XRP's 400% Growth: A Prudent Investor's Guide To Buying Or Selling.

Table of Contents

Understanding XRP's Recent Price Surge

Factors Contributing to the Growth

Several factors have contributed to XRP's remarkable price increase. These include:

- Increased adoption by financial institutions: Ripple, the company behind XRP, has been actively forging partnerships with major financial institutions for cross-border payments, boosting XRP's utility and demand.

- Positive legal developments regarding the ongoing SEC lawsuit: While the SEC lawsuit remains a significant factor, positive developments or changes in legal arguments have often led to short-term price increases for XRP. Any shifts in legal momentum should be carefully monitored.

- Growing interest in Ripple's technology and partnerships: Ripple's technology continues to gain traction, further driving demand for XRP within the financial industry. New partnerships and successful implementations fuel positive market sentiment.

- Overall market trends in the cryptocurrency sector: Broader positive trends within the cryptocurrency market often lift all boats, including XRP. However, it's crucial to remember that XRP can still underperform or outperform the overall market.

- Specific events or announcements impacting the price: Keep an eye on announcements regarding new partnerships, regulatory updates, technological advancements, and any other news directly impacting Ripple and XRP.

Analyzing Market Sentiment

Analyzing market sentiment is critical for gauging investor confidence in XRP.

- Social media sentiment: Monitoring social media platforms like Twitter and Reddit can provide insights into public opinion, although it's vital to filter out noise and misinformation.

- News articles and expert opinions: Reading reputable news sources and following expert analysis can offer a more objective perspective on XRP's price movements.

- Trading volume and price charts: Examining trading volume alongside price charts helps identify trends, support levels, and potential resistance points crucial for XRP trading strategies.

Evaluating the Sustainability of the Surge

Whether this surge is sustainable depends on several factors:

- Continued adoption: Sustained adoption by financial institutions and broader acceptance of XRP as a payment solution are key to long-term growth.

- Resolution of the SEC lawsuit: A positive resolution to the SEC lawsuit would significantly bolster investor confidence and likely drive further price appreciation. Conversely, a negative outcome could cause a significant correction.

- Competition: Competition from other cryptocurrencies and payment solutions poses a significant challenge to XRP's long-term dominance.

- Market corrections: The cryptocurrency market is inherently volatile, and price corrections or consolidation phases are expected, even during periods of strong growth.

Assessing the Risks of Investing in XRP

Regulatory Uncertainty

The ongoing SEC lawsuit against Ripple casts a shadow of regulatory uncertainty over XRP.

- SEC lawsuit impact: The outcome of the lawsuit could significantly impact XRP's price and its future viability in the US market.

- Global regulatory landscape: The regulatory landscape for cryptocurrencies varies widely across jurisdictions, creating uncertainty and potential risks for investors.

Market Volatility

XRP, like all cryptocurrencies, is highly volatile.

- Price fluctuations: Expect significant price swings, which can result in substantial gains or losses in a short period.

- Market manipulation: The cryptocurrency market is susceptible to manipulation, potentially impacting XRP's price.

Technological Risks

Investing in XRP involves technological risks.

- Technological challenges: Ripple's technology, while innovative, faces potential technological challenges and vulnerabilities.

- Security breaches: The risk of hacking or security breaches exists for any digital asset, including XRP.

A Prudent Investor's Approach to XRP

Determining Your Investment Strategy

A successful XRP investment strategy requires careful consideration:

- Long-term vs. short-term: Decide whether you're a long-term holder (HODLer) or a short-term trader.

- Diversification: Never put all your eggs in one basket. Diversify your investment portfolio across various assets, reducing risk.

- Due diligence: Thoroughly research XRP, Ripple, and the cryptocurrency market before investing.

Setting Realistic Expectations

Avoid unrealistic profit expectations.

- Risk management: Develop a robust risk management plan, including setting stop-loss orders to limit potential losses.

