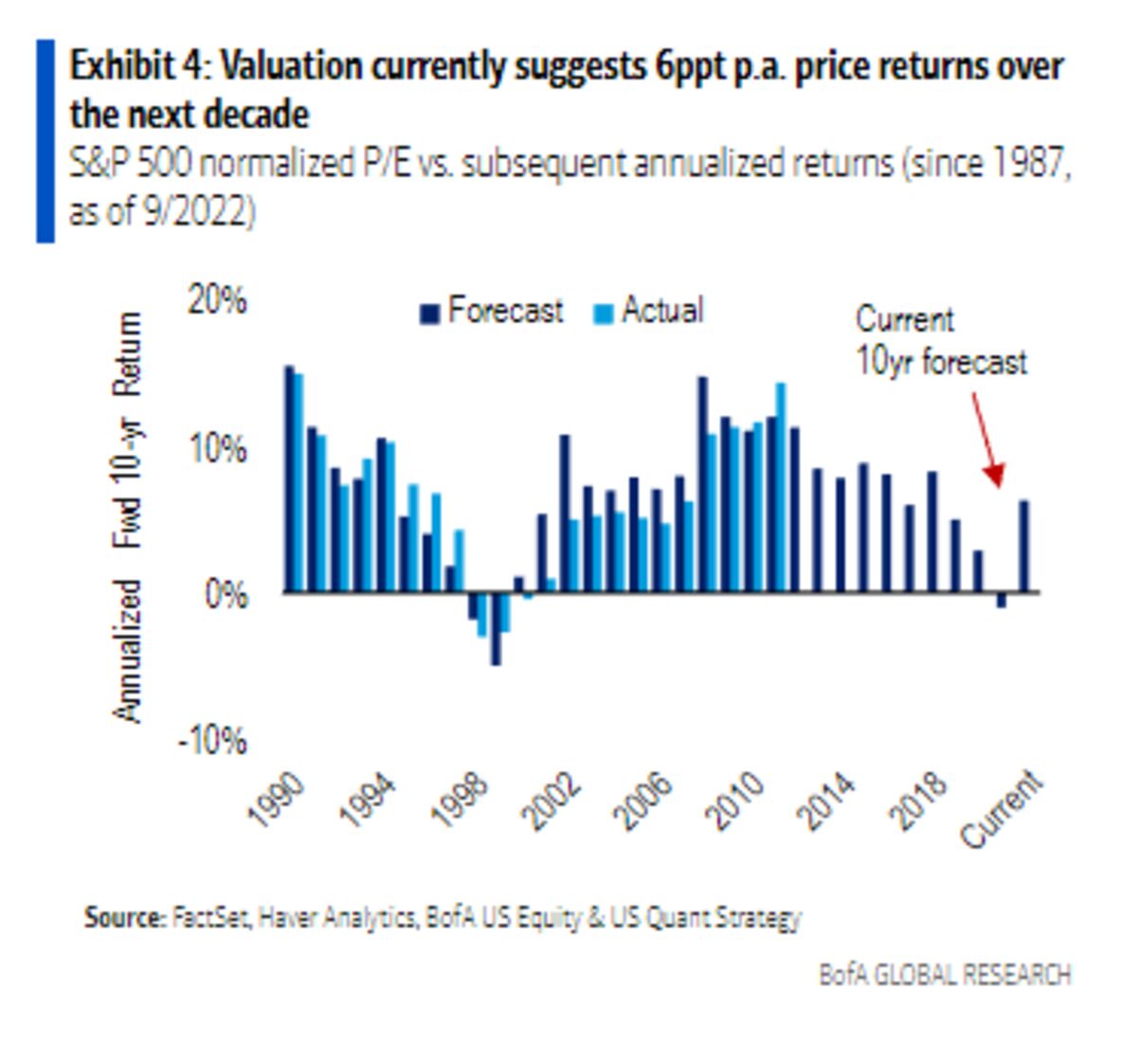

Are High Stock Market Valuations A Cause For Concern Bof A Weighs In

Apr 26, 2025

Are High Stock Market Valuations A Cause For Concern Bof A Weighs In

Apr 26, 2025 -

Public Opinion On Martin Luther King Jr Day Celebration Or Abolition

Apr 26, 2025

Public Opinion On Martin Luther King Jr Day Celebration Or Abolition

Apr 26, 2025 -

I Heart Radio Music Awards 2025 Benson Boones Striking Sheer Top

Apr 26, 2025

I Heart Radio Music Awards 2025 Benson Boones Striking Sheer Top

Apr 26, 2025 -

Tom Cruises Death Defying Mission Impossible 8 Biplane Stunt

Apr 26, 2025

Tom Cruises Death Defying Mission Impossible 8 Biplane Stunt

Apr 26, 2025 -

Mission Impossibles Final Chapter A Look At Missing Sequels

Apr 26, 2025

Mission Impossibles Final Chapter A Look At Missing Sequels

Apr 26, 2025

Latest Posts

-

Forgotten Star Patrick Schwarzenegger In Ariana Grandes White Lotus Music Video

Apr 27, 2025

Forgotten Star Patrick Schwarzenegger In Ariana Grandes White Lotus Music Video

Apr 27, 2025 -

Patrick Schwarzeneggers Surprising Cameo A Deep Dive Into Ariana Grandes White Lotus

Apr 27, 2025

Patrick Schwarzeneggers Surprising Cameo A Deep Dive Into Ariana Grandes White Lotus

Apr 27, 2025 -

Did You Spot Patrick Schwarzenegger In Ariana Grandes White Lotus Video

Apr 27, 2025

Did You Spot Patrick Schwarzenegger In Ariana Grandes White Lotus Video

Apr 27, 2025 -

Where Is Patrick Schwarzenegger In Ariana Grandes White Lotus A Video Mystery

Apr 27, 2025

Where Is Patrick Schwarzenegger In Ariana Grandes White Lotus A Video Mystery

Apr 27, 2025 -

The Mystery Of Patrick Schwarzeneggers Appearance In Ariana Grandes White Lotus Video

Apr 27, 2025

The Mystery Of Patrick Schwarzeneggers Appearance In Ariana Grandes White Lotus Video

Apr 27, 2025