Grayscale's XRP ETF Filing: XRP Price Surge And Implications For The Crypto Market

Table of Contents

Grayscale's XRP ETF Filing: A Detailed Look

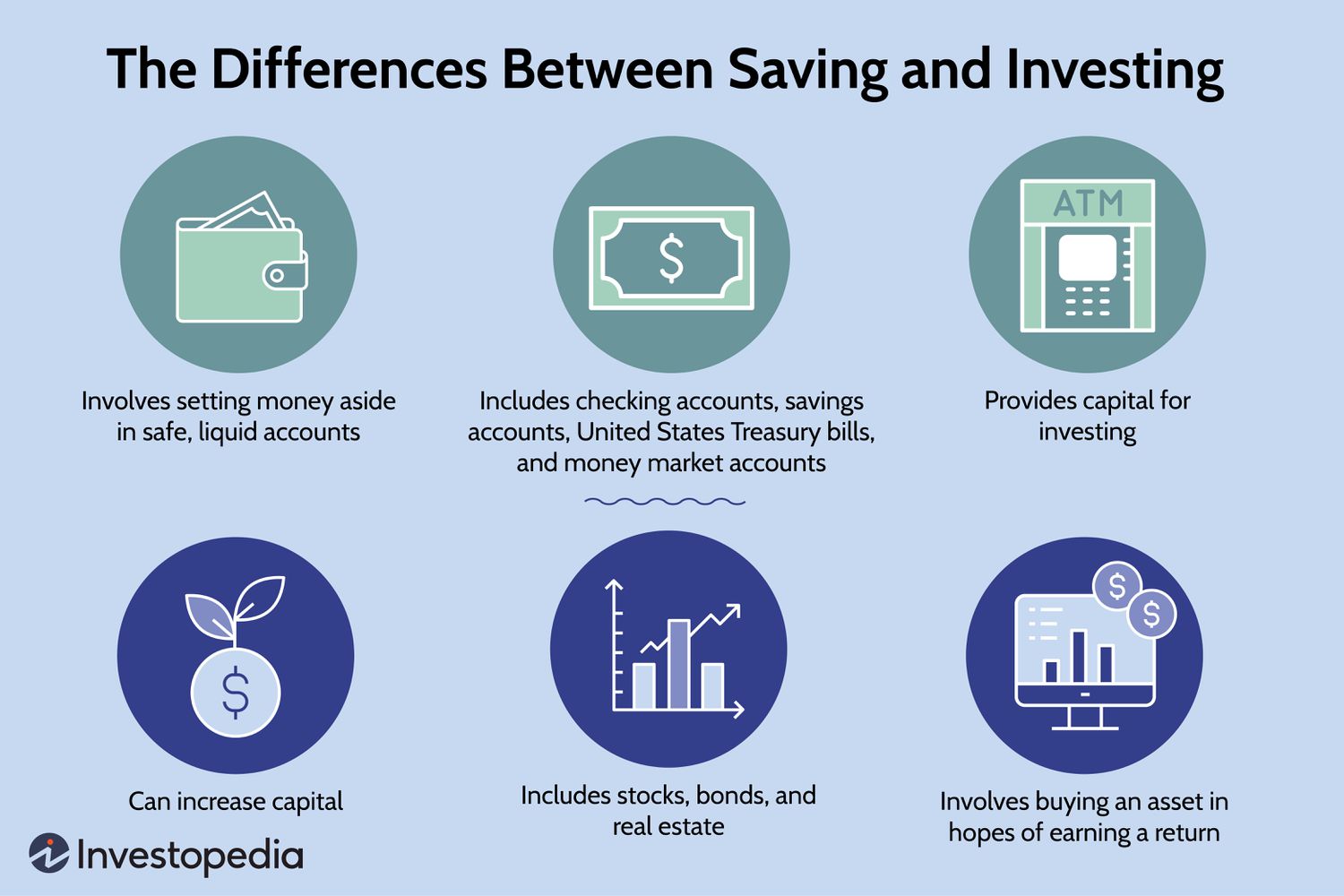

Grayscale Investments, a prominent digital currency asset manager, submitted its application for an XRP exchange-traded fund (ETF). This filing represents a significant step for XRP, potentially opening avenues for increased institutional investment and mainstream adoption. The proposed structure, investment strategy, and regulatory hurdles are key aspects to consider.

- Date of filing: [Insert date of filing – this information needs to be updated when the article is published].

- SEC's potential response timeline: The Securities and Exchange Commission (SEC) typically takes several months to review ETF applications. We can expect a decision sometime in [insert estimated timeframe based on SEC's typical review process and any relevant news].

- Comparison with other Grayscale ETF filings (e.g., Bitcoin, Ethereum): Grayscale's previous filings for Bitcoin and Ethereum ETFs provide a benchmark for assessing the potential success of their XRP ETF application. The SEC's decisions on these prior filings will heavily influence their approach to the XRP ETF.

- Potential advantages of an XRP ETF: An XRP ETF would offer several key advantages, including increased liquidity, regulatory compliance, and simplified access for institutional investors. This would likely lead to greater price stability and reduced volatility compared to trading XRP directly on exchanges.

- Potential risks associated with an XRP ETF: Despite the potential upsides, risks remain. The ongoing legal battle between Ripple and the SEC poses a significant challenge. Negative SEC decisions, market downturns, and inherent cryptocurrency volatility are also major risks to consider for investors.

