G-7 Nations Consider Revised De Minimis Tariffs For Chinese Products

Table of Contents

Current De Minimis Tariff Levels and their Impact

Currently, de minimis tariff levels for Chinese imports vary across G7 nations. These levels determine the value below which imported goods are exempt from tariffs. For example, some countries may have a threshold of $800, while others might have a higher or lower limit. These existing de minimis values significantly impact e-commerce and small businesses, offering them a competitive advantage by reducing import costs on smaller shipments.

The impact of these current levels is substantial:

- Examples of products currently affected: Numerous everyday consumer goods, such as clothing, electronics accessories, and small household items, frequently benefit from the current de minimis exemptions.

- Statistics illustrating the volume of goods currently exempt: While precise figures are difficult to obtain across all G7 nations, estimates suggest a substantial volume of goods currently enter these markets tariff-free due to the existing de minimis thresholds. This has fueled the growth of e-commerce platforms and cross-border trade.

- Analysis of the competitive landscape shaped by existing tariffs: The current system creates a competitive landscape where smaller businesses and online retailers selling Chinese products have a distinct cost advantage over larger importers who face full tariffs. This has led to concerns from some domestic industries about unfair competition.

Proposed Revisions to De Minimis Tariffs and their Rationale

The proposed revisions to de minimis thresholds aim to significantly lower the exemption value. Specific numerical changes are still under discussion, but a reduction to a level closer to zero or a significantly lower value is anticipated.

The rationale behind these proposed revisions is multifaceted:

- Addressing unfair trade practices: Some argue that the current low thresholds facilitate unfair competition from Chinese businesses engaging in practices that undermine domestic industries.

- Protecting domestic industries: Raising de minimis tariffs is seen by some as a way to level the playing field and safeguard domestic producers from cheaper imports.

- Revenue generation: Increasing tariffs could lead to increased government revenue.

Specific details of the proposed changes include:

- Specific numerical changes suggested: While exact numbers remain confidential, a reduction of the de minimis threshold to as low as $20 or even elimination is being discussed.

- Statements from G7 officials regarding the rationale: Public statements from G7 officials highlight the need to address concerns about unfair trade practices, protect domestic jobs, and ensure a level playing field.

- Potential impact on different product categories: The impact will vary greatly depending on the product category and its price point. Lower-priced items will be more severely affected.

Potential Economic and Political Consequences of the Changes

The proposed changes will have far-reaching economic and political consequences:

- Potential effects on Chinese exporters: Chinese exporters, particularly small and medium-sized enterprises (SMEs) relying on low-value shipments, will face significant challenges. Increased tariffs could drastically reduce their competitiveness in G7 markets.

- Impact on G7 consumers: Consumers may see price increases on a wide range of products imported from China, and the availability of some lower-cost goods could decrease.

- Possible political ramifications: The changes could strain trade relations between the G7 and China, potentially leading to retaliatory measures and increased trade tensions.

Further consequences include:

- Predictions for economic growth in affected sectors: Sectors heavily reliant on low-cost Chinese imports may experience slowed growth, while domestic industries producing comparable goods might see a boost.

- Analysis of consumer price sensitivity to tariff changes: The impact on consumer spending will depend on the elasticity of demand for affected products. Essential goods are likely to see less of a drop in demand.

- Potential retaliatory measures from China: China may respond with its own trade restrictions or tariffs, escalating trade tensions and harming global economic stability.

Industry Reactions and Lobbying Efforts

The proposed changes have spurred significant reactions and lobbying efforts from various industries and stakeholders.

- Responses from different industries: Retailers are generally concerned about potential price increases and reduced product availability. Manufacturing industries, on the other hand, may welcome the changes as a form of protection.

- Highlighting lobbying activities by businesses and trade organizations: Intense lobbying is underway, with industry groups and trade organizations presenting their arguments to G7 governments.

- Discuss the perspectives of various stakeholders: The perspectives vary considerably, with importers and consumers generally opposed to the changes, while domestic producers and some government officials support them.

Specific examples of these activities include:

- Quotes from industry leaders expressing concerns or support: Numerous statements from CEOs and industry leaders reflect the divergent opinions and the potential economic ramifications.

- Examples of lobbying efforts by specific groups: Powerful lobbying groups representing diverse interests are actively involved in shaping the final outcome.

