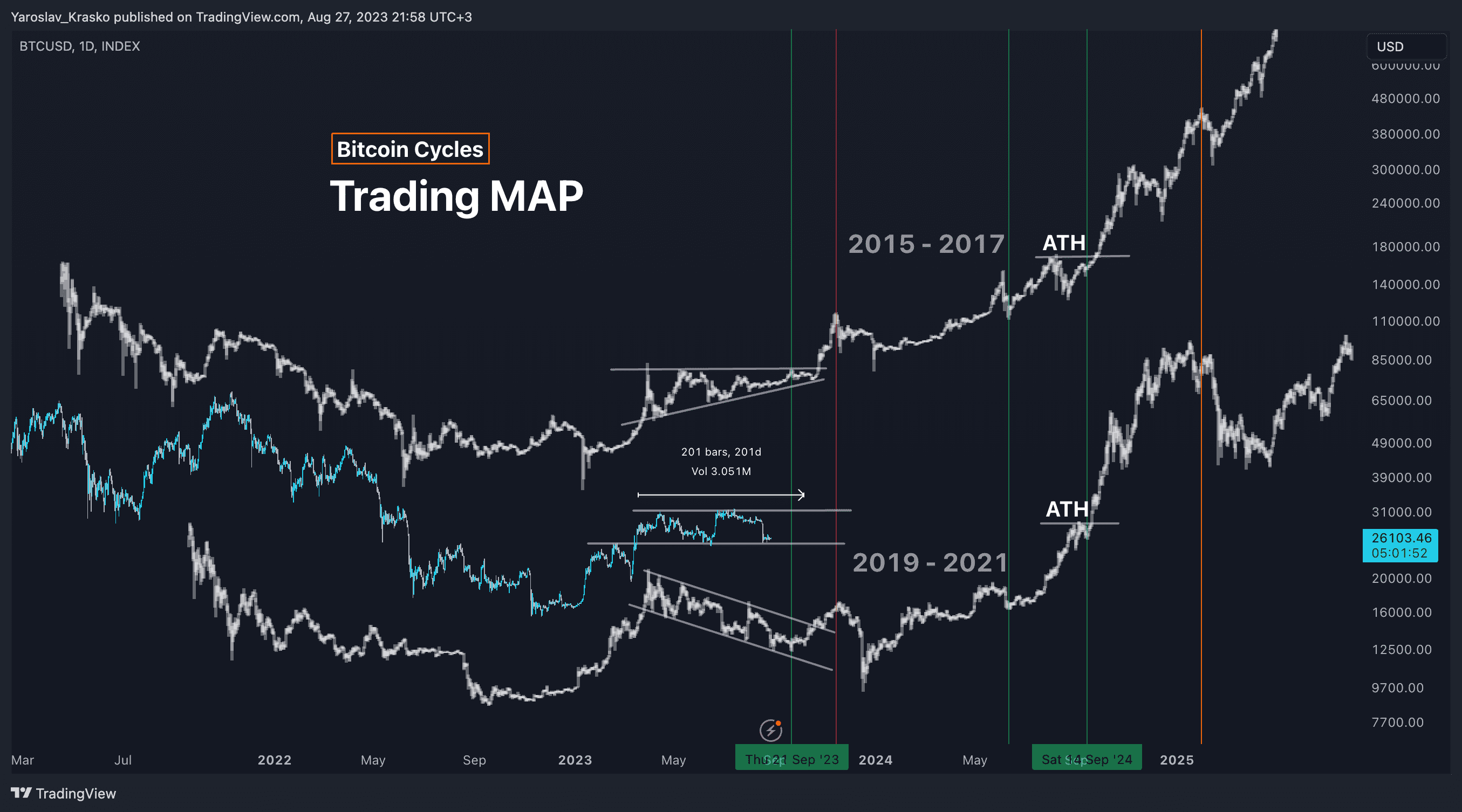

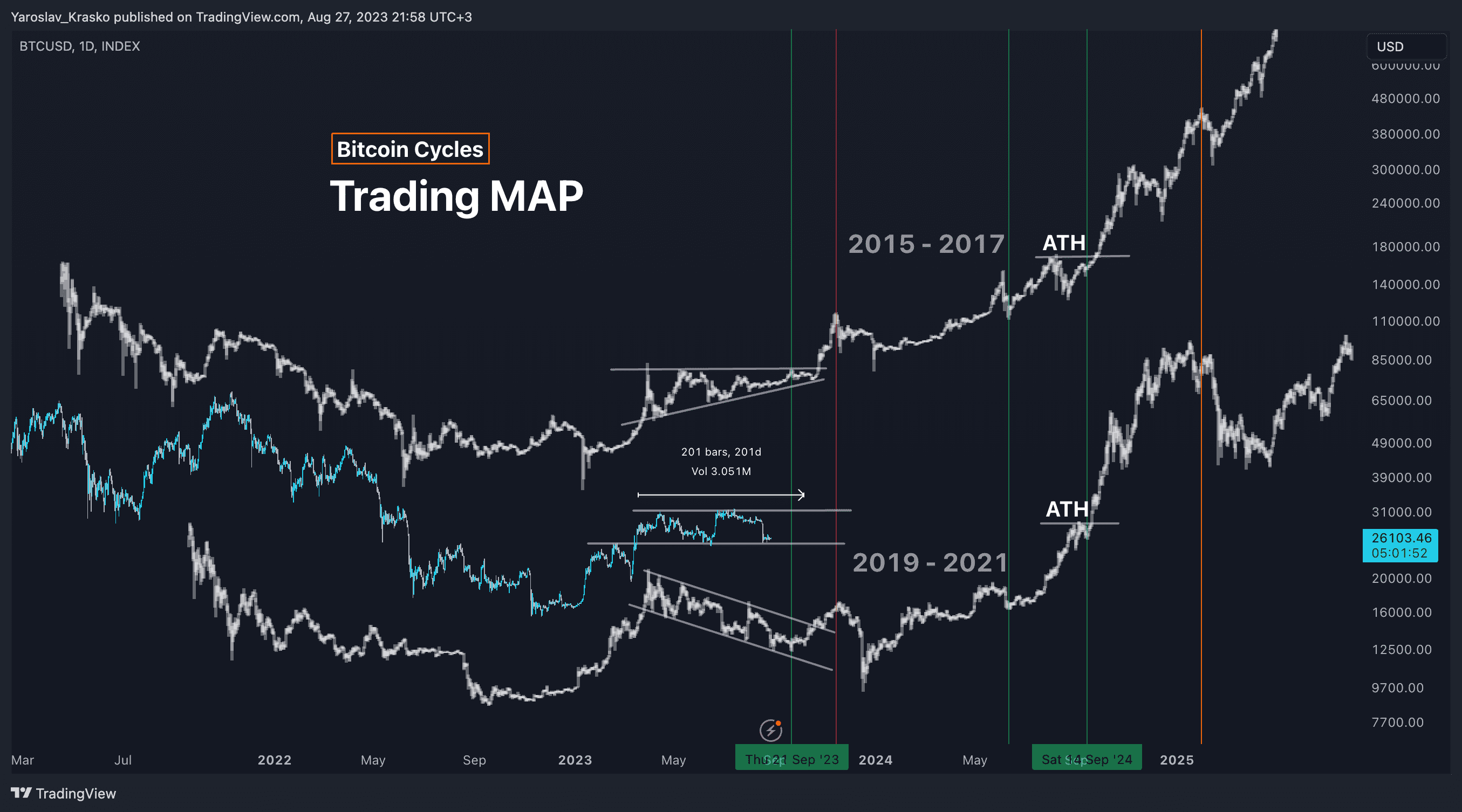

Five-Year Bitcoin Forecast: Potential For 1,500% Growth

Table of Contents

H2: Bitcoin's Growing Adoption and Institutional Investment

The increasing acceptance of Bitcoin by major players is a key driver of this Five-Year Bitcoin Forecast.

