Paris Economic Slowdown: Luxury Goods Sector Impact - March 7, 2025

Table of Contents

Declining Tourist Spending and its Effect on Luxury Retail

The Paris economic slowdown is significantly impacting luxury retail, primarily due to a decline in tourist spending. This decrease affects both international and domestic tourism, creating a ripple effect throughout the luxury goods market.

Reduced Tourist Numbers

- Statistic: A recent report indicates a 15% drop in tourist arrivals in Paris compared to the same period last year. This decrease directly correlates with reduced spending on luxury goods.

- Global Events: Global economic uncertainty, geopolitical instability, and lingering concerns about public safety have all contributed to the decline in tourist numbers. The impact of these factors is heavily felt within the high-end retail sector.

- Spending Habits: Tourists, particularly those from Asia and the Middle East, historically constitute a significant portion of luxury purchases in Paris. Their reduced presence directly translates to lower sales for high-end fashion houses, jewelry stores, and other luxury retailers. A noticeable decrease in sales of high-end fashion and jewelry has been reported.

Shift in Consumer Behavior

The Paris economic slowdown has also led to a shift in consumer behavior, affecting luxury purchases.

- Experiences over Goods: Luxury consumers are increasingly prioritizing unique experiences and personalized services over the acquisition of material goods. This shift impacts sales of traditional luxury items.

- Inflation's Impact: Rising inflation has eroded consumer purchasing power, impacting discretionary spending on luxury goods. Many consumers are choosing to delay or forgo luxury purchases in the face of rising prices.

- Changing Demographics: The demographic profile of luxury buyers is also changing, with a growing focus on younger consumers who may have different spending priorities than previous generations. This necessitates innovative strategies to appeal to a new segment of the luxury market.

The Impact on Luxury Brand Performance and Strategies

The Paris economic slowdown has undeniably affected the financial performance and strategies of key luxury players in the city.

Financial Performance of Key Luxury Players

- Chanel: Chanel reported a slight decline in Q1 sales, partly attributed to the overall economic slowdown in Paris. This underscores the broader impact on even the most established luxury brands.

- Dior: Dior, while not releasing specific figures publicly, has acknowledged a softening in demand in the Paris market.

- Hermès: Hermès, known for its resilient performance, has also seen a slight slowdown in sales growth, although its impact is less pronounced than some competitors.

Adaptive Strategies by Luxury Brands

Luxury brands are implementing various strategies to mitigate the impact of the economic slowdown.

- Price Adjustments: Some brands have subtly adjusted prices, aiming to balance profitability with maintaining market competitiveness.

- Domestic Focus: Many brands have launched marketing campaigns targeting domestic consumers, emphasizing exclusivity and personalized experiences to attract local clientele.

- Product Diversification: Several brands are exploring diversification of their product offerings, introducing more accessible luxury items to cater to a broader consumer base.

The Broader Economic Context in Paris and its Spillover Effects

The slowdown in the luxury goods sector is part of a broader economic context in Paris.

Macroeconomic Factors

- Inflation: High inflation rates are a major contributing factor to decreased consumer spending, impacting both luxury and non-luxury sectors.

- Interest Rates: Rising interest rates increase borrowing costs, affecting both businesses and consumers, further dampening spending.

- Unemployment: While relatively low compared to other European cities, any increase in unemployment will further constrain consumer spending.

Impact on Related Industries

The slowdown in luxury tourism has ripple effects on other industries in Paris.

- Hospitality: The hotel industry, particularly the high-end segment, is directly affected by the decrease in tourist arrivals.

- Tourism: The entire tourism ecosystem, including restaurants, transportation, and entertainment, experiences a negative impact from reduced tourist spending.

- Real Estate: The real estate market, particularly in areas with high concentrations of luxury properties, may also see a slowdown in demand.

Navigating the Paris Economic Slowdown: A Future for Luxury Goods?

In summary, the Paris economic slowdown is significantly impacting the luxury goods sector. Decreased tourist spending, shifting consumer behavior, and broader macroeconomic factors all play a role. Luxury brands are adapting through strategic pricing, marketing campaigns, and product diversification. However, the full extent of the impact and the long-term consequences for the luxury sector remain to be seen. The resilience of the luxury sector, its ability to adapt, and the broader economic context will all determine its future trajectory. Understanding these factors is crucial for navigating this challenging economic climate.

Key Takeaways: The Paris economic slowdown is significantly impacting the luxury goods sector, necessitating adaptive strategies from luxury brands. Macroeconomic factors and reduced tourist spending are key drivers of this slowdown.

Call to Action: Stay updated on the evolving impact of the Paris economic slowdown on the luxury goods sector by following reputable financial news sources and industry analyses. Continue to monitor the changing landscape of the luxury market in Paris to better understand the ongoing challenges and opportunities within this crucial sector of the Parisian economy.

