Escape To The Country: Nicki Chapman's Profitable Home Investment

Table of Contents

Nicki Chapman's Property Investment Philosophy

Nicki Chapman's property investment strategy isn't about quick flips; it's about building a portfolio of valuable, personally resonant properties. Her approach centers around three core principles: location, renovation potential, and long-term growth. She displays a clear preference for rural properties, often highlighting the emotional connection she forms with each investment, transforming houses into cherished homes. This personal touch is a key differentiator in her approach.

- Focus on undervalued properties with renovation potential: Nicki seeks properties with inherent charm but requiring some updating. This allows for adding value through renovations while purchasing at a lower initial cost.

- Thorough market research is crucial before any purchase: Understanding local market trends, comparable property sales, and future development plans is essential to making informed decisions.

- Long-term vision, not quick profits: Nicki prioritizes long-term growth and capital appreciation over short-term gains, focusing on building wealth steadily over time.

- Strong emphasis on creating a home with personal value: Her investments aren't purely financial; they are about creating spaces she connects with, reflecting her personal style and preferences.

- Location, location, location – access to amenities and transport: Whilst prioritizing rural locations, Nicki ensures her properties offer good access to essential services and transportation links. This maximizes rental potential and resale value.

Key Strategies for Profitable Country Property Investment

This section translates Nicki Chapman's philosophy into actionable steps for your own property journey. It covers the practicalities of finding, renovating, and financing a profitable country property.

Finding the Right Property

Finding the right property is the cornerstone of successful investment. Here's how to emulate Nicki's approach:

- Utilize online property portals and local estate agents: Websites like Rightmove and Zoopla, coupled with the expertise of local agents, offer broad exposure to available properties.

- Network with other investors and local contacts: Building relationships within the industry can provide access to off-market opportunities and valuable insights.

- Attend property auctions (with caution): Auctions can offer great deals, but require thorough due diligence and a clear understanding of the risks involved.

- Look beyond cosmetic issues to identify hidden potential: Nicki's skill lies in seeing beyond surface flaws and recognizing the true potential of a property.

- Consider future development potential (planning permission, etc.): Investigating potential for extensions or alterations can significantly increase long-term value.

Renovation and Improvement

Renovating strategically maximizes your return on investment.

- Budget effectively for renovations and repairs: Create a detailed budget that accounts for all potential costs, including contingencies.

- Source reliable and skilled tradespeople: A strong team of professionals is crucial for a smooth and efficient renovation process.

- Prioritize energy-efficient upgrades: Improving insulation, windows, and heating systems enhances appeal and lowers running costs, attracting environmentally-conscious buyers.

- Consider adding modern amenities to increase property value: Updates to kitchens, bathrooms, and technology can dramatically boost property value.

- Balance cost with return on investment: Focus on renovations that deliver the highest return on investment, avoiding unnecessary expenses.

Financing Your Investment

Securing the right financing is critical.

- Explore mortgage options specifically designed for investment properties: Research buy-to-let mortgages and other suitable financing solutions.

- Understand interest rates and repayment terms: Compare different mortgage offers carefully before making a decision.

- Secure pre-approval for a mortgage before starting your search: Knowing your borrowing capacity simplifies the property search process.

- Consider bridging loans or other short-term financing options: These can be useful for bridging the gap between purchase and renovation completion.

- Manage your finances carefully: Maintain a healthy financial buffer to cover unexpected expenses and maintain a strong credit rating.

Lessons Learned from Nicki Chapman's Success

Nicki's success isn't accidental; it's a result of a combination of factors:

- Patience and perseverance are key: Building a successful property portfolio takes time and effort.

- Due diligence is paramount in every stage of the process: Thorough research and careful planning are essential for minimizing risk.

- Emotional intelligence plays a significant role in negotiation: Strong negotiation skills are essential for securing favorable deals.

- Building a strong network of contacts is essential: Networking with other professionals in the industry opens doors to opportunities.

- Combining passion with business acumen leads to success: Nicki's success demonstrates the power of combining personal passion with sound financial strategy.

Conclusion

Ready to embark on your own profitable "escape to the country"? Finding undervalued properties, strategic renovations, careful financing, and a long-term perspective are crucial for profitable country property investment, mirroring Nicki Chapman's successful approach. Start your research today and take the first step towards achieving your own country home investment dreams. Learn more about Nicki Chapman's investment techniques and find your perfect country property investment now! Begin your Nicki Chapman property investment journey today!

