Extreme Price Hike Concerns: AT&T On Broadcom's VMware Acquisition

Table of Contents

Broadcom's Acquisition of VMware: A Deep Dive

Understanding the Deal

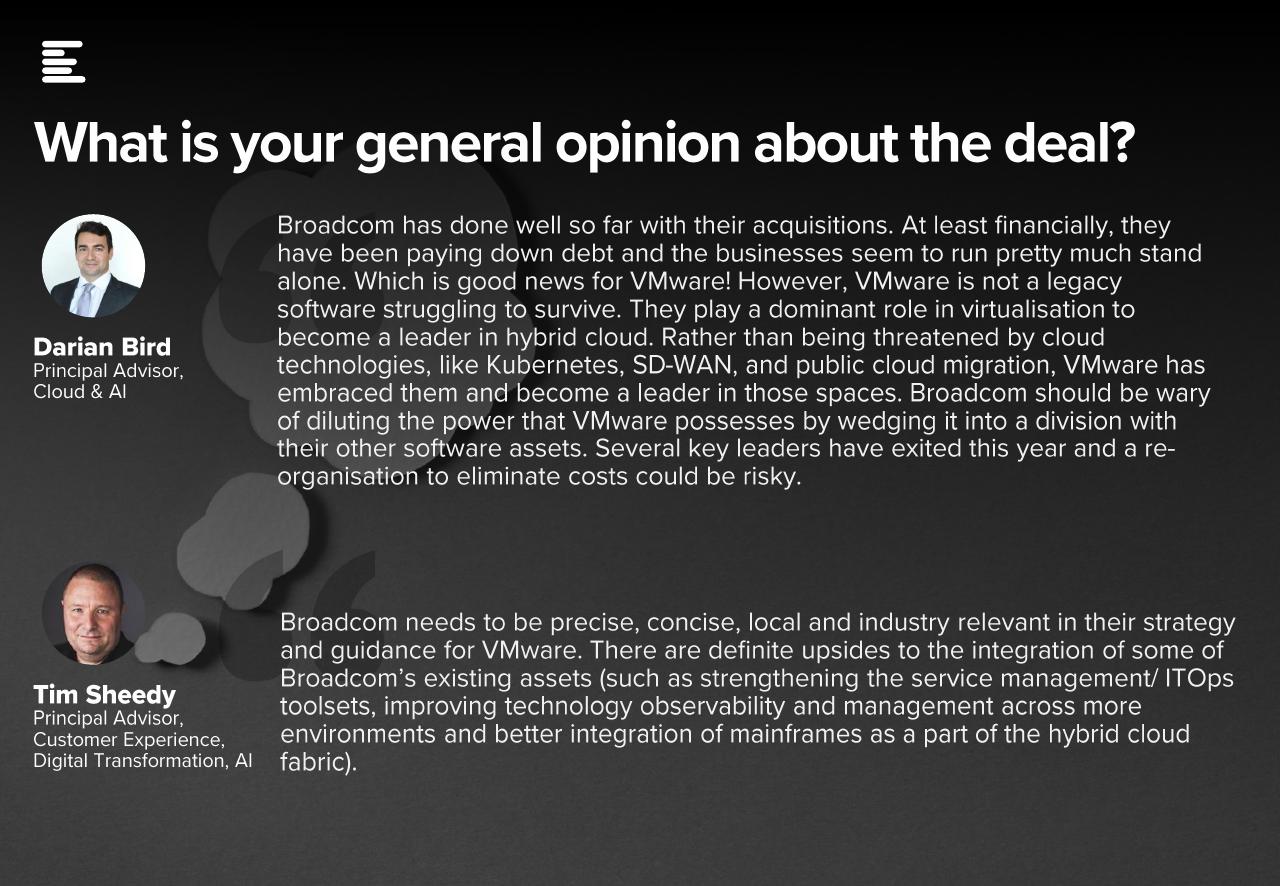

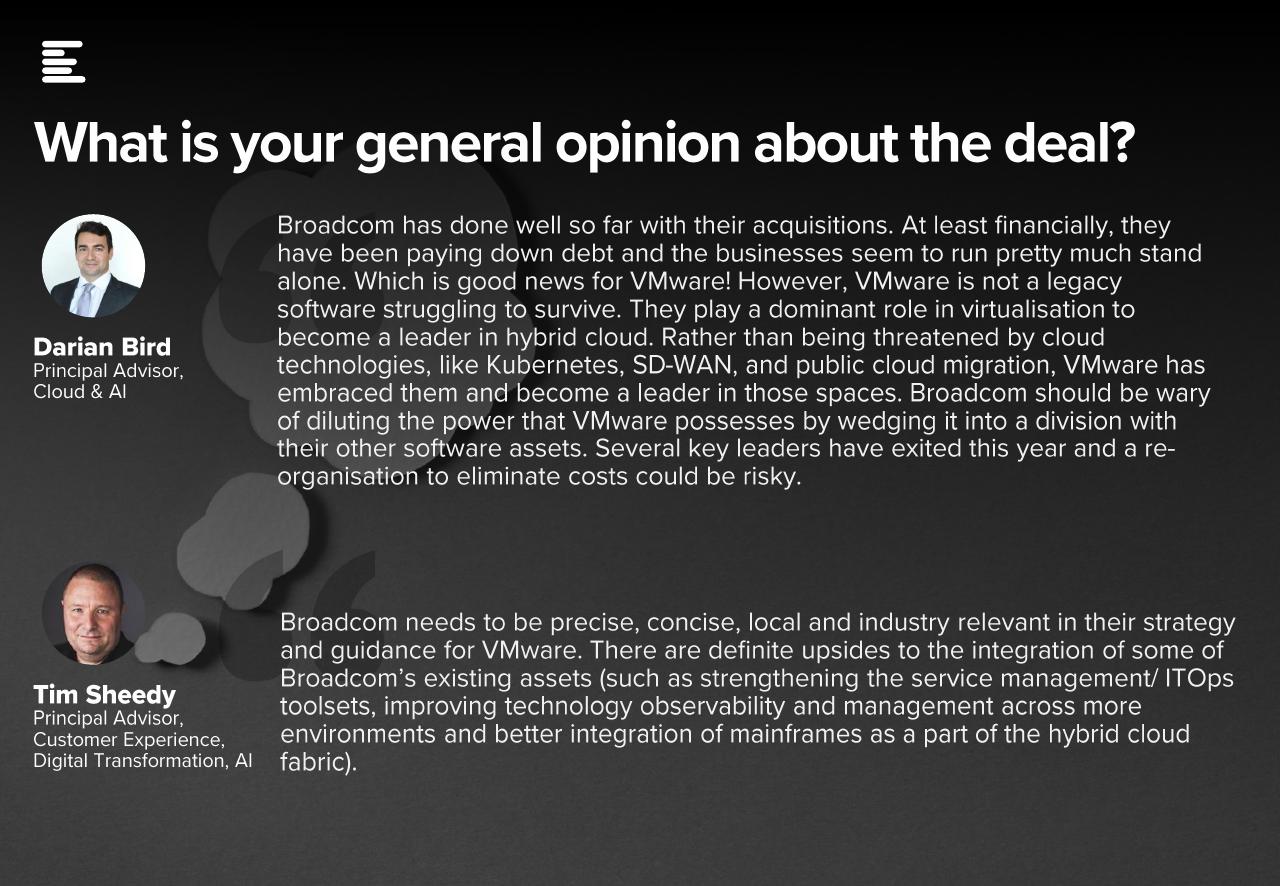

Broadcom's acquisition of VMware represents one of the largest tech mergers in history. The deal combines Broadcom's expertise in semiconductor and infrastructure software with VMware's leading virtualization and cloud technologies. This strategic move aims to expand Broadcom's market share and dominance in the enterprise software market. The acquisition is expected to close in 2023, pending regulatory approvals.

Broadcom's Business Model and History

Broadcom has a history of acquiring companies, often followed by price increases on their products and services. This has raised concerns about potential market dominance and monopoly issues. Their business model centers on acquiring key players in various technology sectors, integrating their technologies, and leveraging their market power to increase profitability. This history fuels apprehension regarding the potential impact of this VMware acquisition.

- Key aspects of the acquisition agreement: The deal includes a cash and stock offer for VMware shareholders.

- Broadcom's track record of post-acquisition price increases: Numerous past acquisitions have resulted in noticeable price increases for customers.

- Potential for reduced competition in the market: The merger could lead to less competition and less innovation in the virtualization and cloud infrastructure sectors.

