FTC Appeals Activision Blizzard Acquisition Decision

Table of Contents

The FTC's Arguments Against the Acquisition

The FTC's central argument hinges on the potential for Microsoft's acquisition to stifle competition, particularly within the burgeoning cloud gaming market. They contend that Microsoft, already a major player, would gain an unfair competitive advantage by controlling hugely popular franchises like Call of Duty, Warcraft, and Candy Crush. This dominance, the FTC argues, could lead to detrimental consequences for consumers, including higher prices, limited game accessibility, and reduced innovation.

- Market Domination Concerns: The FTC's worry is that the merger would create a monopoly, granting Microsoft undue influence over the market and potentially excluding smaller competitors. This concern extends beyond console gaming to encompass the rapidly growing cloud gaming sector.

- Exclusionary Practices: A key fear is that Microsoft might leverage its ownership of Activision Blizzard to make popular titles exclusive to its Xbox ecosystem, effectively locking out competitors like Sony PlayStation and Nintendo Switch. This would create an uneven playing field and limit consumer choice.

- Pricing Power: By controlling such valuable intellectual property, the FTC believes Microsoft could exert considerable pricing power, potentially leading to inflated prices for games and subscriptions. This would directly harm consumers and limit their access to gaming entertainment.

The Court's Initial Ruling and Its Rationale

A federal judge initially dismissed the FTC’s lawsuit, ruling that the evidence presented was insufficient to demonstrate the merger would substantially lessen competition. The judge's decision rested heavily on Microsoft's proposed remedies, particularly the licensing agreement for Call of Duty, as sufficient to mitigate potential anti-competitive effects.

- Insufficient Evidence: The court found the FTC's evidence of a likely anti-competitive outcome to be unconvincing. The burden of proof in antitrust cases is high, and the FTC failed to meet that threshold in the initial ruling.

- Proposed Remedies: A key aspect of the court's decision was the acceptance of Microsoft's commitment to license Call of Duty to competitors for ten years. This was considered a significant concession aimed at preserving competition.

- Cloud Gaming Market Dynamics: The court also acknowledged the dynamic and still-evolving nature of the cloud gaming market, arguing that it was too premature to definitively conclude that the merger would lead to market dominance.

Microsoft's Defense Strategy

Microsoft has consistently argued that the acquisition will ultimately benefit consumers by increasing game accessibility, fostering innovation, and driving technological advancements. Their defense strategically highlighted the proposed licensing agreements as proof of their commitment to fair competition.

- Consumer Benefits: Microsoft's narrative focused on the potential for increased game availability across various platforms, potentially benefiting a wider audience.

- Licensing Agreements: The licensing deals for Call of Duty and other Activision Blizzard titles were presented as a crucial element in their defense, demonstrating their willingness to prevent anti-competitive practices.

- Innovation and Expansion: Microsoft emphasized the potential for increased innovation and expansion within the gaming market resulting from the combined resources and expertise of the two companies.

Implications of the FTC Appeal

The FTC's appeal introduces significant uncertainty and has far-reaching implications for the future of mega-mergers in the tech industry. It establishes a critical precedent for future antitrust cases and will be closely scrutinized by regulators and businesses worldwide.

- Antitrust Precedent: The outcome of this appeal will serve as a critical precedent, influencing future antitrust reviews of similar acquisitions, not only in gaming but also in other tech sectors.

- Regulatory Scrutiny: This appeal heightens the scrutiny applied to large-scale M&A activity, potentially leading to stricter regulations and more stringent reviews in the future.

- Market Volatility: The ongoing legal battle contributes to uncertainty and potential volatility in the gaming market, impacting investor confidence and business decisions.

Conclusion

The FTC's appeal of the Activision Blizzard acquisition decision is a landmark event in the ongoing battle over competition in the gaming industry. The resolution of this appeal will not only determine the fate of the merger itself but will also profoundly influence the regulatory landscape surrounding large-scale tech acquisitions. While the ultimate success of the FTC's appeal remains uncertain, the ongoing debate underscores the critical role of antitrust enforcement in safeguarding consumer interests and ensuring a fair and competitive market. Stay informed about this crucial case and its impact on the future of Activision Blizzard and the gaming industry by following updates on the FTC's appeal of the Activision Blizzard acquisition.

