Apple Stock Prediction: $254? Analyst's Outlook & Buy Recommendation At $200

Table of Contents

Analyst's Rationale for the $254 Apple Stock Prediction

Strong Financial Performance and Growth Projections

Apple's recent financial performance paints a picture of robust growth. The most recent earnings reports showcase impressive figures across various segments. For instance, iPhone sales continue to be a significant revenue driver, even amidst a fluctuating global market. Furthermore, the services sector, encompassing Apple Music, iCloud, and the App Store, has exhibited remarkable year-over-year growth, demonstrating the strength and stickiness of the Apple ecosystem. Wearables, including Apple Watches and AirPods, also contribute substantial revenue.

- Apple Revenue Growth: [Insert latest revenue growth percentage].

- Apple Earnings Per Share (EPS): [Insert latest EPS figures and projections].

- Projected Growth Areas: Future product launches, such as the anticipated new iPhone models and the much-rumored AR/VR headset, are expected to further fuel Apple revenue growth and boost the Apple stock forecast. These innovations should attract new users and drive upgrades among existing customers.

These positive Apple financial performance indicators strongly support the ambitious $254 Apple stock prediction.

Innovation and Market Dominance

Apple's sustained innovation is a cornerstone of its market dominance. The company consistently introduces cutting-edge products and services that set trends and redefine user expectations. This Apple innovation maintains a strong Apple market share and fosters significant Apple brand loyalty.

- Innovative Products: [Mention specific recent product launches and their market impact].

- Market Leadership: Apple's position at the forefront of consumer electronics ensures its continued relevance and profitability, further solidifying the Apple competitive advantage.

This innovative approach bolsters investor confidence and fuels the optimistic Apple stock prediction.

Positive Market Sentiment and Investor Confidence

The overall market sentiment towards Apple stock remains overwhelmingly positive. Recent positive news, such as [mention specific positive news or announcements, e.g., successful product launches, positive industry reports], has reinforced Apple investor sentiment. This positive Apple stock outlook and widespread market confidence contribute significantly to the $254 Apple stock prediction.

- Positive Analyst Ratings: [Mention the number of analysts with buy ratings and their target prices].

- Institutional Investment: [Mention any significant increases in institutional investment in Apple stock].

This positive sentiment among investors strengthens the belief in the potential of the Apple stock prediction.

