Global Trade Tensions Chill Tech IPO Market

Table of Contents

Increased Geopolitical Risk and Investment Hesitation

Rising global trade tensions, coupled with escalating sanctions and political instability, are injecting a hefty dose of uncertainty into the global financial markets. This uncertainty fosters a climate of risk aversion, making investors hesitant to commit substantial capital to the inherently risky ventures of tech IPOs. Investors are increasingly seeking safer, more established investments, leaving many promising tech startups stranded in the pre-IPO phase.

- Increased unpredictability in global markets: Trade wars and geopolitical conflicts create unpredictable shifts in market sentiment, making it difficult to forecast the long-term performance of even the most promising tech companies.

- Shift towards safer, more established investments: Investors are flocking towards established companies and assets perceived as less vulnerable to global economic shocks, reducing the pool of capital available for riskier tech IPOs.

- Higher perceived risk for tech startups entering the public market: The heightened uncertainty amplifies the already considerable risk associated with investing in young, rapidly growing companies, deterring potential investors.

- Examples of specific trade disputes impacting investor confidence: The ongoing US-China trade war, sanctions against certain countries, and regional conflicts all contribute to a general sense of global instability, negatively impacting investor confidence in the tech sector.

Supply Chain Disruptions and Their Impact on Tech Companies

Trade wars and sanctions don't just affect investor sentiment; they directly disrupt global supply chains, creating significant challenges for tech companies. These disruptions increase manufacturing costs, introduce delays, and create uncertainty regarding the availability of essential components. These factors significantly impact a company's profitability projections, making them less attractive to potential investors considering an IPO.

- Increased manufacturing costs due to tariffs and trade barriers: Import/export tariffs and trade barriers dramatically increase the cost of procuring raw materials and manufacturing goods, squeezing profit margins for tech companies.

- Difficulty in sourcing essential components and raw materials: Disruptions to global supply chains can lead to shortages of vital components, delaying production and negatively affecting a company's ability to meet market demands.

- Impact on production timelines and delivery schedules: Supply chain disruptions inevitably lead to delays, impacting a company’s ability to fulfill orders and meet revenue projections, thereby reducing investor confidence.

- Examples of tech companies affected by supply chain disruptions: Numerous tech companies, particularly those reliant on complex global supply chains for components like semiconductors and rare earth minerals, have experienced significant disruptions and cost increases due to trade tensions.

The Impact on Valuation and Funding Rounds

The current global trade environment significantly impacts the valuations of tech companies planning to go public. Increased investor risk aversion leads to lower valuations, making it harder for companies to secure favorable funding in later funding rounds and attract the necessary capital to successfully navigate the IPO process. This, in turn, contributes to fewer companies attempting IPOs or delaying their plans indefinitely.

- Lower valuations due to increased investor risk aversion: Uncertainty surrounding future market conditions and the potential for further trade disruptions leads to lower valuations for tech companies, reducing the potential returns for investors.

- Reduced venture capital and private equity investment: The current climate has seen a decrease in venture capital and private equity investment in the tech sector, as investors adopt a more cautious approach.

- Increased difficulty in securing favorable IPO pricing: Lower valuations translate into less attractive IPO pricing for companies, making it harder to raise the necessary capital and potentially leading to canceled or postponed IPOs.

- Examples of companies delaying or canceling IPOs due to market conditions: Several tech companies have postponed or canceled their IPO plans due to concerns about market volatility and the impact of global trade tensions on their business prospects.

Alternative Funding Sources and Their Limitations

Faced with the challenges of the volatile IPO market, some tech companies are exploring alternative funding sources such as private investment, debt financing, strategic partnerships, or bootstrapping. However, these alternatives often come with their own set of limitations. Private funding might require relinquishing a larger equity stake, debt financing can burden the company with substantial debt obligations, and securing strategic partnerships can be time-consuming and may not provide the necessary capital. Bootstrapping, relying solely on internal resources, limits growth potential.

