Global Bond Market Instability: A Posthaste Warning

Table of Contents

Rising Interest Rates and Their Impact

The actions of central banks around the world are having a profound impact on the global bond market. Understanding the mechanics of these interest rate hikes is crucial to navigating the current instability.

The Mechanics of Interest Rate Hikes

Central banks raise interest rates primarily to combat inflation. However, this action has a direct and often inverse relationship with bond prices. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This reduced demand leads to a decline in the price of existing bonds. Furthermore, an inverted yield curve—where short-term bond yields exceed long-term yields—often signals an impending economic slowdown or recession, further exacerbating market uncertainty.

- Increased borrowing costs for governments and corporations: Higher interest rates make it more expensive for governments and companies to borrow money, potentially slowing economic growth and impacting their ability to service existing debt.

- Reduced demand for existing bonds, leading to price declines: As new bonds offer higher yields, investors are less inclined to hold onto older bonds, driving down their prices.

- Increased risk of defaults for high-yield bonds: Companies with weaker credit ratings are particularly vulnerable to rising interest rates, increasing the risk of defaults on their bonds.

- Impact on different bond types (government bonds, corporate bonds, emerging market bonds): Different bond types are affected differently. Government bonds, often considered safe-haven assets, may see increased demand during periods of uncertainty, while corporate and emerging market bonds are more susceptible to price volatility.

This interplay of factors highlights the significance of understanding "interest rate risk" and how "rising interest rates impact" bond portfolios. Careful monitoring of "bond yield" curves and central bank policy announcements are crucial.

Inflationary Pressures and Bond Market Performance

Inflation poses a significant threat to the stability of the global bond market. The relationship between inflation and bond prices is fundamentally inverse.

The Inflation-Bond Price Relationship

High inflation erodes the purchasing power of fixed-income investments like bonds. When inflation rises unexpectedly, the real return (or "real yield") on a bond decreases, making them less attractive to investors. This leads to a decline in bond prices as investors seek assets that offer better protection against inflation.

- How high inflation erodes the purchasing power of fixed-income investments: Inflation reduces the value of future interest payments and the principal repayment at maturity.

- The role of inflation expectations in shaping bond yields: Investors factor in expected inflation when assessing bond yields, demanding higher yields to compensate for anticipated inflation.

- The impact of unexpected inflation on bond market volatility: Unexpected surges in inflation can trigger significant volatility in the bond market as investors re-evaluate their holdings and adjust their expectations.

Understanding "inflationary pressures" and their impact on "bond price volatility" is critical. Strategies like "inflation hedging" through inflation-linked bonds or other assets become vital to maintaining portfolio value.

Geopolitical Risks and Their Influence

Geopolitical events exert a considerable influence on global bond market stability, often causing abrupt shifts in investor sentiment.

Global Conflicts and Market Uncertainty

Global conflicts and political instability introduce significant uncertainty into financial markets. This uncertainty can lead to increased risk aversion, capital flight, and volatility in bond prices.

- Increased risk aversion and capital flight: Investors may withdraw investments from riskier assets, including bonds, and seek safer havens.

- Flight to safety and the demand for government bonds: During times of geopolitical uncertainty, investors often flock to government bonds of stable economies, driving up their prices and lowering yields.

- The impact of sanctions and trade wars on international bond markets: Geopolitical tensions can disrupt global trade and investment flows, impacting the performance of international bond markets.

The term "geopolitical risk" has become increasingly relevant in assessing "global bond market volatility." Identifying and evaluating "market uncertainty" stemming from global events is crucial for effective risk management. Safe haven assets like US treasury bonds often benefit from this flight to safety.

Assessing and Mitigating Risk in the Global Bond Market

Navigating the current period of "global bond market instability" requires a proactive approach to risk management.

Diversification Strategies

Diversifying across different bond types (government, corporate, municipal), maturities, and geographies is crucial to reducing overall portfolio risk. This helps to mitigate the impact of any single event or factor.

Hedging Techniques

Employing hedging techniques, such as using derivatives or investing in inflation-linked bonds, can help to protect against specific risks, such as rising interest rates or unexpected inflation.

- Importance of due diligence and credit analysis: Thorough research and analysis of individual bonds are crucial to identifying and managing credit risk.

- The role of professional financial advice: Seeking guidance from a financial advisor experienced in fixed-income investments is highly recommended.

- Regular portfolio monitoring and rebalancing: Regularly reviewing and adjusting your portfolio based on market conditions is vital for maintaining an optimal risk profile.

Effective "risk management" and "bond portfolio diversification" are essential to navigating "global bond market investment" during times of instability. Employing "risk mitigation strategies" is key to preserving capital and achieving investment goals.

Conclusion

In summary, Global Bond Market Instability is driven by a confluence of factors: rising interest rates, inflationary pressures, and escalating geopolitical risks. Understanding these interconnected forces is paramount. The key takeaways emphasize the importance of proactive risk management, including diversification, hedging, thorough due diligence, and seeking professional financial guidance. Understanding and managing the risks associated with Global Bond Market Instability is crucial for investors. Consult with a financial professional to create a resilient investment strategy tailored to your specific needs.

