Estimating The Cost: Trump Tariffs And California's $16 Billion Revenue Decrease

Table of Contents

Understanding the Impact of Trump Tariffs on California's Economy

Trump's tariffs, implemented as part of a broader trade war, significantly impacted international trade. These tariffs, ranging from 10% to 25%, targeted various goods imported from China and other countries, disrupting established supply chains and increasing costs for businesses and consumers alike.

- Types of goods affected: Agricultural products (e.g., almonds, walnuts, wine), manufactured goods (e.g., electronics, textiles), and components used in various industries were all subject to tariffs.

- Specific industries heavily impacted: California's agriculture, manufacturing, and technology sectors bore the brunt of these tariffs, facing increased input costs, reduced export demand, and heightened competition.

- Increased prices for consumers: Tariffs led to higher prices for consumers on a wide range of goods, decreasing consumer spending and impacting overall economic growth.

The $16 Billion Revenue Decrease: A Detailed Breakdown

The $16 billion figure represents a significant drop in California's revenue, stemming from various factors. While precise figures are challenging to isolate, research from organizations like the Public Policy Institute of California (PPIC) and the University of California, Berkeley's Institute of Governmental Studies (IGS) points to a combination of factors contributing to this loss.

- Reduced tax revenue from affected businesses: Businesses facing increased costs and reduced sales paid less in taxes, directly impacting state revenue.

- Decreased consumer spending: Higher prices on imported goods led to reduced consumer spending, impacting sales tax revenue and overall economic activity. This decrease in consumer confidence further exacerbated the problem.

- Job losses and decreased investment: The economic uncertainty caused by the tariffs contributed to job losses in affected industries, and reduced investment further hampered economic growth.

(Note: Ideally, this section would include a graph or chart illustrating the breakdown of the $16 billion revenue loss, sourced from reputable economic research. This visual aid would significantly enhance the article's impact and readability.)

Analyzing the Effects on Specific California Industries

The impact of Trump tariffs wasn't uniform across all sectors. Certain industries experienced disproportionately severe consequences.

Agriculture's Struggle with Tariff-Related Challenges

California's agricultural sector, a major contributor to the state's economy, faced considerable challenges due to retaliatory tariffs imposed by China and other countries on Californian agricultural exports.

- Key exports affected: Almonds, walnuts, wine, and other agricultural products faced significant export reductions, leading to surplus and decreased prices for farmers.

- Ripple effect: The decreased export demand impacted not only farmers but also agricultural workers, transportation companies, and related businesses involved in the agricultural supply chain.

- Price fluctuations: The imposition of tariffs created significant price volatility for many agricultural products, making it difficult for farmers to plan and manage their businesses effectively. For example, almond prices experienced significant drops as a result of decreased exports to China.

