Find The Right Personal Loan: Interest Rates Compared Today

Table of Contents

Understanding Personal Loan Interest Rates

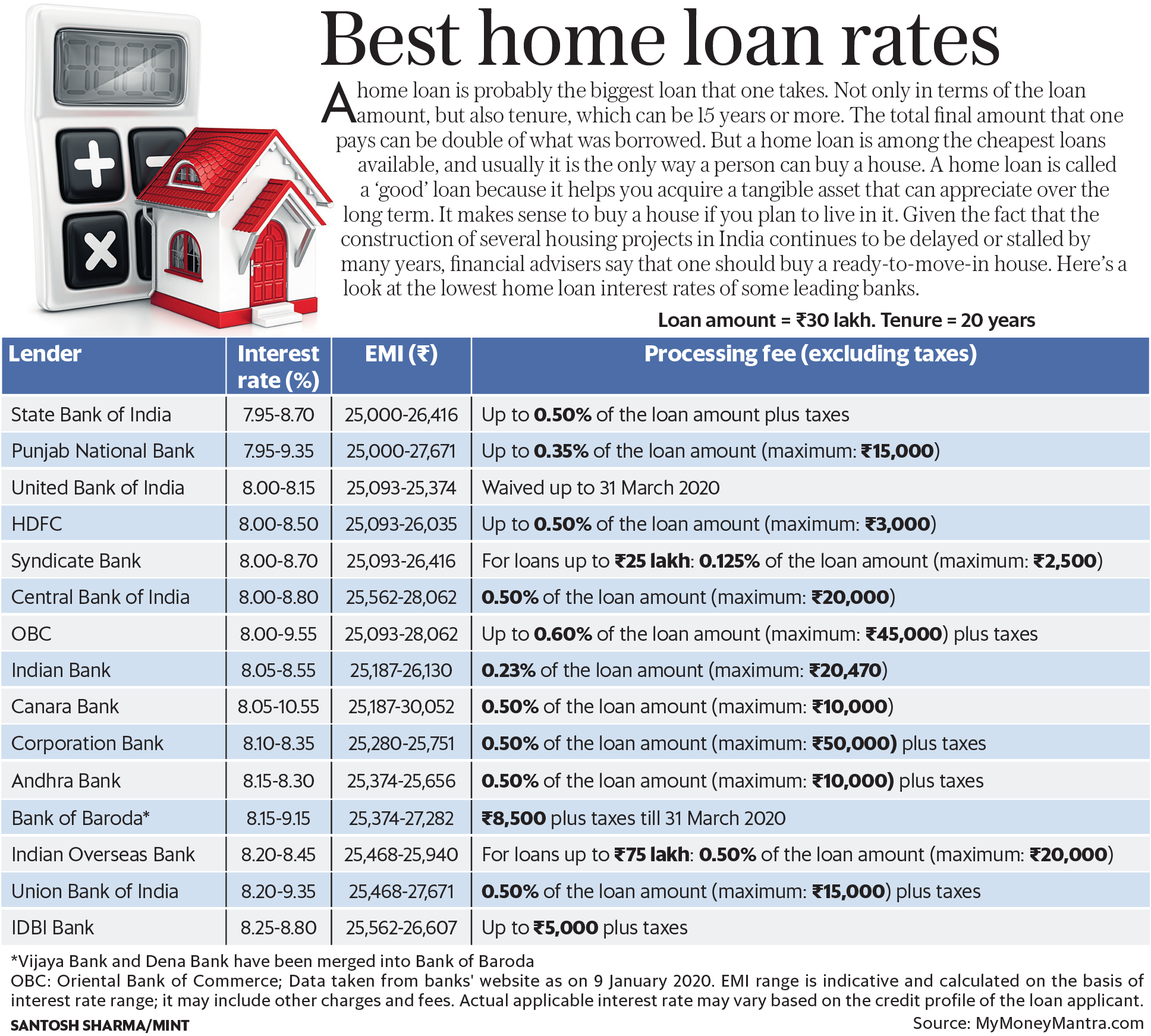

Before diving into different loan types, understanding the basics of interest rates is paramount. The Annual Percentage Rate (APR) represents the yearly cost of borrowing, including interest and any fees. Comparing APRs is essential when comparing personal loan offers, as a seemingly small difference in the interest rate can translate to significant savings or losses over the loan's lifetime.

-

Fixed vs. Variable Interest Rates: Fixed interest rates remain consistent throughout the loan term, offering predictable monthly payments. Variable interest rates fluctuate based on market conditions, potentially leading to lower payments initially but increasing risk of higher payments later.

