Extreme Price Hike: AT&T Challenges Broadcom's VMware Acquisition Proposal

Table of Contents

AT&T's Concerns: The "Extreme Price Hike" Allegation

AT&T's opposition centers around the anticipated price increases for VMware products and services post-acquisition. The company claims these increases represent an "extreme price hike," potentially impacting its operational costs and profitability significantly. While specific figures haven't been publicly disclosed, the implication is that the proposed increases are substantial enough to warrant a strong public challenge.

- Quantifying the Unknown: AT&T hasn't released exact percentage increases or dollar amounts. However, the intensity of their objection suggests the price hike is not marginal but rather a significant jump in VMware's pricing structure. This lack of transparency adds to the uncertainty surrounding the deal.

- Leverage and Negotiations: As a major VMware customer, AT&T holds considerable leverage in negotiations. Their public opposition could influence other large VMware clients to join their protest, strengthening their bargaining position and potentially forcing Broadcom to reconsider its pricing strategy.

- Public Statements: AT&T's official communications haven't provided precise numbers, focusing instead on the principle of an unacceptable price increase. This strategic ambiguity allows AT&T to maintain pressure while keeping some negotiating cards close to the vest.

- Operational Impact: The potential price increase could significantly affect AT&T's operational costs, impacting their bottom line and potentially forcing them to explore alternative virtualization solutions, a move that would be both costly and disruptive.

Antitrust Scrutiny and Regulatory Hurdles

The Broadcom-VMware merger is already facing intense antitrust scrutiny. AT&T's opposition adds fuel to the fire, providing ammunition for regulatory bodies concerned about reduced competition and potential market dominance.

- Antitrust Implications: The merger raises concerns about Broadcom's potential control over a significant portion of the enterprise software market. Critics argue that this consolidation could stifle innovation and lead to higher prices across the board for businesses relying on virtualization technologies.

- Strengthening Antitrust Arguments: AT&T's public complaint strengthens the arguments against the merger. It provides concrete evidence of potential harm to customers, a key factor in regulatory decisions regarding mergers and acquisitions.

- Regulatory Investigations: The Federal Trade Commission (FTC) and the Department of Justice (DOJ) are likely to closely examine AT&T's claims as part of their ongoing review of the merger. These investigations could lead to significant delays or even the outright blocking of the deal.

- Market Dominance and Stock Prices: The uncertainty surrounding the deal is already impacting Broadcom's stock price. Further regulatory challenges and potential concessions to address antitrust concerns could significantly affect the company's market valuation.

Impact on VMware Customers and the Broader Technology Market

The potential impact extends beyond AT&T. Other VMware customers face the prospect of similar price increases, potentially disrupting their operations and budgets.

- Ripple Effect: If Broadcom implements the proposed price increases across the board, numerous businesses reliant on VMware products could face significant cost increases, impacting their competitiveness and potentially shifting them to alternative solutions.

- Cloud Computing and Virtualization: The merger's outcome will significantly impact the competitive landscape of the cloud computing and virtualization markets. Increased prices could incentivize the growth of open-source alternatives and potentially accelerate the adoption of competing technologies.

- Alternative Solutions: Facing prohibitive VMware pricing, businesses will likely explore alternative virtualization platforms and cloud solutions, potentially leading to a shift in market share and accelerating the innovation of rival technologies.

- Long-Term Implications: The long-term consequences could include a less competitive market, reduced innovation, and potentially higher prices for businesses across various industries that depend on virtualization technologies.

Broadcom's Response and Potential Next Steps

Broadcom will need to respond strategically to AT&T's challenge to avoid derailing the acquisition.

- Broadcom's Response: Broadcom will likely attempt to address AT&T's concerns publicly, potentially offering price concessions or contractual adjustments tailored to meet AT&T's specific needs.

- Negotiation Strategies: The company may seek to negotiate a compromise with AT&T, potentially offering long-term pricing guarantees or service-level agreements to alleviate the concerns.

