Foreign Investment Fuels Japan's Prolonged Yield Rebound: Swap Market Analysis

Table of Contents

The Role of Foreign Investment in Japan's Bond Market

Increased Foreign Demand for Japanese Government Bonds (JGBs)

The heightened foreign demand for Japanese Government Bonds (JGBs) is a key driver of the recent yield rebound. Several factors contribute to this surge:

- Safe-Haven Asset: JGBs are considered a safe-haven asset, particularly during times of global economic uncertainty. Foreign investors seek the relative stability and low risk associated with Japanese government debt.

- Diversification: International investors utilize JGBs to diversify their portfolios, reducing overall risk exposure. The low correlation between JGBs and other asset classes makes them an attractive addition to globally diversified portfolios.

- Higher Yields (relatively): While still low by historical standards, JGB yields have become comparatively more attractive compared to other developed markets with negative or near-zero interest rates. This yield differential incentivizes foreign investment.

Data supporting this increased foreign demand includes:

- A significant rise in foreign holdings of JGBs, exceeding [insert percentage or specific data if available] in the last [time period].

- Increased participation by foreign investors in JGB auctions, often bidding aggressively.

- A notable increase in investment from various sources, including central banks, pension funds, and global asset management firms.

Impact of Foreign Investment on JGB Prices and Yields

The relationship between bond prices and yields is inversely proportional. Increased demand for JGBs pushes their prices higher, consequently driving yields lower. Conversely, decreased demand leads to lower prices and higher yields. The substantial influx of foreign investment has created upward pressure on JGB prices, thus contributing to the observed yield rebound. [Include a chart or graph here visually demonstrating the correlation between foreign investment and JGB yields. Source the data clearly].

Analyzing the Japanese Swap Market

Understanding the Japanese Swap Market and its Significance

The Japanese swap market plays a crucial role in hedging interest rate risk. Participants use swaps to exchange fixed-rate interest payments for floating-rate payments, or vice versa. This market offers valuable insights into investor sentiment and expectations regarding future interest rates and yield movements. The activity in the swap market can be a strong indicator of underlying foreign investment activity in the JGB market, providing a more granular view than simply looking at total JGB holdings.

Swap Market Indicators Revealing Foreign Investment Activity

Several indicators within the Japanese swap market reflect foreign investment flows into JGBs:

- Basis Swaps: These swaps help identify the relative value of borrowing in different currencies. Changes in basis swaps involving the Japanese yen can signal shifts in foreign investment flows into JGBs.

- Cross-Currency Swaps: These swaps allow investors to exchange interest payments in different currencies. Increased activity in cross-currency swaps involving the yen can indicate significant foreign investment in JGBs.

[Provide data points and examples illustrating how these indicators correlate with the yield rebound. Analyze any unusual patterns or anomalies observed in the swap market data. Cite reputable sources for all data].

Potential Implications and Future Outlook

Economic Consequences of the Yield Rebound

The yield rebound has several significant economic consequences:

- Increased Borrowing Costs: Higher yields translate to increased borrowing costs for Japanese businesses and the government, potentially impacting investment and spending.

- Inflationary Pressures: While currently subdued, rising yields could contribute to inflationary pressures in the long term, particularly if the increase is sustained.

- Economic Growth: The impact on economic growth is complex and depends on the interplay between increased borrowing costs and potentially increased investment driven by higher yields. There is a risk of a negative impact on growth if the increase in borrowing costs outweighs the positive effects of investment.

Predictions and Future Trends

Predicting the future direction of JGB yields and foreign investment is challenging. However, several factors could influence future trends:

- Global Monetary Policy: Changes in global monetary policy, particularly from the Federal Reserve, will significantly affect the flow of foreign capital into Japan.

- Domestic Economic Conditions: Japan's domestic economic growth and inflation will play a role in influencing JGB yields and attractiveness to foreign investors.

- Geopolitical factors: Global geopolitical stability and risk aversion will heavily influence the safe-haven demand for JGBs.

[Offer informed predictions, supported by credible analysis, about the likely future trajectory of JGB yields and foreign investment].

Foreign Investment and Japan's Yield Rebound – Key Takeaways and Future Analysis

This analysis demonstrates a strong correlation between increased foreign investment and the prolonged yield rebound in Japan. The Japanese swap market offers a valuable lens through which to understand the dynamics of this relationship. The economic implications are multifaceted, potentially impacting borrowing costs, inflation, and economic growth.