Buy Recommendation at $200: A Detailed Analysis

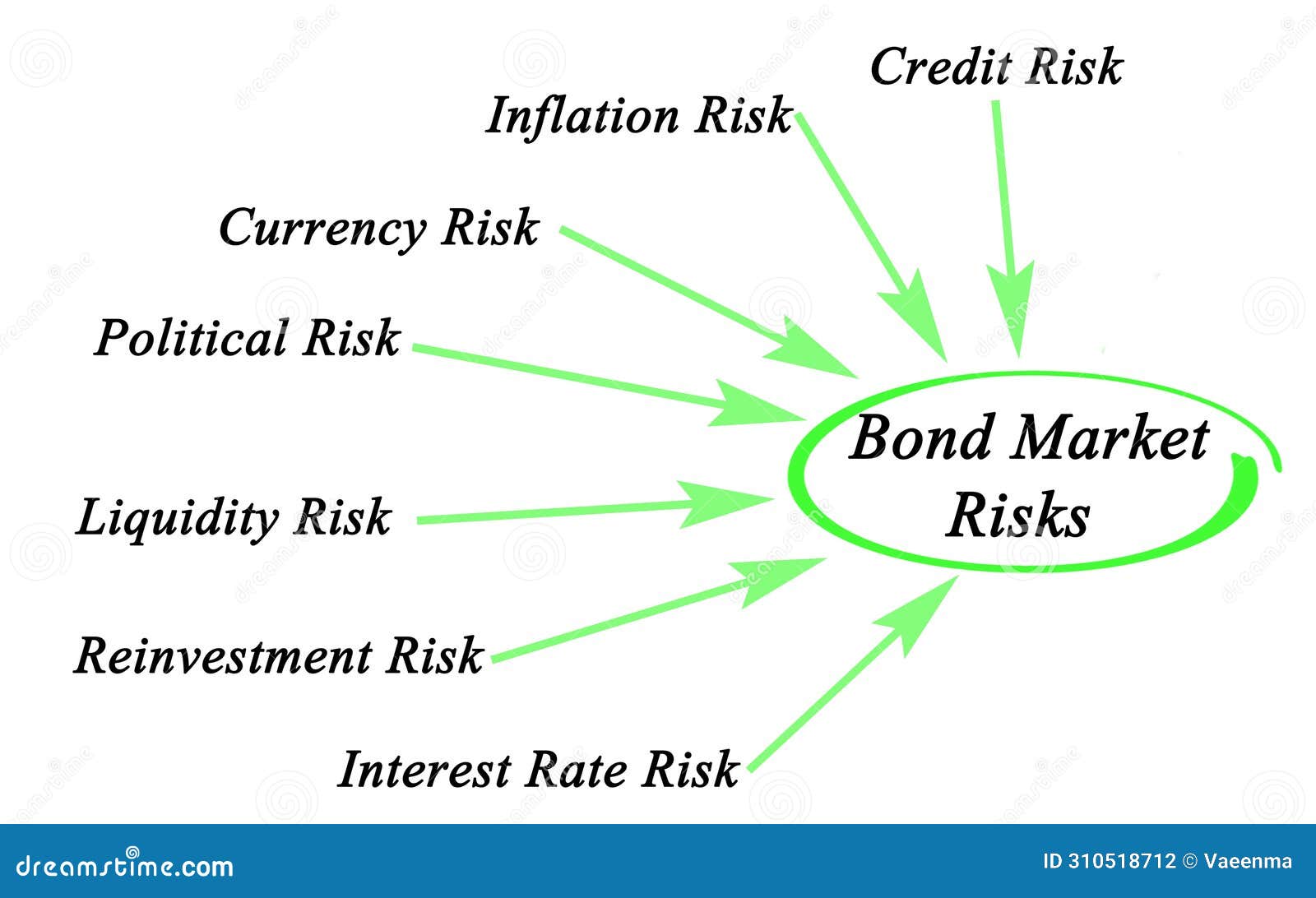

Risk Assessment and Potential Downsides

While the outlook is optimistic, it's crucial to acknowledge potential risks. A global economic slowdown could dampen consumer spending, impacting Apple stock volatility. Intense competition from other tech giants presents another challenge. Furthermore, supply chain disruptions, which have affected various industries in recent years, could also impact Apple's production and sales, thus affecting the Apple stock risk. The possibility of the stock price falling below the $200 buy recommendation cannot be ignored.

