Amundi DJIA UCITS ETF: A Guide To Net Asset Value (NAV)

Table of Contents

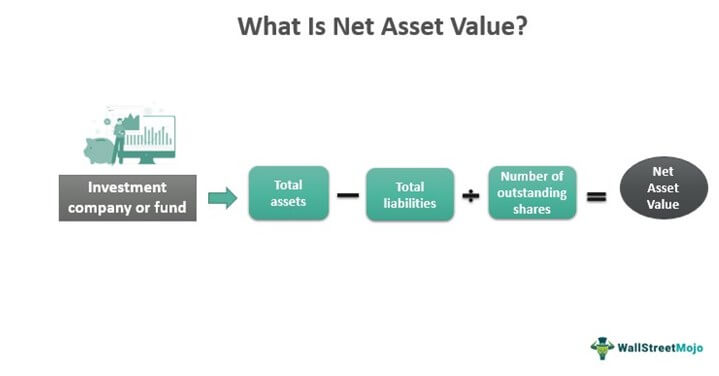

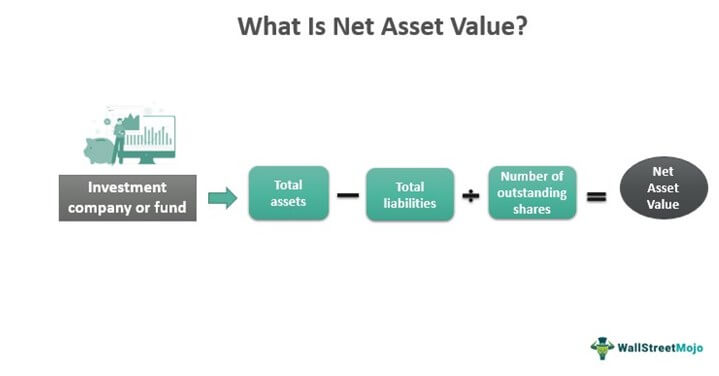

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. For the Amundi DJIA UCITS ETF, which tracks the Dow Jones Industrial Average, the NAV calculation involves determining the total market value of all the stocks comprising the index held within the ETF, subtracting any liabilities (like management fees and expenses), and then dividing by the total number of outstanding ETF shares. This calculation provides a snapshot of the ETF's intrinsic worth.

- NAV represents the per-share value of the ETF's assets. This is the fundamental value of your investment.

- It's calculated daily, usually at the end of the trading day. This ensures the NAV reflects the closing prices of the underlying assets.

- Understanding NAV helps assess the ETF's performance. Tracking changes in the NAV provides a clear picture of how your investment is performing.

- NAV fluctuations reflect changes in the underlying Dow Jones index. Since the ETF tracks the DJIA, its NAV will generally move in line with the index's performance.

How Amundi DJIA UCITS ETF NAV Impacts Your Investment

The Amundi DJIA UCITS ETF NAV and its market price are closely related, though they may not always be identical. The difference between the NAV and the market price can indicate whether the ETF is trading at a premium or a discount. Changes in the NAV directly impact your investment returns. A rising NAV signifies growth, while a falling NAV indicates a decrease in the value of your holdings.

- NAV helps determine if the ETF is trading at a premium or discount. A premium means the market price is higher than the NAV, while a discount means the market price is lower.

- Tracking NAV changes provides insight into the ETF’s performance. Consistent upward movement suggests strong performance, while downward trends warrant attention.

- Comparing NAV to the ETF's market price allows for arbitrage opportunity identification. Significant discrepancies can present trading opportunities for sophisticated investors.

- NAV is crucial for understanding your investment's growth. It's a key metric to assess the success of your investment in the Amundi DJIA UCITS ETF.

