Euronext Amsterdam Stocks Jump 8% Following Trump's Tariff Decision

Table of Contents

Trump's Tariff Decision and its Global Impact

The unexpected surge in Euronext Amsterdam stocks stemmed from [Clearly state the specific Trump tariff decision, e.g., the announcement of a delay or alteration of tariffs on specific goods imported from the EU]. While initially, the global market reaction was mixed, with some sectors experiencing negative impacts due to trade uncertainty, the Euronext Amsterdam market reacted positively. This seemingly counterintuitive response requires a closer examination of specific market dynamics.

- Positive Impacts: The decision may have been interpreted as less negative than initially feared, potentially easing concerns about a full-blown trade war and boosting investor confidence in specific sectors within the Dutch economy.

- Negative Impacts: Other global markets, particularly those heavily reliant on exports to the US, experienced negative impacts, highlighting the uneven distribution of the effects of the tariff decision.

- Related Agreements: This decision needs to be considered in the context of ongoing trade negotiations between the US and the EU, and its effect on existing international trade agreements like [mention specific agreements if relevant, e.g., the Transatlantic Trade and Investment Partnership (TTIP)]. [Insert links to relevant news sources and official documents here].

Analysis of the Euronext Amsterdam Stock Market Reaction

The 8% jump in Euronext Amsterdam stocks wasn't a uniform phenomenon. Several factors specific to the Dutch market played a significant role in this dramatic increase. The relatively strong performance of certain sectors within the Dutch economy, combined with a general positive shift in investor sentiment, likely fuelled this surge.

- Key Companies: [Mention specific companies that experienced significant gains. Provide data on their percentage increases, if available. For example: "Royal Dutch Shell saw a 5% increase, while ASML Holding experienced a 10% jump."].

- Investor Types: The surge likely involved a mix of institutional and retail investors, with institutional investors potentially capitalizing on perceived undervaluation in the market, while retail investors may have followed suit.

- Market Sentiment: Speculation and positive market sentiment played a crucial role. The market’s perception of the tariff decision's impact on the Dutch economy, rather than the raw economic data itself, likely drove this significant increase.

Longer-Term Implications for Euronext Amsterdam and European Markets

The long-term implications of this tariff decision remain uncertain. However, several potential scenarios should be considered for both Euronext Amsterdam and the broader European markets.

- Trade Pattern Shifts: The decision could trigger shifts in trade patterns, potentially leading to increased diversification of trading partners for Dutch companies and a reevaluation of supply chains.

- Economic Sector Impact: Specific sectors of the Dutch economy, such as [mention specific sectors and their likely impacts, e.g., agriculture, technology, or finance], will experience varying levels of impact, both positive and negative, depending on their level of exposure to US markets.

- Investor Confidence: The long-term effects will depend significantly on the evolution of investor confidence. Continued uncertainty regarding future trade relations between the US and the EU could lead to increased volatility in the Euronext Amsterdam market.

Investing Strategies in the Wake of Market Volatility

The sudden market shift underscores the need for robust investment strategies that can weather market volatility. Investors should focus on risk management and diversification.

- Risk Tolerance: Investors with different risk tolerances should adopt diverse strategies. Conservative investors might focus on lower-risk assets, while more aggressive investors could explore opportunities within the affected sectors.

- Financial Instruments: ETFs (Exchange Traded Funds) offering exposure to the Euronext Amsterdam market or specific sectors within it can provide diversified exposure. Options trading can also be utilized, although it involves a higher risk profile.

- Professional Advice: Thorough research and consultation with financial advisors are crucial before making any investment decisions.

Conclusion: Understanding the Euronext Amsterdam Stock Market's Future After the Tariff Decision

The 8% surge in Euronext Amsterdam stocks following Trump's tariff decision was an unexpected but significant event. This article explored the factors contributing to the surge, including the specific details of the tariff decision, the market's unique reaction, and the potential longer-term implications for the Euronext Amsterdam and European markets. Understanding the complexities of global trade and their impact on individual stock markets is crucial for making informed investment decisions. Stay updated on the latest developments affecting Euronext Amsterdam stocks and make informed investment decisions. Continue monitoring the market for further shifts in response to ongoing trade negotiations.

Featured Posts

-

Analisi Borsa Fed Banche Italiane E Il Futuro Di Piazza Affari

May 24, 2025

Analisi Borsa Fed Banche Italiane E Il Futuro Di Piazza Affari

May 24, 2025 -

The Ultimate Guide To An Escape To The Country Lifestyle

May 24, 2025

The Ultimate Guide To An Escape To The Country Lifestyle

May 24, 2025 -

Camunda Con 2025 Amsterdam Optimizing Ai And Automation With Process Orchestration

May 24, 2025

Camunda Con 2025 Amsterdam Optimizing Ai And Automation With Process Orchestration

