Escape To The Country: Budgeting And Financing Your Rural Move

Table of Contents

Assessing Your Finances for a Country Escape

Before you start house hunting in picturesque villages or browsing charming countryside cottages, a realistic assessment of your finances is crucial. This involves understanding your current financial situation and projecting your future expenses in a rural setting.

Determining Your Budget:

Moving to the country often involves significantly different cost structures compared to city living. It's crucial to create a comprehensive budget that accounts for all potential expenses.

- Property Costs: This is likely your largest expense. Factor in the purchase price (or rental costs) of your rural property. Consider property taxes, which can vary greatly depending on location.

- Moving Expenses: Relocating to a rural area can involve higher moving costs due to distance and potential accessibility challenges. Include packing supplies, transportation, and potential temporary accommodation.

- Renovations and Repairs: Older rural properties often require significant renovations or repairs. Budget for these unforeseen costs. A thorough home inspection is essential before purchasing.

- Commuting Costs: Rural living often means longer commutes. Factor in increased fuel costs, vehicle maintenance, and potential toll fees.

- Loss of Income: Consider any potential impact on your income if you need to change jobs or reduce your working hours after moving.

- Rural Living Expenses: Rural life often presents unique expenses like well maintenance, septic system upkeep, and potentially higher utility costs.

Use budgeting apps, spreadsheets, or consult a financial advisor to help create a detailed and realistic budget. Remember to research different rural locations, as costs can vary significantly across regions.

Evaluating Your Savings and Investments:

Once you have a comprehensive budget, evaluate your current financial situation.

- Current Savings: How much savings do you currently have? This will form the basis of your down payment and initial expenses.

- Investment Portfolio: Consider liquidating some investments to fund your move. However, carefully weigh the tax implications and potential loss of long-term growth. Consult a financial advisor before making any significant investment decisions.

- Income Generation: If your move will impact your current income, explore ways to supplement your earnings. This could involve freelancing, starting a home-based business, or finding a remote job.

Securing Financing for Your Rural Property

Securing financing for your rural property might present unique challenges compared to urban areas. Understanding your options is vital.

Exploring Mortgage Options:

- Rural Lenders: Research mortgage lenders specializing in rural properties or agricultural loans. They often have more experience with the specific challenges of financing in rural areas.

- Mortgage Types: Compare different mortgage types, including conventional loans, FHA loans, USDA loans (particularly beneficial for rural properties), and VA loans (for eligible veterans). Each has different eligibility requirements and interest rates.

- Credit Score: A strong credit score is vital for securing favorable mortgage terms. Check your credit report and address any issues before applying.

Prepare a strong application, including detailed financial statements, credit reports, and proof of income.

Considering Alternative Financing Methods:

In addition to traditional mortgages, explore alternative financing methods:

- Seller Financing: The seller might be willing to finance a portion of the purchase price. This can be a good option, especially in a buyer's market.

- Land Contract: A land contract (or installment sale contract) allows you to make payments to the seller over time while they retain ownership until the loan is paid off.

- Home Equity Loan/Line of Credit: If you own another property, a home equity loan or line of credit might provide additional funds.

- Crowdfunding: For specific rural property projects, crowdfunding platforms might offer an alternative financing option.

Unexpected Costs of Country Living: Budgeting for the Long Term

While initial costs are significant, ongoing expenses are equally crucial to consider when planning your escape to the country.

Home Maintenance and Repairs:

Rural properties, especially older ones, often require more maintenance and repairs than urban homes.

- Regular Maintenance: Budget for routine maintenance such as landscaping, plumbing, electrical work, and roof repairs.

- Emergency Fund: Set aside a dedicated emergency fund to cover unexpected home repairs.

- Well and Septic: Factor in the costs of well and septic system maintenance, which can be substantial.

Increased Transportation Costs:

Longer commutes and limited public transportation are common in rural areas.

- Fuel Costs: Calculate increased fuel costs based on your commute distance and vehicle's fuel efficiency.

- Vehicle Maintenance: Increased mileage means more frequent vehicle maintenance and potential repairs.

- Second Vehicle: Consider the possibility of needing a second vehicle for rural living, particularly if you rely on a vehicle for work and other activities.

Higher Property Taxes and Insurance:

Property taxes and insurance rates in rural areas can differ from urban areas.

- Property Tax Research: Research property tax rates in your target area before making a purchase.

