How To Calculate The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Understanding the Components of the Amundi Dow Jones Industrial Average UCITS ETF NAV

The Amundi Dow Jones Industrial Average UCITS ETF tracks the performance of the Dow Jones Industrial Average (DJIA), mirroring the price movements of its 30 constituent companies. Calculating the ETF's NAV involves understanding these components and their impact on the overall value.

The ETF's holdings consist of shares in each of the 30 blue-chip companies comprising the DJIA. Each company is weighted within the ETF according to its representation in the DJIA index. This weighting ensures the ETF's performance closely reflects the index.

Market prices play a vital role in NAV calculation. The market value of each holding fluctuates throughout the trading day, directly affecting the ETF's overall value. These prices, obtained from reputable financial exchanges, form the foundation of the NAV calculation.

Besides the market value of its holdings, other factors influence the NAV. These include:

- Management fees: These are deducted from the total asset value of the ETF.

- Expenses: Administrative and operational costs incurred by the ETF provider.

- Other liabilities: Any other outstanding financial obligations.

To understand the complete picture, we need to consider these factors:

- Market value of each holding: The current market price multiplied by the number of shares held.

- Number of shares held: The quantity of each company's shares owned by the ETF.

- Total value of holdings: The sum of the market value of all holdings.

- Total expenses: The aggregation of management fees and all other operating expenses.

- Total assets: The sum of the total value of holdings less total expenses.

Step-by-Step Guide to Calculating the Amundi Dow Jones Industrial Average UCITS ETF NAV

Let's illustrate the NAV calculation with a simplified hypothetical example. Assume the ETF holds 100 shares of each of the 30 Dow Jones companies.

Step 1: Gather Market Prices: Obtain the closing prices for each of the 30 Dow Jones Industrial Average companies from a reliable source like Yahoo Finance or Bloomberg.

Step 2: Calculate the Market Value of Each Holding: For each company, multiply its closing price by the number of shares held by the ETF (in our example, 100 shares).

Step 3: Sum the Market Values: Add up the market values calculated in Step 2 to determine the total value of all holdings.

Step 4: Deduct Total Expenses: Subtract the total expenses (management fees and other costs) from the total value of holdings. This gives you the net asset value.

Step 5: Divide by Outstanding Shares: Divide the net asset value (calculated in Step 4) by the total number of outstanding shares of the Amundi Dow Jones Industrial Average UCITS ETF. This provides the NAV per share.

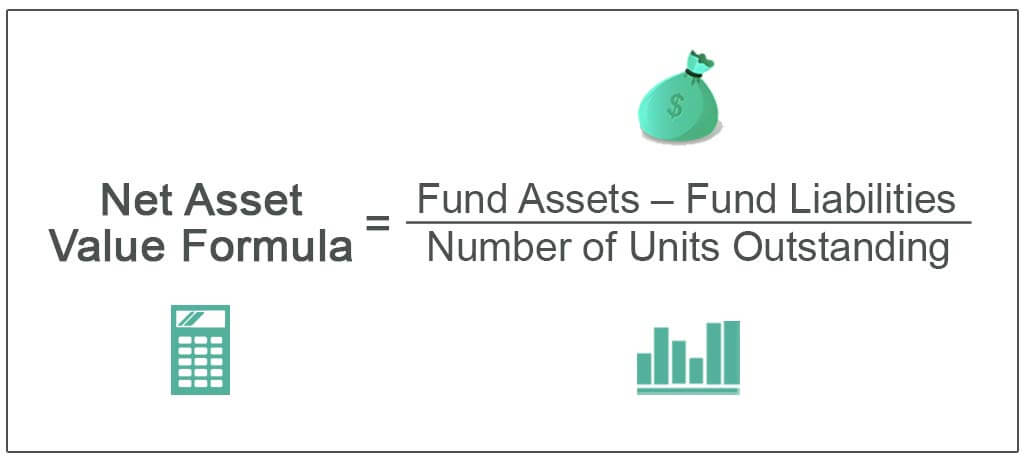

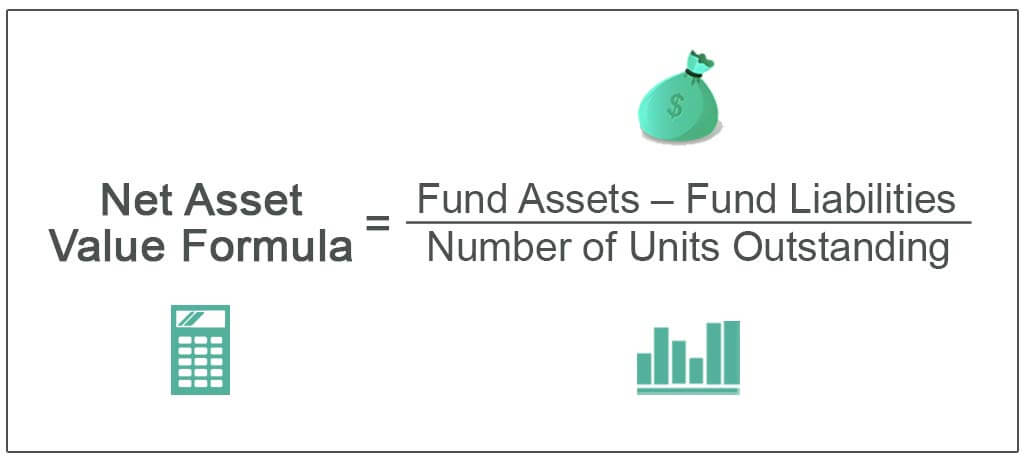

Formula:

