Market Downturns: An Analysis Of Professional And Individual Investor Actions

Table of Contents

Professional Investor Actions During Market Downturns

Professional investors, with their access to sophisticated tools and resources, employ a range of strategies to manage risk and capitalize on opportunities during market downturns. Their actions differ significantly from those of individual investors, largely due to their access to information, expertise, and resources.

Risk Management Strategies Employed by Professionals

Professional investors prioritize risk management above all else. Their strategies often include:

- Diversification across asset classes: They spread their investments across various asset classes like stocks, bonds, real estate, commodities, and alternative investments to reduce the impact of any single market downturn. This diversification strategy is a cornerstone of professional portfolio management.

- Hedging techniques: These investors utilize hedging strategies such as options and futures contracts to protect against potential losses. These sophisticated tools allow them to limit downside risk while maintaining exposure to potential upside.

- Quantitative analysis and modeling: Professionals leverage advanced quantitative analysis and sophisticated econometric modeling to predict market movements and assess risk. This data-driven approach helps inform their investment decisions and portfolio adjustments.

- Dynamic portfolio allocation: They actively adjust their portfolio allocations based on market conditions and their assessment of risk appetite. This means shifting funds between asset classes as market dynamics change. For example, they might increase allocation to defensive sectors like consumer staples during economic uncertainty.

Opportunities Sought by Professional Investors

Market downturns, while presenting challenges, also create opportunities for savvy investors. Professionals actively seek:

- Undervalued assets: They identify companies or assets whose prices have fallen below their intrinsic value, representing a buying opportunity. This often requires in-depth fundamental analysis.

- Strategic acquisitions: Market downturns can create opportunities to acquire distressed companies at significantly lower prices than during periods of economic expansion.

- Market inefficiencies and arbitrage: Professional investors exploit temporary market inefficiencies and arbitrage opportunities created by price discrepancies. This often involves complex trading strategies.

- Value investing: Many professional investors employ value investing strategies, focusing on fundamentally strong companies trading below their intrinsic value. This is a long-term strategy that benefits from market corrections.

Professional Investor Sentiment and Market Timing

Professional investor sentiment and market timing are crucial during market downturns. Unlike individual investors, professionals:

- Take a long-term perspective: They avoid panic selling and instead focus on the long-term value of their investments. This patience allows them to ride out market volatility.

- Analyze economic indicators: They meticulously analyze economic indicators (like consumer confidence, manufacturing PMI, inflation rates, and unemployment data) to predict market turning points.

- Employ contrarian strategies: Many utilize contrarian investing strategies, buying when others are selling, recognizing that fear often leads to overselling. This requires strong conviction and in-depth market knowledge.

Individual Investor Actions During Market Downturns

Individual investors, often lacking the resources and expertise of professionals, frequently exhibit different behaviors and face unique challenges during market downturns. Understanding these challenges and implementing appropriate strategies is vital for mitigating losses.

Common Behavioral Biases in Individual Investors

Individual investors are often susceptible to several behavioral biases that can negatively impact their investment decisions during market downturns:

- Panic selling: Fear and emotional reactions often lead to panic selling, locking in losses at the worst possible time.

- Herding behavior: Investors may follow the actions of others without conducting independent analysis, exacerbating market declines.

- Confirmation bias: They may seek out information confirming their pre-existing beliefs, ignoring contradictory evidence.

- Overconfidence bias: Overconfidence can lead to excessive risk-taking during volatile market conditions.

Strategies for Individual Investors to Mitigate Losses

To mitigate losses during market downturns, individual investors should:

- Maintain a diversified portfolio: Spread investments across different asset classes to reduce overall risk.

- Stick to a well-defined investment plan: Avoid impulsive decisions driven by fear or greed. A well-defined plan helps to maintain a long-term perspective.

- Avoid emotional investing: Adhere to a long-term investment horizon and avoid making rash decisions based on short-term market fluctuations.

- Dollar-cost averaging: Regularly invest a fixed amount of money regardless of market conditions. This strategy helps to average out the cost basis over time.

Opportunities for Individual Investors

Market downturns also present opportunities for individual investors:

- Buy low: Utilize market downturns as opportunities to acquire quality assets at discounted prices.

- Focus on long-term value: Prioritize long-term value creation over short-term gains.

- Rebalance portfolios: Regularly rebalance portfolios to maintain the desired asset allocation. This helps to re-establish your target risk level.

Comparing Professional and Individual Investor Approaches

The key difference between professional and individual investor approaches lies in their risk tolerance, investment strategies, and access to resources. Professionals have far greater access to information, sophisticated analytical tools, and financial expertise. They can also take on larger risks due to diversification and hedging strategies, making them better equipped to weather market downturns. Individual investors, however, are often more susceptible to behavioral biases and may lack the knowledge or resources to employ complex strategies. This often results in less effective responses to market volatility.

Conclusion

Market downturns present significant challenges but also significant opportunities for both professional and individual investors. While professionals often leverage sophisticated strategies and resources, individual investors can significantly benefit by focusing on long-term strategies, mitigating behavioral biases, and carefully considering their risk tolerance. Understanding the differences in approach between these two investor groups offers valuable insights for navigating future market downturns and making sound investment decisions. To learn more about effective strategies for managing your investments during periods of economic uncertainty, explore our resources on risk management and investment planning. Remember, navigating market downturns successfully requires a well-defined plan and a long-term perspective.