Featured Posts

-

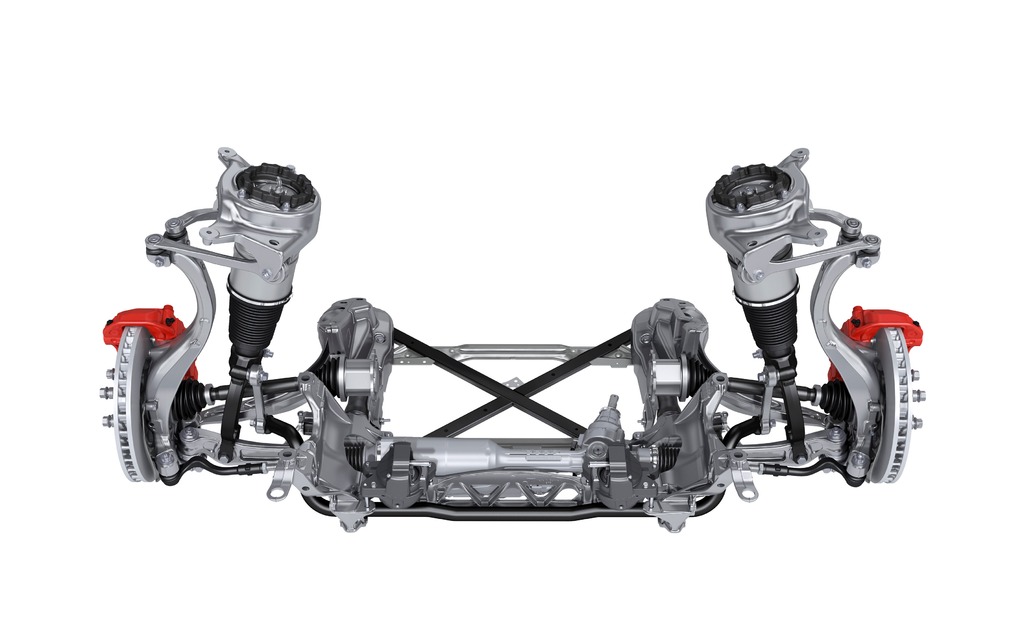

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025 -

Taenaeaen Tuukka Taponen Ja Mahdollinen F1 Ura Taenae Vuonna

May 24, 2025

Taenaeaen Tuukka Taponen Ja Mahdollinen F1 Ura Taenae Vuonna

May 24, 2025 -

M6 Crash Live Updates And Traffic Delays

May 24, 2025

M6 Crash Live Updates And Traffic Delays

May 24, 2025 -

Rekomendasi Dayamitra Telekomunikasi Mtel And Merdeka Battery Mbma Pasca Masuk Msci Small Cap Index

May 24, 2025

Rekomendasi Dayamitra Telekomunikasi Mtel And Merdeka Battery Mbma Pasca Masuk Msci Small Cap Index

May 24, 2025 -

Thlyl Daks 30 Tjawz Mstwa Mars Elamt Ela Anteash Alswq Alawrwbyt

May 24, 2025

Thlyl Daks 30 Tjawz Mstwa Mars Elamt Ela Anteash Alswq Alawrwbyt

May 24, 2025

Latest Posts

-

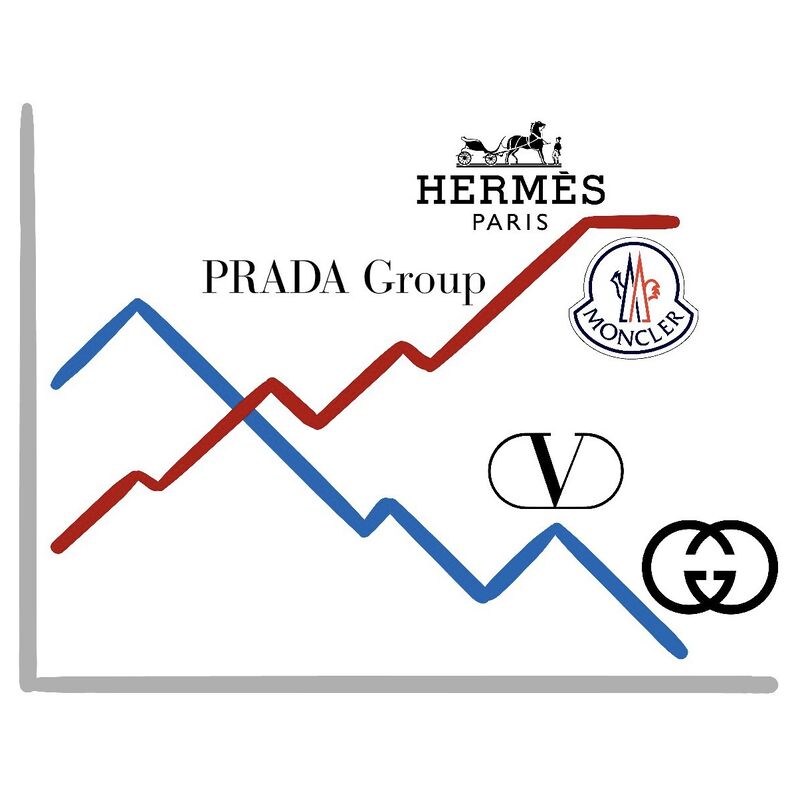

Paris Faces Economic Headwinds Luxury Goods Market Decline March 7 2025

May 24, 2025

Paris Faces Economic Headwinds Luxury Goods Market Decline March 7 2025

May 24, 2025 -

Departure Of Guccis Chief Industrial And Supply Chain Officer

May 24, 2025

Departure Of Guccis Chief Industrial And Supply Chain Officer

May 24, 2025 -

Paris In The Red Luxury Market Downturn Hits Hard March 7 2025

May 24, 2025

Paris In The Red Luxury Market Downturn Hits Hard March 7 2025

May 24, 2025 -

Gucci Supply Chain Officer Massimo Vians Exit

May 24, 2025

Gucci Supply Chain Officer Massimo Vians Exit

May 24, 2025 -

Paris Economic Slowdown Luxury Goods Sector Impact March 7 2025

May 24, 2025

Paris Economic Slowdown Luxury Goods Sector Impact March 7 2025

May 24, 2025