- Realistic ROI: Understand that high potential returns often come with higher risk.

Using Technical Indicators

Technical indicators can help inform your trading decisions, but don't rely solely on them.

- Moving averages: Useful for identifying trends and potential support/resistance levels.

- RSI (Relative Strength Index): Helps gauge the momentum of price movements.

- Combine with fundamental analysis: Use technical analysis in conjunction with fundamental analysis for a more holistic view.

Practical Guide to Buying and Selling XRP

Choosing a Reputable Exchange

Selecting a reputable exchange is paramount. Consider factors like:

- Security: Choose exchanges with robust security measures to protect your funds.

- Liquidity: Opt for exchanges with high trading volume for easier buying and selling.

- Fees: Compare fees charged by different exchanges. Examples include Coinbase, Binance, Kraken, and others. Always conduct thorough due diligence before selecting an exchange.

Securely Storing Your XRP

Safeguarding your XRP is crucial.

- Hardware wallets: Offer the highest level of security for storing your XRP.

- Software wallets: More convenient but generally less secure than hardware wallets.

- Exchange wallets: Least secure option; only use them for short-term trading.

Tax Implications of XRP Trading

Tax implications vary by jurisdiction.

- Consult a tax professional: Seek professional advice to understand the tax implications of your XRP trading activities in your specific location.

Conclusion: Making Informed Decisions about XRP

XRP's recent growth presents both opportunities and risks. Understanding the factors driving the price surge, assessing the associated risks, and employing a prudent investment strategy are vital for success. Thorough research and risk assessment are crucial before investing in XRP or any cryptocurrency. Make informed decisions based on your individual risk tolerance and financial goals. Learn more about making informed decisions regarding XRP investment and trading by [link to further resources/articles]. Remember, carefully consider the risks before buying or selling XRP.