Conclusion

In summary, global trade tensions are significantly impacting the tech IPO market. Increased geopolitical risk, supply chain disruptions, and the consequent negative effects on company valuations are creating a chilling effect on investor enthusiasm. This increased risk aversion is leading to a significant slowdown in tech initial public offerings. Understanding the chill in the tech IPO market caused by global trade tensions is crucial for investors, entrepreneurs, and policymakers alike. Staying informed about global trade developments and their potential impact on specific sectors and companies is paramount. Further research into the evolving geopolitical landscape and its influence on the tech industry will be vital in navigating this challenging period.

Featured Posts

-

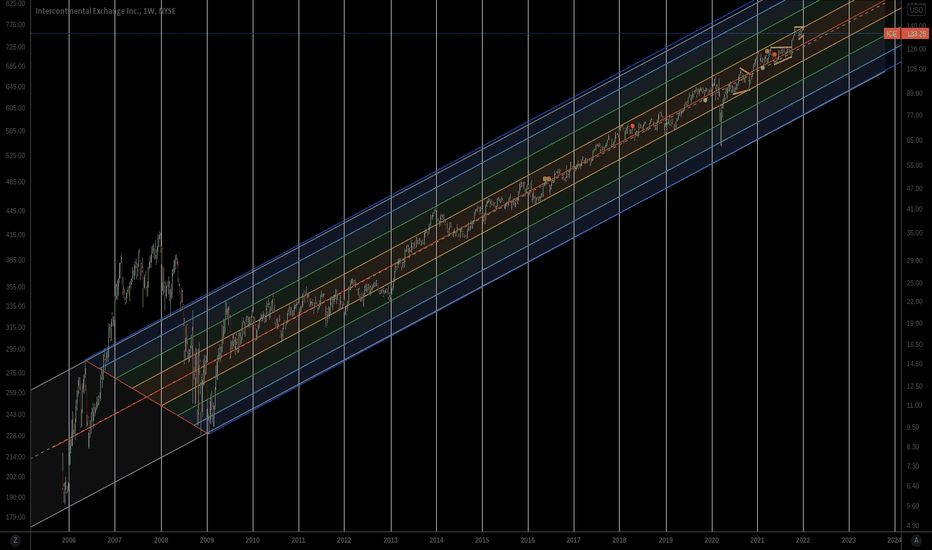

Strong Nyse Trading Volume Boosts Ices First Quarter Earnings Beyond Forecasts

May 14, 2025

Strong Nyse Trading Volume Boosts Ices First Quarter Earnings Beyond Forecasts

May 14, 2025 -

Find Your Perfect Weekend Movie Netflixs Charming New Release

May 14, 2025

Find Your Perfect Weekend Movie Netflixs Charming New Release

May 14, 2025 -

Discover Lindts Chocolate Paradise A New London Experience

May 14, 2025

Discover Lindts Chocolate Paradise A New London Experience

May 14, 2025 -

Celta Vs Sevilla En Vivo Fecha 35 De La Liga Espanola

May 14, 2025

Celta Vs Sevilla En Vivo Fecha 35 De La Liga Espanola

May 14, 2025 -

Federer Se Vra A Nedosta U Mi Publika I Puni Stadioni

May 14, 2025

Federer Se Vra A Nedosta U Mi Publika I Puni Stadioni

May 14, 2025

Latest Posts

-

Cannonball U Tv Show Episode Guide And Air Dates

May 14, 2025

Cannonball U Tv Show Episode Guide And Air Dates

May 14, 2025 -

Boycott Eurovision Israel Directors Response To Criticism

May 14, 2025

Boycott Eurovision Israel Directors Response To Criticism

May 14, 2025 -

Cannonball U Your Complete Tv Guide

May 14, 2025

Cannonball U Your Complete Tv Guide

May 14, 2025 -

Revealed Maya Jamas Beauty Secrets And Her Go To Hair Product

May 14, 2025

Revealed Maya Jamas Beauty Secrets And Her Go To Hair Product

May 14, 2025 -

Gary Linekers Comment On Ruben Dias Maya Jamas Response

May 14, 2025

Gary Linekers Comment On Ruben Dias Maya Jamas Response

May 14, 2025