H3: Increased Institutional Interest

The narrative surrounding Bitcoin is shifting. We're seeing a significant surge in institutional Bitcoin adoption. No longer is Bitcoin solely the realm of individual investors; major corporations and financial institutions are increasingly allocating significant portions of their portfolios to this digital asset.

- MicroStrategy's massive Bitcoin holdings demonstrate a clear vote of confidence in the long-term potential of Bitcoin as a store of value.

- Tesla's initial investment, though later partially liquidated, highlights the growing interest of established corporations in diversifying their assets with Bitcoin.

- The ongoing discussion surrounding a Bitcoin ETF in the United States could significantly boost institutional investment and increase liquidity, potentially driving up the price dramatically. Regulatory clarity, or even the absence of overly restrictive regulations, plays a significant role in this institutional embrace. The effect on Bitcoin's price could be exponential.

- Many corporations are now building corporate Bitcoin treasuries, mirroring the adoption of gold as a reserve asset in the traditional financial system.

H3: Global Adoption and Emerging Markets

The expansion of Bitcoin adoption in developing economies is another powerful factor contributing to this Five-Year Bitcoin Forecast.

- Countries with high inflation rates or unstable currencies are increasingly turning to Bitcoin as a hedge against economic uncertainty. This increased demand from emerging markets significantly boosts Bitcoin's price.

- The use of Bitcoin for peer-to-peer Bitcoin transactions, especially for remittances, circumvents traditional banking systems and enables faster, cheaper cross-border payments. This increased utility fuels further adoption.

- The Bitcoin adoption rate in several emerging markets is far higher than in developed nations, showcasing its potential as a truly global currency.

H2: Technological Advancements and Network Upgrades

Technological improvements are crucial to the long-term viability and scalability of Bitcoin, underpinning this Five-Year Bitcoin Forecast.

H3: Scaling Solutions and Transaction Speed

Bitcoin's scalability has been a frequent point of discussion. However, advancements in layer-2 scaling solutions are addressing these concerns.

- The Lightning Network, a second-layer solution, allows for faster and cheaper transactions without impacting the main Bitcoin blockchain.

- These Bitcoin scaling solutions are crucial for mainstream adoption. Faster transaction speeds and lower fees will attract a broader range of users and businesses.

- The continued development and improvement of the Lightning Network and similar technologies are critical to enhancing Bitcoin's usability.

H3: Taproot and Future Upgrades

Recent and upcoming upgrades are enhancing Bitcoin's security and efficiency.

- Bitcoin Taproot, implemented in 2021, improved transaction privacy and reduced transaction fees.

- Ongoing development of Bitcoin upgrades ensures the network's continued evolution and resilience against potential threats.

- These improvements to Bitcoin security and efficiency are essential for sustaining long-term growth and attracting institutional investors.

H2: Macroeconomic Factors and Inflationary Pressures

Macroeconomic conditions significantly influence the Bitcoin price prediction within this Five-Year Bitcoin Forecast.

H3: Bitcoin as a Hedge Against Inflation

Bitcoin is increasingly viewed as a hedge against inflation and a store of value, analogous to gold.

- The concept of Bitcoin as digital gold suggests its potential to maintain its value, or even appreciate, during periods of inflation.

- Its price correlation with inflation in traditional markets further supports this notion.

- Investors seeking to protect their wealth from the erosive effects of inflation are increasingly turning to Bitcoin, boosting demand and price.

H3: Global Economic Uncertainty and Safe-Haven Asset

Global economic uncertainty frequently drives investors towards safe-haven assets.

- Historically, Bitcoin has demonstrated a tendency to perform well during periods of economic instability, showcasing its potential as a Bitcoin safe haven.