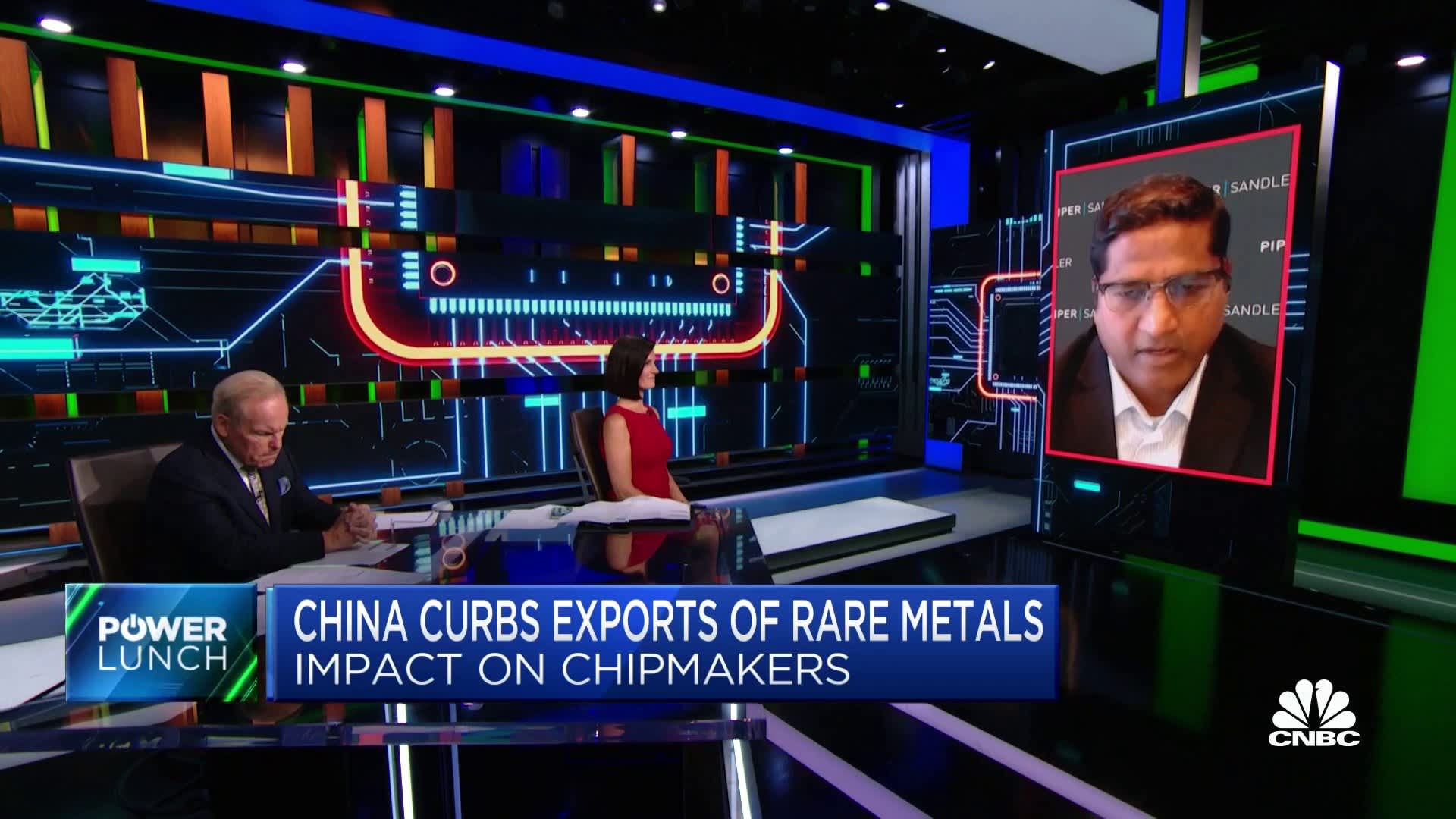

Manufacturing and Technology Sectors: Navigating the Trade War

California's manufacturing and technology sectors also felt the impact of the trade war, though in different ways.

- Supply chain disruptions: Increased tariffs disrupted established supply chains, forcing businesses to source materials from alternative, often more expensive, suppliers.

- Increased production costs: Higher input costs from tariffs forced manufacturers to either absorb the extra expense or raise prices, impacting their competitiveness.

- Adaptation strategies: Many California businesses adapted by diversifying their supply chains, investing in automation, or exploring new markets to mitigate the negative effects of the tariffs.

Long-Term Economic Consequences and Future Projections

The $16 billion revenue decrease stemming from Trump tariffs had significant long-term economic consequences for California.

- Impact on job growth: The reduced economic activity and increased uncertainty hampered job growth across various sectors.

- Impact on investment: Businesses were hesitant to invest in expansion or new projects due to the economic uncertainty created by the tariffs.

- Impact on economic competitiveness: The increased costs and reduced competitiveness of California businesses relative to those in other states and countries had a lasting effect on the state's overall economic performance.

(Note: This section could benefit from incorporating specific data projections and predictions from reputable economic sources, such as the Federal Reserve Bank of San Francisco or the California Department of Finance. These projections would strengthen the article's credibility and provide a more comprehensive analysis of the long-term economic consequences.)

Conclusion

The Trump-era tariffs inflicted a substantial blow to California's economy, resulting in an estimated $16 billion revenue loss and cascading effects on various industries. The agricultural, manufacturing, and technology sectors experienced significant challenges, facing increased costs, supply chain disruptions, and reduced export demand. Understanding the long-term implications of these "Trump Tariffs California Revenue" losses is critical for informed economic planning and policymaking. To gain a deeper understanding of the impact on your specific industry or region, research the effects of tariffs using keywords like "Trump tariffs economic impact," "California trade policy," "analyzing tariff effects," and "estimating tariff costs." Consult official government reports and economic analyses from sources like the PPIC and IGS for a more in-depth understanding.

Featured Posts

-

Cobalt Prices Surge Assessing The Impact Of Congos Export Restrictions

May 15, 2025

Cobalt Prices Surge Assessing The Impact Of Congos Export Restrictions

May 15, 2025 -

Trumps Claim Does The Us Really Need Canadas Goods Expert Analysis

May 15, 2025

Trumps Claim Does The Us Really Need Canadas Goods Expert Analysis

May 15, 2025 -

Anthony Edwards Facing Custody Battle Mothers Response

May 15, 2025

Anthony Edwards Facing Custody Battle Mothers Response

May 15, 2025 -

Maple Leafs Vs Red Wings Expert Nhl Predictions Betting Odds And Picks For Tonight

May 15, 2025

Maple Leafs Vs Red Wings Expert Nhl Predictions Betting Odds And Picks For Tonight

May 15, 2025 -

Examining Tylas Interpretation Of Chanels Iconic Designs

May 15, 2025

Examining Tylas Interpretation Of Chanels Iconic Designs

May 15, 2025