Analyzing Market Behavior: Professionals Vs. Individuals During Downturns

Table of Contents

Investment Strategies During Downturns

How professionals and individuals approach investing during an economic downturn differs significantly. Understanding these differences can help you make more informed decisions during periods of market volatility and recession.

Professional Investors

Professional investors, such as portfolio managers and hedge fund managers, generally approach market downturns with a long-term perspective and a sophisticated toolkit. Their investment strategies are characterized by:

- Long-term strategies and diversification: They employ diversified portfolios across various asset classes (stocks, bonds, real estate, etc.) to mitigate risk. This strategy helps to cushion the impact of market declines in any single sector.

- Advanced analytical tools and economic forecasting: Professionals leverage advanced analytical tools and economic models to identify undervalued assets and predict market trends. This data-driven approach allows them to make informed investment decisions, even amidst uncertainty.

- Active buying during corrections: They may actively seek opportunities to buy undervalued assets during market corrections, anticipating a rebound in the future. This "buy low, sell high" strategy is a cornerstone of professional investing.

Bullet points:

- Employ sophisticated portfolio hedging strategies to protect against losses.

- Leverage macroeconomic indicators (inflation, interest rates, GDP growth) to inform investment decisions.

- Seek undervalued assets, distressed debt, and opportunities created by market dislocations.