Featured Posts

-

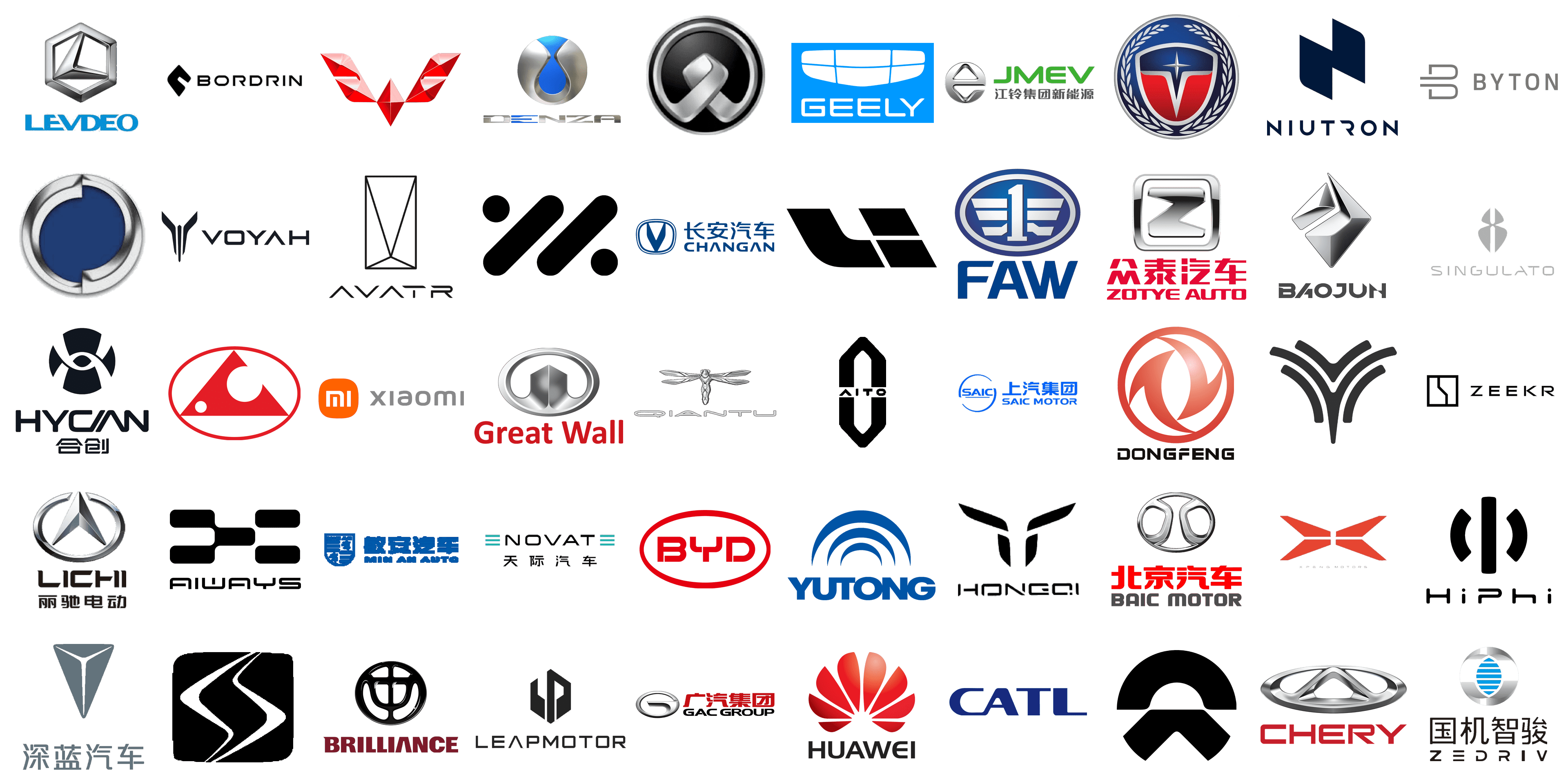

Analyzing The Headwinds Why Luxury Car Brands Face Challenges In China

Apr 28, 2025

Analyzing The Headwinds Why Luxury Car Brands Face Challenges In China

Apr 28, 2025 -

Silent Divorce Recognizing The Telltale Signs Of Marital Dissolution

Apr 28, 2025

Silent Divorce Recognizing The Telltale Signs Of Marital Dissolution

Apr 28, 2025 -

Solving Americas Growing Truck Size Problem

Apr 28, 2025

Solving Americas Growing Truck Size Problem

Apr 28, 2025 -

Gpu Prices Soar Are We Facing Another Crisis

Apr 28, 2025

Gpu Prices Soar Are We Facing Another Crisis

Apr 28, 2025 -

U S Dollar Performance A Troubling First 100 Days Compared To Nixon Era

Apr 28, 2025

U S Dollar Performance A Troubling First 100 Days Compared To Nixon Era

Apr 28, 2025

Latest Posts

-

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025 -

The Curse Is Broken Orioles Announcer And The 160 Game Hit Streak

Apr 28, 2025

The Curse Is Broken Orioles Announcer And The 160 Game Hit Streak

Apr 28, 2025 -

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Prediction

Apr 28, 2025

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Prediction

Apr 28, 2025 -

160 Game Hit Streak Ends For Orioles Player Announcers Curse Debunked

Apr 28, 2025

160 Game Hit Streak Ends For Orioles Player Announcers Curse Debunked

Apr 28, 2025