Featured Posts

-

Thunder Vs Pacers Injury Report March 29th Game Preview

May 08, 2025

Thunder Vs Pacers Injury Report March 29th Game Preview

May 08, 2025 -

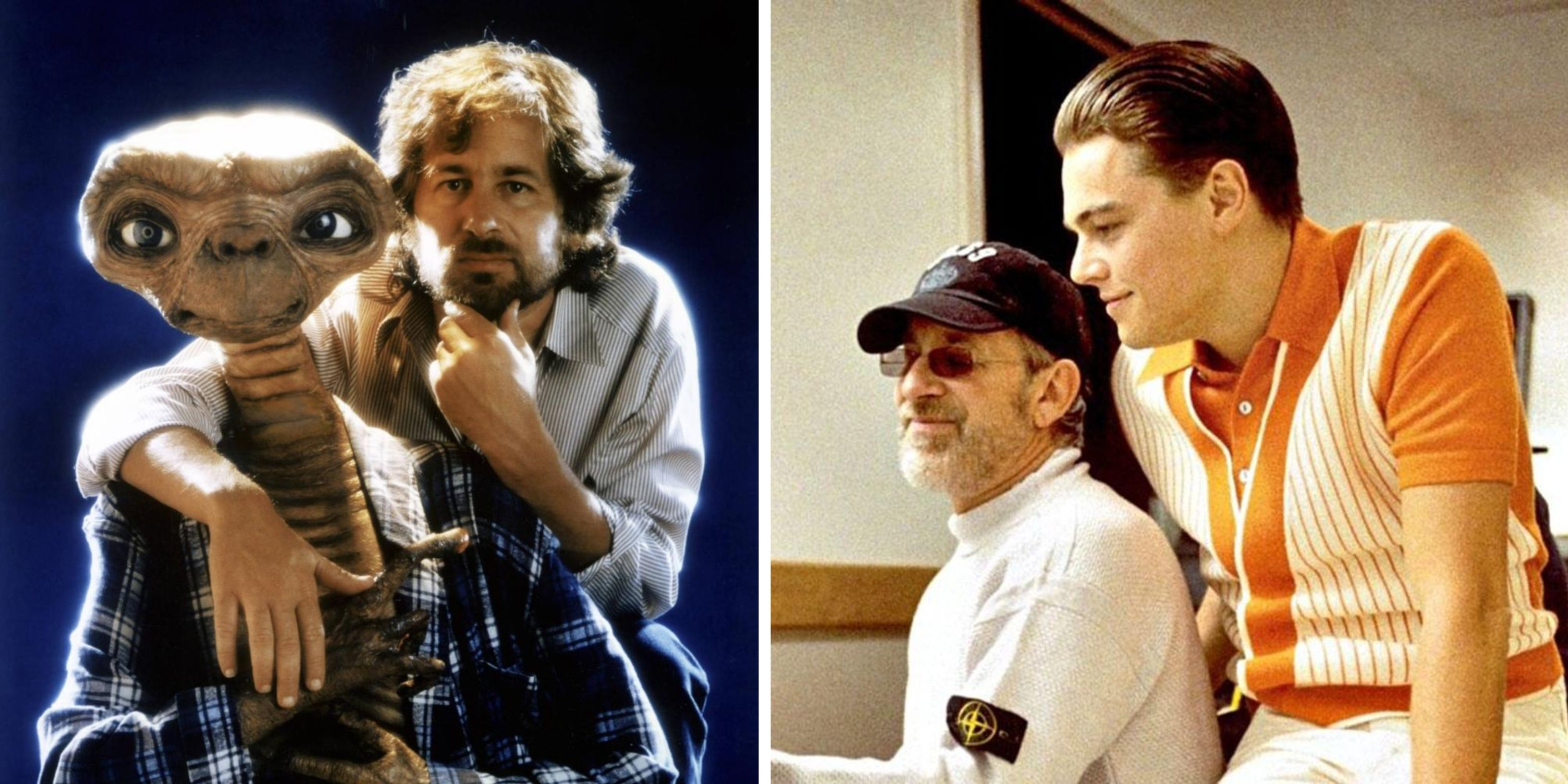

Steven Spielbergs Best War Movies 7 Essential Films Ranked Saving Private Ryan Excluded

May 08, 2025

Steven Spielbergs Best War Movies 7 Essential Films Ranked Saving Private Ryan Excluded

