European Stock Market Update: Trump's Tariff Comments And LVMH's Decline

Table of Contents

Trump's Tariff Comments and their Impact on European Markets

Specific Tariff Concerns

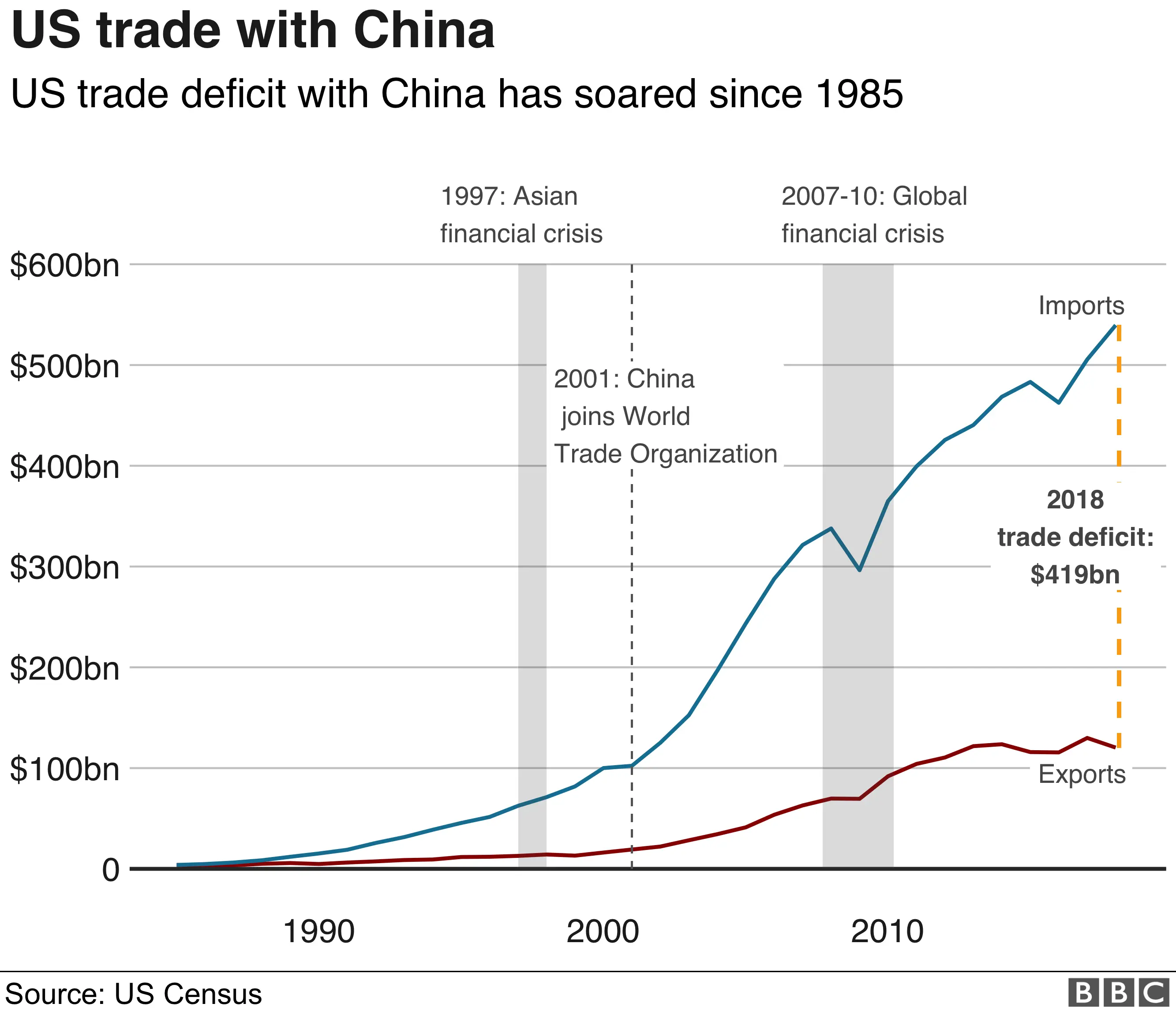

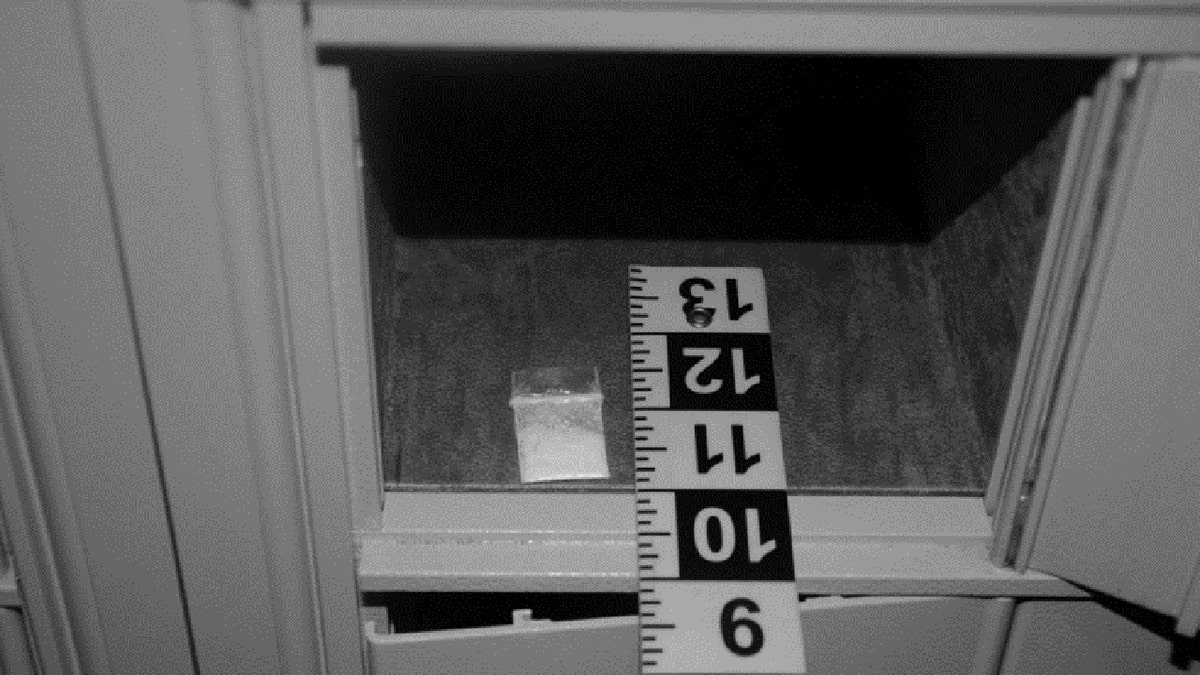

President Trump's recent comments regarding potential tariffs on European goods have sent ripples through the European stock market. These concerns primarily center around sectors like automobiles, steel, and potentially other manufactured goods. Countries like Germany, France, and Italy, major exporters in these sectors, are particularly vulnerable.

- Sectors Most Vulnerable: Automotive manufacturing, steel production, machinery, and consumer goods.

- Market Reactions: The EURO STOXX 50 index experienced a noticeable dip (e.g., a hypothetical 2% drop) following the comments, with automotive stocks being particularly hard hit (e.g., a hypothetical 3% drop in the automotive sector index). Similar drops were observed in other relevant indices.

- Broader Economic Impact: Beyond the immediate market reactions, the uncertainty surrounding these potential tariffs creates a chilling effect on investment and business confidence. Companies may postpone expansion plans, hindering economic growth and potentially leading to job losses.

Investor Sentiment and Market Volatility

Investor sentiment has soured considerably in response to the renewed tariff threats. This uncertainty is fueling market volatility.

- Investor Actions: Many investors are adopting risk-averse strategies, selling off stocks in vulnerable sectors or hedging their positions against further declines.

- Volatility Indices: European volatility indices (e.g., the VSTOXX) have shown a marked increase, reflecting heightened market uncertainty.

- Impact on Future Decisions: The prevailing uncertainty makes it challenging for investors to make long-term investment decisions, creating a climate of cautious waiting.