Featured Posts

-

The Four Women Who Loved Frank Sinatra Exploring His Marriages

May 24, 2025

The Four Women Who Loved Frank Sinatra Exploring His Marriages

May 24, 2025 -

Understanding The Philips 2025 Annual General Meeting Agenda

May 24, 2025

Understanding The Philips 2025 Annual General Meeting Agenda

May 24, 2025 -

Alexandria International Airport And England Airparks Fly Local Explore Global Campaign Takes Off

May 24, 2025

Alexandria International Airport And England Airparks Fly Local Explore Global Campaign Takes Off

May 24, 2025 -

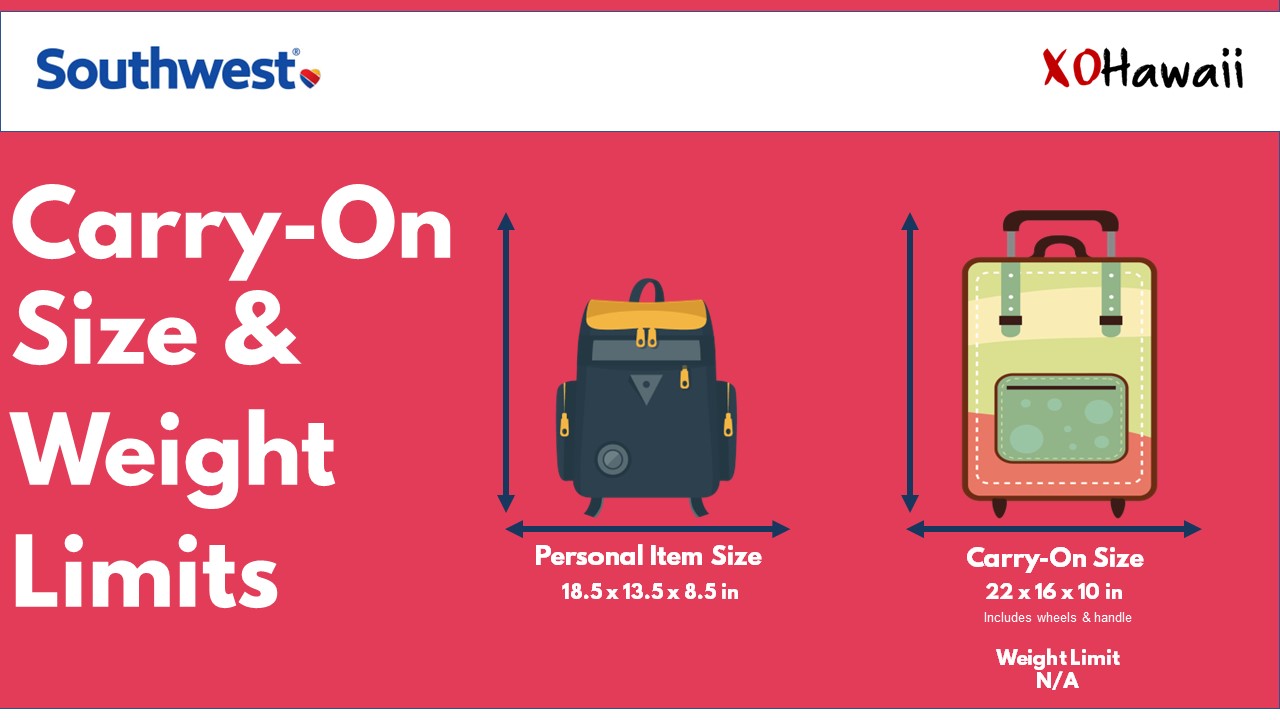

Carry On Changes Southwest Airlines Restricts Portable Chargers

May 24, 2025

Carry On Changes Southwest Airlines Restricts Portable Chargers

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Factors Affecting Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Factors Affecting Net Asset Value

May 24, 2025

Latest Posts

-

Trump Tax Bill House Passage And What It Means

May 24, 2025

Trump Tax Bill House Passage And What It Means

May 24, 2025 -

House Approves Amended Trump Tax Legislation

May 24, 2025

House Approves Amended Trump Tax Legislation

May 24, 2025 -

Revised Trump Tax Bill Approved By The House

May 24, 2025

Revised Trump Tax Bill Approved By The House

May 24, 2025 -

Microsofts Controversial Email Filter Palestine Keyword And Employee Response

May 24, 2025

Microsofts Controversial Email Filter Palestine Keyword And Employee Response

May 24, 2025 -

Viral Tik Tok A Personal Reflection On Pope Leos Past

May 24, 2025

Viral Tik Tok A Personal Reflection On Pope Leos Past

May 24, 2025