May 08, 2025 -

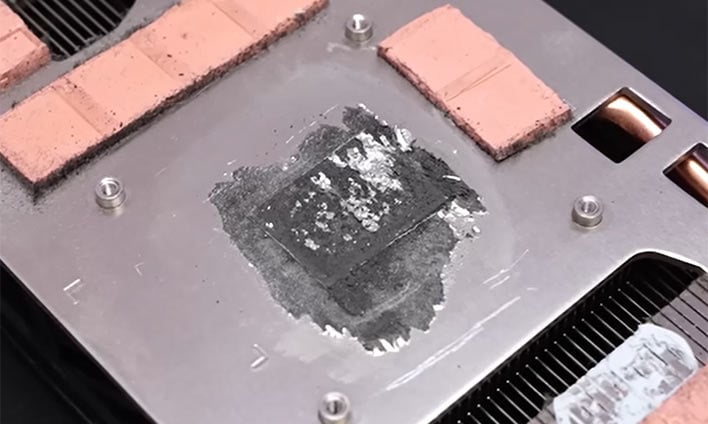

Official Sony Ps 5 Pro Teardown Inside The Liquid Metal Cooling

May 08, 2025

Official Sony Ps 5 Pro Teardown Inside The Liquid Metal Cooling

May 08, 2025 -

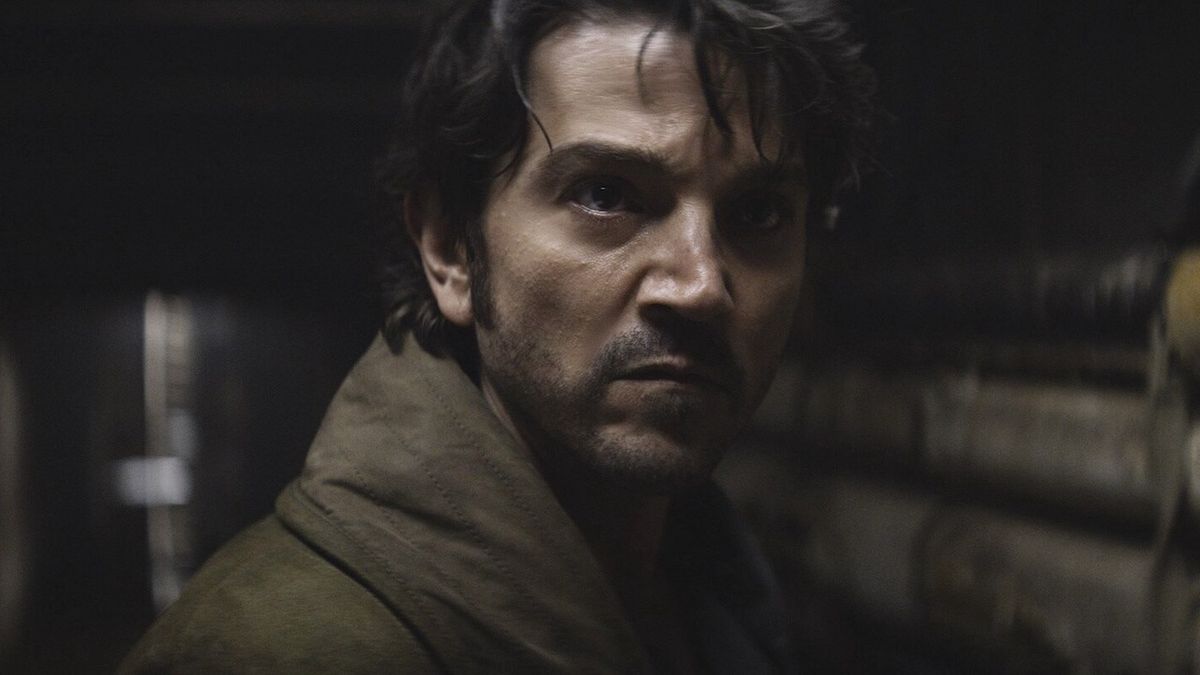

Andor Season 2 Diego Luna Promises A Game Changing Star Wars Story

May 08, 2025

Andor Season 2 Diego Luna Promises A Game Changing Star Wars Story

May 08, 2025 -

Thunder Players Respond To National Media Criticism

May 08, 2025

Thunder Players Respond To National Media Criticism

May 08, 2025

Latest Posts

-

Barhwyn Brsy Aym Aym Ealm Ky Khdmat Kw Yad Krna

May 08, 2025

Barhwyn Brsy Aym Aym Ealm Ky Khdmat Kw Yad Krna

May 08, 2025 -

Saglik Bakanligi Personel Alimi 37 Bin Hekim Disi Pozisyon Icin Basvuru Rehberi

May 08, 2025

Saglik Bakanligi Personel Alimi 37 Bin Hekim Disi Pozisyon Icin Basvuru Rehberi

May 08, 2025 -

Psl 10 Ticket Sales Starting Today

May 08, 2025

Psl 10 Ticket Sales Starting Today

May 08, 2025 -

Qwmy Hyrw Aym Aym Ealm Kw Khraj Eqydt

May 08, 2025

Qwmy Hyrw Aym Aym Ealm Kw Khraj Eqydt

May 08, 2025 -

Saglik Bakanligi 37 Bin Personel Alimi Son Dakika Bilgileri Ve Basvuru Sartlari

May 08, 2025

Saglik Bakanligi 37 Bin Personel Alimi Son Dakika Bilgileri Ve Basvuru Sartlari

May 08, 2025