Gold Rises Amidst Heightened Trade War Concerns After Trump's EU Statements

Table of Contents

Keywords: Gold price, trade war, gold investment, safe haven asset, Trump, EU trade, precious metals, gold market, economic uncertainty, inflation hedge.

President Trump's recent pronouncements regarding trade relations with the European Union have ignited fresh anxieties about a potential escalation of global trade tensions. This uncertainty has, predictably, driven investors towards the traditional safe haven asset: gold. The price of gold has experienced a notable surge in response, prompting analysis of the relationship between geopolitical instability and precious metal investment. This article delves into the reasons behind gold's recent rise and examines its role as a hedge against economic uncertainty.

Trump's Statements and Market Reaction

The Impact of Trade War Rhetoric

President Trump's rhetoric surrounding trade with the EU has significantly impacted investor sentiment and market volatility. His statements, often delivered via Twitter and press conferences, frequently introduce uncertainty into the market. This unpredictability creates a climate of fear and doubt, leading to significant market fluctuations.

- Specific Statement Example 1: On [Date], President Trump announced [Specific statement about tariffs or trade restrictions on EU goods]. This immediately led to a [Percentage]% increase in the gold price within [Timeframe].

- Specific Statement Example 2: Following [Another specific statement or event], the Dow Jones Industrial Average experienced a [Percentage]% drop, while the price of gold rose by [Percentage]%.

- Media Amplification: The media plays a crucial role in amplifying these concerns, often contributing to a heightened sense of panic and uncertainty amongst investors. Sensationalized headlines and 24/7 news coverage can exacerbate market reactions.

Safe Haven Demand for Gold

Gold's recent price surge reflects its historical role as a safe haven asset during periods of economic and geopolitical uncertainty. When investors feel anxious about the future, they often "flight-to-safety," seeking assets perceived as stable and reliable stores of value. Gold, with its limited supply and enduring appeal, fits this description perfectly.

- Flight-to-Safety: This phenomenon is driven by a desire to preserve capital during times of turmoil. Investors move away from riskier assets like stocks and bonds and into assets perceived as less vulnerable to market fluctuations.

- Historical Examples: Gold's value has historically increased during periods of significant global instability, including previous trade wars, financial crises (e.g., the 2008 financial crisis), and geopolitical conflicts.

- Portfolio Diversification: Including gold in a diversified investment portfolio can help mitigate risk and protect against losses in other asset classes. It acts as a buffer against overall portfolio volatility.

The Weakening Dollar and Gold's Price

The Inverse Relationship

Gold prices are inversely correlated with the US dollar. This means that when the dollar weakens, the price of gold (which is typically priced in USD) tends to rise. This is because it takes more dollars to buy the same amount of gold.

- Why a Weaker Dollar Boosts Gold Prices: A weaker dollar makes gold more attractive to international investors who hold other currencies. The increased demand drives up the price.

- Factors Contributing to Dollar Weakness: Several factors can contribute to dollar weakness, including interest rate differentials between the US and other countries, widening trade deficits, and geopolitical uncertainties.

- Chart Correlation: [Insert a chart or graph visually demonstrating the inverse correlation between the US Dollar Index and gold prices].

Inflationary Pressures

Trade disputes often lead to inflationary pressures. Tariffs and trade restrictions can increase the cost of imported goods, pushing up prices for consumers. Gold has historically served as an inflation hedge, meaning its value tends to increase during inflationary periods.

- Gold as an Inflation Hedge: Gold's value is not directly tied to the performance of any particular economy, making it a relatively stable asset during inflationary times.

- Inflation from Trade Disputes: Tariffs and trade wars disrupt supply chains and can lead to shortages, increasing the prices of affected goods.

- Central Bank Policies: Central bank policies, such as interest rate adjustments, also play a crucial role in influencing both inflation and gold prices.

Investing in Gold During Uncertain Times

Investment Options

There are several ways to invest in gold, each with its own set of advantages and disadvantages:

- Physical Gold: Buying physical gold (bars, coins) offers tangible ownership but involves storage and security considerations.

- Gold ETFs (Exchange-Traded Funds): ETFs offer a convenient way to invest in gold without the hassle of physical storage. They track the price of gold and are easily traded on stock exchanges.

- Gold Mining Stocks: Investing in gold mining companies can provide leverage to gold price movements but carries higher risk due to the operational complexities of mining companies.

Strategies for Managing Risk

Investing in gold, like any investment, involves risk. However, you can mitigate those risks by:

- Portfolio Diversification: Don't put all your eggs in one basket. Diversify your portfolio across different asset classes to reduce overall risk.

- Asset Allocation: Carefully allocate your investment funds across different assets based on your risk tolerance and investment goals.

- Thorough Research: Before investing in gold, conduct thorough research to understand the various investment options and associated risks.

- Long-Term Perspective: Gold investments are generally best suited for a long-term outlook. Short-term fluctuations are less significant when considering long-term growth.

Conclusion

President Trump's statements on EU trade have undeniably fueled market uncertainty, driving investors towards gold as a safe haven asset. The weakening dollar and potential inflationary pressures further bolster gold's appeal. Understanding the inverse relationship between the dollar and gold, as well as gold's role as an inflation hedge, is crucial for navigating the current economic climate. Several investment options exist, each with varying risk profiles. Careful consideration of risk management strategies, including portfolio diversification and thorough research, is essential.