- Insurance Quotes: Obtain insurance quotes from multiple providers specializing in rural properties.

Conclusion

Planning your escape to the country requires careful budgeting and financial strategy. By thoroughly assessing your finances, exploring various financing options, and anticipating potential unforeseen costs, you can make informed decisions and increase your chances of a successful transition. Remember to create a detailed budget, compare your options carefully, and don't hesitate to seek professional advice from financial advisors specializing in rural property purchases. Start planning your escape to the country today!

Featured Posts

-

Ferrari Loeysi Uuden Taehden 13 Vuotias Kuljettaja

May 24, 2025

Ferrari Loeysi Uuden Taehden 13 Vuotias Kuljettaja

May 24, 2025 -

Lauryn Goodmans Relocation To Italy A New Chapter Following Kyle Walkers Ac Milan Transfer

May 24, 2025

Lauryn Goodmans Relocation To Italy A New Chapter Following Kyle Walkers Ac Milan Transfer

May 24, 2025 -

Nicki Chapmans Garden Design Inspiration From Her Chiswick Home

May 24, 2025

Nicki Chapmans Garden Design Inspiration From Her Chiswick Home

May 24, 2025 -

Guccis Massimo Vian Departs Supply Chain Leadership Change

May 24, 2025

Guccis Massimo Vian Departs Supply Chain Leadership Change

May 24, 2025 -

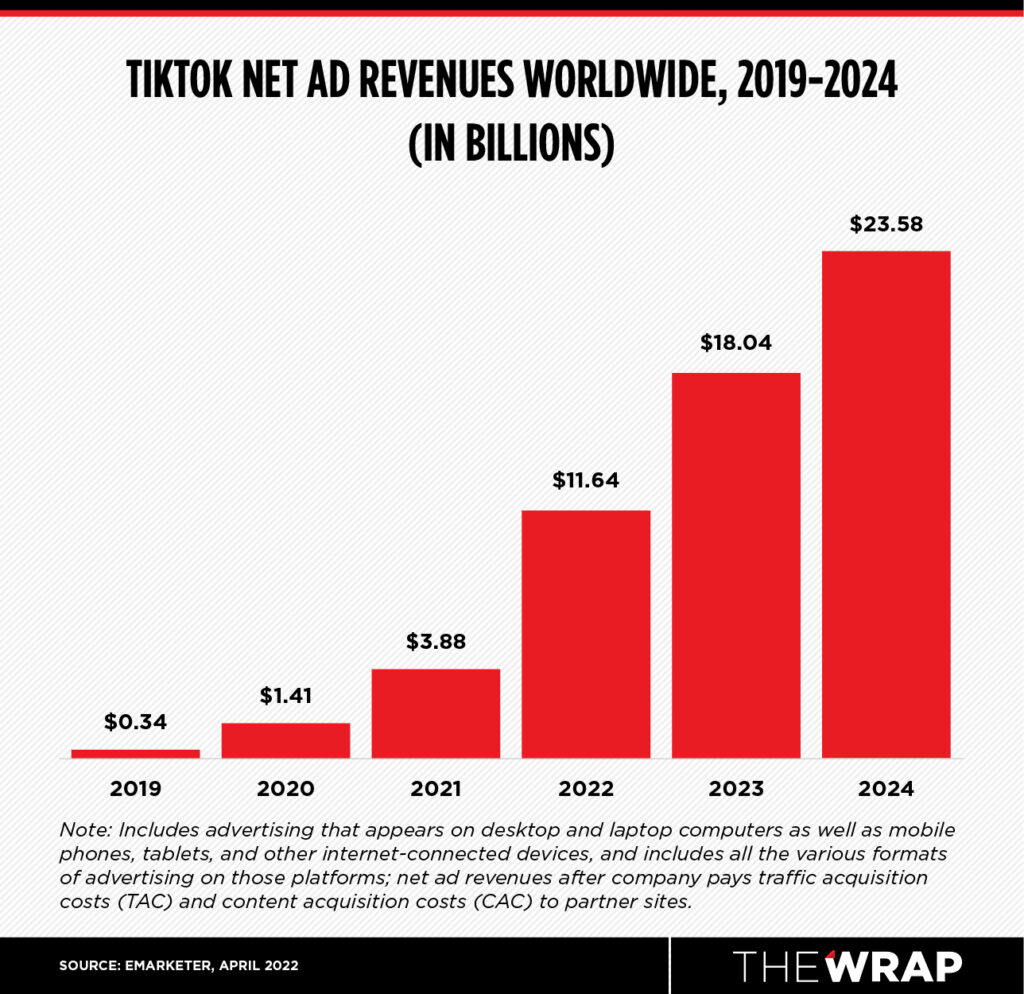

Legal Battle Amsterdam Residents Vs City Hall Tik Toks Impact On Local Business

May 24, 2025

Legal Battle Amsterdam Residents Vs City Hall Tik Toks Impact On Local Business

May 24, 2025

Latest Posts

-

Sean Penns Doubts Re Examining The Woody Allen Dylan Farrow Allegations

May 24, 2025

Sean Penns Doubts Re Examining The Woody Allen Dylan Farrow Allegations

May 24, 2025 -

Apple Stock Prediction 254 Analysts Outlook And Buy Recommendation At 200

May 24, 2025

Apple Stock Prediction 254 Analysts Outlook And Buy Recommendation At 200

May 24, 2025 -

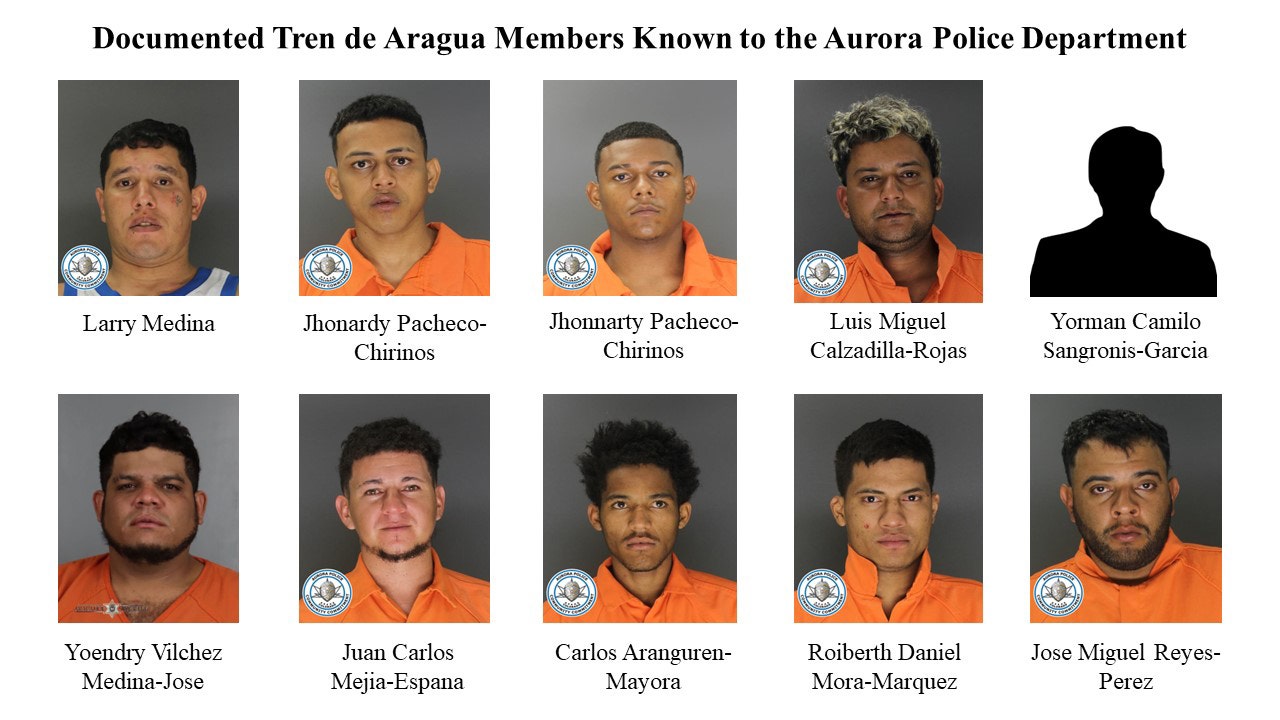

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Actress Mia Farrow Seeks Trumps Arrest In Venezuelan Deportation Controversy

May 24, 2025

Actress Mia Farrow Seeks Trumps Arrest In Venezuelan Deportation Controversy

May 24, 2025 -

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 24, 2025