AT&T's Reliance on VMware Technologies

VMware's Role in AT&T's Infrastructure

AT&T utilizes VMware's virtualization and cloud technologies extensively in its network infrastructure. VMware's solutions are critical to AT&T's operations, enabling efficient management of its vast data centers and cloud services. The company relies on VMware vSphere, vCenter, and other products for server virtualization, network virtualization, and cloud management.

Potential Impacts on AT&T's Operations

The Broadcom acquisition could significantly impact AT&T's operations. Increased prices for VMware products and services could lead to higher operational costs for AT&T. Additionally, potential changes in VMware's product strategy or support following the acquisition could lead to disruptions or inefficiencies.

- Specific VMware products used by AT&T: vSphere, vCenter, NSX, vRealize.

- AT&T's dependence on these technologies: These technologies are integral to AT&T's network infrastructure and services.

- Potential for service disruptions or increased costs for AT&T: Any disruption or significant cost increase will likely be passed onto AT&T's customers.

The Threat of Extreme Price Hikes for AT&T Customers

Analyzing Potential Price Increases

Given Broadcom's history and AT&T's reliance on VMware, the potential for substantial price increases on AT&T services is significant. The extent of these increases is uncertain, but even a moderate rise could have a considerable impact on consumers already facing increasing telecom costs.

Impact on Consumer Choice and Competition

The potential price increases resulting from the Broadcom-VMware acquisition could significantly impact consumer choice and competition within the telecom industry. Increased prices could force consumers to choose less desirable or more expensive alternatives. Reduced competition could also stifle innovation and lead to lower-quality services.

- Examples of past price increases following similar acquisitions: Several past acquisitions in the tech industry have led to observable price hikes for consumers.

- Potential impact on different AT&T services (e.g., internet, mobile): All AT&T services could be affected, leading to higher bills for customers.

- Alternatives for consumers if prices rise significantly: Consumers may need to switch providers or reduce their service levels.

Regulatory Scrutiny and Antitrust Concerns

Government Oversight and Investigations

The Broadcom-VMware acquisition is under scrutiny from regulatory bodies worldwide, including the US Federal Trade Commission (FTC) and the European Commission. These agencies are investigating the potential antitrust implications of the deal, focusing on whether it could reduce competition and harm consumers.

Potential Outcomes and Their Impact on AT&T

The outcome of these investigations will significantly impact AT&T's pricing. If regulators deem the acquisition anti-competitive, they could impose fines, restrictions, or even block the deal entirely. This would significantly influence AT&T's ability to pass on increased costs to consumers.

- Relevant antitrust laws and regulations: The Sherman Act, Clayton Act, and other relevant antitrust laws are being considered.

- Potential fines or restrictions for Broadcom: Significant penalties could be imposed if antitrust violations are found.

- The likelihood of regulatory intervention impacting AT&T's pricing: Regulatory intervention could mitigate or prevent extreme price hikes.

Conclusion: Addressing Extreme Price Hike Concerns: AT&T and the Broadcom-VMware Deal

In summary, Broadcom's acquisition of VMware poses a significant threat of extreme price hikes for AT&T customers. AT&T's heavy reliance on VMware technologies, combined with Broadcom's history of post-acquisition price increases, creates a concerning scenario. Regulatory scrutiny is underway, but the outcome remains uncertain. The key takeaway is the potential for substantial price increases on AT&T services and the need for consumer vigilance.

Stay informed about the ongoing regulatory investigations and monitor AT&T's pricing strategies closely. Contact your representatives to voice your concerns about potential price increases and advocate for fair pricing in the telecom industry. Don't let extreme price hikes become the new normal for your AT&T services.

Featured Posts

-

Nba Tonight Hornets Vs Celtics Prediction Analysis And Best Odds

May 16, 2025

Nba Tonight Hornets Vs Celtics Prediction Analysis And Best Odds

May 16, 2025 -

Part One

May 16, 2025

Part One

May 16, 2025 -

Understanding Congos Cobalt Export Quota Plan Market Implications

May 16, 2025

Understanding Congos Cobalt Export Quota Plan Market Implications

May 16, 2025 -

Behind The Scenes Of Andor Cast Insights Into The Rogue One Prequels Final Season

May 16, 2025

Behind The Scenes Of Andor Cast Insights Into The Rogue One Prequels Final Season

May 16, 2025 -

Ge Force Now Game Update Doom Blades Of Fire And Other May Additions

May 16, 2025

Ge Force Now Game Update Doom Blades Of Fire And Other May Additions

May 16, 2025