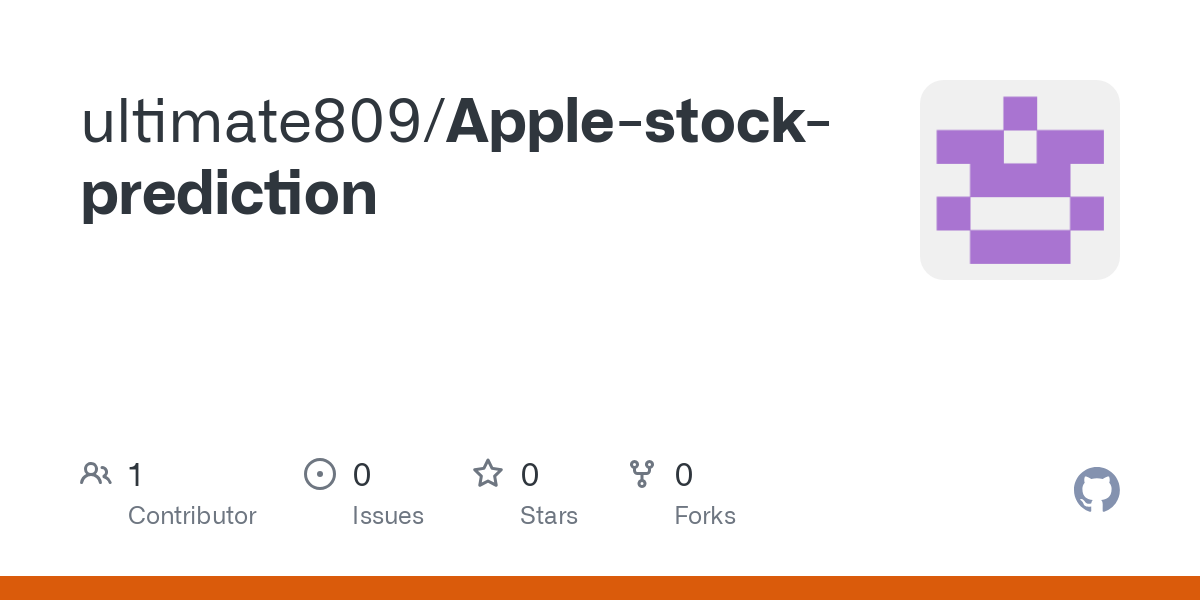

- Geopolitical Risks: [Mention any potential geopolitical factors impacting the market].

- Competitive Landscape: [Discuss competitors and their potential impact on Apple's market share].

Understanding these market risks is vital for informed investment decisions regarding Apple investment risk.

Factors Supporting the Buy Recommendation

Despite the risks, several factors firmly support the analyst's buy recommendation at $200. Apple's long-term growth potential, anchored by its strong financial fundamentals and unmatched brand strength, remains significant. The potential return on investment (ROI) if the $254 Apple stock prediction materializes is substantial, making it an attractive proposition for investors with a long-term horizon.

- Long-Term Growth Potential: Apple's consistent innovation and expansion into new markets ensure continued long-term growth.

- Strong Financial Fundamentals: Apple's robust balance sheet and cash reserves provide a safety net against economic downturns.

- Brand Strength: Apple's brand loyalty and premium pricing power are key competitive advantages.

This makes the Apple stock buy recommendation appealing, offering significant Apple investment opportunity and potentially high Apple stock return on investment based on the Apple long term growth potential.

Alternative Perspectives and Considerations

While the $254 Apple Stock Prediction is compelling, it's vital to consider alternative perspectives. Other analysts may hold different views, offering varying Apple stock predictions. Unforeseen market events, changes in consumer behavior, or unexpected technological disruptions could all influence the accuracy of any prediction. A comprehensive Apple stock analysis requires considering all perspectives and scenarios.

Making Informed Decisions about Apple Stock

In conclusion, the $254 Apple stock prediction presents a compelling case for potential growth, supported by strong financial performance, innovation, and positive investor sentiment. However, the $200 buy recommendation must be assessed alongside potential risks. Thorough research, including understanding alternative views and considering your personal risk tolerance, is crucial before making any investment decisions. Remember to consult with a qualified financial advisor before investing. Further research into Apple stock prediction and related analyses is highly recommended. Disclaimer: Investing involves inherent risks. The potential for significant returns comes with the possibility of losses. Don't put all your eggs in one basket. Despite the inherent risks, the potential for growth and opportunities surrounding Apple Stock remains considerable, making it a compelling investment for many.