Individual Investors

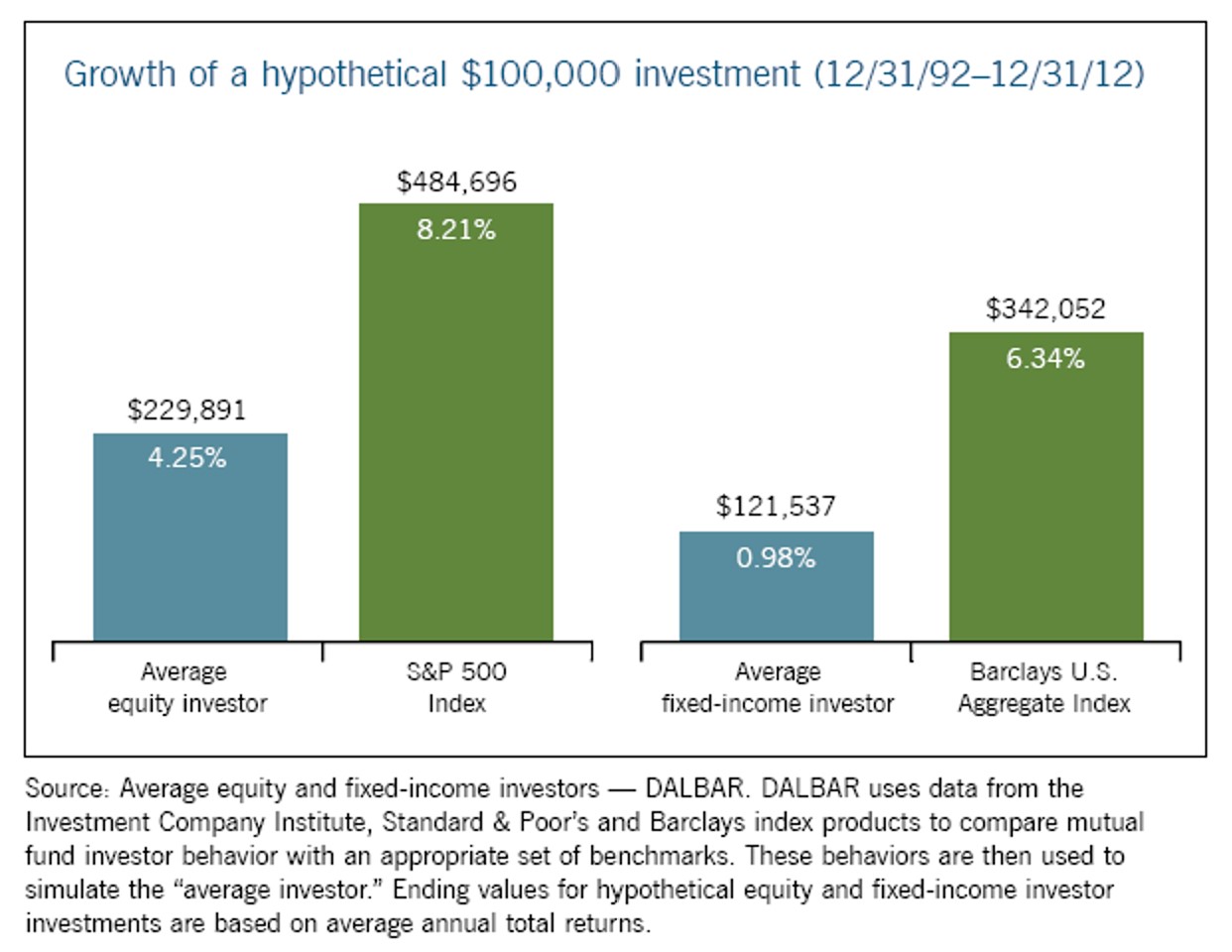

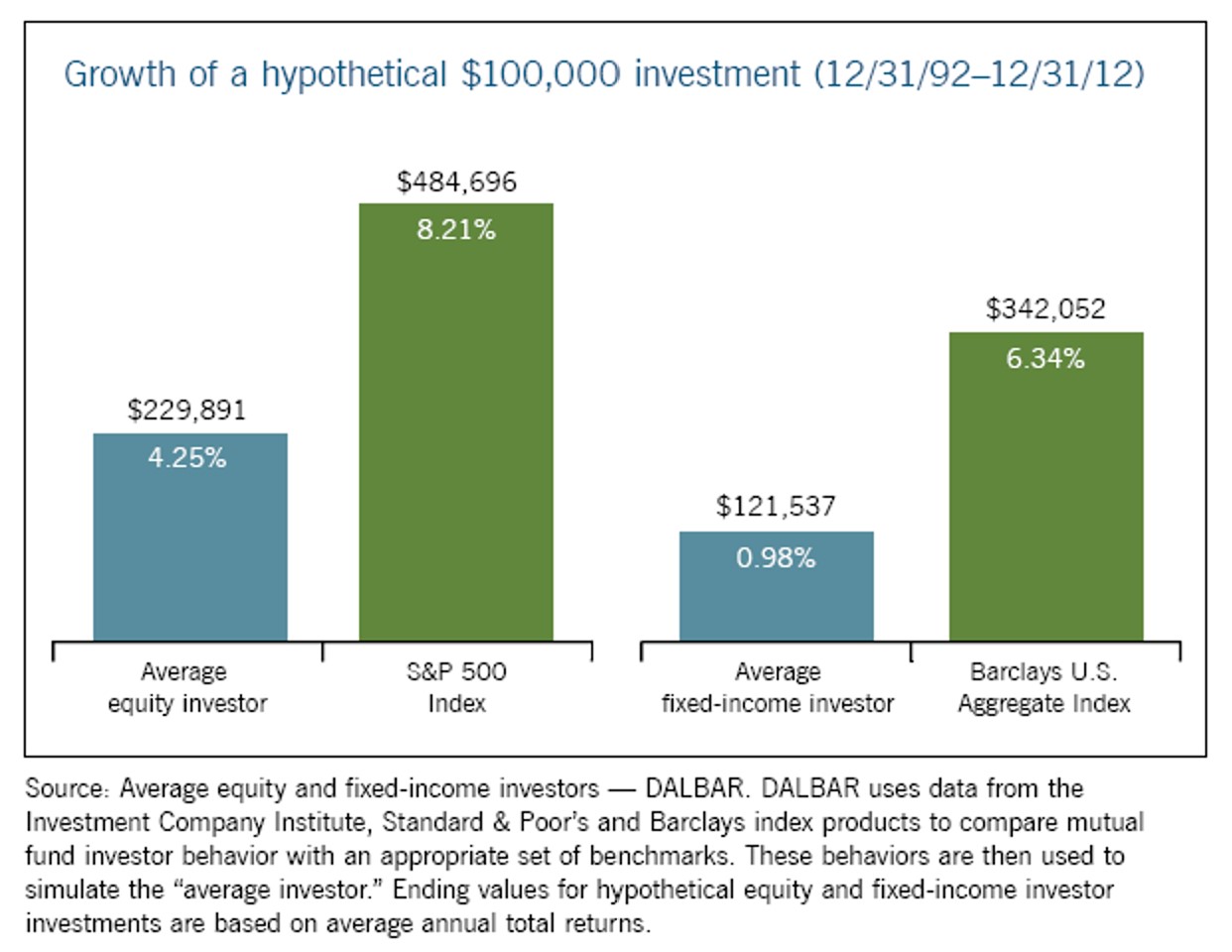

Individual investors, on the other hand, often react emotionally to market volatility, leading to less optimal investment decisions during economic downturns. Their behaviors are often influenced by:

- Emotional decision-making: Fear and panic selling are common reactions to market declines. This often leads to selling assets at their lowest points, locking in losses.