The XRP Price Surge: Analyzing the Factors

The announcement of Grayscale's XRP ETF filing immediately triggered a noticeable price surge for XRP. Understanding the contributing factors is crucial for navigating this dynamic market.

- Percentage price increase since the filing: [Insert percentage increase – this needs to be updated dynamically].

- Comparison with historical XRP price movements: Comparing this price surge to previous XRP price movements provides valuable context. It allows us to assess whether this increase is significantly different or aligns with past patterns of volatility.

- Influence of investor sentiment and market speculation: Positive investor sentiment and speculation surrounding the potential success of the XRP ETF have fueled the price increase. The anticipation of increased institutional involvement plays a significant role.

- Role of social media and news coverage: Social media platforms and news outlets have amplified the news, contributing to increased market interest and speculation, further driving up the price.

- Technical analysis of the price chart: A technical analysis of the XRP price chart can reveal supporting trends, resistance levels, and potential future price movements. This requires expertise in technical indicators and chart patterns.

Implications for the Crypto Market

A successful Grayscale XRP ETF could have profound implications for the entire cryptocurrency market.

- Increased institutional investment in XRP: The ETF would pave the way for increased institutional investment, bringing significant capital into the XRP market.

- Potential impact on the overall cryptocurrency market capitalization: The ripple effects could boost the overall market capitalization of cryptocurrencies, increasing investor confidence and attracting new participants.

- Effects on other altcoins: The success of an XRP ETF could positively impact other altcoins, especially those with similar use cases or technology. This could lead to a broader altcoin market rally.

- Increased regulatory scrutiny of cryptocurrencies: The SEC's review and potential approval of the ETF will likely increase regulatory scrutiny on other cryptocurrencies.

- Potential for wider cryptocurrency adoption: Increased institutional participation and regulatory clarity could lead to broader cryptocurrency adoption across various industries.

Ripple's Ongoing Legal Battle and its Influence

The ongoing legal battle between Ripple Labs and the SEC significantly impacts the success of the Grayscale XRP ETF.

- Summary of the Ripple vs SEC lawsuit: The lawsuit centers on whether XRP is a security. A favorable ruling for Ripple could significantly increase the likelihood of the ETF's approval.

- Possible outcomes and their influence on the ETF application: Different outcomes in the Ripple case could either accelerate or hinder the ETF approval process. A ruling against Ripple could significantly delay or even prevent ETF approval.

- Market reaction to developments in the Ripple case: Any news regarding the lawsuit directly influences XRP's price and investor sentiment towards the potential ETF.

Conclusion

Grayscale's XRP ETF filing is a pivotal moment for the cryptocurrency market. The potential for a successful ETF could significantly boost XRP's price and attract substantial institutional investment. While the ongoing legal battle between Ripple and the SEC adds uncertainty, the implications for the broader crypto landscape are undeniable. Staying informed about the progress of the Grayscale XRP ETF application and its potential approval is crucial for anyone invested in or interested in the cryptocurrency market. Continue to monitor developments regarding the Grayscale XRP ETF and its influence on the future of XRP and the entire crypto ecosystem. Understanding the Grayscale XRP ETF implications is essential for navigating the evolving crypto market.

Featured Posts

-

Sec Acknowledges Grayscale Xrp Etf Filing Impact On Xrp And Bitcoin Prices

May 08, 2025

Sec Acknowledges Grayscale Xrp Etf Filing Impact On Xrp And Bitcoin Prices

May 08, 2025 -

Inter Milan Contracts 2026 Four Players Facing Uncertain Futures

May 08, 2025

Inter Milan Contracts 2026 Four Players Facing Uncertain Futures

May 08, 2025 -

Gcci Presidents Expo 2025 Planning Receives Positive Feedback From Sufian

May 08, 2025

Gcci Presidents Expo 2025 Planning Receives Positive Feedback From Sufian

May 08, 2025 -

Impact Of Dwps Universal Credit Overhaul What Claimants Need To Know

May 08, 2025

Impact Of Dwps Universal Credit Overhaul What Claimants Need To Know

May 08, 2025 -

Xrp Up 400 In Three Months Is It Time To Invest Risks And Rewards

May 08, 2025

Xrp Up 400 In Three Months Is It Time To Invest Risks And Rewards

May 08, 2025

Latest Posts

-

Andor Season 2 Trailer Release Date Speculation And Confirmed Details

May 08, 2025

Andor Season 2 Trailer Release Date Speculation And Confirmed Details

May 08, 2025 -

Todays Weather Partly Cloudy With A Chance Of Insert Relevant Condition

May 08, 2025

Todays Weather Partly Cloudy With A Chance Of Insert Relevant Condition

May 08, 2025 -

Everything We Know About Andor Season 2 Release Date Trailer And More

May 08, 2025

Everything We Know About Andor Season 2 Release Date Trailer And More

May 08, 2025 -

Pwlys Mqablh Gjranwalh Myn Fayrng Ka Waqeh 5 Hlaktyn Dyrynh Dshmny

May 08, 2025

Pwlys Mqablh Gjranwalh Myn Fayrng Ka Waqeh 5 Hlaktyn Dyrynh Dshmny

May 08, 2025 -

Expect Partly Cloudy Conditions Weather Outlook And Planning

May 08, 2025

Expect Partly Cloudy Conditions Weather Outlook And Planning

May 08, 2025