Factors Affecting Amundi DJIA UCITS ETF NAV

Several factors influence the Amundi DJIA UCITS ETF NAV. The most significant is the performance of the Dow Jones Industrial Average itself. The ETF's holdings mirror the DJIA composition, so positive or negative movements in the index directly impact the NAV. Currency fluctuations can also play a role, particularly if the ETF holds assets denominated in currencies other than your base currency. Finally, the expense ratio, which covers the ETF's operational costs, gradually reduces the NAV over time.

- The performance of the Dow Jones directly impacts the ETF's NAV. A rising Dow Jones generally leads to a rising NAV, and vice versa.

- Currency exchange rates can affect the NAV for internationally traded ETFs. Fluctuations in exchange rates can influence the value of the underlying assets.

- Expense ratios reduce the overall NAV over time. While usually small, these fees impact the net asset value over the long term.

- Understanding these factors helps predict potential NAV movements. By considering these variables, investors can better anticipate NAV changes.

Accessing Amundi DJIA UCITS ETF NAV Information

Investors can access the daily Amundi DJIA UCITS ETF NAV through several channels. The official source is typically the fund provider's website, Amundi. Financial news websites, brokerage platforms, and many financial data providers also publish this information. It is advisable to bookmark reliable sources for easy and consistent access.

- Regularly check the Amundi website for official NAV data. This ensures you have the most accurate and up-to-date information.

- Utilize financial news platforms and brokerage accounts for NAV updates. Many platforms offer real-time or near real-time data.

- Bookmark reliable sources for convenient access. This saves time and effort when monitoring your investment.

Conclusion

This guide provided a comprehensive overview of the Amundi DJIA UCITS ETF NAV, highlighting its calculation, significance, and impact on investment decisions. Understanding the factors influencing NAV allows for more informed participation in the ETF market. For a deeper understanding of your Amundi DJIA UCITS ETF investments, regularly monitor the Amundi DJIA UCITS ETF NAV and stay informed about market trends. Further research into ETF investing strategies can also enhance your portfolio management.

Featured Posts

-

Net Asset Value Nav Analysis Amundi Msci World Catholic Principles Ucits Etf Acc

May 25, 2025

Net Asset Value Nav Analysis Amundi Msci World Catholic Principles Ucits Etf Acc

May 25, 2025 -

Police Helicopter Pursuit Drivers Text And Refuel At 90mph

May 25, 2025

Police Helicopter Pursuit Drivers Text And Refuel At 90mph

May 25, 2025 -

Analisi Dell Impatto Dei Dazi Trump Del 20 Sul Settore Moda

May 25, 2025

Analisi Dell Impatto Dei Dazi Trump Del 20 Sul Settore Moda

May 25, 2025 -

The Truth About Lauryn Goodmans Move To Italy Following Kyle Walkers Transfer

May 25, 2025

The Truth About Lauryn Goodmans Move To Italy Following Kyle Walkers Transfer

May 25, 2025 -

Live Pedestrian Accident On Princess Road Emergency Response Underway

May 25, 2025

Live Pedestrian Accident On Princess Road Emergency Response Underway

May 25, 2025

Latest Posts

-

Amsterdam Stock Market Experiences Major Setback Aex Index At 1 Year Low

May 25, 2025

Amsterdam Stock Market Experiences Major Setback Aex Index At 1 Year Low

May 25, 2025 -

Us Tariff Pause Sends Euronext Amsterdam Stocks Up 8

May 25, 2025

Us Tariff Pause Sends Euronext Amsterdam Stocks Up 8

May 25, 2025 -

Significant Drop In Amsterdam Stock Exchange Aex Index Down Over 4

May 25, 2025

Significant Drop In Amsterdam Stock Exchange Aex Index Down Over 4

May 25, 2025 -

Relx Succes Ai Strategie Overwint Economische Onzekerheid

May 25, 2025

Relx Succes Ai Strategie Overwint Economische Onzekerheid

May 25, 2025 -

Aex Index Falls Below Key Support Level Years Lowest Point Reached

May 25, 2025

Aex Index Falls Below Key Support Level Years Lowest Point Reached

May 25, 2025