- Lack of resources and expertise: Individual investors may lack access to advanced analytical tools and the expertise to navigate complex market conditions effectively.

- Short-term focus: They may be more susceptible to making hasty decisions based on short-term market fluctuations, rather than long-term investment goals.

Bullet points:

- Higher likelihood of panic selling during downturns, exacerbating losses.

- May rely on less reliable information sources, such as social media or biased news reports.

- Often lack a well-defined, long-term investment plan, making them vulnerable to market swings.

Spending Habits During Economic Slowdowns

Consumer spending patterns also diverge significantly between professionals and individuals during economic slowdowns. Understanding these differences can provide insight into broader market trends.

Professional Spending

Businesses, guided by professionals, typically adopt a more strategic approach to spending during economic downturns:

- Focus on essential expenditures: They prioritize essential business expenditures, such as salaries and operational costs, while carefully evaluating non-essential spending.

- Strategic investments for long-term growth: While cutting back on some areas, professionals may continue strategic investments in research and development or technology upgrades to maintain a competitive edge.

- Cost-cutting measures: Implementing efficient budget management and cost-cutting measures is paramount to ensuring long-term viability.

Bullet points:

- Focus on maintaining operational efficiency and productivity.

- Strategic investments in research and development may continue or even increase.

- Cutting back on discretionary spending, such as marketing or travel.

Individual Spending

Individual spending habits during an economic slowdown tend to reflect a more immediate response to uncertainty:

- Significant reduction in discretionary spending: Consumers often curtail spending on non-essential items like entertainment, dining out, and travel.

- Prioritization of essential expenses: Essential expenses such as housing, food, and healthcare remain the top priorities.

- Increased savings and debt reduction: Many individuals increase their savings rate to create a financial buffer or focus on reducing existing debt.

Bullet points:

- Reduced spending on entertainment, leisure activities, and non-essential goods.

- Increased focus on saving and debt reduction to enhance financial security.

- Potential for increased frugality and price sensitivity when making purchasing decisions.

Risk Tolerance and Management

Risk management strategies also reveal a stark contrast between professional and individual approaches during market downturns.

Professional Risk Management

Professional investors employ robust methodologies to assess and mitigate risk:

- Sophisticated risk assessment: They use advanced models and simulations to estimate potential losses and evaluate the risk-reward profile of investments.

- Diversification across asset classes: Diversification remains a cornerstone of professional risk management, limiting exposure to any single asset or sector.

- Hedging strategies: They often employ hedging strategies, such as options or futures contracts, to protect against potential losses.

Bullet points:

- Sophisticated modeling and simulation techniques to stress test portfolios.

- Implementation of stop-loss orders to limit potential losses.

- Regular portfolio rebalancing to maintain desired asset allocation.

Individual Risk Management

Individual investors often exhibit a less sophisticated approach to risk management, influenced heavily by emotion:

- Higher risk aversion: During market downturns, individuals tend to become more risk-averse, potentially missing out on investment opportunities.

- Limited understanding of risk mitigation: They may lack the knowledge and tools to effectively mitigate risk.

- Emotional decision-making: Emotional biases can significantly impact risk management strategies, leading to suboptimal decisions.

Bullet points:

- Limited diversification of investments, often concentrating in a few assets.

- Less sophisticated risk assessment methodologies, relying on intuition or limited information.

- Susceptibility to emotional biases (fear, greed, herd mentality) affecting investment choices.

Conclusion

Analyzing market behavior reveals significant differences between how professionals and individuals navigate economic downturns. Professionals tend to employ more sophisticated strategies, prioritizing long-term goals and effective risk management. Conversely, individual investors often react emotionally, potentially leading to poor decisions. Understanding these distinct approaches is key to making informed financial decisions during periods of market volatility. By studying both professional and individual approaches to analyzing market behavior during downturns, you can better position yourself for financial success regardless of economic conditions. Learn more about effective strategies for navigating market downturns by researching and understanding analyzing market behavior further.