- Increasing geopolitical risk and economic uncertainty can fuel demand for Bitcoin as a store of value, potentially driving its price upward.

- The role of Bitcoin as a Bitcoin economic uncertainty hedge is a significant factor in this forecast.

H2: Potential Risks and Challenges

It's crucial to acknowledge the potential risks and challenges associated with investing in Bitcoin.

H3: Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies remains dynamic and uncertain.

- Changes in Bitcoin regulation globally could significantly impact its price and adoption.

- The cryptocurrency regulation landscape is constantly evolving, creating both opportunities and uncertainties.

- Navigating the Bitcoin legal landscape is critical for investors and businesses involved in the Bitcoin ecosystem.

H3: Market Volatility and Price Fluctuations

Bitcoin is known for its significant price volatility.

- Understanding Bitcoin volatility is crucial for any investor.

- The inherent risks associated with Bitcoin price prediction risk should be carefully considered.

- Implementing proper cryptocurrency risk mitigation strategies is essential for protecting investments.

3. Conclusion:

This Five-Year Bitcoin Forecast suggests a strong potential for significant growth, driven by factors such as increasing institutional adoption, technological advancements, and its role as a hedge against inflation and economic uncertainty. While regulatory uncertainty and market volatility present risks, the confluence of positive factors outlined above makes a 1,500% increase over five years a viable, albeit ambitious, projection. However, remember that investing in Bitcoin involves significant risk. Conduct thorough research and carefully consider your risk tolerance before making any decisions related to the Five-Year Bitcoin Forecast. Learn more about the potential of a Five-Year Bitcoin Forecast and the factors influencing its price trajectory to make informed investment choices.

Featured Posts

-

Browns Bolster Receiving Corps With Addition Of De Andre Carter From Chicago Bears

May 08, 2025

Browns Bolster Receiving Corps With Addition Of De Andre Carter From Chicago Bears

May 08, 2025 -

Gary Nevilles Psg Vs Arsenal Prediction A Tense Match Ahead

May 08, 2025

Gary Nevilles Psg Vs Arsenal Prediction A Tense Match Ahead

May 08, 2025 -

Sony Ps 5 Pro Everything We Expect From The New Console

May 08, 2025

Sony Ps 5 Pro Everything We Expect From The New Console

May 08, 2025 -

Bitcoins Next Big Move Evaluating The Potential Impact Of Trumps Upcoming Address

May 08, 2025

Bitcoins Next Big Move Evaluating The Potential Impact Of Trumps Upcoming Address

May 08, 2025 -

Toronto Housing Market Cools Sales Plummet 23 Prices Dip 4

May 08, 2025

Toronto Housing Market Cools Sales Plummet 23 Prices Dip 4

May 08, 2025

Latest Posts

-

Miras Planlamasi Kripto Varliklarinizi Guevence Altina Alin

May 08, 2025

Miras Planlamasi Kripto Varliklarinizi Guevence Altina Alin

May 08, 2025 -

Kripto Para Yatirimi Wall Street Kurumlarinin Degisen Perspektifi

May 08, 2025

Kripto Para Yatirimi Wall Street Kurumlarinin Degisen Perspektifi

May 08, 2025 -

Rusya Merkez Bankasi Nin Kripto Para Hakkindaki Son Uyarisi Ve Oenemli Detaylar

May 08, 2025

Rusya Merkez Bankasi Nin Kripto Para Hakkindaki Son Uyarisi Ve Oenemli Detaylar

May 08, 2025 -

Kriptoda Yeni Doenem Spk Nin Son Aciklamasi Ve Etkileri

May 08, 2025

Kriptoda Yeni Doenem Spk Nin Son Aciklamasi Ve Etkileri

May 08, 2025 -

Kripto Para Mirasi Sifresiz Kalanlar Ne Yapmali

May 08, 2025

Kripto Para Mirasi Sifresiz Kalanlar Ne Yapmali

May 08, 2025