Featured Posts

-

Stock Market Valuation Concerns Bof A Offers Perspective

May 20, 2025

Stock Market Valuation Concerns Bof A Offers Perspective

May 20, 2025 -

The Undervalued Asset How Middle Managers Contribute To Company And Employee Well Being

May 20, 2025

The Undervalued Asset How Middle Managers Contribute To Company And Employee Well Being

May 20, 2025 -

Agatha Christies Poirot A Critical Analysis Of The Stories

May 20, 2025

Agatha Christies Poirot A Critical Analysis Of The Stories

May 20, 2025 -

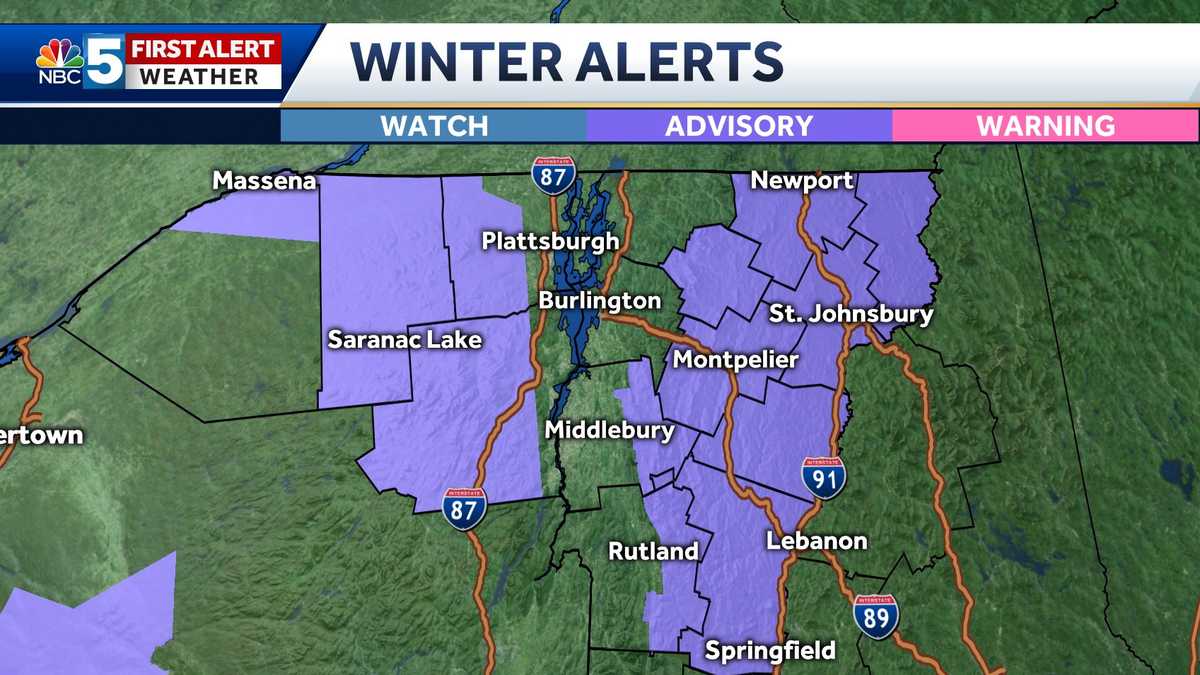

How Winter Weather Advisories Impact School Schedules

May 20, 2025

How Winter Weather Advisories Impact School Schedules

May 20, 2025 -

Politique Camerounaise Macron Referendum Et Troisieme Mandat En 2032

May 20, 2025

Politique Camerounaise Macron Referendum Et Troisieme Mandat En 2032

May 20, 2025

Latest Posts

-

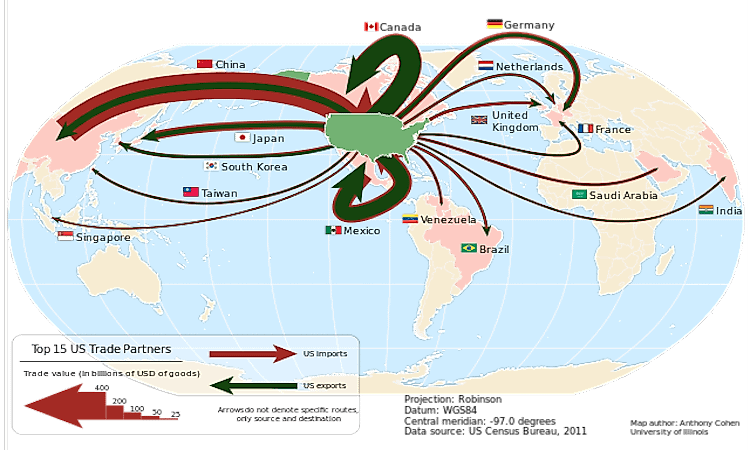

European Union Trade Macron Advocates For Prioritizing Domestic Goods

May 21, 2025

European Union Trade Macron Advocates For Prioritizing Domestic Goods

May 21, 2025 -

Southern French Alps Weather Storm Brings Unexpected Late Snow

May 21, 2025

Southern French Alps Weather Storm Brings Unexpected Late Snow

May 21, 2025 -

Macrons Push For Intra Eu Trade A Challenge To Us Imports

May 21, 2025

Macrons Push For Intra Eu Trade A Challenge To Us Imports

May 21, 2025 -

Late Snowfall Impacts Southern French Alps Stormy Weather Update

May 21, 2025

Late Snowfall Impacts Southern French Alps Stormy Weather Update

May 21, 2025 -

Eu Trade Shift Macrons Plea For European Made Products

May 21, 2025

Eu Trade Shift Macrons Plea For European Made Products

May 21, 2025