The future trajectory of JGB yields and foreign investment remains uncertain, dependent on a complex interplay of global and domestic factors. We encourage readers to continue monitoring market trends and conducting their own analysis of foreign investment’s impact on Japan's prolonged yield rebound using reliable sources such as swap market data. Further research focusing on the specific impact of different types of foreign investors or the influence of specific geopolitical events would provide valuable insights into this dynamic relationship.

Featured Posts

-

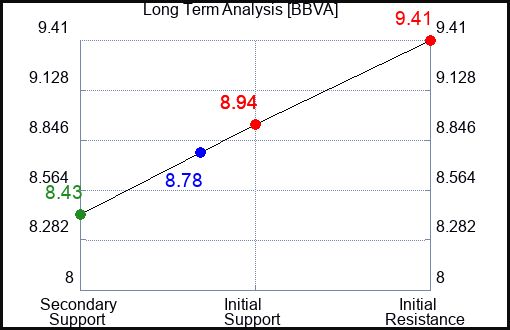

The Future Of Bbva Investment Banking A Long Term Strategy

Apr 25, 2025

The Future Of Bbva Investment Banking A Long Term Strategy

Apr 25, 2025 -

Post Roe America How Over The Counter Birth Control Impacts Access

Apr 25, 2025

Post Roe America How Over The Counter Birth Control Impacts Access

Apr 25, 2025 -

Analysis The Reintroduction Of The Taiwan International Solidarity Act In The Us Congress

Apr 25, 2025

Analysis The Reintroduction Of The Taiwan International Solidarity Act In The Us Congress

Apr 25, 2025 -

This New Crime Drama Is So Stressful Viewers Are Obsessed

Apr 25, 2025

This New Crime Drama Is So Stressful Viewers Are Obsessed

Apr 25, 2025 -

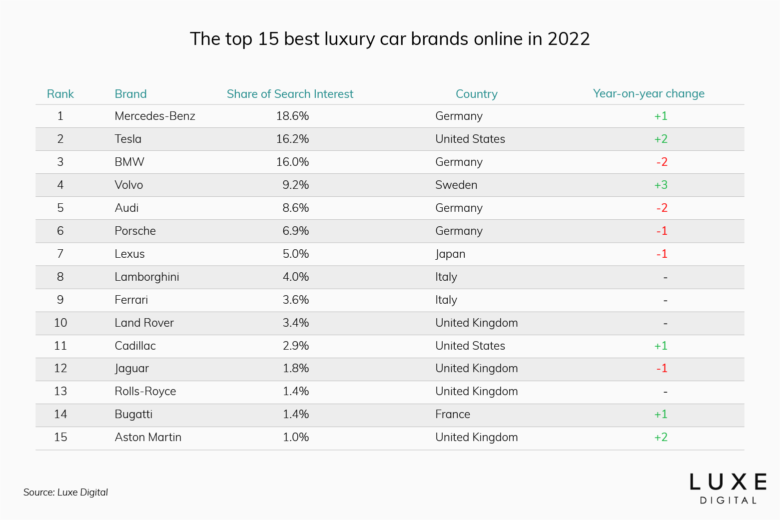

The China Market Opportunities And Obstacles For Premium Car Brands Bmw Porsche Etc

Apr 25, 2025

The China Market Opportunities And Obstacles For Premium Car Brands Bmw Porsche Etc

Apr 25, 2025

Latest Posts

-

Germanys Spd Coalition Agreement Campaign Before Crucial Party Vote

Apr 30, 2025

Germanys Spd Coalition Agreement Campaign Before Crucial Party Vote

Apr 30, 2025 -

Asparagus And Your Health Exploring Its Nutritional Value And Benefits

Apr 30, 2025

Asparagus And Your Health Exploring Its Nutritional Value And Benefits

Apr 30, 2025 -

Asparagus Nutrition How This Vegetable Supports Your Well Being

Apr 30, 2025

Asparagus Nutrition How This Vegetable Supports Your Well Being

Apr 30, 2025 -

Cdu Spd Coalition Talks Key Issues And Potential Outcomes

Apr 30, 2025

Cdu Spd Coalition Talks Key Issues And Potential Outcomes

Apr 30, 2025 -

German Conservatives And Social Democrats Begin Coalition Talks

Apr 30, 2025

German Conservatives And Social Democrats Begin Coalition Talks

Apr 30, 2025