Featured Posts

-

Kak Zhenyatsya Na Kharkovschine Svadebniy Bum Bolee 600 Brakov Za Mesyats

May 24, 2025

Kak Zhenyatsya Na Kharkovschine Svadebniy Bum Bolee 600 Brakov Za Mesyats

May 24, 2025 -

Escape To The Country Affordable Luxury Homes Under 1 Million

May 24, 2025

Escape To The Country Affordable Luxury Homes Under 1 Million

May 24, 2025 -

Nyt Mini Crossword Answers And Clues April 18 2025

May 24, 2025

Nyt Mini Crossword Answers And Clues April 18 2025

May 24, 2025 -

Escape To The Country Budgeting And Financing Your Rural Move

May 24, 2025

Escape To The Country Budgeting And Financing Your Rural Move

May 24, 2025 -

Hot Wheels Ferrari New Sets A Mamma Mia Experience

May 24, 2025

Hot Wheels Ferrari New Sets A Mamma Mia Experience

May 24, 2025

Latest Posts

-

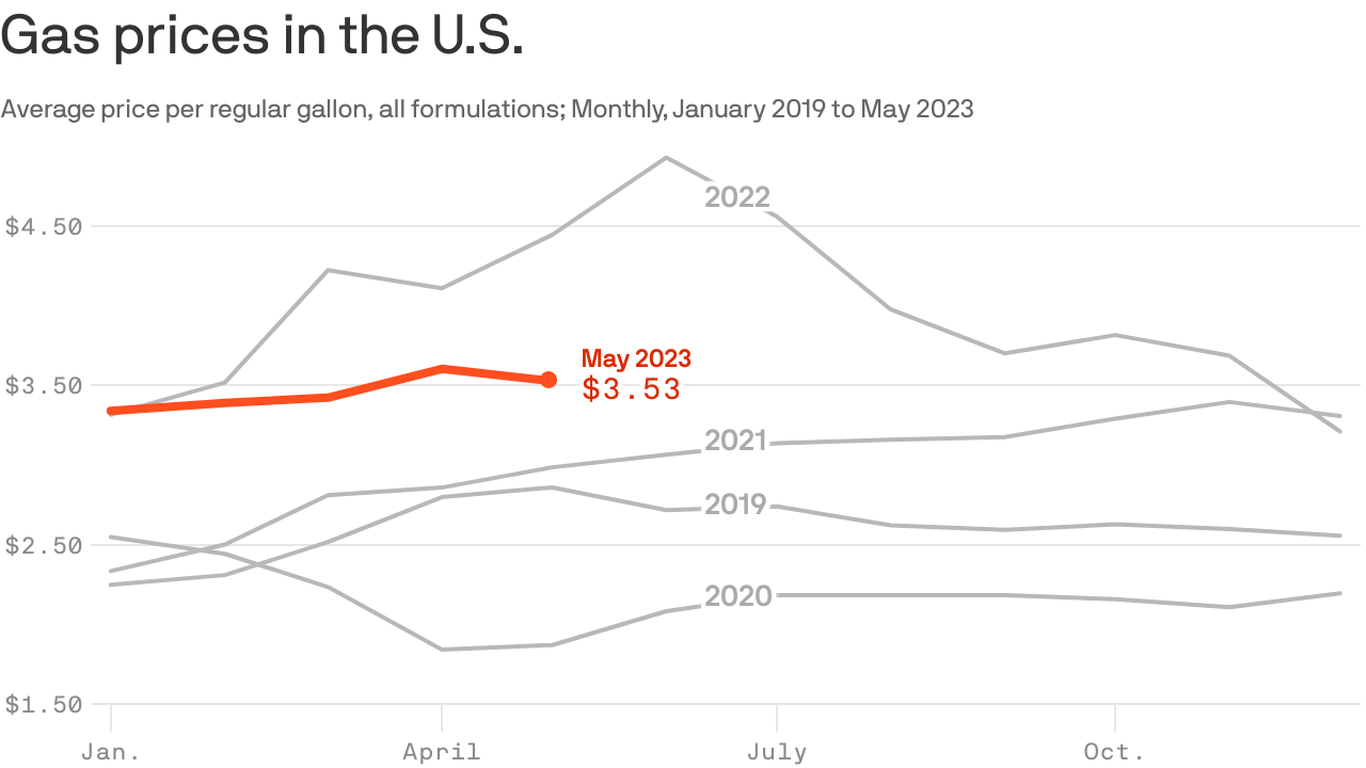

Memorial Day Gas Prices Expected To Be Historically Low

May 24, 2025

Memorial Day Gas Prices Expected To Be Historically Low

May 24, 2025 -

Lowest Memorial Day Gas Prices In Years

May 24, 2025

Lowest Memorial Day Gas Prices In Years

May 24, 2025 -

Bull Riding Faith And Film Neal Mc Donough Discusses The Last Rodeo

May 24, 2025

Bull Riding Faith And Film Neal Mc Donough Discusses The Last Rodeo

May 24, 2025 -

Sylvester Stallone In Tulsa King Season 3 Cast Updates Filming News And New Look

May 24, 2025

Sylvester Stallone In Tulsa King Season 3 Cast Updates Filming News And New Look

May 24, 2025 -

Cheaper Gas This Memorial Day Weekend What To Expect

May 24, 2025

Cheaper Gas This Memorial Day Weekend What To Expect

May 24, 2025