Featured Posts

-

Impact Of G 7 De Minimis Tariff Talks On Chinese Exports

May 24, 2025

Impact Of G 7 De Minimis Tariff Talks On Chinese Exports

May 24, 2025 -

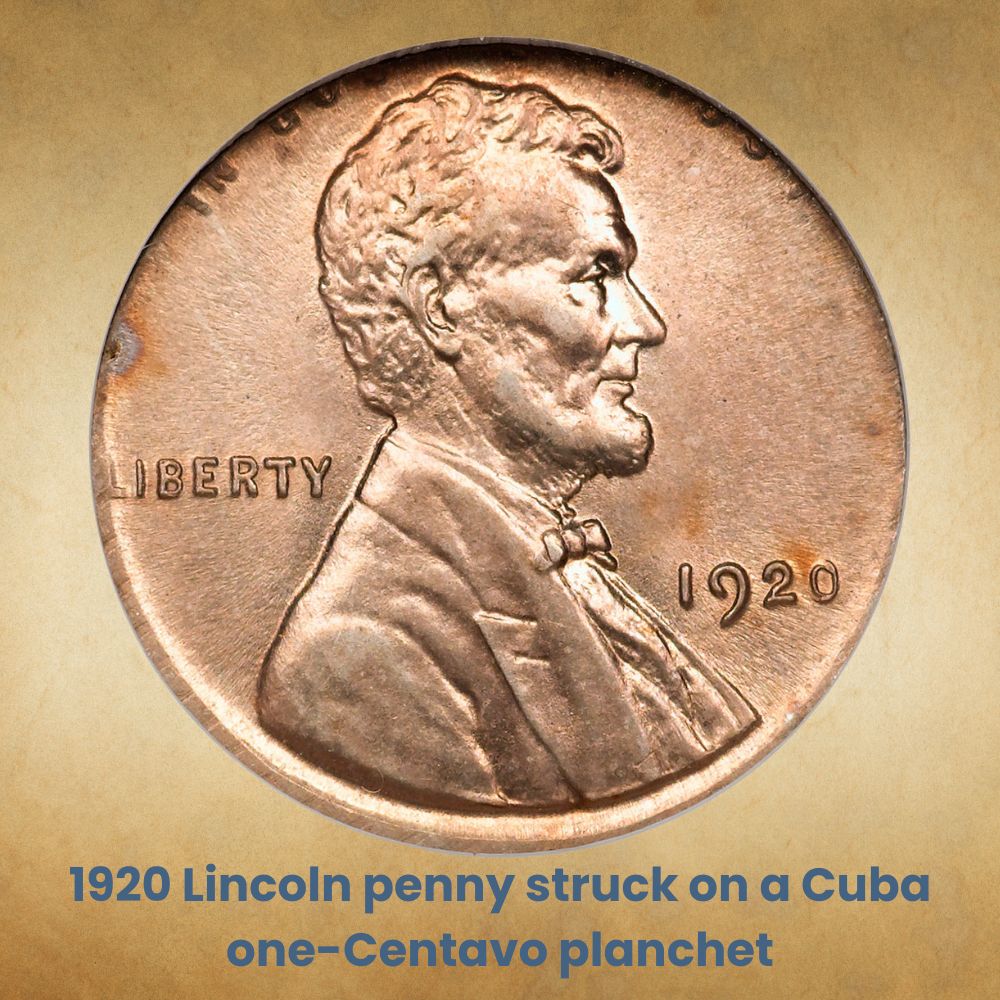

End Of The Penny Us To Halt Penny Circulation By Early 2026

May 24, 2025

End Of The Penny Us To Halt Penny Circulation By Early 2026

May 24, 2025 -

Stock Market Analysis Bonds Dow Futures And Bitcoins Current Trends

May 24, 2025

Stock Market Analysis Bonds Dow Futures And Bitcoins Current Trends

May 24, 2025 -

Aapl Stock Analysis Of Important Price Levels

May 24, 2025

Aapl Stock Analysis Of Important Price Levels

May 24, 2025 -

I Dazi E Il Mercato Della Moda Negli Stati Uniti Prezzi E Analisi

May 24, 2025

I Dazi E Il Mercato Della Moda Negli Stati Uniti Prezzi E Analisi

May 24, 2025

Latest Posts

-

Posthaste Risks And Implications Of The Global Bond Markets Instability

May 24, 2025

Posthaste Risks And Implications Of The Global Bond Markets Instability

May 24, 2025 -

V Mware Costs To Skyrocket At And T Highlights 1 050 Price Increase From Broadcom

May 24, 2025

V Mware Costs To Skyrocket At And T Highlights 1 050 Price Increase From Broadcom

May 24, 2025 -

Is The Worlds Largest Bond Market About To Collapse A Posthaste Analysis

May 24, 2025

Is The Worlds Largest Bond Market About To Collapse A Posthaste Analysis

May 24, 2025 -

Global Bond Market Instability A Posthaste Warning

May 24, 2025

Global Bond Market Instability A Posthaste Warning

May 24, 2025 -

Tva Group Restructuring 30 Positions Eliminated Due To Industry Challenges

May 24, 2025

Tva Group Restructuring 30 Positions Eliminated Due To Industry Challenges

May 24, 2025