Forecasting Apple Stock (AAPL) Price Levels

Table of Contents

Predicting the future price of Apple stock (AAPL) is a challenge that fascinates investors and analysts alike. Accurate AAPL stock price prediction requires a multi-faceted approach, combining fundamental analysis with technical analysis and a keen understanding of macroeconomic factors. This comprehensive guide will equip you with the knowledge and strategies to improve your Apple stock forecast and investment decisions. Whether you're a seasoned investor or just starting to learn about AAPL stock, this guide will provide valuable insights into predicting AAPL price levels.

Understanding the Fundamentals of AAPL Stock

Before diving into technical analysis, a strong understanding of Apple's fundamentals is crucial for accurate AAPL price prediction. This involves a thorough assessment of its financial health, competitive positioning, and the broader economic environment.

Analyzing Apple's Financial Performance

Apple's financial statements – the income statement, balance sheet, and cash flow statement – are treasure troves of information for forecasting AAPL stock. Analyzing these statements reveals crucial trends and growth indicators:

- Revenue Growth: Consistent and robust revenue growth indicates a healthy and expanding business. Look for trends in revenue from various product segments (iPhone, Mac, Services, etc.).

- Profit Margins: High and stable profit margins suggest efficient operations and strong pricing power. Decreasing margins may signal increasing competition or rising costs.

- Earnings Per Share (EPS): EPS growth signifies increasing profitability on a per-share basis, a key driver of stock price appreciation.

- Debt Levels: High levels of debt can increase financial risk and negatively impact future performance. Analyzing Apple's debt-to-equity ratio is essential.

- Free Cash Flow: Strong free cash flow indicates Apple's ability to reinvest in its business, return capital to shareholders through dividends or buybacks, and weather economic downturns.

Interpreting key financial ratios, such as the Price-to-Earnings (P/E) ratio and Price-to-Earnings-Growth (PEG) ratio, provides valuable context. A high P/E ratio might suggest the stock is overvalued, while a low PEG ratio could indicate undervaluation relative to its growth prospects.

Assessing Apple's Competitive Landscape

Apple operates in a highly competitive tech landscape. Analyzing its market position and competitive advantages is vital for Apple stock price prediction:

- Market Share: Tracking Apple's market share in key product categories helps gauge its dominance and potential for future growth.

- Brand Strength: Apple's strong brand loyalty provides a significant competitive advantage, influencing consumer purchasing decisions.

- Innovation: Apple's ability to innovate and introduce groundbreaking products is a critical driver of its long-term success.

- Technological Advancements: Keeping up with advancements in areas like AI, 5G, and augmented reality is crucial for understanding future opportunities and threats.

- Regulatory Environment: Changes in regulations and government policies can significantly impact Apple's operations and profitability.

Competitors like Samsung, Google, and other tech giants constantly challenge Apple's dominance. Understanding their strategies and market share is essential for a complete AAPL stock forecast.

Evaluating Macroeconomic Factors

Broader economic conditions significantly influence AAPL stock price. Factors to consider include:

- Impact of Inflation on Consumer Spending: High inflation can reduce consumer discretionary spending, impacting demand for Apple products.

- Interest Rate Hikes and their Effect on Investment: Increased interest rates can make borrowing more expensive for businesses and reduce investor appetite for riskier assets like stocks.

- Global Economic Uncertainty: Geopolitical events and global economic slowdowns can significantly affect Apple's performance and its stock price.

Incorporating macroeconomic forecasts into your Apple stock price prediction model is essential for a comprehensive outlook.

Employing Technical Analysis for AAPL Stock Price Forecasting

Technical analysis uses historical price and volume data to identify patterns and predict future price movements. This approach is complementary to fundamental analysis in forecasting AAPL stock.

Chart Patterns and Indicators

Technical analysts use various tools and indicators to interpret price trends:

- Moving Averages: Moving averages smooth out price fluctuations, revealing underlying trends.

- Relative Strength Index (RSI): RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): MACD identifies changes in momentum by comparing two moving averages.

- Support and Resistance Levels: These levels represent price points where the price is likely to find buying or selling pressure.

- Candlestick Patterns: Candlestick patterns reveal information about the opening, closing, high, and low prices of a period, potentially hinting at future price movements.

These indicators can be combined to generate signals about potential price trends and identify optimal entry and exit points for trading AAPL stock.

Trend Analysis and Momentum

Identifying and interpreting trends is a cornerstone of technical analysis for AAPL price prediction:

- Identifying Trend Lines: Drawing trend lines on charts helps to visualize the overall direction of the price.

- Measuring Momentum Using Indicators: Indicators like RSI and MACD can help gauge the strength of a trend and potential reversals.

- Assessing the Strength of Trends: A strong trend is characterized by consistent price movements in one direction with minimal pullbacks.

Understanding trend reversals is crucial. A significant shift in momentum can drastically impact your Apple stock forecast.

Combining Fundamental and Technical Analysis for Enhanced Forecasting

For a truly effective AAPL stock price prediction, combining fundamental and technical analysis is crucial.

Integrating Fundamental and Technical Insights

A holistic approach involves synthesizing insights from both analyses:

- Identifying Discrepancies between Fundamental Valuation and Technical Indicators: Discrepancies can signal potential buying or selling opportunities. For example, a fundamentally undervalued stock may show bearish technical signals due to short-term market sentiment.

- Using Both Approaches to Refine Price Targets: Fundamental analysis provides a long-term valuation perspective, while technical analysis helps identify optimal entry and exit points based on short-term price movements.

