GPB Capital Founder's Conviction: David Gentile Gets 7 Years For Fraud

Table of Contents

The GPB Capital Fraud Scheme

GPB Capital Holdings, once a prominent private equity firm, engaged in a sophisticated and wide-ranging investment fraud scheme. They marketed themselves as a safe and reliable investment opportunity, promising high returns to investors. However, behind the facade of success, GPB Capital was systematically defrauding its clients through various deceitful practices. The scale of the fraud was immense, impacting countless investors and leaving a trail of financial devastation.

- Misrepresentation of Assets: GPB Capital significantly overstated the value of its assets, creating a false impression of financial stability and profitability.

- Inflated Valuations: The company manipulated financial statements to inflate the worth of its holdings, deceiving investors about the true value of their investments.

- Misleading Investors: GPB Capital actively misled investors through false marketing materials, promises of high returns, and the withholding of critical information about their actual financial performance.

- Lack of Transparency: The firm operated with a distinct lack of transparency, making it incredibly difficult for investors to independently verify the accuracy of their financial reports.

The total amount of money involved in the GPB Capital fraud is estimated to be in the hundreds of millions of dollars, representing significant financial losses for countless victims. The scheme incorporated elements of both investment fraud and securities fraud, highlighting the complex nature of the financial crimes involved.

David Gentile's Role in the GPB Capital Scandal

David Gentile, the founder and CEO of GPB Capital, played a central role in orchestrating the fraudulent activities. As the principal figure within the organization, he held ultimate responsibility for its financial operations and decisions. Prosecutors argued that Gentile was the mastermind behind the scheme, actively directing and participating in the fraudulent activities detailed above.

- Direct Involvement: Evidence presented during the trial indicated Gentile's direct involvement in the misrepresentation of assets, the creation of misleading financial statements, and the dissemination of false information to investors.

- Leadership Role: Gentile's position as CEO gave him the authority and control necessary to execute the scheme.

- Beneficial Ownership: Investigations revealed that Gentile personally benefited significantly from the fraud, accumulating substantial wealth through the illegal activities of GPB Capital.

The Trial and Conviction of David Gentile

The trial of David Gentile was a high-profile legal battle that garnered significant media attention. The prosecution presented overwhelming evidence demonstrating Gentile's culpability in the GPB Capital fraud scheme. Key aspects of the trial included:

- Witness Testimonies: Former employees and investors provided compelling testimony detailing Gentile's involvement in the fraud and the manipulative tactics employed by GPB Capital.

- Financial Documents: Forensic accounting analysis uncovered significant discrepancies in GPB Capital's financial records, highlighting the manipulation and misrepresentation of assets.

- Guilty Verdict: After considering the evidence, the jury delivered a guilty verdict on multiple counts of securities fraud, wire fraud, and conspiracy.

The federal court sentencing reflected the severity of Gentile’s crimes and his central role in the extensive fraud.

The 7-Year Sentence and its Implications

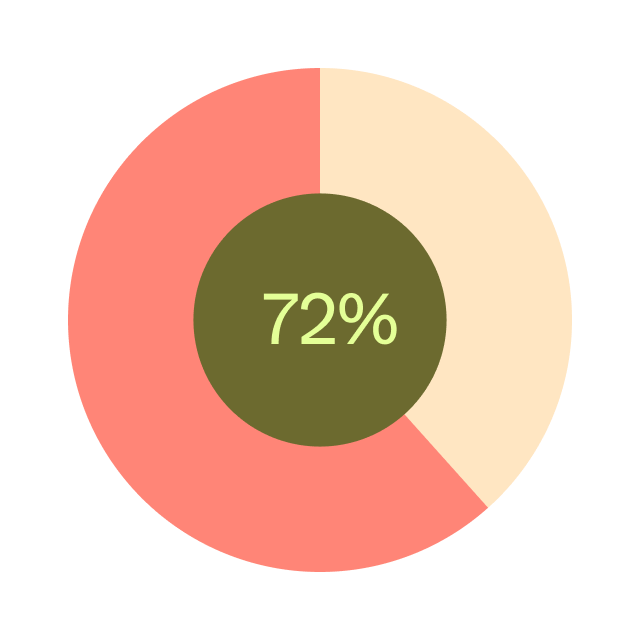

David Gentile received a 7-year prison sentence, a significant penalty that sends a strong message about the consequences of engaging in large-scale financial fraud. In addition to prison time, he likely faces substantial financial penalties including fines and restitution to victims.

- Impact on Victims: The sentence offers some measure of justice to the countless investors who suffered substantial financial losses due to Gentile's actions. However, it's unlikely to fully compensate for the devastating financial impact on victims.

- Broader Implications: The conviction and sentencing have broader implications for the financial industry, serving as a deterrent to others who might contemplate similar fraudulent schemes. The case also highlights the need for enhanced regulatory oversight and stronger investor protections.

- Regulatory Reform: This case is likely to spur increased scrutiny of private equity firms and a renewed focus on preventing future financial scandals.

Impact on Investors and the Future of GPB Capital

The GPB Capital fraud resulted in significant financial losses for countless investors, many of whom had entrusted their savings to the firm. Efforts are underway to recover funds for victims, although the process is complex and likely to take considerable time. GPB Capital itself is effectively defunct, its future prospects nonexistent due to the fallout from the extensive fraud.

Conclusion: Understanding the Significance of the GPB Capital Conviction

The conviction of David Gentile and his 7-year sentence for his role in the GPB Capital fraud represent a critical turning point in the fight against financial crimes. This case underscores the devastating consequences of investment fraud and the importance of investor due diligence. The lengthy prison sentence serves as a potent deterrent, sending a clear message that such criminal behavior will not be tolerated. The GPB Capital scandal highlights the crucial need for stronger regulatory oversight and increased investor protection measures to prevent similar tragedies in the future. If you have been affected by the GPB Capital fraud, or are concerned about potential investment fraud, seek legal counsel immediately. Understanding the intricacies of GPB Capital fraud and David Gentile's conviction is crucial to protecting your investments and advocating for justice.

Featured Posts

-

Stock Market Today Sensex And Nifty 50 Close Flat Amidst Geopolitical Uncertainty

May 10, 2025

Stock Market Today Sensex And Nifty 50 Close Flat Amidst Geopolitical Uncertainty

May 10, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th Wall Street Weighs In

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th Wall Street Weighs In

May 10, 2025 -

Vatikanskaya Vstrecha Zelenskogo I Trampa Analiz Itogov Ot Makrona

May 10, 2025

Vatikanskaya Vstrecha Zelenskogo I Trampa Analiz Itogov Ot Makrona

May 10, 2025 -

The Impact Of Figmas Ai On The Design Landscape

May 10, 2025

The Impact Of Figmas Ai On The Design Landscape

May 10, 2025 -

Sovmestniy Dogovor Frantsii I Polshi Makron I Tusk Obyavlyayut O Podpisanii

May 10, 2025

Sovmestniy Dogovor Frantsii I Polshi Makron I Tusk Obyavlyayut O Podpisanii

May 10, 2025