May 24, 2025 -

Uniklinikum Essen Nachbarschaftliches Ereignis Loest Traenen Aus

May 24, 2025

Uniklinikum Essen Nachbarschaftliches Ereignis Loest Traenen Aus

May 24, 2025 -

Beursherstel Na Trump Uitstel Aex Fondsen Stijgen

May 24, 2025

Beursherstel Na Trump Uitstel Aex Fondsen Stijgen

May 24, 2025

Latest Posts

-

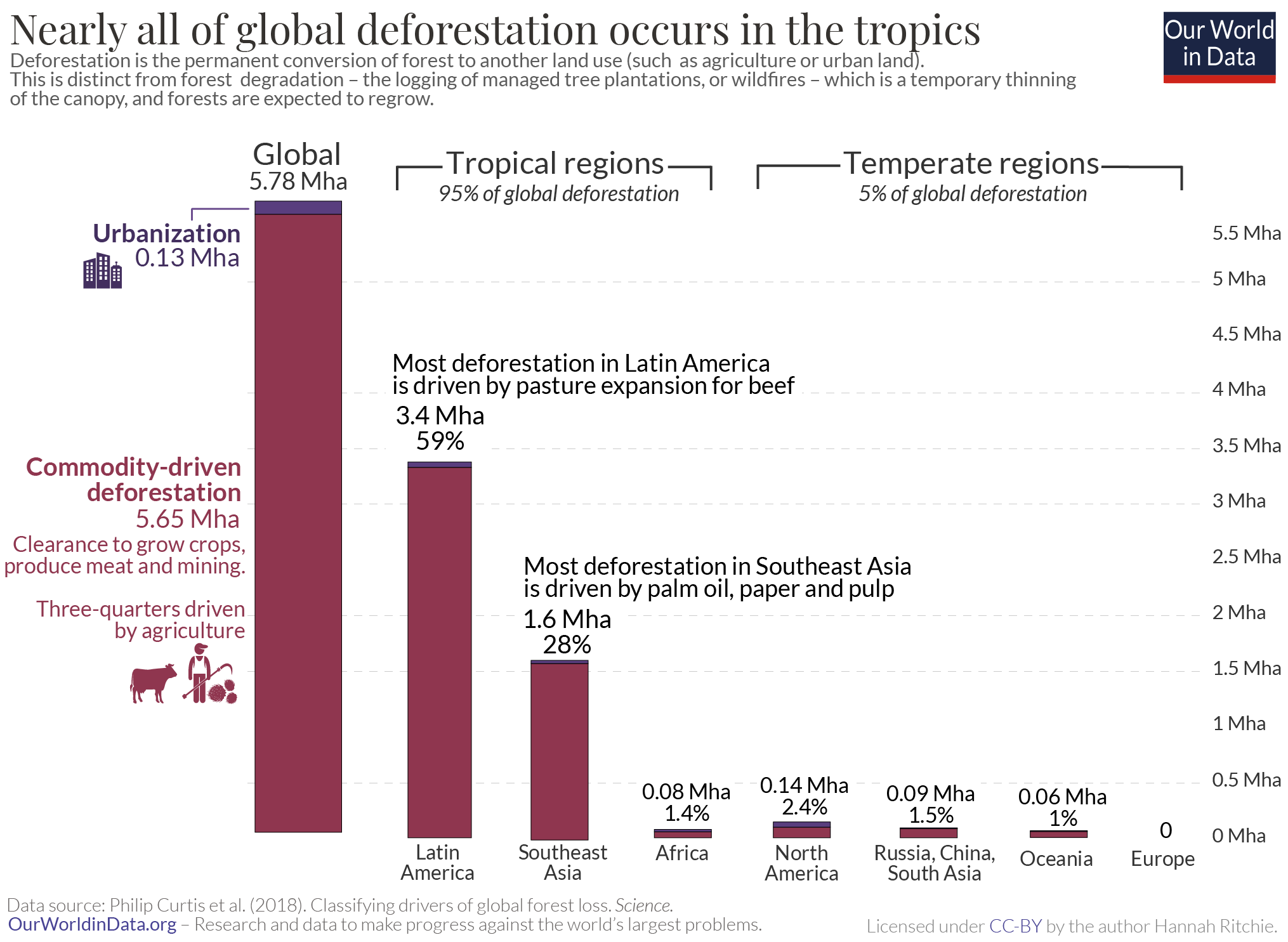

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025 -

2002 Submarine Bribery Case French Investigation Points To Malaysias Former Pm Najib

May 24, 2025

2002 Submarine Bribery Case French Investigation Points To Malaysias Former Pm Najib

May 24, 2025 -

Rethinking Middle Management Their Vital Role In Modern Organizations

May 24, 2025

Rethinking Middle Management Their Vital Role In Modern Organizations

May 24, 2025 -

The Unsung Heroes Of Business The Value Of Middle Management

May 24, 2025

The Unsung Heroes Of Business The Value Of Middle Management

May 24, 2025 -

The China Market And Its Implications For Bmw Porsche And Other Automakers

May 24, 2025

The China Market And Its Implications For Bmw Porsche And Other Automakers

May 24, 2025