- Managing Risk Based on Both Analyses: By combining both types of analysis, you can better understand the risk profile of the investment and adjust your strategy accordingly.

Risk Management and Diversification

Effective risk management is essential for any investment strategy, especially for volatile assets like AAPL stock:

- Diversifying Investments: Don't put all your eggs in one basket. Diversify your portfolio across different asset classes to mitigate risk.

- Setting Stop-Loss Orders: Stop-loss orders automatically sell your shares if the price falls below a predetermined level, limiting potential losses.

- Defining Risk Tolerance: Understand your personal risk tolerance and invest accordingly.

Conclusion

Forecasting Apple stock (AAPL) price levels requires a comprehensive approach that blends fundamental analysis of Apple's financial health and competitive position, technical analysis of price charts and indicators, and a thorough understanding of macroeconomic factors. By combining these approaches and practicing sound risk management, you can significantly improve your investment decisions. Remember that while these techniques can enhance your AAPL stock price prediction, they don't guarantee future performance. Begin researching and developing your own Apple stock (AAPL) price forecasts today using the techniques discussed in this guide. Continue learning about effective techniques for AAPL stock price prediction to improve your investment strategy.

Featured Posts

-

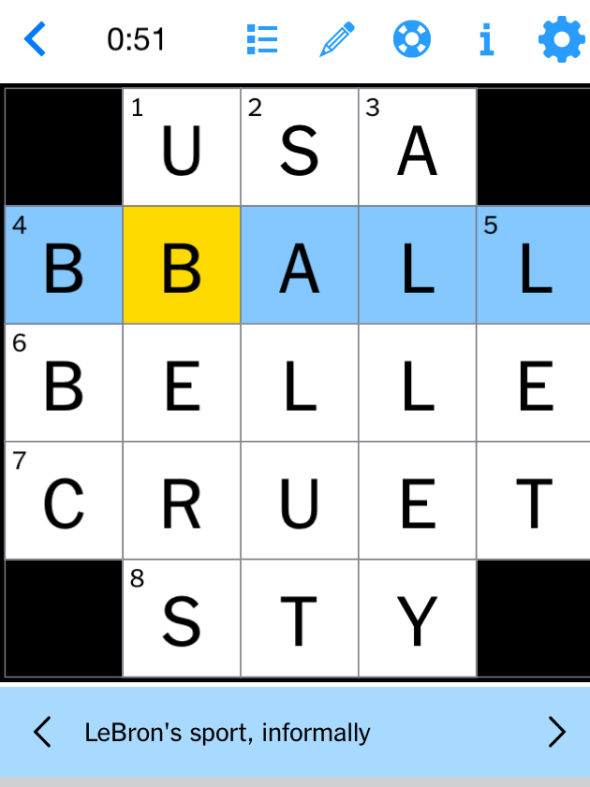

Nyt Mini Crossword April 18 2025 Solutions And Clues

May 24, 2025

Nyt Mini Crossword April 18 2025 Solutions And Clues

May 24, 2025 -

Actress Mia Farrow Seeks Trumps Arrest In Venezuelan Deportation Controversy

May 24, 2025

Actress Mia Farrow Seeks Trumps Arrest In Venezuelan Deportation Controversy

May 24, 2025 -

Air Traffic Controllers Sound Alarm Newark Airport Issues Stem From Trumps First Term Plan

May 24, 2025

Air Traffic Controllers Sound Alarm Newark Airport Issues Stem From Trumps First Term Plan

May 24, 2025 -

Amsterdam Stock Market Plunges 7 Drop Amidst Trade War Fears

May 24, 2025

Amsterdam Stock Market Plunges 7 Drop Amidst Trade War Fears

May 24, 2025 -

Oleg Basilashvili Test Na Znanie Ego Filmov

May 24, 2025

Oleg Basilashvili Test Na Znanie Ego Filmov

May 24, 2025

Latest Posts

-

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025 -

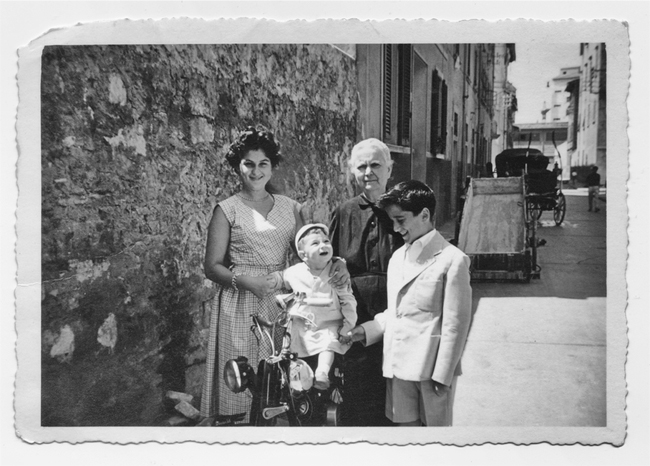

Changes To Italian Citizenship Law Claiming Rights Via Great Grandparents

May 24, 2025

Changes To Italian Citizenship Law Claiming Rights Via Great Grandparents

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Lineage

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Lineage

May 24, 2025 -

Italys New Citizenship Law Claiming Citizenship Through Great Grandparents

May 24, 2025

Italys New Citizenship Law Claiming Citizenship Through Great Grandparents

May 24, 2025 -

Best And Final Job Offer Your Guide To Successful Negotiation

May 24, 2025

Best And Final Job Offer Your Guide To Successful Negotiation

May 24, 2025