- Impact on Acquisition Strategy: This challenge could force Broadcom to re-evaluate its integration plans for VMware, potentially leading to adjustments in their overall acquisition strategy.

- Possible Outcomes: Several scenarios are possible: the deal could be renegotiated, delayed while regulatory issues are addressed, or it could ultimately fail due to unresolved antitrust concerns and customer opposition.

Conclusion

AT&T's challenge to Broadcom's VMware acquisition, fueled by concerns over an extreme price hike, introduces significant uncertainty to the deal. This opposition raises serious antitrust questions and highlights the potential for significant disruption in the technology market. The outcome will have far-reaching consequences for VMware customers, competitors, and the broader industry landscape.

Call to Action: Stay tuned for further updates on this developing story as the battle over the Broadcom-VMware acquisition and the fight against extreme price hikes continues to unfold. Follow our blog for ongoing analysis and insights into this crucial technology merger.

Featured Posts

-

Market Downturns An Analysis Of Professional And Individual Investor Actions

Apr 28, 2025

Market Downturns An Analysis Of Professional And Individual Investor Actions

Apr 28, 2025 -

People Betting On Los Angeles Wildfires A Societal Commentary

Apr 28, 2025

People Betting On Los Angeles Wildfires A Societal Commentary

Apr 28, 2025 -

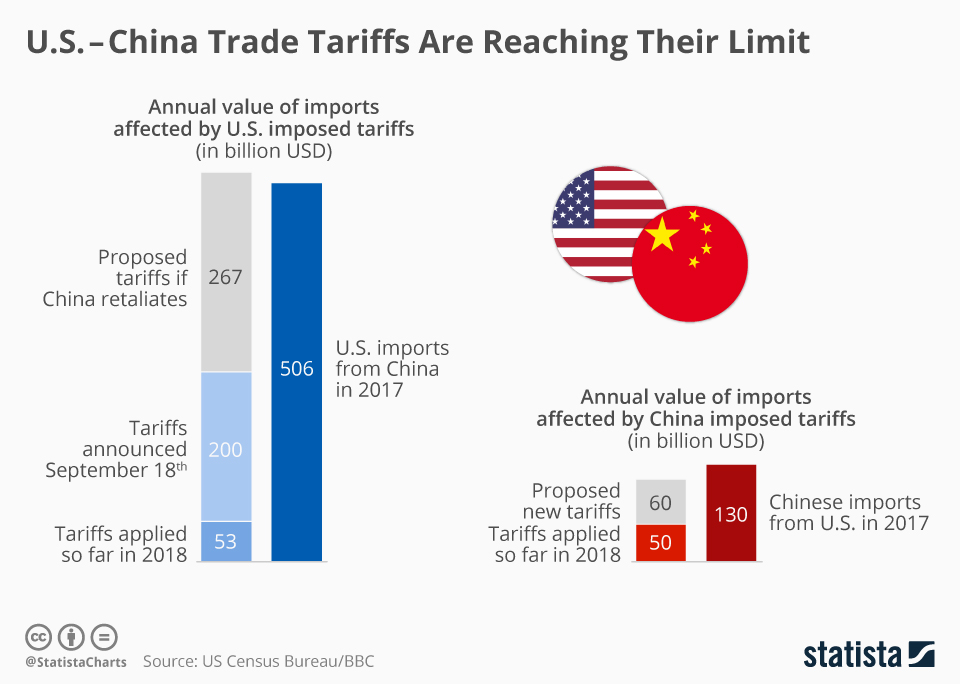

China Eases Tariffs On Certain Us Products A Detailed Look

Apr 28, 2025

China Eases Tariffs On Certain Us Products A Detailed Look

Apr 28, 2025 -

Wga And Sag Aftra Strike The Impact On Hollywood Film And Television Production

Apr 28, 2025

Wga And Sag Aftra Strike The Impact On Hollywood Film And Television Production

Apr 28, 2025 -

Virginia Giuffres Passing Impact On Prince Andrew Case And Epstein Legacy

Apr 28, 2025

Virginia Giuffres Passing Impact On Prince Andrew Case And Epstein Legacy

Apr 28, 2025

Latest Posts

-

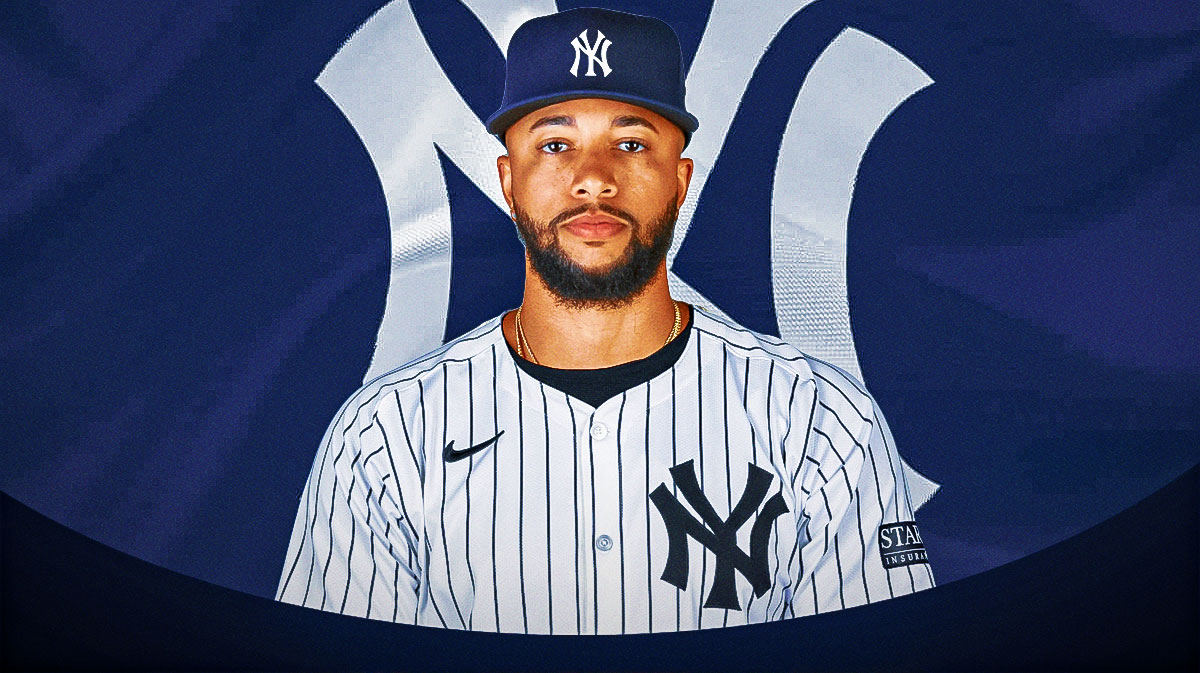

Yankees Suffer Setback Devin Williams Implosion Leads To Loss Against Blue Jays

Apr 28, 2025

Yankees Suffer Setback Devin Williams Implosion Leads To Loss Against Blue Jays

Apr 28, 2025 -

Yankees Loss To Blue Jays Devin Williams Another Collapse

Apr 28, 2025

Yankees Loss To Blue Jays Devin Williams Another Collapse

Apr 28, 2025 -

Devin Williams Implosion Dooms Yankees In Loss To Blue Jays

Apr 28, 2025

Devin Williams Implosion Dooms Yankees In Loss To Blue Jays

Apr 28, 2025 -

Yankees Stave Off Sweep Rodons Pitching Early Offense Key To Victory

Apr 28, 2025

Yankees Stave Off Sweep Rodons Pitching Early Offense Key To Victory

Apr 28, 2025 -

Rodons Strong Performance Yankees Offense Secure Win Against Astros

Apr 28, 2025

Rodons Strong Performance Yankees Offense Secure Win Against Astros

Apr 28, 2025