LVMH's Stock Decline: A Case Study in Luxury Sector Vulnerability

Analyzing LVMH's Performance

LVMH, the world's largest luxury goods company, experienced a significant stock decline (e.g., a hypothetical 5% drop) in recent trading sessions. This decline is noteworthy, as it reflects broader concerns within the luxury sector, often considered a barometer of global economic health.

- Contributing Factors: Beyond the broader market downturn linked to tariff fears, LVMH's specific decline may be attributed to (hypothetical examples): weaker-than-expected sales figures in a key market, concerns about slowing growth in China, or specific negative news related to a particular brand under the LVMH umbrella. (Insert a relevant chart or graph here illustrating LVMH's stock performance).

Implications for the Luxury Goods Sector

LVMH's stock decline serves as a warning sign for the entire European luxury goods sector.

- Other Major Players: Companies like Kering (Gucci, Yves Saint Laurent), Richemont (Cartier, Van Cleef & Arpels), and Hermès are also susceptible to similar pressures. A decline in one major player can trigger a domino effect.

- Consumer Spending and Global Conditions: Luxury goods are highly sensitive to global economic uncertainty and consumer confidence. A slowdown in global growth or a decrease in consumer spending can significantly impact the luxury market.

Potential Recovery Strategies for LVMH and the Luxury Sector

LVMH and other luxury brands need to adopt strategies to mitigate future risks.

- Diversification: Expanding into new markets and product categories less susceptible to economic downturns.

- Cost-Cutting Measures: Optimizing operations and supply chains to enhance profitability.

- Focus on Emerging Markets: Targeting fast-growing emerging markets to offset potential slowdowns in mature markets.

Overall European Market Outlook and Future Predictions

Short-Term Predictions

The short-term outlook for the European stock market remains cautious. The potential implementation of tariffs and ongoing geopolitical uncertainty present significant risks. However, opportunities may exist for investors willing to take calculated risks in undervalued sectors.

- Key Risks: Escalation of trade wars, further economic slowdown, and persistent geopolitical instability.

- Potential Opportunities: Selectively investing in companies well-positioned to weather economic downturns or benefit from emerging trends. Expert opinions should be included here (cite sources).

Long-Term Predictions

The long-term outlook depends on several factors, including the resolution of trade disputes, the pace of global economic growth, and the effectiveness of monetary policy. A positive resolution to trade tensions could lead to a stronger European market recovery.

- Positive Influencing Factors: Resolution of trade disputes, increased global economic growth, and successful implementation of structural reforms within the Eurozone.

- Negative Influencing Factors: Prolonged trade wars, global recession, and further political instability within Europe.

Conclusion

This European Stock Market Update highlights the significant impact of Donald Trump's tariff comments and LVMH's decline on the European market. Understanding these factors is crucial for investors navigating the current climate of uncertainty. The luxury sector, in particular, reveals a vulnerability to broader economic and geopolitical shifts. To stay informed about the ever-evolving European Stock Market Update, subscribe to our newsletter, follow reputable market analysis platforms, or consult with a financial advisor. Stay updated on European Market Analysis and European Stock Market Trends to make informed investment decisions.