- Analysis of the effectiveness of these lobbying strategies: The outcome will significantly depend on the success of these lobbying efforts in influencing government policy.

Conclusion

The G7's consideration of revised de minimis tariffs on Chinese products is a significant development with profound consequences for global trade. The proposed changes could substantially alter global trade flows, impacting businesses, consumers, and international relations. Understanding the intricacies of these adjustments is vital for effective strategic planning.

Call to Action: Stay informed about the ongoing developments regarding G7 de minimis tariffs on Chinese products. Regularly monitor updates on trade policy and engage in discussions to fully grasp the impact of these changes on your business or industry. Understanding these de minimis tariff revisions is key to navigating the future of international trade.

Featured Posts

-

Sadie Sink And Mia Farrow Broadways Photo 5162787 Moment

May 25, 2025

Sadie Sink And Mia Farrow Broadways Photo 5162787 Moment

May 25, 2025 -

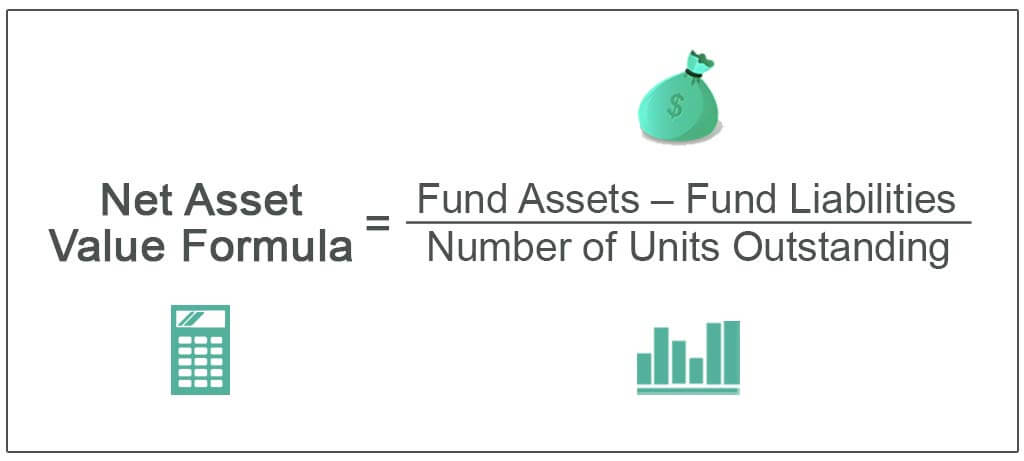

How To Calculate The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

How To Calculate The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Auto Legendas F1 Motorral Szerelt Porsche Koezuti Verzio

May 25, 2025

Auto Legendas F1 Motorral Szerelt Porsche Koezuti Verzio

May 25, 2025 -

Controversy Surrounding Claire Williams And George Russells Time At Williams Racing

May 25, 2025

Controversy Surrounding Claire Williams And George Russells Time At Williams Racing

May 25, 2025 -

Mercedes Boss Wolff On Russell Lucky To Have Him Addressing Underrated Comments

May 25, 2025

Mercedes Boss Wolff On Russell Lucky To Have Him Addressing Underrated Comments

May 25, 2025

Latest Posts

-

Atletico Madrid Hasret Sonunda Bitti Yeniden Kazaniyor

May 25, 2025

Atletico Madrid Hasret Sonunda Bitti Yeniden Kazaniyor

May 25, 2025 -

Atletico Madrid In 3 Maclik Kara Serisi Sonlandi

May 25, 2025

Atletico Madrid In 3 Maclik Kara Serisi Sonlandi

May 25, 2025 -

3 Mac Sonra Galibiyet Atletico Madrid In Zaferi

May 25, 2025

3 Mac Sonra Galibiyet Atletico Madrid In Zaferi

May 25, 2025 -

Atletico Madrid In 3 Maclik Hasreti Bitti

May 25, 2025

Atletico Madrid In 3 Maclik Hasreti Bitti

May 25, 2025 -

Atletico Madrid 3 Maclik Galibiyetsizligi Son Buldu

May 25, 2025

Atletico Madrid 3 Maclik Galibiyetsizligi Son Buldu

May 25, 2025