Featured Posts

-

Trumps Time Interview Canada Annexation China Relations And Future Presidency Plans

Apr 28, 2025

Trumps Time Interview Canada Annexation China Relations And Future Presidency Plans

Apr 28, 2025 -

Chinas Quiet Shift Examining Recent Us Tariff Exemptions

Apr 28, 2025

Chinas Quiet Shift Examining Recent Us Tariff Exemptions

Apr 28, 2025 -

Perplexitys Ceo The Fight For Ai Search Dominance

Apr 28, 2025

Perplexitys Ceo The Fight For Ai Search Dominance

Apr 28, 2025 -

Signs Your Silent Divorce Is Imminent Recognizing The Warning Signals

Apr 28, 2025

Signs Your Silent Divorce Is Imminent Recognizing The Warning Signals

Apr 28, 2025 -

Global Leaders Gather To Mourn Pope Francis

Apr 28, 2025

Global Leaders Gather To Mourn Pope Francis

Apr 28, 2025

Latest Posts

-

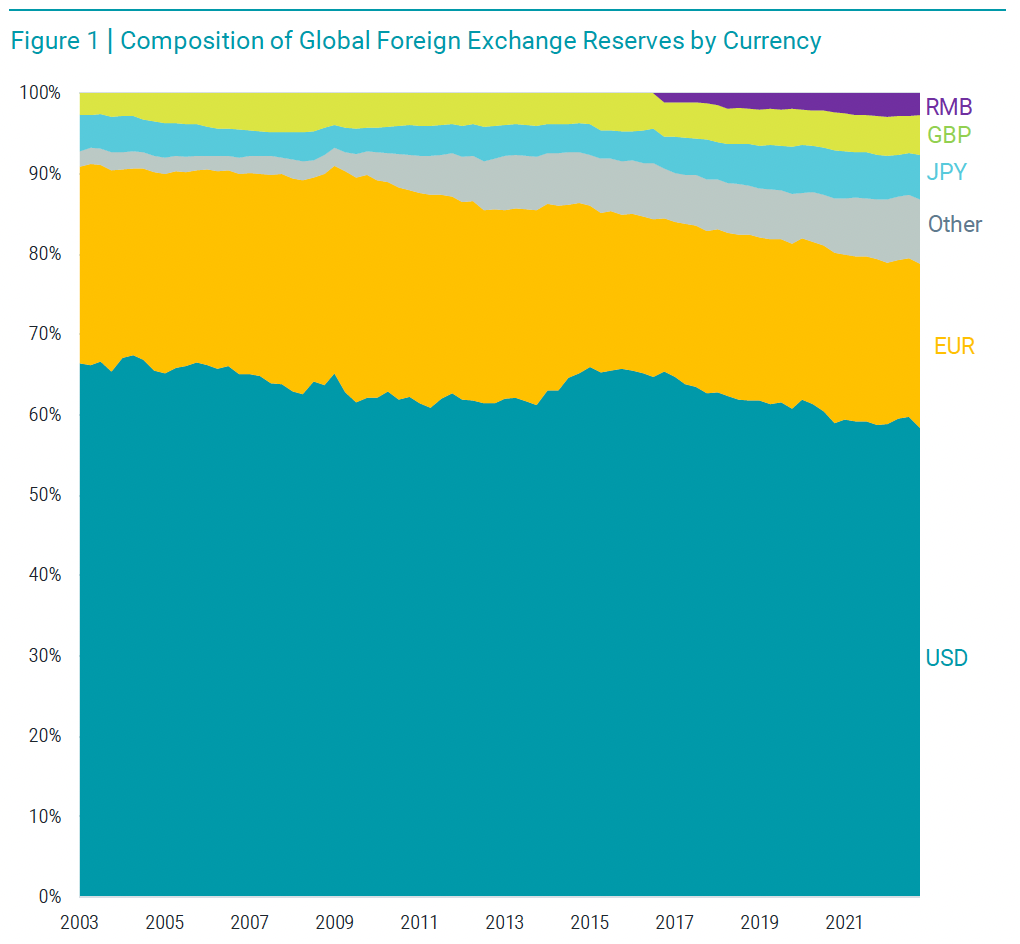

Analyzing The U S Dollars Early Performance A Nixon Era Comparison

Apr 28, 2025

Analyzing The U S Dollars Early Performance A Nixon Era Comparison

Apr 28, 2025 -

Nixons Shadow Will The U S Dollars First 100 Days Underperform

Apr 28, 2025

Nixons Shadow Will The U S Dollars First 100 Days Underperform

Apr 28, 2025 -

U S Dollar Performance A Troubling First 100 Days Compared To Nixon Era

Apr 28, 2025

U S Dollar Performance A Troubling First 100 Days Compared To Nixon Era

Apr 28, 2025 -

Is The U S Dollar Headed For Its Worst 100 Days Since Nixon

Apr 28, 2025

Is The U S Dollar Headed For Its Worst 100 Days Since Nixon

Apr 28, 2025 -

U S Dollars Steep Decline Worst Start Since Nixon

Apr 28, 2025

U S Dollars Steep Decline Worst Start Since Nixon

Apr 28, 2025