Given the current geopolitical climate and the rising price of gold, now is the time to understand how to incorporate gold into your investment portfolio to mitigate risk. Research different gold investment options and consider consulting a financial advisor to develop a suitable strategy. [Link to a relevant resource on gold investment]

Featured Posts

-

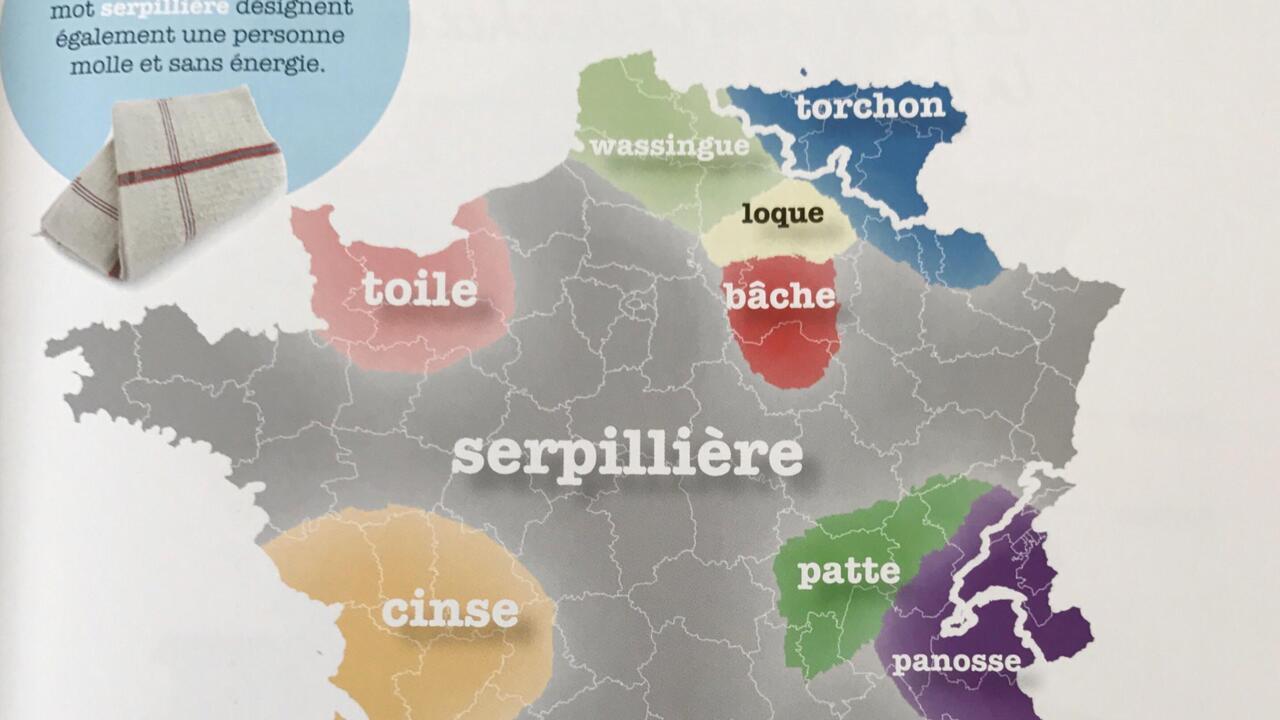

Mathieu Avanzi Le Francais Une Langue Vivante Qui Depasse L Ecole

May 25, 2025

Mathieu Avanzi Le Francais Une Langue Vivante Qui Depasse L Ecole

May 25, 2025 -

Astonishing Highway Refueling 90mph Police Chase Ends In Bizarre Scene

May 25, 2025

Astonishing Highway Refueling 90mph Police Chase Ends In Bizarre Scene

May 25, 2025 -

The Future Of Berkshire Hathaways Apple Stock A Post Buffett Analysis

May 25, 2025

The Future Of Berkshire Hathaways Apple Stock A Post Buffett Analysis

May 25, 2025 -

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 25, 2025

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 25, 2025 -

Finding Peace Amidst The Pandemic A Seattle Womans Connection To Nature

May 25, 2025

Finding Peace Amidst The Pandemic A Seattle Womans Connection To Nature

May 25, 2025

Latest Posts

-

Mynamynw Ywqe Ela Eqd Jdyd Me Mwnakw Tfasyl Altmdyd

May 25, 2025

Mynamynw Ywqe Ela Eqd Jdyd Me Mwnakw Tfasyl Altmdyd

May 25, 2025 -

El Estilo En El Baile De La Rosa 2025 De Carolina De Monaco A Alexandra De Hannover

May 25, 2025

El Estilo En El Baile De La Rosa 2025 De Carolina De Monaco A Alexandra De Hannover

May 25, 2025 -

Baile De La Rosa 2025 Los Vestidos Mas Elegantes De Carolina De Monaco Y Otras Invitadas

May 25, 2025

Baile De La Rosa 2025 Los Vestidos Mas Elegantes De Carolina De Monaco Y Otras Invitadas

May 25, 2025 -

Mwnakw Yjdd Eqd Mynamynw Mwsm Idafy Llnjm Alyabany

May 25, 2025

Mwnakw Yjdd Eqd Mynamynw Mwsm Idafy Llnjm Alyabany

May 25, 2025 -

Como Llevar Lino En Otono Consejos De Estilo De Charlene De Monaco

May 25, 2025

Como Llevar Lino En Otono Consejos De Estilo De Charlene De Monaco

May 25, 2025