Featured Posts

-

Alshrtt Alalmanyt Tetql Mshjeyn Khlal Mdahmat

May 24, 2025

Alshrtt Alalmanyt Tetql Mshjeyn Khlal Mdahmat

May 24, 2025 -

Atfaq Tjary Amryky Syny Tdaeyat Iyjabyt Ela Mwshr Daks

May 24, 2025

Atfaq Tjary Amryky Syny Tdaeyat Iyjabyt Ela Mwshr Daks

May 24, 2025 -

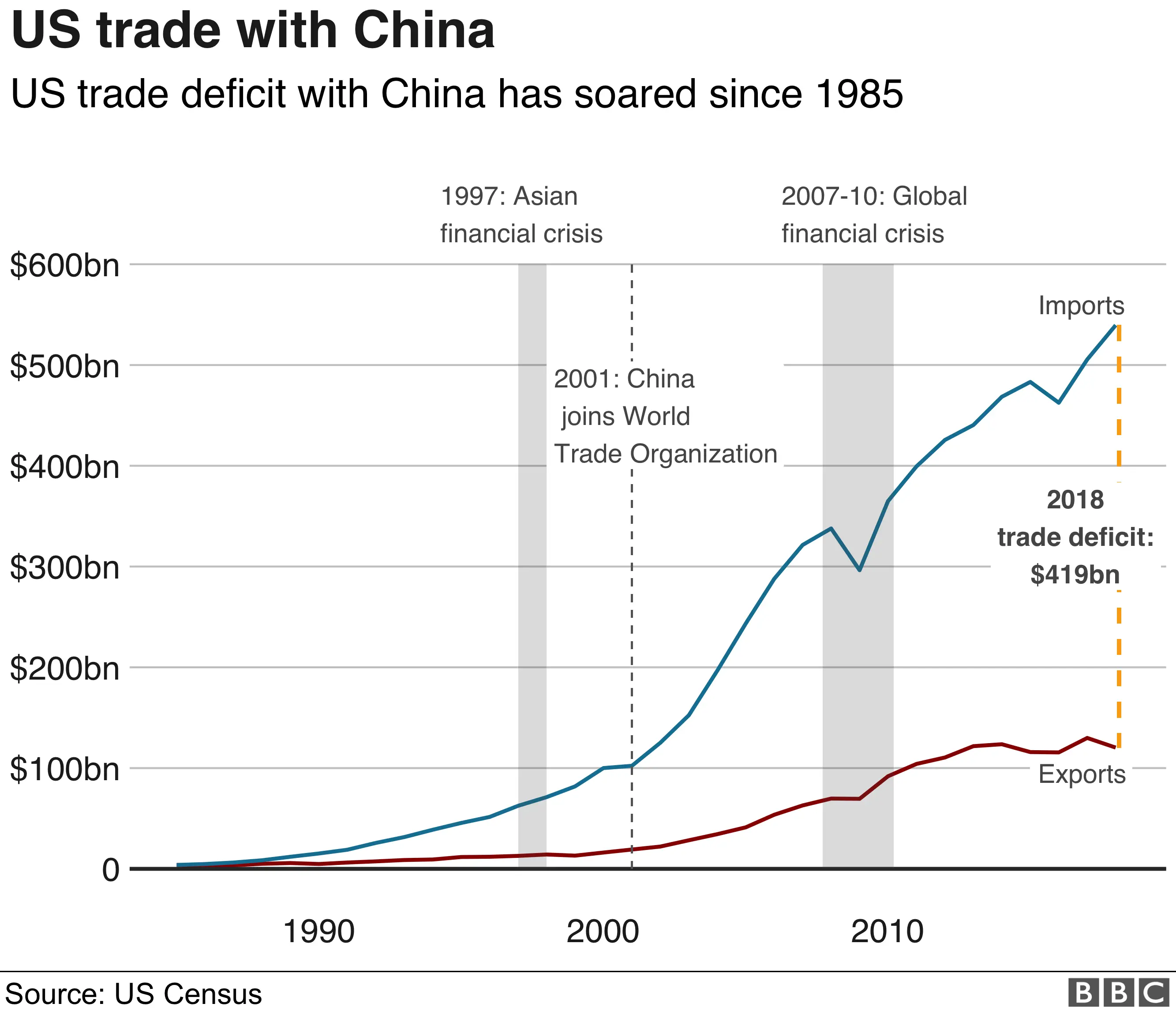

France Comment La Chine Muselle Ses Opposants

May 24, 2025

France Comment La Chine Muselle Ses Opposants

May 24, 2025 -

New Opportunities Bangladesh And Europes Focus On Collaborative Growth

May 24, 2025

New Opportunities Bangladesh And Europes Focus On Collaborative Growth

May 24, 2025 -

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025

Latest Posts

-

Cocaine Found At White House Secret Service Announces End Of Investigation

May 24, 2025

Cocaine Found At White House Secret Service Announces End Of Investigation

May 24, 2025 -

Anchor Brewing Companys Closure A Legacy In Beer Ends

May 24, 2025

Anchor Brewing Companys Closure A Legacy In Beer Ends

May 24, 2025 -

End Of The Penny Us To Halt Penny Circulation By Early 2026

May 24, 2025

End Of The Penny Us To Halt Penny Circulation By Early 2026

May 24, 2025 -

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025