NAV per share = (Total Market Value of Holdings - Total Expenses) / Total Number of Outstanding ETF Shares

It is crucial to use real-time or end-of-day market data for the most accurate NAV calculation. Using delayed or outdated data will lead to an inaccurate representation of the ETF's value.

- Gather market prices for each Dow Jones component.

- Calculate the market value of each holding (Price x Number of Shares).

- Sum the market values of all holdings.

- Deduct total expenses (fees, etc.).

- Divide the net asset value by the total number of outstanding ETF shares.

- Result: NAV per share.

Where to Find Official NAV Data for the Amundi Dow Jones Industrial Average UCITS ETF

While calculating the NAV yourself provides a deeper understanding, relying on official sources for investment decisions is paramount. The most reliable sources for the Amundi Dow Jones Industrial Average UCITS ETF NAV are:

- Amundi's official website: Check their investor relations section for daily NAV updates.

- Financial news websites: Reputable financial news websites like Bloomberg, Yahoo Finance, and Google Finance typically provide ETF NAV data.

- Your brokerage account: Your online brokerage account will display the current NAV of your holdings.

It's important to understand that the NAV you calculate might differ slightly from the official NAV. This discrepancy arises from timing differences in data acquisition and the inclusion of certain operational adjustments made by the fund manager. Always prioritize the official NAV published by Amundi or a trusted data provider for your investment decisions.

- Amundi's official website

- Financial news websites (e.g., Bloomberg, Yahoo Finance)

- Your brokerage account

Conclusion: Mastering Amundi Dow Jones Industrial Average UCITS ETF NAV Calculation

Calculating the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF involves understanding its holdings, applying the correct formula, and utilizing accurate, real-time data. While a self-calculated NAV offers valuable insights, always refer to the official NAV published by Amundi or reputable financial data providers for investment decisions. Mastering this calculation empowers you to actively monitor your investment, assess performance, and optimize your portfolio management strategies. Master your investment strategy by regularly calculating the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF and make informed decisions about your portfolio.

Featured Posts

-

Finding Peace Amidst The Pandemic A Seattle Womans Connection To Nature

May 25, 2025

Finding Peace Amidst The Pandemic A Seattle Womans Connection To Nature

May 25, 2025 -

Kuda Propali Pobediteli Evrovideniya Zhizn Posle Pobedy Za Poslednie 10 Let

May 25, 2025

Kuda Propali Pobediteli Evrovideniya Zhizn Posle Pobedy Za Poslednie 10 Let

May 25, 2025 -

Frances National Rally Le Pens Sunday Demonstration Falls Short Of Expected Show Of Force

May 25, 2025

Frances National Rally Le Pens Sunday Demonstration Falls Short Of Expected Show Of Force

May 25, 2025 -

Prime Videos Picture This Every Song Featured In The Romantic Comedy

May 25, 2025

Prime Videos Picture This Every Song Featured In The Romantic Comedy

May 25, 2025 -

F1 Technologia A Koezuton Egyedi Porsche Modell Bemutatasa

May 25, 2025

F1 Technologia A Koezuton Egyedi Porsche Modell Bemutatasa

May 25, 2025

Latest Posts

-

Amsterdam Stock Market Experiences Major Setback Aex Index At 1 Year Low

May 25, 2025

Amsterdam Stock Market Experiences Major Setback Aex Index At 1 Year Low

May 25, 2025 -

Us Tariff Pause Sends Euronext Amsterdam Stocks Up 8

May 25, 2025

Us Tariff Pause Sends Euronext Amsterdam Stocks Up 8

May 25, 2025 -

Significant Drop In Amsterdam Stock Exchange Aex Index Down Over 4

May 25, 2025

Significant Drop In Amsterdam Stock Exchange Aex Index Down Over 4

May 25, 2025 -

Relx Succes Ai Strategie Overwint Economische Onzekerheid

May 25, 2025

Relx Succes Ai Strategie Overwint Economische Onzekerheid

May 25, 2025 -

Aex Index Falls Below Key Support Level Years Lowest Point Reached

May 25, 2025

Aex Index Falls Below Key Support Level Years Lowest Point Reached

May 25, 2025