-

Factors Influencing Personal Loan Interest Rates: Several factors impact the interest rate you qualify for:

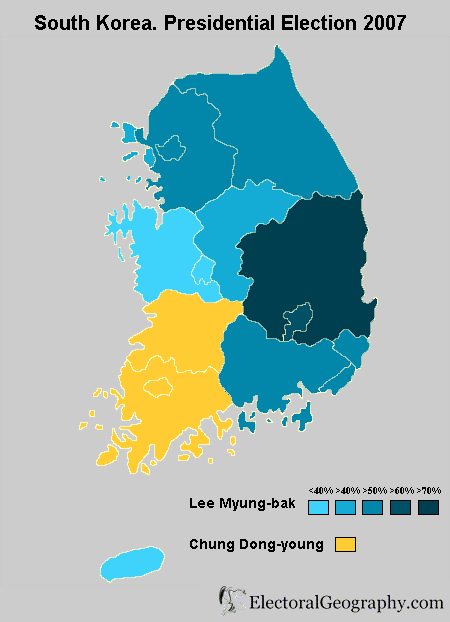

- Credit Score: Your credit history is a major factor. Excellent credit (750+) typically earns the lowest rates, while poor credit (below 600) significantly increases interest rates or even prevents approval.

- Loan Amount: Larger loan amounts often correlate with higher interest rates due to increased risk for the lender.

- Loan Term: Shorter loan terms mean higher monthly payments but lower overall interest paid, whereas longer terms result in lower monthly payments but higher total interest costs.

- Lender Type: Banks, credit unions, and online lenders offer varying rates and fees. Credit unions often provide more competitive rates for their members.

- Debt-to-Income Ratio (DTI): A high DTI (the percentage of your income going towards debt payments) can negatively impact your approval odds and interest rates.

Different Types of Personal Loans and Their Interest Rates

Personal loans come in various forms, each with its own set of characteristics and typical interest rate ranges. Understanding these differences is crucial for choosing the right loan for your needs.

- Unsecured Personal Loans: These loans don't require collateral, making them easier to qualify for but typically resulting in higher interest rates due to the increased risk for the lender.

- Secured Personal Loans: Secured loans require collateral (like a car or savings account) to back the loan, lowering the risk for the lender and resulting in lower interest rates.

- Debt Consolidation Loans: These loans are designed to consolidate multiple debts into a single monthly payment, often with a lower interest rate than the original debts.

- Peer-to-Peer Loans: These loans are funded by individuals or groups through online platforms. They can sometimes offer competitive rates, but thorough research is essential.

- Balance Transfer Loans: Credit cards sometimes offer balance transfer promotions with 0% introductory APR periods. However, be mindful of the interest rate after the introductory period ends.

Average Interest Rates: It's important to remember that average interest rates for personal loans vary significantly between lenders and are influenced by the factors discussed above. Always compare offers from multiple sources.

Tools and Resources for Comparing Personal Loan Interest Rates

Finding the best personal loan requires diligent comparison shopping. Fortunately, numerous tools and resources can simplify this process:

- Online Loan Comparison Websites: Reputable websites allow you to compare offers from multiple lenders simultaneously, saving you time and effort.

- Loan Calculators: Use online loan calculators to estimate your monthly payment and total interest paid based on different loan amounts, interest rates, and terms.

- Lender Reviews and Ratings: Check online reviews and ratings from independent sources to gauge the reputation and customer service of different lenders.

- Financial Advisor: Consider consulting a financial advisor for personalized guidance and assistance in securing the best loan terms.

Tips for Getting the Best Personal Loan Interest Rate

Securing the most competitive interest rate requires proactive steps:

- Improve Your Credit Score: Before applying for a loan, work towards improving your credit score through responsible credit management. Even a small improvement can significantly impact your interest rate.

- Shop Around and Compare: Don't settle for the first offer. Compare rates and terms from multiple lenders to find the most favorable option.

- Negotiate Interest Rates: Don't be afraid to negotiate with lenders. They may be willing to lower the interest rate, especially if you have a strong credit score and multiple offers.

- Consider Pre-qualification: Pre-qualification allows you to check your eligibility without impacting your credit score, helping you refine your search.

- Understand All Fees: Pay close attention to all associated fees, including origination fees, late payment fees, and prepayment penalties.

Conclusion: Securing the Best Personal Loan Interest Rate Today

Finding the right personal loan involves understanding interest rates, comparing loan types, using comparison tools, and improving your creditworthiness. Remember that comparing interest rates from multiple lenders is paramount to securing the best deal. By carefully considering the factors discussed in this article and utilizing the available resources, you can confidently navigate the loan market and find the right personal loan: interest rates compared today. Start comparing personal loan interest rates today and find the perfect loan to meet your needs!

Featured Posts

-

Arraezs Concussion Padres React To Scary Collision Injured List Stint

May 28, 2025

Arraezs Concussion Padres React To Scary Collision Injured List Stint

May 28, 2025 -

Taylor Swift Easter Eggs Fan Theories And The Anticipation For A May Reveal

May 28, 2025

Taylor Swift Easter Eggs Fan Theories And The Anticipation For A May Reveal

May 28, 2025 -

South Korea Presidential Election Meet The Leading Candidates And Their Platforms

May 28, 2025

South Korea Presidential Election Meet The Leading Candidates And Their Platforms

May 28, 2025 -

Top Tribal Loans For Bad Credit Direct Lenders Offering Guaranteed Approval

May 28, 2025

Top Tribal Loans For Bad Credit Direct Lenders Offering Guaranteed Approval

May 28, 2025 -

Is Bianca Censori Trapped Divorce From Kanye West And Control Allegations

May 28, 2025

Is Bianca Censori Trapped Divorce From Kanye West And Control Allegations

May 28, 2025